02.2023 Life Guide

Inherit wealth and make good use of stock

Oriental Securities Corporation / Chen Ruiyi

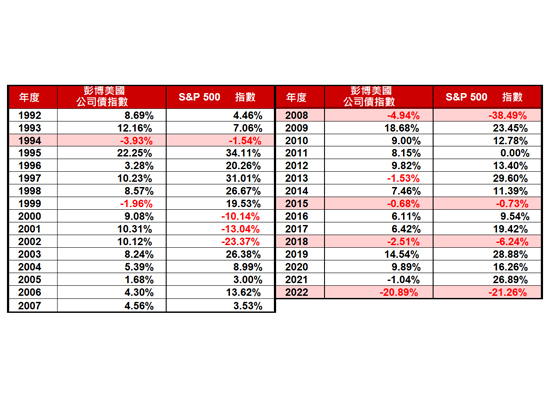

In 2022, due to problems such as the Ukrainian-Russian war, inflation, and hawkish interest rate hikes, the Taiwan Stock Weighted Index is like a roller coaster. For depositors, they can buy slowly at the low point of the stock price while the stock market returns. Many parents will invest for their children to help accumulate financial resources; Parents with deep pockets can also make good use of the gift tax exemption to transfer their wealth to the next generation year by year.

In 2022, due to problems such as the Ukrainian-Russian war, inflation, and hawkish interest rate hikes, the Taiwan Stock Weighted Index is like a roller coaster. For depositors, they can buy slowly at the low point of the stock price while the stock market returns. Many parents will invest for their children to help accumulate financial resources; Parents with deep pockets can also make good use of the gift tax exemption to transfer their wealth to the next generation year by year.The reason why Jews are rich is that their parents have taught their children what assets and liabilities are by giving them stocks, instilling the concept of investment and financial management since childhood. That is to say, in the process of parent-child education, they have accumulated amazing wealth and earning power by virtue of wisdom passed down from generation to generation and long-term planning.

In fact, not only Jews, but also many parents worry that when their children grow up, they will face a world where everything is rising, and the money they earn will be difficult to fight inflation. Therefore, they plan to save shares for their children in advance. In fact, the concept of saving shares is the same as that of saving money. It is only to convert money into shares in order to obtain higher dividends or dividends than the bank's fixed deposit. In addition to purchasing the whole stock (1000 shares), the method of saving shares can also be used to purchase shares in the form of fractional shares and fixed fixed amount.

Advantages of saving shares for children

1. Build up the concept of money since childhood

Through parent-child co-financing, children can establish the concept of investment and finance, help them understand the power of compound interest as early as possible, and also let them experience the process of asset increase or decrease, from which they can cultivate a correct view of money and cherish wealth. For example, if NTD3000 is allocated from the salary every month to help children buy shares and the annual target rate of return of 5% is rolled into compound interest, NTD1230000 will be rolled out in 20 years.

2. Increase the winning rate of subscription shares

The subscription of shares is called lottery. Each time the handling fee is NTD20 and the lottery winner pays NTD50 (including the postage of the lottery winner notice), the shares can be obtained at the subscription price. Applying for shares for children is equal to one more account and one more chance to draw lots! "Oriental Securities Corporation e means earning" can help calculate the premium amount, so as to evaluate whether it is worth participating in the lottery. It is very convenient.

3. Start long-term investment as soon as possible

From the birth of a child to adulthood, there is a full 20 years. If you can make a long-term investment of its annual lucky money, you can only get in and out, and use the power of time, you can accumulate small money into large money, receive dividends by relying on stocks, and create passive income.

4. Early gift

Each donor can enjoy an annual tax exemption of NTD2440000. In other words, no matter how many children you have and how many accounts you remit, as long as the total amount each parent remitts to all children each year does not exceed NTD2440000, there is no need to pay gift tax. Transferring assets to the next generation year by year can not only save tax burden, but also do a good job in asset allocation.

Necessary documents for minors to open securities accounts

The starting point of stock deposit is to open an account. If you want to help your child open an account and buy stocks, you need to bring the following information to the securities brokerage branch to go to the counter.

ID card, secondary supporting certificate and seal of the legal representative (if both parents are legal representatives, both parties must be present)

Child's ID card (or household register), secondary supporting certificate, seal

If the child is less than seven years old, the legal representative can sign on his behalf; If you are over seven years old, you must sign in person

Saving shares will not double wealth quickly. It saves time. Time equals reward. It can be free from market factors. The longer it accumulates, the lower the cost will be. Even if the stock price falls, there is no need to worry too much. However, it is still recommended to regularly check the operating conditions of the investment target and whether the dividends received meet the expectations to reduce the probability of regret. Let's work out a stock deposit plan for ourselves and the next generation!

Image source: storyset

#