05.2024 Life Guide

Participating in ETF investment starts with understanding

Oriental Securities Corporation / Yang Yixuan

In 2024, Taiwan's stock market saw a sharp performance driven by AI and related electronic stocks, with the weighted index successfully reaching the 20000 point mark in March. The strong performance of IC stocks, high priced stocks, and high equity stocks contributed greatly, driving up the prices of related ETFs. Under the active influx of investors, the trading volume of listed ETFs exceeded the market total by as much as 7%. This wave of enthusiasm has expanded to the initial issuance market, with multiple ETFs experiencing a large number of subscription surges during IPOs, and even rumors that investors are willing to withdraw their deposits or borrow money to subscribe to ETFs. What exactly is an ETF? This issue of "Finance Column" will answer your questions.

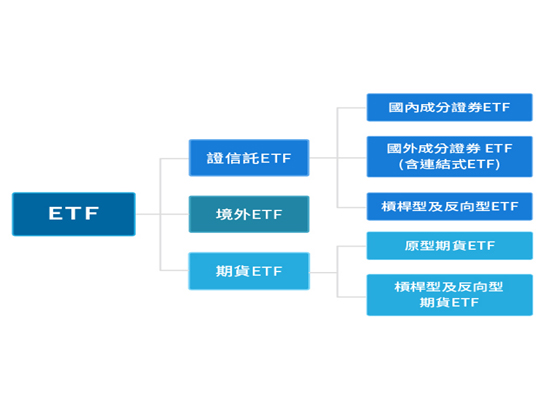

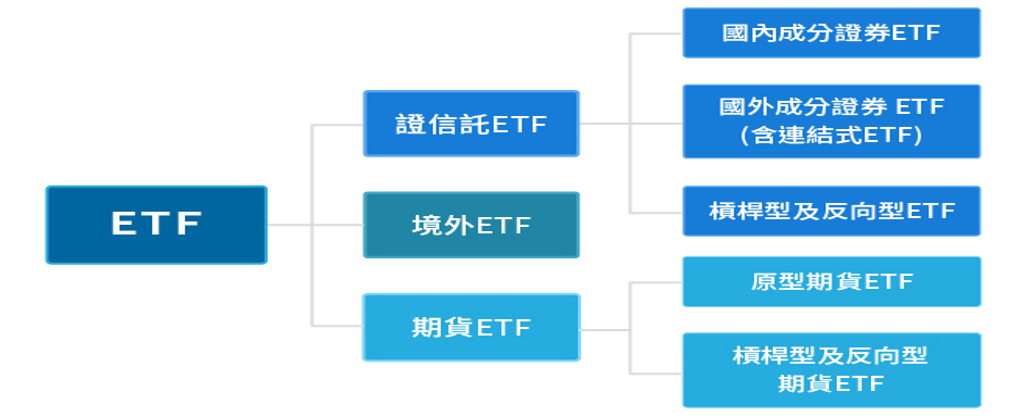

In 2024, Taiwan's stock market saw a sharp performance driven by AI and related electronic stocks, with the weighted index successfully reaching the 20000 point mark in March. The strong performance of IC stocks, high priced stocks, and high equity stocks contributed greatly, driving up the prices of related ETFs. Under the active influx of investors, the trading volume of listed ETFs exceeded the market total by as much as 7%. This wave of enthusiasm has expanded to the initial issuance market, with multiple ETFs experiencing a large number of subscription surges during IPOs, and even rumors that investors are willing to withdraw their deposits or borrow money to subscribe to ETFs. What exactly is an ETF? This issue of "Finance Column" will answer your questions.The full name of an ETF is "Exchange Traded Fund", which is a commodity issued by an investment trust company. It mainly simulates the performance of the underlying assets it recognizes. The underlying assets can be domestic and foreign indices, stock investment portfolios, bonds, or commodity futures. In addition, investment trust companies use leverage or reverse operations to launch products such as double ETFs or reverse ETFs.

Source: Taiwan Stock Exchange

Source: Taiwan Stock ExchangeTaking the 0050 ETF, which was the earliest issued ETF in Taiwan, as an example, it is linked to the Taiwan 50 Index jointly compiled by the Stock Exchange and FTSE. The consistency stock is one of the top 50 companies in the total market value of the Stock Exchange, mainly considering the relatively stable operation and dividend distribution of large enterprises. Through diversified investment methods, it can also reduce the risk of a single position, making it suitable for long-term investors who choose the market but not the stocks, and aim to save stocks.

Recently, investment and trust companies have successively issued ETFs linked to high-value stocks, continuously locking their investment portfolios in high-value stocks through regular adjustment of holdings, and adopting regular dividend distribution methods (such as monthly dividend distribution) to enable investors to obtain high and stable returns. In addition to having high dividend characteristics, this type of ETF has also been driven up by the recent continuous rise in the stock price of related consumer stocks, which in turn has led to an increase in ETF prices. Investors not only earn dividends, but also have particularly amazing potential capital gains, thus attracting more investors to participate in subscription frenzy.

However, can ETFs really make a steady profit without losing? The discussion will be conducted from two perspectives:

1、 Price fluctuation risk

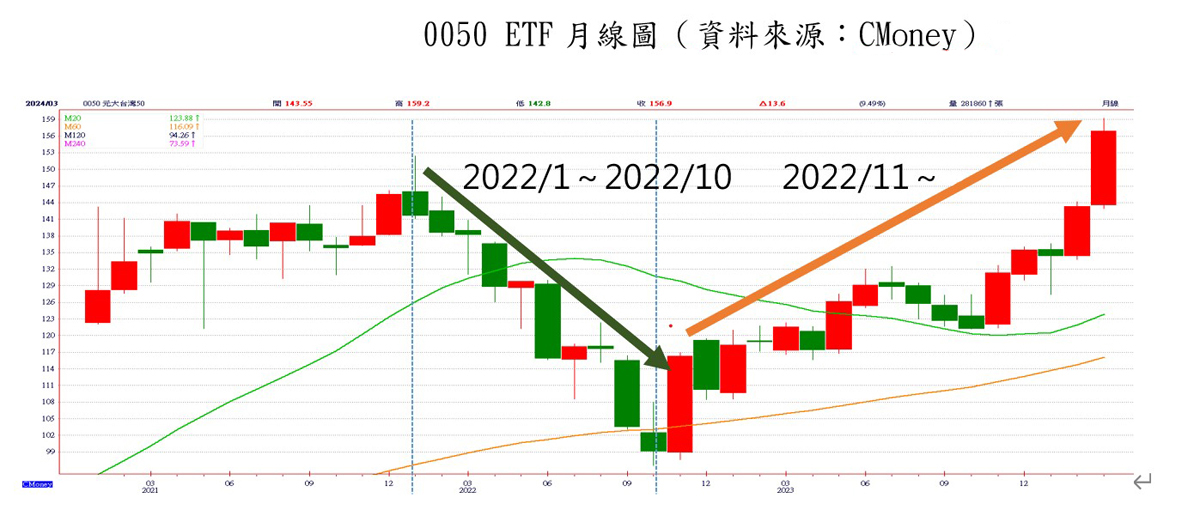

Taking the 0050 ETF as an example, Taiwan stocks have recently shown strong performance under the leadership of weighted stocks. The 0050 ETF can quickly pay interest every six months after interest distribution, and the investment return rate is quite astonishing. But if we pull back to 2022, when the COVID-19 pandemic is gradually coming to an end and market demand is not showing any significant improvement, international stock markets have seen another wave of retracement, and the 0050 ETF has not been spared. The largest decline during this period was as much as 36%, indicating that ETFs, like general stock commodities, are also subject to fluctuations in prices due to factors such as business cycles and government policies.

0050 ETF monthly chart (source: CMoney)

In addition, ETFs belong to open-end funds, and investors can directly subscribe and redeem from investment companies. Investment companies must purchase stocks in the market in an equal proportion based on the funds obtained from the investor's subscription. If a large amount of funds are raised during the initial public offering (IPO) of an ETF, and investment trust companies continue to buy portfolio targets, it will inevitably drive up the stock price and cause an increase in ETF costs; On the contrary, if the market unfortunately encounters a reversal, investors may gradually demand the redemption of ETFs, and investment trust companies must reduce their holdings in the market in an equal proportion. At that time, there may also be a downward trend in stock prices, resulting in a decrease in the net value of ETFs. Therefore, for ETFs with large fundraising amounts during IPOs, special attention should be paid to the increase in price fluctuations caused by portfolio chasing high and killing low.

2、 Leveling gold mechanism

In recent product descriptions of multiple high dividend ETFs, it has been mentioned that the source of interest distribution may be "income equalization funds.". Due to the lack of a reserve fund mechanism for ETFs, the announcement of their high dividend payout amounts may attract active participation from new investors in the primary market, resulting in a reduction in the actual dividend payout ratio (all new and old investors jointly distribute cash dividends allocated to the investment portfolio). Therefore, in order to stabilize the dividend payout ratio of ETFs, recently issued ETFs have mostly adopted the "reserve fund" mechanism, which means that a portion of the amount invested by new subscription investors will be included in the "reserve fund" to provide all investors with dividend payouts, so that the actual dividend payout ratio of the fund is consistent with the previously announced dividend payout ratio. But for new subscription investors, the actual investment amount will be lower than the original investment amount, and a portion of the dividends obtained will come from the previously paid reserve fund.

For existing ETF investors, even if they receive high dividends according to the original dividend payout ratio, if they do not reinvest the dividends, the asset value after ex dividend may decrease, which may affect future investment returns. ETF investors who pursue stable high dividend yields should pay attention to the differences and respond accordingly.

In recent times, due to excessive market speculation, there is a risk of increased ETF investment risks. The Financial Supervision Commission has repeatedly reminded investors to understand the characteristics of commodities and raised potential risks such as the impact of market changes on ETF prices, the issue of discounts and premiums between ETF prices and actual net worth, excessive concentration of certain ETF investment groups in specific industries, and the possibility of unstable actual interest distribution for high-yield ETFs.

However, from a long-term investment perspective, ETFs with portfolio characteristics are indeed a good investment target. To avoid excessive chasing high and killing low, it is recommended to adopt a "fixed period and fixed amount" investment method. After the ETF has gone through a complete business cycle, stable profits can be achieved. Especially for investors who do not have time to view the market or are unable to place orders during working hours, it is recommended to sign a fixed period and fixed amount contract with securities firms. Investors can decide on the fixed purchase time and quantity, and securities firms can assist in buying according to the agreement.

At present, Oriental Securities Corporation has provided more than 50 fixed term investment ETF targets, including high interest value ETFs, ESG, and bond ETFs that have recently been highly discussed. Friends who are interested in fixed term investment are welcome to visit the official website of the Asia Securities Regulatory Commission to view relevant explanations and jointly grasp the opportunity for long-term stable profits.

#