05.2024 Life Guide

Make good use of trust financial tools to safeguard retirement life

Far Eastern International Bank / Jian Finland

Living a stable life in the elderly is a common expectation of the people. According to statistics released by the competent authority, the average life expectancy in Taiwan in 2021 was 80.86 years. If calculated from the official retirement age of 62 years and a healthy remaining life of 73.3 years, the unhealthy remaining life of Taiwanese people is about 7-8 years. Therefore, the adequacy of retirement benefits will determine the quality of life in the latter half of one's life.

Living a stable life in the elderly is a common expectation of the people. According to statistics released by the competent authority, the average life expectancy in Taiwan in 2021 was 80.86 years. If calculated from the official retirement age of 62 years and a healthy remaining life of 73.3 years, the unhealthy remaining life of Taiwanese people is about 7-8 years. Therefore, the adequacy of retirement benefits will determine the quality of life in the latter half of one's life.The World Bank proposed the "three-layer pension system" in 1994, which means injecting elderly pensions through three pillars. The first layer is the mandatory social security system, which provides social insurance for the government, such as labor insurance, public security, etc; The second layer is the "occupational pension system", which refers to the retirement benefits allocated by service institutions in accordance with the law, such as labor pension, civil servant retirement pension, private school retirement pension, etc; The third layer is personal savings, financial management, and commercial insurance based on personal needs.

Under the wave of international ESG Sustainability Development, Taiwanese companies are strengthening their implementation of corporate social responsibility and corporate governance through excellent employee benefits, good labor relations, and other means, moving towards the goal of sustainable operation. In order to assist the public in accumulating future wealth and retirement financial planning, the Financial Supervisory Commission and the Trust Industry Commercial Association (hereinafter referred to as the Trust Association) continue to encourage financial operators who also operate trust industries (hereinafter referred to as trust operators) to promote the application of "employee welfare trusts" to enterprises as the third pillar to strengthen employee retirement preparedness. Commercial Times revealed in November 2023 that a total of 668 publicly issued companies have established employee welfare trusts, with trust assets reaching NTD 208.315 billion. Among them, 379 companies in the electronics industry have the highest proportion, accounting for 56.71%.

Strengthening personal retirement protection through employee welfare trusts

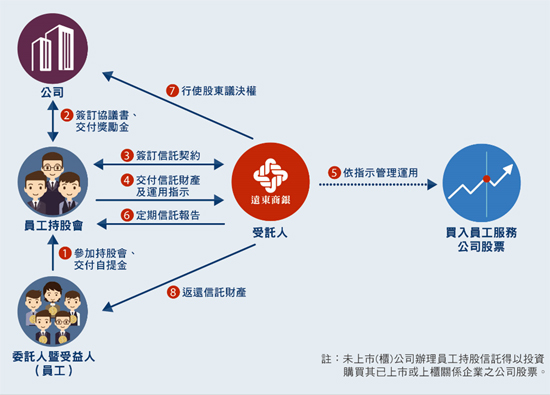

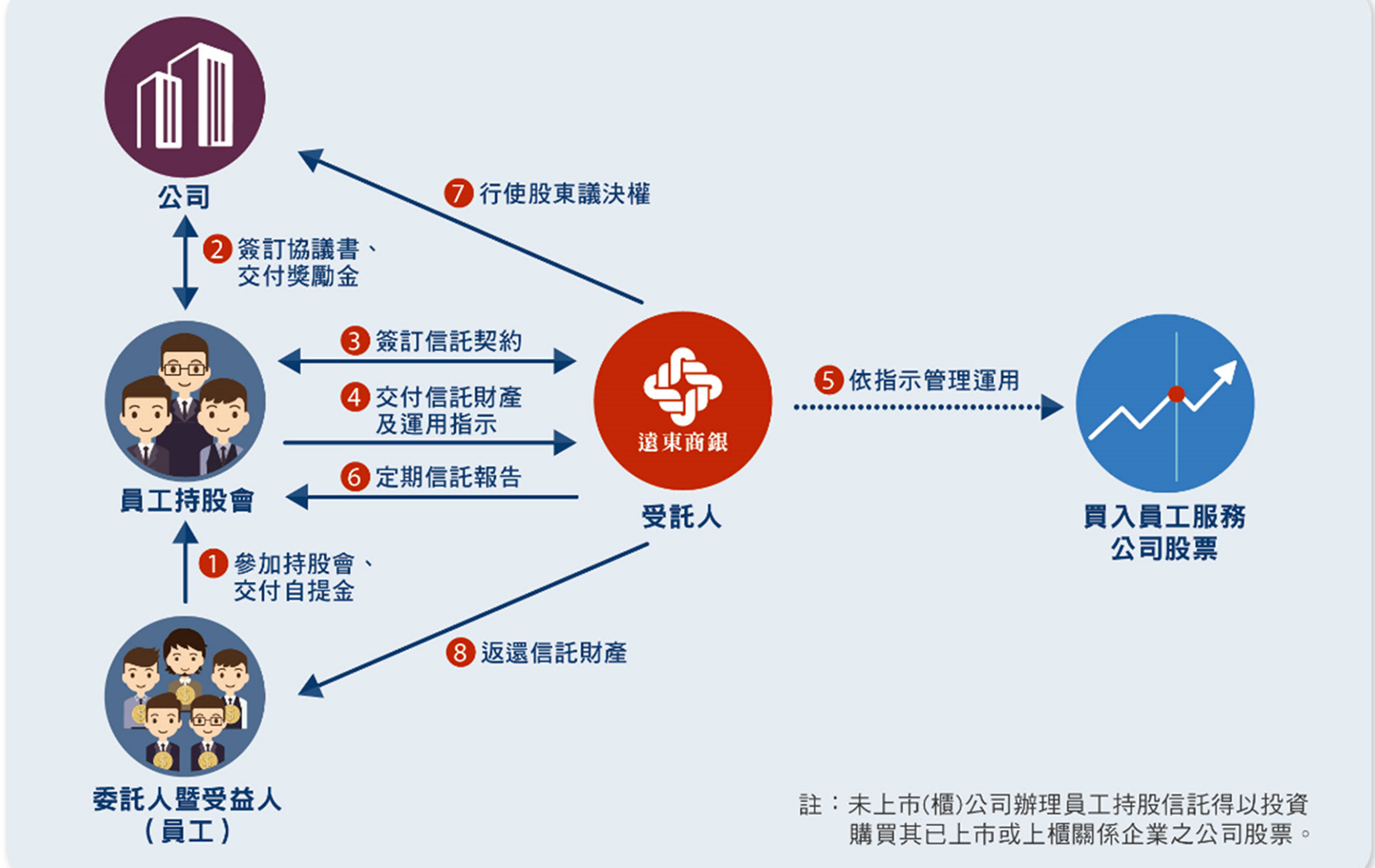

The Employee Welfare Trust, which combines savings and investment management, is a welfare plan provided by enterprises to employees. The operation mode is composed of employees from the same enterprise, forming the Employee Shareholding Trust Committee/Employee Welfare Savings Trust Committee (hereinafter referred to as the Shareholding Association/Welfare Reserve Committee), which stipulates the allocation of a certain amount (hereinafter referred to as the "self withdrawal fund") from the employee's salary, bonus or bonus, and the reward funds allocated by the employee's affiliated enterprise, to be delivered to the trust operator. The operator invests the self withdrawal and reward funds in the company's stocks or financial products in accordance with the trust contract and the instructions of the Shareholding Association/Welfare Reserve Committee, and achieves the purpose of long-term investment and accumulated retirement through regular and fixed investment. There are two common types: "Employee Stock Ownership Trust" and "Employee Welfare Savings Trust":

1. "Employee Stock Ownership Trust": The company invests the monthly self withdrawal funds allocated by employees and the reward funds allocated by the company in its own company stocks, suitable for listed (OTC) companies or non listed (OTC) companies that have control and subordinate relationships with listed (OTC) companies.

2. "Employee Welfare Savings Trust": Enterprises can invest their employee self withdrawal funds and company rewards in their own company stocks, as well as in domestic and foreign funds or other securities, suitable for non listed (over-the-counter) companies.

In order to protect the rights and interests of the majority of unpublished quoted entity employees, and to support enterprises in assisting employees in preparing pensions, taking care of employees, and retaining talents, the Financial Supervisory Commission agreed on September 23, 2023 that unpublished quoted entities can invest the funds of the Employee Stock Ownership Trust in the stocks of any single company issued by any public quoted entity that has control and subordination with the company within the affiliated group. This move is undoubtedly a great blessing for unpublished quoted entity employees, who can share the profit opportunities of outstanding stocks with employees of the same group's publicly quoted entity.

In addition to providing benefits to employees, handling employee welfare trusts by enterprises is beneficial for the company's operation and image maintenance. For employees, participants can enjoy rewards provided by the company, indirectly increasing their personal salary income, and accumulating wealth through long-term fixed quotas, providing more security for retirement life; For enterprises, it can not only retain talent, improve employee loyalty and morale, reduce turnover, but also realize the concept of employees as shareholders, share business results together, promote equity stability, establish a good reputation, and shape the image of a happy enterprise.

How to participate in employee welfare trusts?

Firstly, general enterprises will limit the number of regular employees or those who have served for a certain period of time to join the stock holding association and enjoy the rewards allocated by the enterprise. Secondly, the representative of the shareholding committee shall sign a trust agreement with the trust operator, specifying management and utilization matters such as stock investment date and frequency. Thirdly, employees usually need to wait for resignation, retirement, or approval from the shareholders' meeting before exiting and disposing of their stocks. Fourthly, when a company distributes dividends or handles capital increases, employees can also enjoy shareholder rights. Finally, trust operators will charge trust management fees, which are usually borne proportionally by employees.

Seamless integration between employee welfare trust and hospice trust to create a perfect retirement plan

According to statistics from the Police Administration of the Ministry of the Interior, the number of fraud crimes increased by 7000 from January to October 2023 compared to the same period last year, with investment fraud cases showing the largest increase; The proportion of victims over 50 years old in all fraud cases is as high as 24.54%. Due to the retirement age of most employees being between 55 and 60 years old, as their physical functions continue to decline, their understanding and judgment of affairs may decline year by year. Once they are defrauded by someone, the retirement benefits accumulated through years of hard work may become worthless, leading to worries for the latter half of their lives. In response to the arrival of an aging society, trust companies have launched retirement trusts with functions such as asset protection, dedicated use of funds, payment of various fees on behalf of the elderly, and extension of customer will to safeguard the property safety of the elderly. After the elderly deliver their assets to bank trusts, they can also invest in financial products and continuously accumulate retirement and retirement funds to avoid infringement by illegal individuals.

In order to increase the acceptance of trusts by the public, various trust companies have launched "pre opening type elderly care trusts", which means that the public signs an elderly care trust contract with the trust company in advance, transfers personal assets to a special trust account for management and use (such as handling fixed-term deposits), and when the agreed period expires, designated situations occur, or customers give instructions, the trust company will pay various living expenses such as elderly care institution fees, medical expenses, and hiring caregivers in accordance with the provisions of the trust contract. Before paying fees or distributing trust property income, the trust operator will only charge a small or even no trust management fee. Taking Far Eastern International Bank's pre opened "Leling Rehabilitation Trust" as an example, customers will not charge trust management fees before initiating various payments or distributing trust property income.

When enterprise employees participate in employee welfare trusts, if they can also sign a "pre opening type of retirement trust" with the trust company, they can directly transfer the funds accumulated before retirement or the stocks disposed of during retirement to the "pre opening type of retirement trust" trust account. This not only protects the hard-earned pension, but also provides assistance from the trust company in management and special use of funds, making your retirement life happy and worry free.

#