03.2020 Life Guide

Real estate can also manage money! Make good use of your real estate

Far Eastern International Bank / Liu meihui

Buying a house is the dream of many people, but now the house price is often tens of millions. Even if you borrow from the bank, you have to empty all your property. Once you meet the urgent need to use funds, you have to raise money everywhere. This issue of "finance column" introduces a little-known "revolving loan", which repays the bank's principal as a reserve fund for temporary expenditure and makes good use of real estate financing at home.

Generally speaking, a lot of information must be prepared to apply for a house purchase loan from a bank, including: real estate transcripts, sales contracts, half year salary slips or withholding vouchers, double certificates If the loan amount is higher, the bank may also need to provide deposit, fund, stock and other information for the bank's evaluation; the bank also needs to conduct on-site survey, photo taking and evaluation of the real estate, and set the real estate mortgage after the approval. Therefore, from loan application to appropriation, the fastest time is one week, the slowest time is three weeks. The setting fee is one thousandth of the amount of the set mortgage according to the setting fee of real estate mortgage registration. For example, if the loan is 10 million yuan, the bank will set a mortgage of 12 million yuan, then the land administration fees will be 12000 yuan. In addition, the bank will also have to bear the agency fees ranging from 4000 to 6000 yuan.

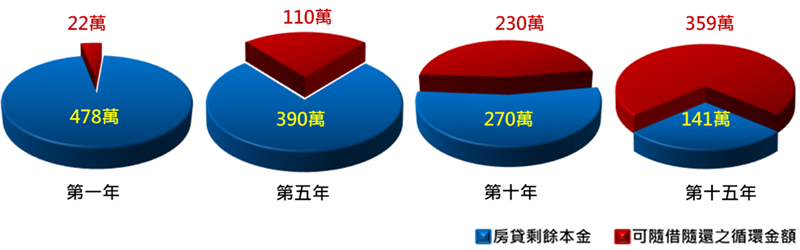

It is suggested that when you apply to the bank for housing loan, you can apply for the reply type revolving housing loan at the same time. In general, the loan is of the principal and interest sharing type. If you apply for a 20-year loan, during the loan period, all the loan principal and interest will be equally distributed in each period. Therefore, when the interest rate is unchanged, the monthly amortization amount is equal, which is convenient for you to master the monthly income and expenditure budget. In the recycling type of loan, the monthly repayment amount of the bank principal will be automatically converted into the circulation amount Ring house loan amount, as shown in the following figure:

Take the loan amount of NT $5 million and the loan period of 20 years as an example. The red part is the principal of the annual repayment, that is, the revolving amount that can be borrowed and repaid along with the loan, without the use of interest, which is calculated according to the interest rate signed by the bank (at present, the revolving interest rate of Far Eastern International Bank is 2%). Assuming that there is a demand for funds, it is necessary to use NT $100000 for 20 days, with an interest rate of 2%, then the interest to be used is NT $110.

Advantages of circular housing loan

1. Convenience: there is no need to prepare documents before applying to the bank for the limit.

2. Immediacy: cash card, passbook or internet bank can be used anytime, anywhere, all year round.

3. Cost saving: interest shall be calculated according to the amount and days of use, and the amount shall be calculated according to the time of use. Interest shall be calculated on a daily basis, and shall be repaid with borrowing. No handling fee shall be charged for each use, and no additional charge for mortgage setting is required.

Applicable objects of circular house loan

1. People engaged in investment and financing activities.

2. SOHO, self-employed.

3. People who have real estate and may have temporary expenses (e.g. EMBA education expenses, children education expenses, house repair, tourism And so on.

What's the difference between revolving loans and other loans?

Although the interest rate of circular house loan is slightly higher than that of general house loan, it is still more favorable and convenient than that of credit loan, stock financing loan and credit card circular interest. The relevant comparison is as follows:

1. Revolving housing loan vs. micro credit

Mr. Lin, who works in a science and technology company, happened to have no pay leave, so he decided to use this time to study to improve his competitiveness in the workplace. Fortunately, I applied to the bank for 5 million yuan of revolving real estate loan at the beginning, and decided to use 1 million yuan first, with the interest rate of 2.2%. I only need to repay 1833 yuan of interest per month, which is easy to bear. Half a year later, the company will return to work, and I will repay the loan every month if I have extra free money, which is super convenient to pay back as I borrow.

If Mr. Lin applies to bank a for credit, the interest rate is 5%, and he has to pay the principal and interest every month. The loan is calculated by 7 years, and the monthly payment is 14, 134 yuan, not only the interest rate is high, the principal and interest must be amortized at the same time every month, the burden is heavier, the company returns to work half a year later, but there is liquidated damages in order to pay off in advance, which is quite uneconomical. Moreover, the bank may not be willing to lend to Mr. Lin because of unpaid leave, poor prospects and inability to repay.

2. Revolving mortgage vs. traditional mortgage

Compared with the circular mortgage, although the interest rate of the traditional general mortgage is lower, the monthly payment is the principal plus the interest, and the monthly burden is heavier, and the repaid principal can not be used again. If the repayment in advance is more likely to be charged liquidated damages, the convenience is low. The application of traditional general house loans is mostly for new house buyers or those with a longer period of fund demand; the circular house loans are mainly for short-term fund demanders, such as working capital, family living reserve fund, investment fund, stock financing, etc., so when applying for house loans, it is advisable to cooperate with the reverse circular house loans to establish a reserve line and calmly respond to the urgent fund demand.