11.2022 Life Guide

How to adjust fund allocation when financial markets remain weak

Far Eastern International Bank / Luo Jingyi

Financing is a major event in life. In recent years, as banks provide a friendly fund trading environment, more and more investors choose fixed investment funds as a way of financing or pension accumulation. However, the market environment has changed a lot, and the fund commodities are very diverse. In the face of a continuously weak bear market, how to adjust the fund allocation and turn challenges into opportunities is a compulsory topic for investors.

Financing is a major event in life. In recent years, as banks provide a friendly fund trading environment, more and more investors choose fixed investment funds as a way of financing or pension accumulation. However, the market environment has changed a lot, and the fund commodities are very diverse. In the face of a continuously weak bear market, how to adjust the fund allocation and turn challenges into opportunities is a compulsory topic for investors.In 2022, the financial market was affected by the black swan events such as war, inflation, interest rate rise, recession, and energy crisis. Since the beginning of the year, global stocks and bonds have simultaneously fallen into a technical bear market (a drop of more than 20%). In particular, the bond market recorded the largest drop since 1990 in August. I believe that many people feel bad after receiving the recent fund statement. How to deal with the disordered market environment? Should the investment plan be adjusted?

Should we continue to make regular and fixed deductions?

General investors often sell their funds at low points and buy them again when the stock market rises. However, if they plan to invest for a long time, they should continue to invest in the bear market and ask the fund manager to help you buy more stocks at low points. Warren Buffett said, how to view the bear market depends on whether you are a buyer or seller. If you are accumulating pension funds, it is good to see the stock price fall, and you can buy more cheap stocks; For investors who want to earn short-term income, the decline of stock price is bad news, which will cause short-term investment losses. Far Eastern International Bank suggested that investors should think calmly. The investment plan may need to be adjusted, but the investment pace should not stop there.

How to check and adjust the investment portfolio?

After the construction of the portfolio, it is unnecessary to frequently review the performance, otherwise it will increase the unnecessary time cost, and even derive unnecessary transaction costs in order to pursue short-term performance. Experience shows that lazy investors usually have higher profits than industrious investors. Therefore, it is recommended to review the portfolio quarterly, semi annually or even more frequently. In order to find out whether the investment portfolio has structural problems, the following points can be referred to:

1. Confirm whether the investment objective has changed

If personal conditions (such as age, family members, living environment, work and income) have changed significantly, we must rethink the allocation proportion and portfolio characteristics that are suitable for our life goals. Even if the investment objective has not changed much, if the investment strategy or market performance of the fund held is not as expected, the asset allocation will change. Therefore, we should first check whether the above factors have changed, how big the gap is, and what the fund outlook is, and then judge whether adjustment is needed and how to adjust.

2. Perspective the portfolio with the help of review tools

In response to the demand of risk diversification, investors may hold multiple funds in asset allocation, such as developed or emerging market hybrid asset stock funds, multi industry asset theme funds, etc., which makes it impossible to intuitively see the actual allocation of the overall portfolio. It is recommended to use portfolio inspection tools to understand the national and industrial distribution of various assets, as well as the annual volatility and Sharp value of the portfolio, In addition, it can also check whether the proportion of stocks or assets held by a single company is too high, as a reference for asset allocation adjustment.

3. Adjust according to the future outlook of the fund

Investors can seek help from financial consultants of professional institutions to deeply analyze the funds in the investment portfolio. For example, "Far Eastern International Bank Smart Wealth Management" can provide five force analysis of funds for each fund: equity funds are scored according to the cost to earnings ratio, market to business ratio, industrial concentration, liquidity, and future earnings growth rate; Bond funds will be given scores based on duration, yield to maturity, liquidity, credit score and concentration of bonds; Balanced funds provide both stock and debt analysis. Investors can refer to the analysis results and comprehensive scores to evaluate how to adjust asset allocation.

4. Review relative performance

Although investors should regularly review the funds with the highest and lowest performance in their portfolios, they should not pay too much attention to short-term performance. It is recommended that quarterly, half a year or longer performance be taken as the review cycle. At the same time, investors should not easily reduce the number of funds with poor performance, and increase the number of funds with good performance. It is recommended to evaluate the relative position of their actual value and price, otherwise they are easy to sell at the low point and buy at the high point.

After understanding your investment portfolio in depth through the above four points, you can discuss with the financial consultant before making adjustments (also known as "rebalancing"). In the process, you must pay attention to the following three points:

1. Plan before you act

It is not advisable to adjust the investment portfolio substantially in a short period of time. It is necessary to draw up a plan first and adjust it in batches and gradually within the scheduled time to avoid the risk of buying high and selling low. However, due to the relatively large volatility of equity funds, if the proportion of equity funds in the investment portfolio is too high (especially high-risk assets), the earlier the adjustment, the better.

2. New funds available

If the adjustment of the investment portfolio is not urgent, in addition to selling the old and buying the new, the allocation proportion can also be adjusted through the new capital increase, so that the final investment proportion is consistent with the expected goal.

3. Not completely measured by performance

If the original fund must be sold to adjust the investment portfolio, the first consideration is of course the fund with poor overall performance. It is worth noting that we must first compare with the same type of goods and find out the alternative goods, not only based on the absolute compensation.

Fund for the Lazy Global Multi Asset Fund

Funds have become quite mature financial products in Taiwan. There are more than 3000 funds to choose from in the market, and the number and types are very diverse. However, the operating styles and capabilities of various asset management companies are different, and the market is cyclical and highly uncertain. Therefore, few single type funds can dominate the performance for a long time.

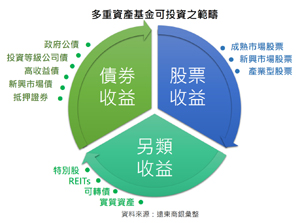

If investors only allocate funds of a single asset class, it is usually difficult to avoid the impact of cyclical fluctuations. Harry Markowitz, the Nobel laureate in economics, once said that "asset allocation is the only free lunch in the investment market". At present, there are many global multi asset funds that can not only assist investors in asset allocation, but also effectively diversify risk and asset choices. Multi asset fund is not a single product that pursues performance, but a stable allocation of assets. It allocates stocks, bonds and real assets of different types and styles. At the same time, it helps investors find bonds with good financial health and stocks with good prospects of the company by virtue of the professional management ability of the fund manager team (usually this type of fund is managed by the stock and bond teams respectively), and reduces the overall asset volatility to a certain extent, And then improve the investment experience. In addition, the fund Manager team will adjust the investment portfolio flexibly according to market changes. If you are a petty bourgeois or a busy office worker and do not have time to handle the allocation and adjustment of fund assets, this type of fund can meet basic investment needs.

Effective asset allocation is the best way to seek the Holy Grail of financial management

If you have doubts about the current fund allocation, you may wish to review the fund portfolio according to the above points, and contact the financial consultant, and the professional team will provide in-depth analysis and suggestions. Effective and long-term asset allocation can reduce investment volatility and stabilize returns, which is the best way to seek the Holy Grail of financial management.