09.2022 Life Guide

The fairest way of investment -- competitive auction

Oriental Securities Corporation / Lin Yizhen

If you want to buy a stock that is cheaper than the market price, but you can't always win by "public subscription"? It doesn't matter. This issue's "finance column" introduces you to a fair investment method -- competitive auction, which doesn't need to draw lots. You can earn a price difference with the movement of your fingers.

If you want to buy a stock that is cheaper than the market price, but you can't always win by "public subscription"? It doesn't matter. This issue's "finance column" introduces you to a fair investment method -- competitive auction, which doesn't need to draw lots. You can earn a price difference with the movement of your fingers.1、 Origin

Since 2016, the Financial Supervisory Commission has promoted the new system of underwriting competitive auction (hereinafter referred to as "auction"), which means that in addition to meeting certain conditions, the underwriting cases of initial listed (OTC) stocks should be preferentially auctioned in a fairer and more open manner. Since May 2020, it has been stipulated that when issuing convertible corporate bonds in Taiwan, except for cases where the issuance amount exceeds NTD20 billion or the conversion price premium rate exceeds 105%, all convertible corporate bonds must be issued by auction.

2、 Auction features

1. Through online bidding, all eligible bidders can participate.

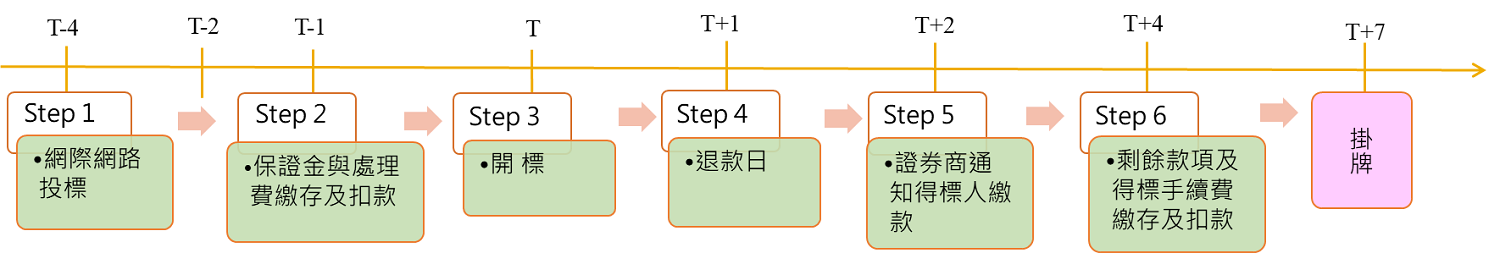

2. It only takes 7 days from bid opening, payment to listing.

3. Multiple bids may be submitted for one case, but the maximum number of bids for each bid is 10% of the current number of bids.

4. After the bidding process is completed on the Internet, the relevant processing fees and security deposits will be automatically deducted from the delivery bank, saving the time for payment at the counter.

5. American Standard shall be adopted, and the one with the highest price shall prevail; However, after bidding, the bid shall not be withdrawn or changed. If the payment obligation is not fulfilled on time, the bid bond will be forfeited by the underwriter.

6. The bid processing fee for unqualified and unsuccessful bid forms will not be returned.

3、 Eligibility to participate in bidding

A securities underwriter may accept competitive bidding only for the following objects, except that those who are "insiders of the issuing company and the underwriting syndicate, investees of the equity method of the issuing company, and investors of the equity method of the issuing company" shall not participate in the bidding.

1. An adult national of the Republic of China.

2. Securities investment trust funds offered by Taiwan legal persons and securities investment trust enterprises.

3. Overseas Chinese and foreigners who may invest in securities in accordance with the regulations governing the investment of securities by overseas Chinese and foreigners.

4. The Executive Yuan's development fund, postal savings, public servants' pension fund, labor pension fund, and labor insurance fund.

5. Other objects approved by the government.

4、 How investors participate

1. It shall hold a securities trading account and open a securities online trading account.

2. Using the electronic certificate issued by the securities firm, log in to the "competitive auction system for underwriting securities" of the stock exchange to fill in the tender form, or place an order at the terminal equipment set up at the business premises of the head office (branch office) of the opening securities firm.

3. The bid acceptance period is from 9:00 a.m. to 2:00 p.m. on three business days.

4. The stock exchange shall handle the bid opening at 10:00 a.m. on the second business day after the deadline for submission of bids.

5、 Auction overview of initial OTC cash capital increase and convertible corporate bonds vs. market trend

5、 Auction overview of initial OTC cash capital increase and convertible corporate bonds vs. market trend1. The discount rate of the initial OTC cash capital increase auction price is not highly correlated with the market trend

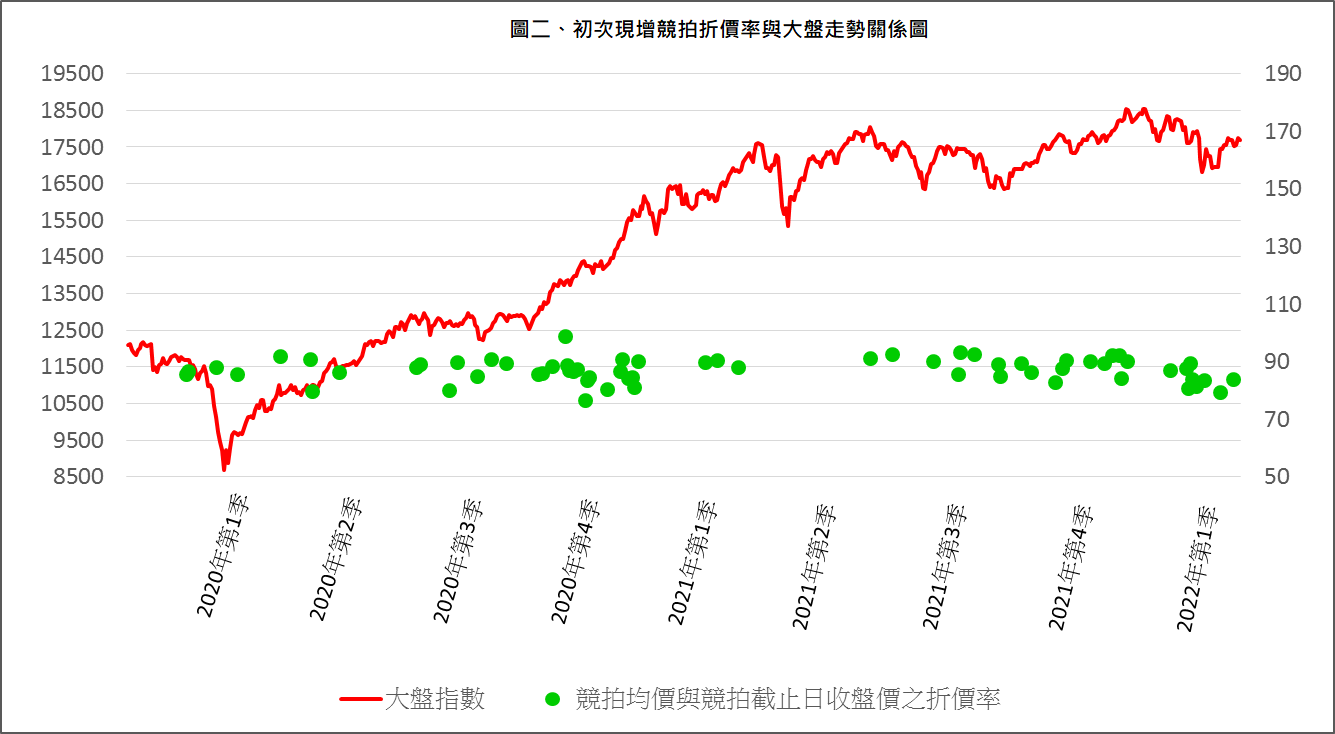

Investors participate in the "competitive auction of initial OTC cash capital increase" (hereinafter referred to as the "initial cash increase auction") in the hope of obtaining stocks lower than the emerging market price to earn capital gains. From the "relationship between the discount rate of initial cash increase auction and the market trend" (Figure 2), it can be seen that the discount rate of auction (the average price of auction / the closing price on the closing date of auction) is not highly correlated with the market trend, and the cases in the first quarter of 2020-2022, The discount rate ranges from 76.51% to 98.77%, of which the average discount rate of each year is 86.76%, 88.60% and 84.61% respectively. Therefore, the price at which investors are willing to participate in the bidding should depend on the fundamentals of the target company, the overall social and economic atmosphere, and the performance of recent initial OTC listed stocks.

(data collection: underwriting department of Oriental Securities Corporation)

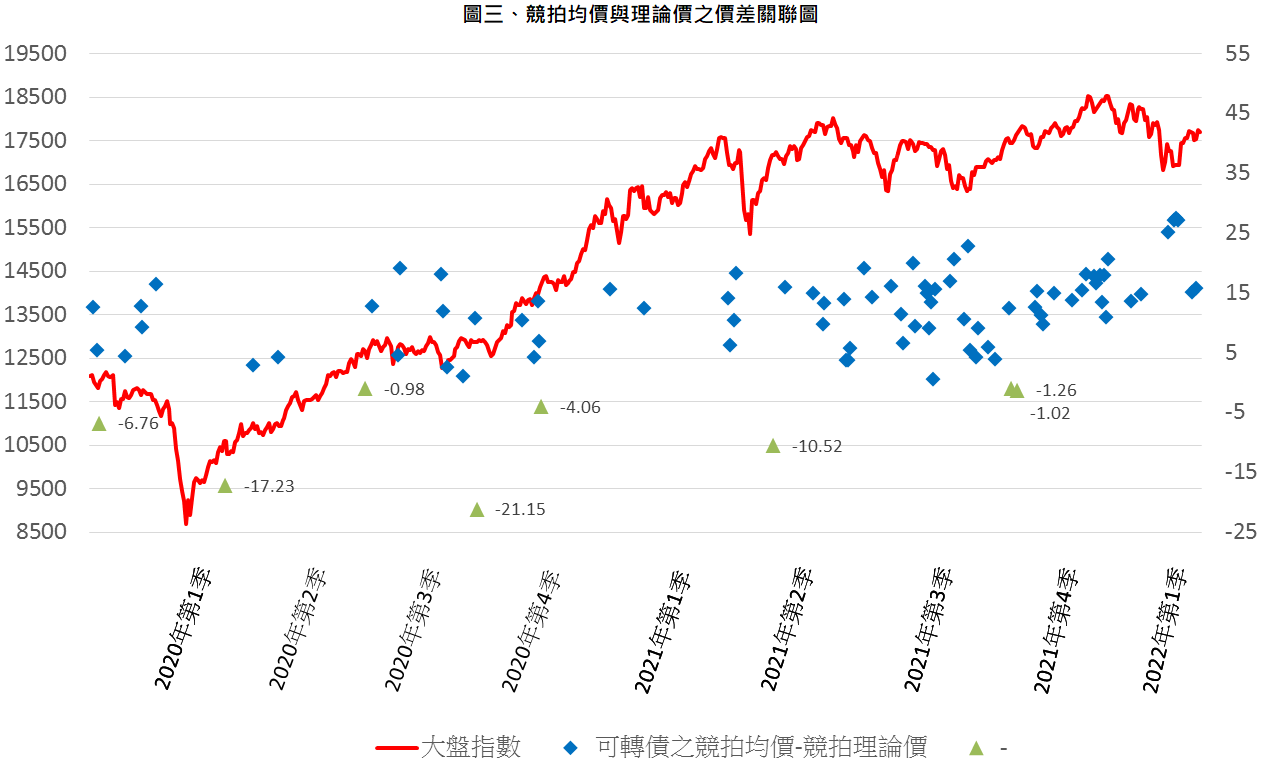

(data collection: underwriting department of Oriental Securities Corporation)2. The auction prices of convertible bonds and corporate bonds are mostly premium

The theoretical price of the convertible bond (hereinafter referred to as the "theoretical price") is "market price ÷ conversion price". If the theoretical price is greater than the nominal price (NTD100), it means that the convertible bond has conversion value; Otherwise, there is no conversion value. It can be seen from the "correlation diagram of the price difference between the average auction price and the theoretical price" (Figure 3), that the price difference between the average auction price and the theoretical price is mostly a premium (> 0), mainly because the convertible bond has the characteristics of a bond and contains a conversion right; As for the discount (< 0) in a few cases, most of them are caused by the sharp rise of the stock price during the bidding period, and the theoretical price is far higher than the par value. Investors consider that they can not convert into ordinary shares immediately after issuance.

6、 How to fill in the bidding price

1. Initial additional auction

Before bidding, investors participating in the initial cash in auction should pay attention to whether there is a reasonable discount rate between the auction price and the emerging market price after adding the costs such as handling fees and handling fees, so as to avoid losses after the listing of stocks. How much should we discount the market price when we bid? It is recommended to refer to the discount rate of recent initial OTC listed stocks and the stock price trend after listing. If most of the bidding investors can make profits and the capital market atmosphere is relatively warm at that time, they can be slightly more positive in bidding; On the contrary, it should be conservative and avoid bidding for stocks at high prices.

2. Convertible bond auction

Investors participating in the bidding of convertible bonds are advised to base their bids on the theoretical price of the convertible bonds, the issuer's credit rating and issuance conditions. Generally speaking, the higher the theoretical price, the better the credit rating, and the more favorable the issuance conditions are for investors, the higher the average auction price. However, when the convertible bond matures, the issuer will only repay the principal and interest, so it is necessary to consider whether the bidding price has conversion value or opportunity to avoid losses.

7、 Bid related expenses

8、 Conclusion

Due to the characteristics of the highest bidder, bidding is the fairest way of underwriting in the capital market. However, the stock market changes rapidly, and investors' trading mentality also changes. If you can consider the results of recent auction cases before bidding, and match them with the market price performance after listing, you should improve your profit opportunities.

Note 1: the percentage of bid security for each bid is currently 50% of the bid amount.

Note 2: the bid processing fee for each bid is currently ntd400.

Securities auction system: https://scas.twse.com.tw/SCAS/

Auction announcement of the stock exchange -- bidding schedule: https://www.twse.com.tw/zh/page/announcement/auction.html

Securities firm underwriting securities announcement system: http://web.csa.org.tw/Edoc2//