05.2020 Life Guide

New prestigious doctrine of investment: ESG

Far Eastern International Bank / Hong Qizhi

Brand image can not be established in a short period of time. In recent years, more and more companies have invested resources in the hope of reversing the negative impression of the public on the company, or actively building the company's brand image. These investments usually fail to see direct and quantifiable results in the short term, but why do so many enterprises still insist on improving this "invisible energy"?

Basic indicators are standard configuration, and ESG indicators are enough

As an investor, in the past, most of us only care about basic indicators such as how a company's financial performance and how much money it makes every quarter. However, if we only observe the financial data, it is likely to produce investment blind spots, such as: we can't see companies that employ child labor or illegal labor, companies that use black heart raw materials, companies that have a great impact on the environment. Once the negative news is reported, the mines will also explode together, which usually has a serious impact on the investment performance of investors.

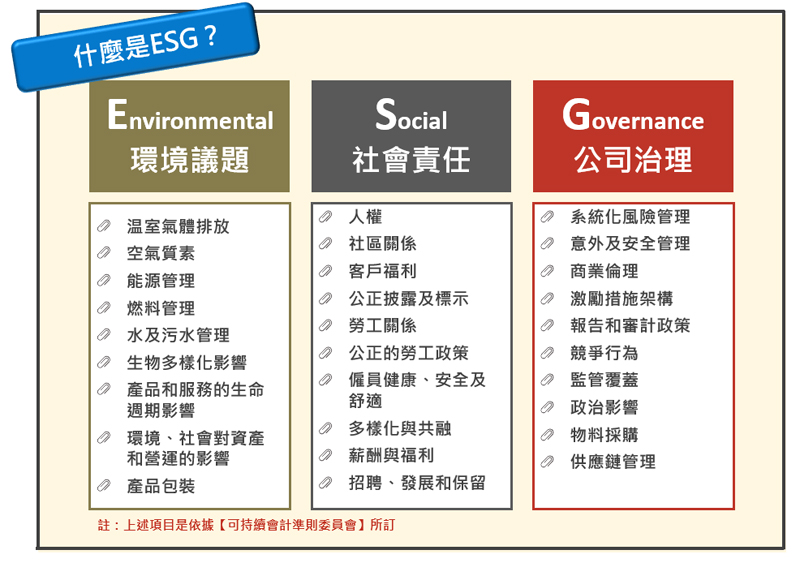

In addition, nowadays, consumers are not only considering the absolute price when purchasing goods, so consumers' trust in the company's brand is very important. How can these positive social perceptions be established? In short, three indicators can be used to prove whether the enterprise has made efforts in the right direction. They are environmental, social and governance "ESG" indicators, which are mainly more "qualitative", "human" and "environmental conservation".

In fact, a similar concept was proposed by UN principles for Responsible Investment (PRI) more than ten years ago. The purpose of this organization is to encourage and support investment institutions. Before each investment transaction, ESG related indicators are used to test whether the investment targets meet the threshold. Since the launch of the principle of responsible investment by the United Nations in 2006, ESG investment has been rapidly popularized all over the world. Today, there are more than 2500 investment institutions that have signed the principle of responsible investment in the world, with a total assets under management of about 85 trillion US dollars. It shows that the global investment market is paying more and more attention to ESG related issues. The following are the six investment principles in the statement of principles of responsible investment:

1. Incorporate ESG issues into the investment analysis and decision-making process

2. Actively exercise ownership and integrate ESG issues into ownership policies and practices

3. Require the invested enterprise to disclose ESG properly

4. Promote the acceptance and implementation of PRI principles in the investment industry

5. Establish cooperation mechanism to strengthen the performance of PRI implementation

6. Report the activities and progress of PRI implementation

Companies with high ESG scores will have a better return on investment in the long run. The purpose of business operation is nothing more than to make money and profit. Of course, the purpose of investors is the same. Only when the company makes money can the stock price rise. However, the common question among investors is: do companies with high ESG scores spend a lot of unnecessary money? Won't these increased costs reduce the profits of enterprises? For this type of question, many foreign investment or research institutions have conducted surveys. For example, Goldman Sachs pointed out that there is a growing consensus in the market on the issue of ESG. The ESG factor of an integrated enterprise has a great positive correlation with the long-term return rate of the company, and can produce performance beyond the overall market. MSCI, an index company, has conducted a series of quantitative analysis on 100 companies and found that in the past five years, companies with high ESG rating have higher average return on capital investment. Fortune also mentioned that the stock price performance of the top five companies in the S & P 500 condition stock is 25% higher than that of the bottom five companies, which is a big gap for investors.

Enterprises are good at fulfilling their sustainable management responsibilities and creating a positive cycle of investment

Enterprises strive for sustainability development There are numerous examples of operation. For example, in the 1990s, Nike, a world-famous sports factory, was protested by American human rights groups and consumers because of the employment of child labor and exploitation of labor on behalf of its manufacturers. Therefore, Nike formulated a code of business conduct, which regulates the operation procedures and relevant regulations of overseas factories, which must conform to the company's standards, and also carries out risk management. In 2013, Amazon, a giant Internet retailer, was also exposed in German warehouses and shipping centers like sweatshops. Not only did the workers have long working hours, low wages and poor accommodation environment. As soon as the news came out, many people protested against the boycott of Amazon. Because of the incident, the German government asked Amazon to make an explanation, forcing Amazon to come out at the first time It is emphasized that the investigation will be conducted in depth and no discrimination against the workers will be allowed. Therefore, the relevant disturbance will subside. From the above cases, we can see how bad news affects the company and how important it is to maintain a positive reputation.

We can start from you and me, refuse to buy clothes made by employing child labor, refuse to buy food made by using black heart raw materials, refuse to use goods made by companies with inhumane production environment or high pollution characteristics, which is our small contribution to this society. Similar methods can be adopted for investment behavior. Companies with high ESG scores will surely win the favor of investors and consumers in the long run, which will be reflected in profit performance and stock price, forming a positive cycle for both consumers and enterprises. From now on, let's turn over the consumption behavior, change the investment thinking, and become an ESG investor together!