05.2024 Life Guide

New system of labor retirement fund dividends recorded in accounting, legal reporting, you know

Far Eastern New Century Corporation / Peishan Hong

After the implementation of the "Labor Retirement System", employers are required by law to contribute retirement benefits to eligible workers, which are invested by the Ministry of Labor Labor Fund Utilization Bureau on behalf of them, and income distribution is regularly carried out. The operational performance of this system is related to the rights and interests of workers. How can the fund dividend situation be checked? This issue of the Legal Column introduces various channels to ensure that information is not missed.

After the implementation of the "Labor Retirement System", employers are required by law to contribute retirement benefits to eligible workers, which are invested by the Ministry of Labor Labor Fund Utilization Bureau on behalf of them, and income distribution is regularly carried out. The operational performance of this system is related to the rights and interests of workers. How can the fund dividend situation be checked? This issue of the Legal Column introduces various channels to ensure that information is not missed.Since the implementation of the "Labor Retirement System" on July 1, 2005, employers are required to contribute no less than 6% of their monthly wages as labor pension to workers who are eligible for this system, and deposit these funds into the personal account for labor pension established by the Labor Insurance Bureau; Workers can also voluntarily contribute their retirement pension within the range of 6% of their monthly salary.

After employers and workers contribute to their retirement benefits, these funds will be invested by the Ministry of Labor Labor Fund Utilization Bureau before the workers retire and can only be withdrawn at the age of 60. If there is any income, it will be distributed to the workers, known as "labor retirement dividends".

In recent years, the distribution of dividends from the newly established labor retirement fund has always been a focus of social attention. In early March each year, the Labor Insurance Bureau distributes benefits in proportion to the amount in the labor account, the length of insurance coverage, and the monthly allocation amount, and publishes the amount in the individual labor retirement account. In order to improve transparency and facilitate public access, the government and relevant institutions provide diverse channels as follows:

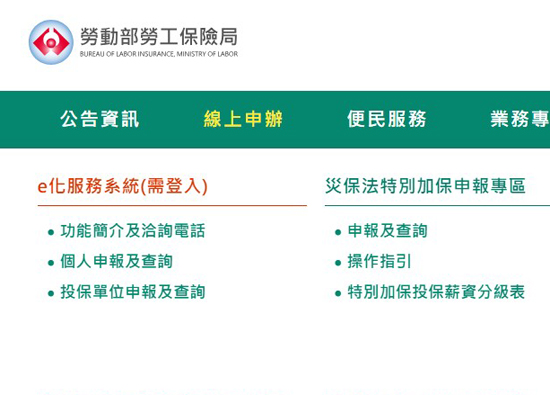

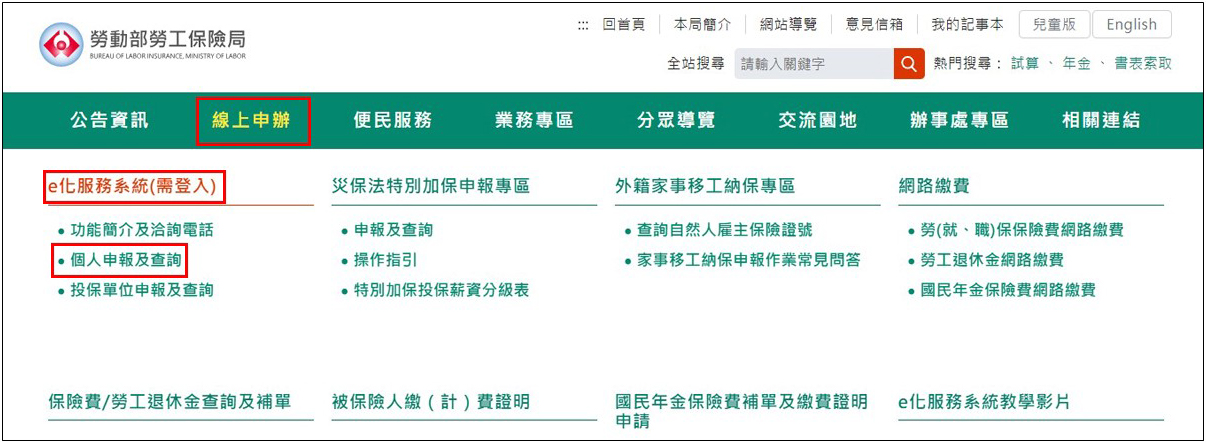

1、 E-service system for the website of the Labor Protection Bureau

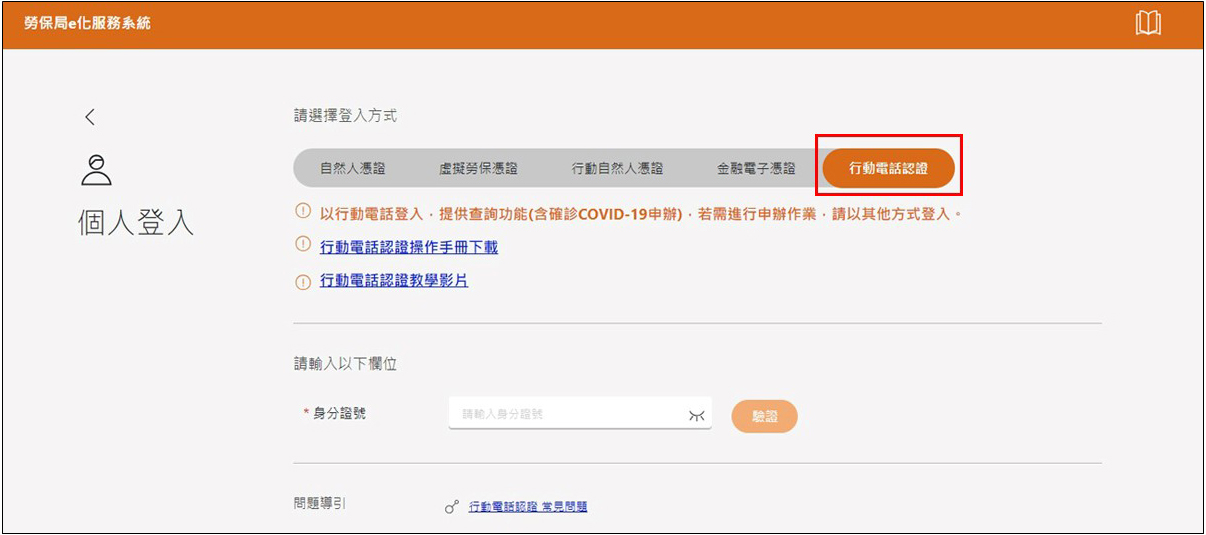

Through online search, users can instantly and conveniently log in to the system using their computer or mobile phone to check their retirement fund dividends, as well as the trial calculation amount and related information. The login methods include "mobile phone authentication", "natural person credentials and card readers", "virtual labor protection credentials", and "mobile natural person credentials". The following is an example of "mobile phone authentication":

(1) Enter the "Labor Protection Bureau" website. (2) Select the "Online Application" project. (3) Click on the "E-service system (login required)". (4) Click on "Personal Declaration and Query". (5) Enter the "Labor Protection Bureau E-service system". (6) Choose to log in with "Mobile Phone Authentication". (7) Use the mobile phone number of the individual's application, complete identity verification through online connection, and log in to the system. (8) After the authentication application is successful, you can query and calculate.

You can apply for a labor security card from a cooperative bank commissioned by the Labor Protection Bureau (such as Land Bank, E.SUN Bank, Taipei Fubon Bank, Taishin International Bank, First Bank), and then go to the issuing bank's physical ATM or check and calculate through an online ATM.

3、 Postal Financial Card

After filling out the "Labor Protection Bureau Information Inquiry Service Agreement" at the post office, you can inquire at the physical ATM of the post office.

4、 Temporary cabinet of the Labor Protection Bureau

I need to bring the original ID card or other identification documents with photos (such as driver's license, health insurance card, passport, residence permit) to the counters of various offices of the Labor Protection Bureau for inquiry. (Source: Ministry of Labor Labor Insurance Bureau, Labor Fund Utilization Bureau)

#