04.2023 Office Talk

EU Initiates Carbon Border Adjustment Mechanism, Global Carbon Tax Trade Era Comes

ESG Focus Committee of the World Taiwan Chamber of Commerce Federation&Yuan Ze University / Jian Weihua&You Jingying

In October 2023, the European Union will launch the Carbon Border Adjustment Mechanism (CBAM), aimed at addressing climate change and avoiding unfair competition for EU companies due to compliance with strict carbon emission regulations. CBAM requires importers to purchase carbon quotas issued by the European Union to offset product carbon emissions, and importers must submit product carbon emission data. Those who do not meet the standards will face fines. This move may increase the cost of imported products and also lead to the arrival of the global carbon tax trade era. Currently, the United Kingdom, the United States, Japan, South Korea, Taiwan, and other countries have developed corresponding carbon tariff policies, which have a significant impact on international trade.

Climate change is a global problem that requires global solutions. The United Nations Framework Convention on Climate Change (UNFCCC), signed in 1992, aims to call on countries to jointly address climate change issues, while allowing for differences in responsibilities and specific content between developed and developing countries in addressing climate change. The Kyoto Protocol, which came into effect in 2005, further adopts market mechanisms and promotes global greenhouse gas emissions reduction through market transactions. It not only promotes technological innovation and green development investment, but also encourages enterprises and countries to achieve long-term sustainability development goals.

The Emissions Trading Scheme (ETS), also known as the Carbon Trading System, is a system of trading 'carbon emissions rights' through the market. Adopting a "cap and trade" approach, countries or enterprises can not only implement their own emission reduction plans or reduce their carbon emissions through technological innovation, but also purchase carbon emission rights from the market to offset their overall demand for carbon emission reduction under the set total emissions.

The EU ETS, established by the European Union in 2005, is the world's most experienced and second largest carbon trading market (Note 1). Companies under regulation must purchase "carbon rights certificates" for their emissions and meet their phased carbon emission reduction requirements (Note 2). Under the set total emissions, enterprises can receive a certain proportion of free quotas, and companies that have achieved success in carbon reduction can also sell the excess quotas to companies with insufficient carbon reduction performance. However, the EU's carbon price does not have a statutory price and is solely determined by the market supply and demand of "carbon rights certificates", using the "polluter pays" approach to incentivize companies to implement or invest in carbon reduction measures.

Due to the EU's strict climate policies, high carbon emission reduction requirements, and over 15 years of experience in implementing EU ETS, the low-carbon emissions of enterprises and domestically manufactured products in EU countries have become a global benchmark. If enterprises move their production to regions with relatively less stringent regulations or import similar but low-cost products from regions with less stringent regulations, it will pose a risk of "carbon leakage". To avoid companies shifting their production and manufacturing of high carbon emissions from EU countries to other countries, or importing substitutes from regions that have not actively reduced carbon emissions, causing carbon emissions in other countries or regions to increase instead of decreasing, offsetting efforts to reduce emissions within the EU and endangering the overall global goal of 2050 net zero carbon emissions, and considering the unfair competition faced by companies due to the implementation of carbon reduction measures. As the most active leader in global climate action, the EU is the most sensitive to 'carbon leakage'.

With the gradual withdrawal of EU ETS' free quotas for managed enterprises, the implementation of carbon tariffs has become an adjustment mechanism to prevent "carbon leakage", also known as the "Carbon Border Adjustment Mechanism", abbreviated as CBAM. This concept originated from the 2019 European Green Deal. In July 2021, the European Commission proposed the first version of the CBAM legislative draft in a package of "Fit for 55" plans to achieve the EU's 2030 carbon reduction target of 55%.

The implementation of the carbon border adjustment mechanism in the EU means that products produced by countries outside of the EU ETS enter the EU tariff zone. If the carbon price of their origin is lower than that of the EU ETS, they must purchase "CBAM certificates" to achieve carbon parity, which is also known as "carbon tariffs". Compared to the previous EU ETS free quota system, CBAM utilizes the introduction of carbon tariffs to enable non EU enterprises to bear the same carbon reduction costs, in order to support the net zero carbon target of EU industry. In addition to providing stronger incentives for companies that were not actively reducing carbon, it can also help EU enterprises avoid the problem of carbon reduction and higher costs, while avoiding the phenomenon of carbon emissions being transferred globally.

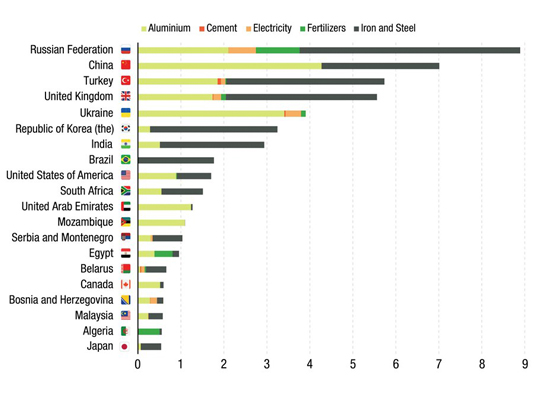

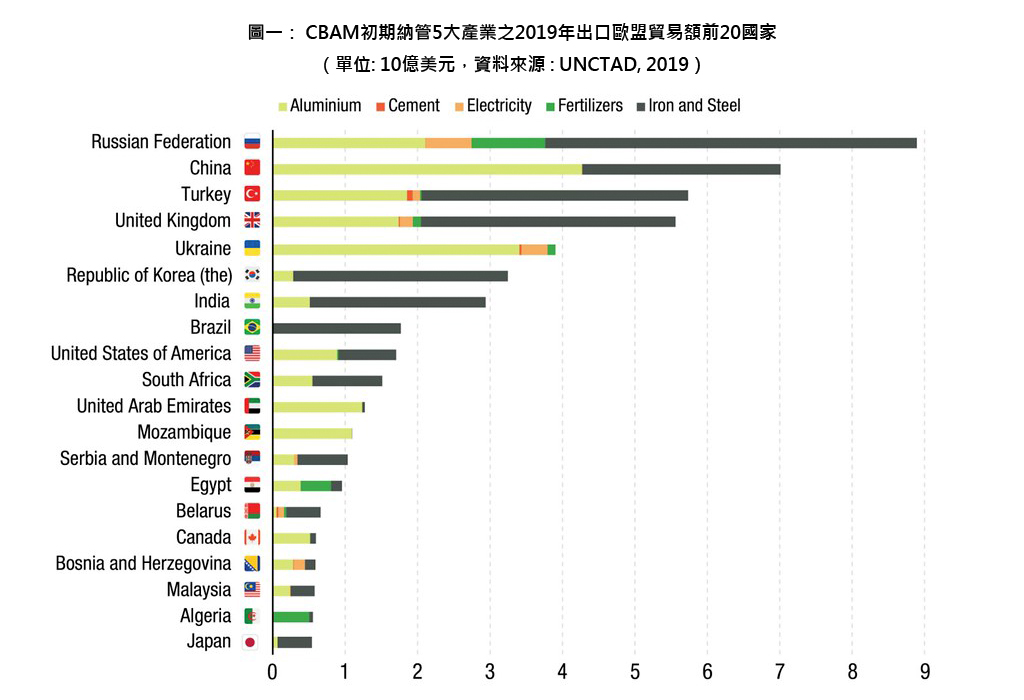

According to the latest agreement of the European Parliament in December 2022, CBAM will regulate industries with high carbon emissions and the greatest risk of carbon leakage, initially covering industries such as cement, steel, aluminum, fertilizers, electricity, and hydrogen, as well as several chemical precursors and downstream products of steel (such as screws, bolts, etc.), and gradually expand to other industries. With the elimination of EU ETS free quotas in 2034, CBAM will be fully launched. Exempt countries for CBAM include EU-27 countries (Note 3), as well as 31 countries such as Switzerland, Iceland, Norway, and Liechtenstein that have joined the EU ETS or carbon market link.

During the transition period from October 1, 2023 to 2025, importers of products in the regulated industries outside of CBAM exempt countries must bear the declaration obligation and submit a CBAM statement stating the quantity of imported products, the total direct emissions and indirect energy emissions of products independently verified by recognized verification agencies, and the carbon price paid in the country of origin. No fees are required during the transition period. As of now, the EU has not proposed detailed regulations on the specific calculation method and specific emission range boundaries of product embedded emissions, and further implementation details are needed in the future.

However, starting from January 1, 2026, a paid based CBAM will be launched. Importers are required to declare the quantity of goods imported into the EU in the previous year, as well as their embedded greenhouse gas emissions, and submit a corresponding number of "CBAM vouchers". The price of the vouchers will be calculated based on the weekly average auction price of the EU ETS Quota (EUA). The market average price of EU ETS quotas (EUA) in 2022 is EUR 85.22 (approximately NTD 2780/ton of carbon equivalent), and on February 22, 2023, it exceeded the historical high price of EUR 100 (approximately NTD 3260/ton of carbon equivalent). Considering the EU's 55% reduction in 2030 and 2050 net zero carbon, as well as the simultaneous implementation of CBAM, the market estimates that the market average price of EU ETS quotas (EUA) from 2025 to 2030 will be EUR 100-210 (approximately NTD 2800-6850/ton of carbon equivalent), Compared with Taiwan, which has not implemented ETS or imposed carbon taxes, the cost of carbon emission price of enterprises is zero. Assuming that the carbon rate will be set in the range of NTD 300~1500/ton of carbon equivalent in the future, products exported to the EU will still have to pay high carbon tariffs after 2026.

In October 2023, the five major industries of cement, steel, aluminum, fertilizers, and electricity that were initially managed by CBAM were not the main export projects for Taiwan and had little impact. However, the downstream products of steel, such as nuts and bolts, are estimated to have an impact on Taiwan's exports to the European Union, with NTD of about 40 billion. Moreover, due to the fact that the screw industry is mostly small and medium-sized enterprises, the weak resources of CBAM will have a significant impact on the industry.

Considering that the EU may expand the scope of CBAM to other products with carbon emission risks during the transitional period from 2023 to 2025, and gradually promote it to the entire industry covered by EU ETS in 2034, which will affect the carbon emission costs of Taiwan's industries. Therefore, it is recommended that business owners take the following response measures:

1. Inventory of corporate carbon emissions and product carbon footprint: By conducting inventory, establish a carbon reduction baseline year and product carbon emissions baseline, and establish a reporting capability that is at least equivalent to that of EU competitors, evaluate and determine whether it will be affected.

2. Reducing carbon emissions: Enterprises should take measures to reduce carbon emissions and product carbon footprint, such as changing design, improving energy efficiency, using renewable energy, changing production processes, and recycling.

3. Take countermeasures: gradually adjust market prices, reduce imports, seek substitutes, supply chain management, investment, purchase carbon reduction plans or carbon rights, etc.

4. Participation in policy formulation: By participating in public consultations and providing feedback and suggestions to the government and legislative bodies, it helps to ensure the fairness and transparency of policy formulation and reduce the negative impact of CBAM on enterprises.

CBAM marks the arrival of the global era of carbon tax trade, which, although it will bring challenges to enterprises, also provides opportunities to promote innovation and promote sustainable technology adoption. Therefore, countries and enterprises should actively take measures to adapt to the new era and accelerate the transition to a low-carbon and sustainable future.

Note 1: In 2022, Chinese Mainland and EU EU-27 respectively controlled 4 billion tons and 2 billion tons of CO2e, which are the world's two largest carbon rights markets.

Note 2: According to the latest agreement reached by the European Union in December 2022, the free quota for EU ETS managed enterprises will be gradually reduced starting from 2026 and completely cancelled by 2034. Carbon emissions based on 2005 will be reduced by 62% by 2030 and 100% by 2035. The specific phased reduction targets are: 2.5% (2026), 5% (2027), 10% (2028), 22.5% (2029), 48.5% (2030), 61% (2031), 73.5% (2032), 86% (2033), and 100% (2034).

Note 3: "EU 27" refers to the 27 member states of the European Union.

#