05.2023 Life Guide

Utilizing S.A.F.E. Investment Mindset to Avoid Market Volatility and Fear

Far Eastern International Bank / Lin Jinyong

Many countries have been using interest rate hikes to combat inflation since last year, however, tight monetary policies have also impacted the price performance of various assets in the financial market. Since the beginning of the year, the global stock market has been declining continuously in 2022, with a final decline of nearly 20%, and the bond market has also experienced a decline of nearly 10%; Although there was a slight improvement in 2023, under the continuous shadow of interest rate hikes, the global stock and bond markets fell again in sync. While the public's pockets have shrunk due to rising prices, their invested assets are also facing losses, making it inevitable for them to feel discouraged. However, if we take the long term and use S.A.F.E.'s investment mindset wisely, there is still a chance to overcome volatile markets.

Many countries have been using interest rate hikes to combat inflation since last year, however, tight monetary policies have also impacted the price performance of various assets in the financial market. Since the beginning of the year, the global stock market has been declining continuously in 2022, with a final decline of nearly 20%, and the bond market has also experienced a decline of nearly 10%; Although there was a slight improvement in 2023, under the continuous shadow of interest rate hikes, the global stock and bond markets fell again in sync. While the public's pockets have shrunk due to rising prices, their invested assets are also facing losses, making it inevitable for them to feel discouraged. However, if we take the long term and use S.A.F.E.'s investment mindset wisely, there is still a chance to overcome volatile markets.Stay in the market, choosing to wait and see may miss out on opportunities for market repair

Based on historical experience, the overall market trend is mostly upward, with few consecutive extreme scenarios occurring. Taking the US stock market as an example, since 1926, the annual performance has mostly fallen between -10% and+40% (with a probability of about 80%); However, there have been only four consecutive cases of negative numbers for more than two years, namely, the Great Depression from 1929 to 1932, the World War II from 1939 to 1941, the oil crisis from 1973 to 1974, and the technological foam from 2000 to 2002.

UBS (UBS) further calculates that since 1960, when the US stock market has fallen by more than 20%, if investors immediately enter the market to invest in stocks, the average return after one year is about 15.6%, which is much higher than the average return of holding cash at 2.2% for one year, and the gap will gradually widen over time. In other words, when the market performs poorly, choosing to wait and see if it is too pessimistic may result in missing out on opportunities for market recovery.

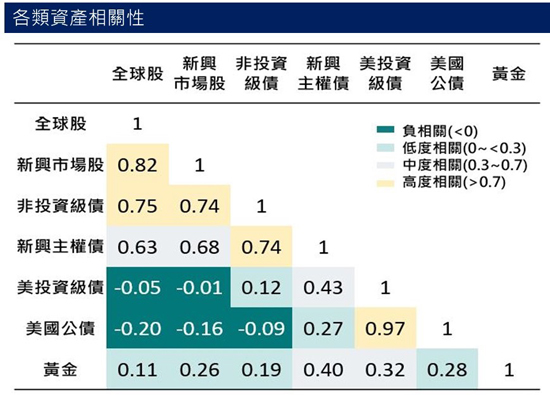

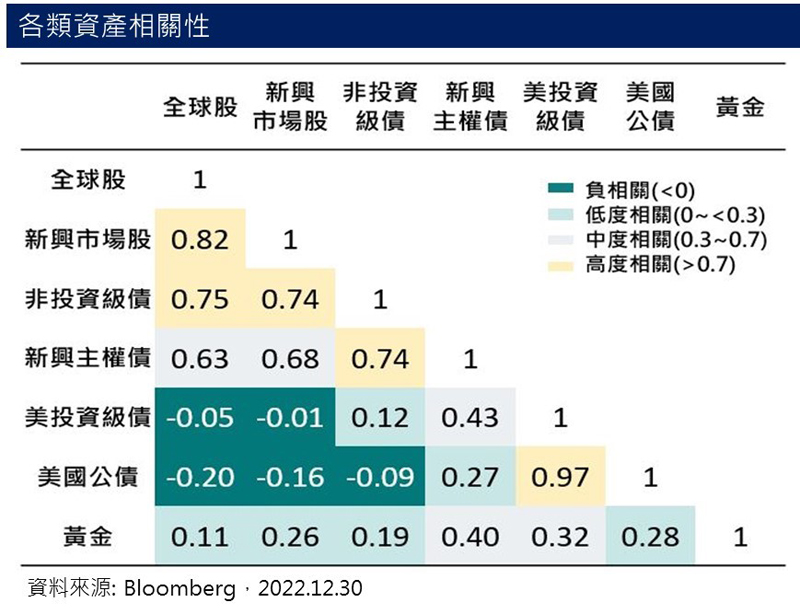

Asset allocation increases the seismic resistance of investment portfolios through diversified asset allocation

In the past year, global stock and bond markets have both fallen, and the traditional approach of asset diversification has been questioned due to the negative correlation between price fluctuations between stocks and bonds. But in fact, synchronizing the stock market with the bond market is not new. If measured on a monthly basis, the probability of both stocks and bonds falling together since 1995 is about 13%, equivalent to a simultaneous decline every seven months; However, if the time unit is extended, the probability of the same rise and fall is lower.

During periods of significant stock market declines in the past, the bond market often showed relatively resilient performance. If viewed from the perspective of investment portfolios, asset allocation should not only focus on low correlation, but also be appropriately allocated to bond assets with lower volatility, which can still be quite helpful in reducing the risk of investment portfolios. Moreover, bonds offer different maturities and types of options, and short-term government bonds are less susceptible to market fluctuations and can play a more protective role.

Searching for high-quality targets with a focus on long-term stable growth

Searching for high-quality targets with a focus on long-term stable growthIt is believed that many people have heard of "stock deposit", which is a common way of investment in Taiwan in recent years. Especially when prices are rising, many investors hope to buy and hold stocks for a long time to receive dividends as passive income to make up for the damage caused by inflation to their pocketbooks. However, dividend distribution depends on the company's profit situation and policies for the year. Therefore, in addition to paying attention to the stability of dividend distribution, attention should also be paid to whether the company's dividends have "grown".

If a company can continuously and stably distribute dividends, and the dividends grow year after year, it represents strong competitiveness, high market share and pricing ability, and therefore stable profit growth. Even in the face of adverse circumstances, the stock price can relatively resist decline. Taking the US stock market as an example, many well-known companies have experienced dividend growth for over 30 consecutive years. As mentioned by Warren Buffett in his annual shareholder letter to his investment company, Berkshire Hathaway, Coca Cola and American Express maintain stable dividend distributions every year and increase year by year, just like receiving a birthday gift. This also confirms Buffett's consistent investment philosophy: long-term ownership of outstanding corporate stocks is the key to achieving long-term returns.

ETF indexation investment has no trouble keeping up with the trend

ETFs (Index Equity Funds) are quite mature financial commodities globally. As of the end of 2022, the total managed assets of ETFs in the United States reached USD 9.1 trillion. Despite last year's poor market, there was still a continuous inflow of USD 0.75 trillion, the second highest in nearly 20 years. This investment tool, which aims to track index performance and is easy to trade like a stock, but also spreads risk like a fund, has been widely accepted by investors. In addition, the number and types of ETFs are diverse, and the management fees are relatively low compared to other financial commodities, making it suitable as one of the tools for long-term investment and asset allocation.

Do you also feel concerned or afraid about the current situation in the financial market? You may refer to the S.A.F.E. investment mindset mentioned above, or contact a wealth management consultant for a professional team to provide in-depth analysis and advice on your assets.

Far Eastern International Bank currently offers over 700 diversified financial products, covering overseas stocks, special shares, and ETFs such as the United States and Hong Kong. With the upcoming launch of online trading platforms, investors can participate in overseas stock and ETF trading through online banking with zero time difference 24 hours a day, or use the "long-term order trading" function to set their own order expiration date, eliminating the daily process of logging into the website to commission orders, More flexible investment operations!

#