08.2024 Life Guide

Focus on Financial Markets from the 2024 Election Year

Oriental Petrochemical (Taiwan) Investment Advisor / Xie Yifan

2024 US Elections

2024 US ElectionsThe US presidential election is expected to be held in November, and the Democratic Party and the Republican Party will once again face off. Due to the dissatisfaction of the American people with the high cost of living caused by post pandemic inflation, the support rate of the ruling party fell to 35% at one point.

Both Trump and Biden have adopted expansionary fiscal policies in the past to stimulate the economy. With the start of the interest rate reduction cycle in the future, the Federal Budget Accountability Committee (CRFB) estimates that if the long-term bond yield of the United States can be maintained at about 4%, the cost of debt interest can still be controlled. In view of the upcoming elections in the second half of 2024, the government can be expected to introduce more active fiscal policies. Relevant concept stocks deserve attention, and the trend of U.S. stocks will also affect the global financial markets.

Taiwan's industrial trends

In the past few months, although the "main force" of Taiwan's electronics industry has temporarily suspended operations, there are still policy concept stocks such as military, heavy power, and green energy that support the market, and funds have not withdrawn. Looking at the overall development priorities of the industry in the future, they can be divided into seven major aspects:

Continuing the six core industries: digital, defense, cybersecurity, healthcare, people's livelihoods, green power, and renewable energy.

Upgrade the five trusted industries: semiconductor, artificial intelligence, military, security, and communication.

Developing a smart technology island: strengthening the strategic layout of semiconductors, promoting the industrialization of AI and industrial AI.

Promote financial innovation and development: enhance digital technology, digital public services and welfare, and establish digital democracy.

Planning a new strategy for green growth: Green Energy Technology, Net Zero Technology recycled economy 、 Green finance.

Establishing a net zero innovation technology development platform: formulating green finance policies, hoping to encourage capital investment in net zero industries and drive enterprise transformation through carbon pricing, carbon trading platforms, and circular guidance.

Establishing a cold chain logistics system: developing smart agriculture to ensure food security.

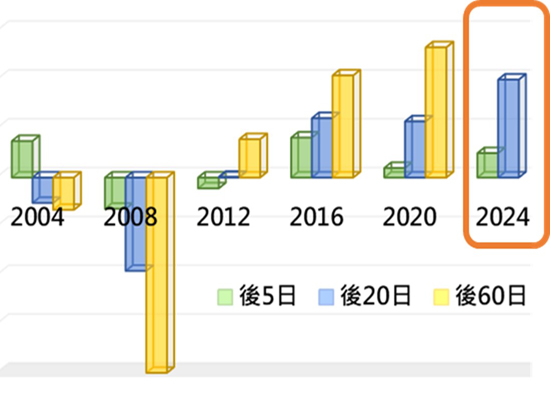

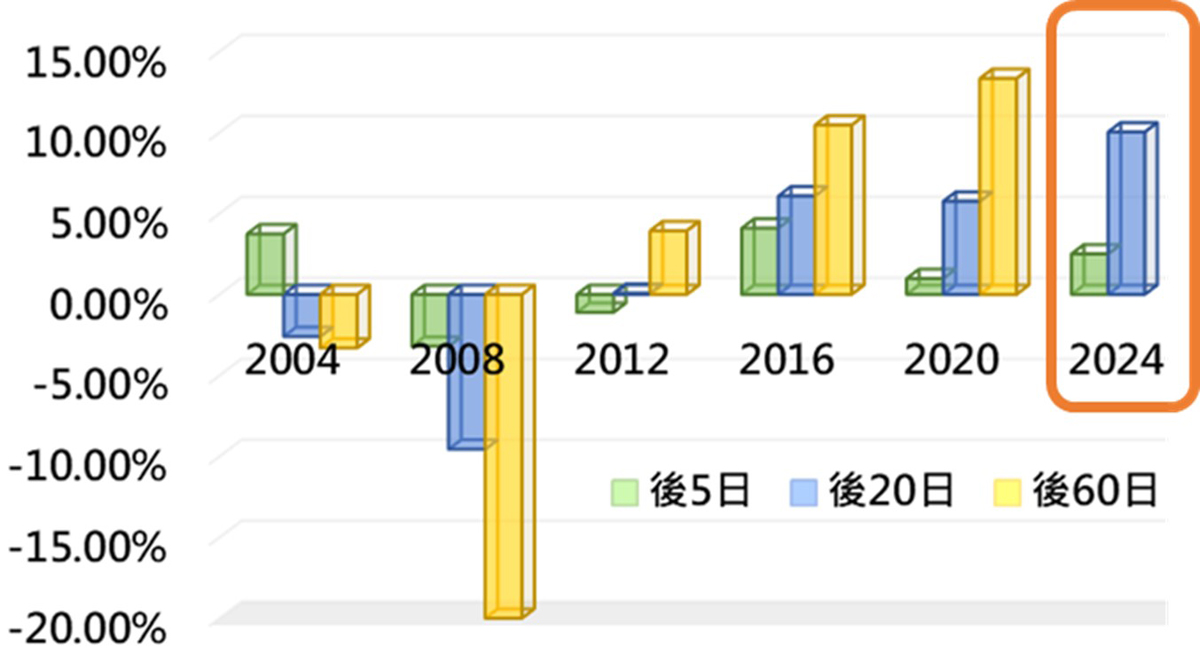

Over the years, the 520 market has seen more increases and less decreases

After the year 520, the stock market has risen more and fallen less, and usually activates the stock market through administrative or fiscal means. Relevant key industries will become market targets, and the expected policy direction will become the focus of investors.

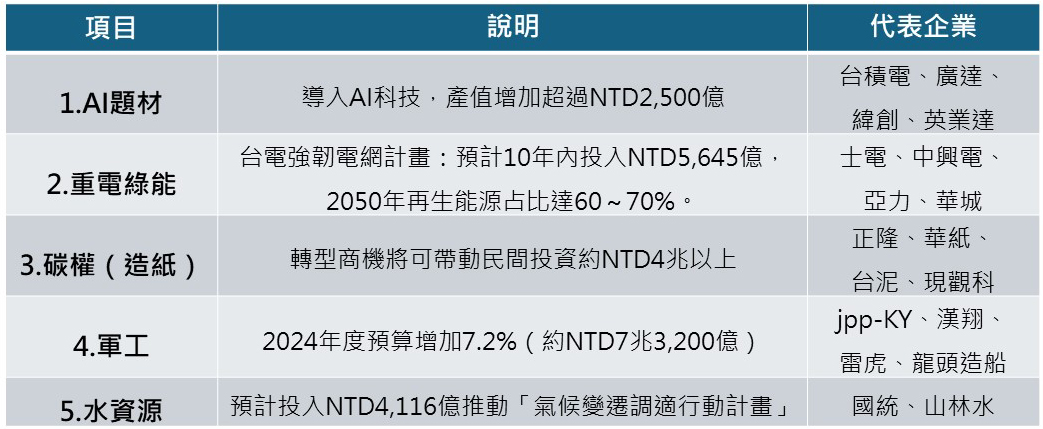

Policy focuses on 5 major directions

Policy focuses on 5 major directionsFuture policies are planned to focus on five directions of development, including artificial intelligence, cybersecurity, biotechnology and healthcare, military industry, and green energy.