02.2023 Life Guide

Investment will stop watching and listening in 2023

Far Eastern International Bank / Gao Yixun

.jpg) To welcome the new year, we all hope that the global economy and financial markets can get rid of the downturn, but in the case of policy bias towards austerity, the momentum of economic growth will inevitably be affected. This issue of "Finance Column" takes a comprehensive view of this year's economic trend, provides asset allocation suggestions, and helps you make the best decisions in the financial market.

To welcome the new year, we all hope that the global economy and financial markets can get rid of the downturn, but in the case of policy bias towards austerity, the momentum of economic growth will inevitably be affected. This issue of "Finance Column" takes a comprehensive view of this year's economic trend, provides asset allocation suggestions, and helps you make the best decisions in the financial market.The value of financial assets is attractive, but still affected by external fluctuations

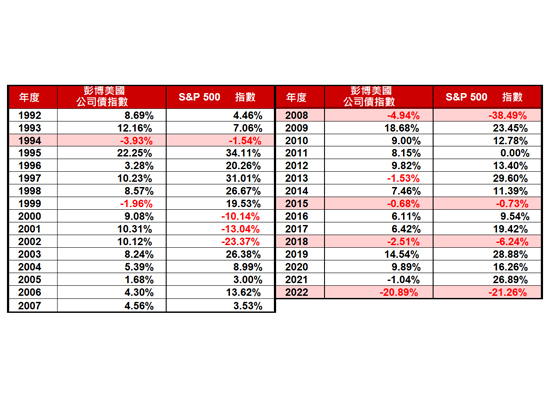

According to statistics, from 1992 to 2021, there were only four times in a single year when stocks and bonds fell at the same time in the financial market. In addition, the extent of bond decline (including bond interest distribution) was in the single digits, showing the anti-decline function of bonds in the investment portfolio. However, in 2022, not only stocks and bonds fell simultaneously, but also bonds fell by 20%, overturning everyone's impression of bonds.

It is precisely because the asset price has been significantly revised down that the value of various assets has become attractive to a certain extent. Taking corporate bonds as an example, on October 20, 2022, the yield to maturity of the Bloomberg US corporate bond index (with an average credit rating of A -, representing that the index component bonds belong to investment grade bonds) was 6.10%, a new high in the past decade, indicating that the current value of investment grade bonds and corporate bonds is relatively cheap; There are similar situations for stocks, such as the S&P 500 index, which is estimated to be 16.82 times of the price-to-earnings ratio on October 20, 2022. Although it is not the lowest level in the past decade, it is far lower than the high point of 27.42 times (September 2020) and the 10-year average of 18.31 times, indicating that the stock market has undergone a considerable degree of correction and the stock value is relatively low.

Table 1. Annual performance of US S&P 500 and US corporate bonds from 1992 to October 20, 2022 (data source: Bloomberg, October 2022)

.jpg) Coincidentally, the volatility of all kinds of assets, especially bonds, will rise significantly in 2022, affected by the central bank's interest rate increase and multiple negative factors. Observe the average fluctuations of stocks, bonds and foreign exchange assets in recent five years. The VIX index is roughly maintained at 15-20. However, due to the outbreak of the COVID-19 in 2020, the VIX index jumped to 29.25. Even by 2022, the index will be at 26.20; From another indicator, the MOVE index was 118.01 in 2022, up 90.86% from 61.83 in 2021. In 2023, it is not likely that the volatility index will rise sharply again. On the one hand, the inflation that the market is most worried about is expected to slow down, and the pace of the central bank's interest rate increase will gradually slow down. On the other hand, asset prices have begun to reflect the negative factors of the economic recession. Even if the economy is sluggish, asset prices are not likely to decline for a long time and significantly. However, the market risk sentiment is still quite conservative, and the price of financial assets is easy to fluctuate with the external changes. The volatility of financial assets will remain high in 2023.

Coincidentally, the volatility of all kinds of assets, especially bonds, will rise significantly in 2022, affected by the central bank's interest rate increase and multiple negative factors. Observe the average fluctuations of stocks, bonds and foreign exchange assets in recent five years. The VIX index is roughly maintained at 15-20. However, due to the outbreak of the COVID-19 in 2020, the VIX index jumped to 29.25. Even by 2022, the index will be at 26.20; From another indicator, the MOVE index was 118.01 in 2022, up 90.86% from 61.83 in 2021. In 2023, it is not likely that the volatility index will rise sharply again. On the one hand, the inflation that the market is most worried about is expected to slow down, and the pace of the central bank's interest rate increase will gradually slow down. On the other hand, asset prices have begun to reflect the negative factors of the economic recession. Even if the economy is sluggish, asset prices are not likely to decline for a long time and significantly. However, the market risk sentiment is still quite conservative, and the price of financial assets is easy to fluctuate with the external changes. The volatility of financial assets will remain high in 2023.Table 2 Average annual fluctuations of stocks, bonds and foreign exchange from 2018 to October 20, 2022 (source: Bloomberg, October 2022)

Asset allocation strategy: both offensive and defensive, let alone regular quota

Anticipating the global economic downturn in 2023 and the continued volatility of the financial market, most people will adopt the conservative strategy of "low shareholding and high cash ratio", but the financial market is full of "surprises", which may change the degree of market risk preference in a short time. If investors only follow the "habit" strategy in 2022, it is likely that after the asset price rises for a period of time in 2023, they will think it is a short rebound without timely adjustment, After all, asset prices always precede economic or corporate fundamentals.

Therefore, it is recommended that investors adopt the strategy of both attack and defense, with the core allocation of bond assets (such as investment grade bond funds or overseas corporate bonds), supplemented by low-volatility or high-quality low-value stocks (such as global high-dividend or optimized volatility funds); For the allocation of satellite assets, investment targets with medium and long-term themes (such as electric vehicles or Dongxie market, etc.) can be considered, and the proportion can be adjusted according to personal risk attributes (for example, the proportion of active core and satellite is 50%: 50%, and that of robust core and satellite is 60%: 40%).

In the face of the current economic environment, in addition to doing a good job in asset allocation, it is also very important to regularly review and rebalance the allocation portfolio to confirm whether the asset ratio deviates from the original plan, or whether the performance of the investment target is different from that of the same type of target, and at the same time, do not forget to check whether the market environment at that time is consistent with the original situation. More importantly, we should continue to make regular quotas. Global equity funds are good targets for investors who want to reduce investment volatility or do not want to hold too much shares. They can not only buy more units when the asset price is low, but also avoid psychological factors and human errors (such as guessing the bottom of the stock market). They can also reduce the cost of investment positions that have lost money and turn from losses to profits as soon as possible.

#