08.2023 Life Guide

Mastering Multiple Investment Tools - Taiwan Index Option

Oriental Securities Corporation / Yang Yixuan

.jpg) The weighted index based "Taiwan Stock Futures" and "Taiwan Index Options" have been listed for more than 20 years. In the early stages, in order to attract investors to enter, securities firms often proposed terms such as "small to big" and "banker win all". As a result, many people equated futures, options, and "gambling", which inevitably deterred them. This issue of 'Finance Column' will help you understand the basics and make investment and financial management more reassuring.

The weighted index based "Taiwan Stock Futures" and "Taiwan Index Options" have been listed for more than 20 years. In the early stages, in order to attract investors to enter, securities firms often proposed terms such as "small to big" and "banker win all". As a result, many people equated futures, options, and "gambling", which inevitably deterred them. This issue of 'Finance Column' will help you understand the basics and make investment and financial management more reassuring.Both futures and options are a concept of Forward contract, which was first used in agricultural products. In order to avoid the sharp fluctuations in future commodity prices, buyers and sellers signed contracts in advance to agree to trade at a specific time and price in the future. In order to make the trading process safer and more transparent, the Exchange further standardized the commodities and performance conditions into so-called futures and options. Among them, "Taiwan Stock Futures" and "Taiwan Index Options" are the most popular commodities promoted and traded by the Taiwan Futures Exchange.

What is' right of choice '? Assuming that when you purchase a pre-sale house, you first pay the builder a signing fee and agree to purchase it for NTD 20 million upon completion. If you breach the contract at that time, the builder can confiscate all the signing fees. The act of paying the signing fee is similar to the concept of 'Buy Call'. If the house price rises to NTD25 million upon completion, the buyer still has the right to buy with NTD20 million. If they resell, they can earn a profit on the price difference; But if there is a significant decline in housing prices, buyers can give up the right to buy, and the maximum loss is the previously paid signing fee. From the perspective of construction companies, collecting a signing fee is equivalent to a 'Sell Call', and in the future, if housing prices soar, there will be a situation where the payment is lower than the market price.

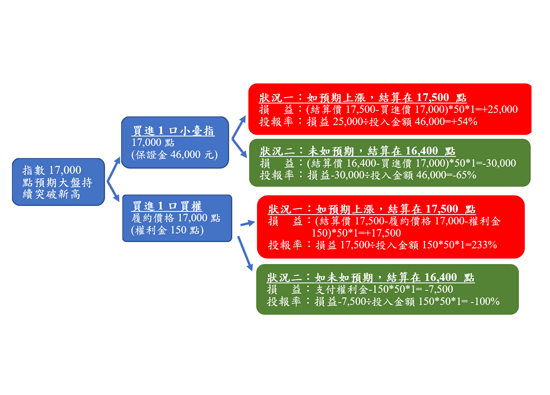

If we apply the above concept to "Taiwan Stock Futures" and "Taiwan Index Options", and take the small Taiwan Index Futures (hereinafter referred to as "the small Taiwan Index") and Taiwan Index Option Call (hereinafter referred to as "the call option") with the same contract specification of 1 point as NTD50 as an example, assume that investors are optimistic about the market trend, and take the option of buying a 17000 point small Taiwan Index or a 17000 point strike price option (assuming the premium is 150 points (note)), If the market rises as expected and the settlement price closes at 17500, both the small Taiwan index and the call option can create profits, and the Return on investment of the call option will be higher than that of the small Taiwan index; On the contrary, if the index returns to 16400 points and the Little Taiwan Index does not immediately reverse its position in the market and hold it until the settlement date, the loss amount will reach NTD30000, while the maximum loss of the option is only the previously paid premium NTD7500.

On the contrary, if investors are bearish on the market, they can adopt a trading strategy of "short selling (selling) futures" or "buy put". The latter also earns a downward band, but if the market does not meet expectations, the maximum loss is only the premium.

It is worth noting that both 'Buy Call' and 'Buy Put' require payment of royalties, which is suitable for use when there is expected to be a large band market in the future. Taking the aforementioned 'Buy Call' as an example, assuming that the index rises slightly to 17100 points at settlement, the price difference return is only 100 points, which is lower than the previously paid premium of 150 points. The holder will lose NTD2500 ((100-150) * 50 * 1). Furthermore, although the maximum loss for buying options is the premium, if investors invest all their funds in buying options, once the market does not meet expectations, there will be a situation of full loss.

Overall, futures and options are more flexible than current stock operations, especially for option commodities. In addition to the buyer's strategy previously introduced, investors can also consider adopting "Sell Call" or "Sell Put" strategies if they anticipate consolidation in the future, and may even adopt combination orders for cross, pull, or spread trading. If you are interested in option commodities, please go to the website of Oriental Securities Corporation or Taiwan Futures Exchange to view the relevant commodity introduction and trading rules. After opening an account, you can actually participate in the operation and grasp the profit opportunity.

※ Go to "Oriental Securities Corporation" to learn more information: https://www.osc.com.tw/Home/Index.aspx

※ Go to the Taiwan Futures Exchange for more information: https://www.taifex.com.tw/mCht/mIndex

※ Note: The premium for option options is generated by a market match between buyers and sellers. In long positions, call options have a greater opportunity to earn price difference returns, so the premium price rises while the put option premium price shows a downward trend; On the contrary, in a bearish trend, put options have a greater opportunity to earn spread returns, so the price of premium increases while the price of call option premium shows a downward trend.

#