06.2024 Life Guide

Labor insurance annuity payment increase! The highest increase is 7.59%

Far Eastern New Century Corporation / Yan Wenting

The payment of labor insurance pension will be increased this year to resist the pressure of inflation on people's lives. According to the Labor Insurance Regulations, when the cumulative growth rate of the Consumer Price Index (CPI) reaches the statutory adjustment standard of 5%, the Labor Insurance Bureau will increase the amount of pension payments in accordance with the law. Those who are currently receiving labor insurance pension payments (including elderly pension, disability pension, and survivor pension) will benefit, with an estimated increase of over 850000 people, and the highest increase is expected to be 7.59%. How to calculate the increase limit? When can I receive the payment amount? Follow this issue of "Legal Column" to understand the basics together.

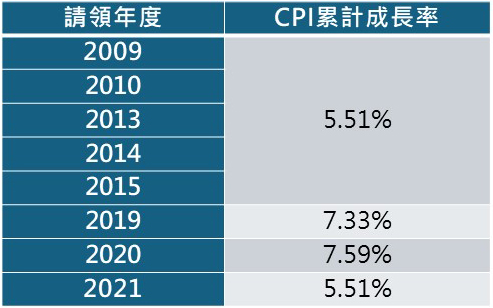

The payment of labor insurance pension will be increased this year to resist the pressure of inflation on people's lives. According to the Labor Insurance Regulations, when the cumulative growth rate of the Consumer Price Index (CPI) reaches the statutory adjustment standard of 5%, the Labor Insurance Bureau will increase the amount of pension payments in accordance with the law. Those who are currently receiving labor insurance pension payments (including elderly pension, disability pension, and survivor pension) will benefit, with an estimated increase of over 850000 people, and the highest increase is expected to be 7.59%. How to calculate the increase limit? When can I receive the payment amount? Follow this issue of "Legal Column" to understand the basics together.The Ministry of Labor announced the adjustment of labor insurance annuities for eight years, including 2009, 2010, 2013, 2014, 2015, 2019, 2020, and 2021, this year. Those who apply for annuity payments in accordance with regulations for each year and still receive them today will have their payment amount increased in accordance with the law starting from May 2024 and recorded on June 27, 2024.

Q1: How to calculate the adjustment amount?

A1: The increase in labor insurance pension is the monthly amount received x the cumulative growth rate of CPI for that year. For example, A will apply for an elderly pension from July 2021, and the monthly pension payment amount for May 2014 will be increased by NTD1102 (calculation formula: NTD20000 x 5.51%=NTD1102).

Q2: How to know if there has been any adjustment to the amount of annuity benefits and how much has been adjusted? When can I receive it?

Q2: How to know if there has been any adjustment to the amount of annuity benefits and how much has been adjusted? When can I receive it?A2: The public can obtain relevant adjustment information by swiping their passbooks after receiving their pension on June 27, 2024. As an example, for the convenience of identification, the annuity payment for May 2024 will be divided into two amounts when issued at the end of June, one of which is the original receiving amount NTD20000, and the other is the increased amount NTD1102 adjusted based on the cumulative CPI growth rate of 5.51% (the summary of the account passbook shows "price adjustment"). However, starting from July, the recorded amount will be restored to the total amount of one sum (NTD20000+NTD1102=NTD21102).

Q3: Why is the amount of annuity payments adjusted from May 2024 instead of January 2024?

A3: According to Article 96, Item 2 of the Implementation Rules of the Labor Insurance Regulations, when the cumulative growth rate of CPI reaches 5%, the Labor Insurance Bureau should submit a report to the Ministry of Labor for approval and announcement by the end of May of that year, and adjust the pension payment amount starting from May of that year. Therefore, this year's pension payment amount will be adjusted from May 2024 and issued before the end of the following month (June 2024).

Q4: If applying for an elderly pension starting from 2022, will the pension payment amount also increase in May 2024?

A4: I don't know. Except for the eight years of 2009, 2010, 2013, 2014, 2015, 2019, 2020, and 2021, which are eligible for adjustment, the cumulative growth rate of CPI for all other years has not reached the statutory adjustment standard of 5%, so it is not within the scope of this adjustment.

*Source: Ministry of Labor, My E-government, Labor Bureau, Labor Insurance Bureau

*Image source: freepik

#