01.2022 Life Guide

Make good use of employee benefit trust to accumulate individual pension

Far Eastern International Bank / Zheng Lixin

On September 1, 2020, the Financial Supervisory Commission announced the trust 2.0 "omnidirectional trust" plan, which listed "encouraging enterprises to handle employee welfare trust" as a key project to improve the income substitution rate of labor pension.

Introduction to employee benefit trust

In order to retain talents and enhance employees' centripetal force, the enterprise takes employee welfare as the starting point, and establishes an "employee welfare trust". The company and employees jointly allocate funds on a monthly basis to purchase financial objects as employees' future pensions. "Employee welfare trust" can be divided into "employee stock ownership trust" and "employee welfare savings trust" due to the different scope of the allocated funds (salary deposit withdrawn by employees and incentive fund allocated by the company) used for investment objects 。 The former invests the trust property in its own company's shares, while the latter can choose to invest in different investment targets such as domestic and foreign funds, marketable securities, ETFs, etc. in addition to investing in its own company's shares.

Structure of employee benefit trust

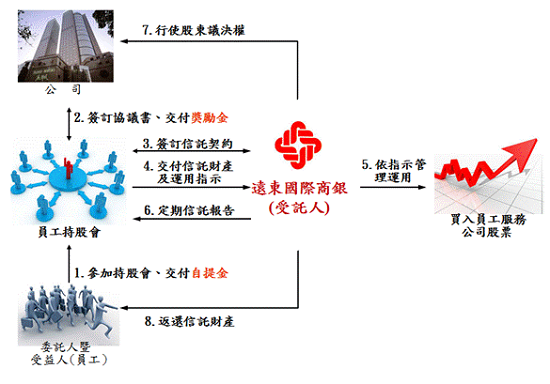

The employee welfare trust has been in operation in Taiwan for many years. Its operation structure is mainly composed of an employee welfare committee formed by the company, After the employees (the trustor and beneficiary) join the committee, the representative of the committee will sign a trust contract with the trust enterprise (trustee) on behalf of the employees. The enrolled employees will allocate a certain amount from their salary every month (such as salary deposit of 5000 yuan per month), and the enterprise will also allocate a certain proportion to the enrolled employees (for example, 30% of the employee's salary deposit shall be allocated as the company's reward); the above funds shall be paid regularly (monthly) the trust enterprise shall use and manage it in accordance with the provisions of the trust contract, and regularly prepare relevant trust rights and interests and profit and loss reports to the employees. When the employees withdraw from the trust contract due to resignation, retirement or death, the trust enterprise shall return cash or shares to the beneficiaries in the manner agreed in the trust contract.

Advantages of employee benefit trust

From the perspective of the company, employees are the largest asset of the enterprise. The establishment of employee welfare trust can attract talents, reduce the turnover rate, improve business performance, promote labor capital harmony and equity stability, and improve the operation of the enterprise. Therefore, many years ago, European and American countries implemented various employee welfare programs to help employees accumulate personal wealth, strengthen employees' centripetal force to the enterprise, and even combine employee goals with the company's growth to improve operating performance.

For employees, in addition to relying on the traditional retirement pension or national annuity, participating in employee welfare trust is like forcing themselves to save, and under the protection of the trust mechanism, it can provide more choices for retirement planning. In addition, choosing "ESOP trust" can also share the company's surplus, participate in the appreciation of stock price, and improve their sense of participation and achievement in work.

epilogue

With the multiple benefits of sharing business results, retaining talents, saving pensions, etc., and the strong promotion of "trust 2.0", in addition to the enterprises that have implemented employee welfare trusts in the past, such as electronic industries and traditional industries, more and more financial industries and start-ups in Taiwan have successively joined the ranks of employee welfare trusts. According to the statistics of the Trust Association of the Republic of China, In the second quarter of 2021, the total amount of employee welfare trust handled by Taiwan's financial institutions has reached NT $134.6 billion. It is expected that more enterprises will set up employee welfare trust in the future to create a win-win situation between enterprises and employees.

#