08.2024 Life Guide

Analysis of Investment Planning for the Second Half of 2024

Far Eastern International Bank / Gao Yixun

Last month, we analyzed the global financial market trends for the second half of 2024. This issue of 'Finance Column' will further analyze relevant investment and wealth management plans for you.

Last month, we analyzed the global financial market trends for the second half of 2024. This issue of 'Finance Column' will further analyze relevant investment and wealth management plans for you.1、 Stocks remain the most profitable asset this year

Since 2023, the stock market has experienced significant growth, and in the second half of 2024, stocks will still be the asset with the largest profit potential. The main reasons are as follows:

1. The economic environment is conducive to stocks: The IMF raised its estimate of global economic growth rate this year in its economic outlook report in April, and regions or countries with poor performance in 2023 will improve in 2024. Even though interest rates in European and American countries are still relatively high, the direction of corporate operations has already been adjusted, and central bank officials have stated that they will gradually cut interest rates in the future.

2. The profit momentum of enterprises is gradually increasing: After experiencing a profit decline in 2023, the proportion of companies turning from losses to profits in the first quarter of 2024 has significantly increased, and the growth rate of profits before the end of this year will increase quarter by quarter.

3. New theme addition: AI is a widely accepted theme in the market this year. If we start counting from the launch of ChatGPT, the current development of AI themes is only about 1.5 years. Another important theme is elections. If a ruling party with good political achievements can continue to hold power, it will benefit the performance of the stock market. Finally, what is more surprising is the stock market in Chinese Mainland. The market was worried about whether real estate risks and policies could be tailored to the case. However, by the end of April this year, investors were still very enthusiastic. The Shanghai Stock Exchange Index was less than 2% higher than the S&P 500 Index, and the Hong Kong Hang Seng Index was more than the S&P 500 Index.

Overall, in the second half of 2024, stocks are still expected to achieve good results, but with only moderate economic growth, investment allocation is recommended to focus on large cap stocks, with the United States as the main investment region and East Asian countries as a supplement.

2、 Bond investment theme: high CP value

In the first half of this year, bond holders were once again disappointed. Stocks can easily rise by 5%, but bonds have to be held for a year to have a chance of receiving the same return. Bond interest distribution is the most important thing for investors, capital gains are about earning more, while stocks are the opposite. Most people invest in stocks with the expectation of earning a much higher proportion of capital gains than receiving dividends. After all, if they can earn 5% in a month, who would be willing to wait for a year to earn only 5% in dividends? In addition, the volatility of bonds is usually much lower than that of stocks, and it is reasonable for their returns to be lower than stocks. Therefore, bonds often play a stabilizing role in investment portfolios. When financial market volatility increases, including bond assets in the investment portfolio can reduce the degree of impact.

If investing in bonds is mainly to obtain the return of bond interest, the "Yield to maturity" of investment grade bonds is currently about 5.5% (taking the ICE US Corporate Bond Index as an example, the average credit rating of its constituent bonds is above BBB -). In other words, holding a bond until maturity yields an annual return of about 5.5% (excluding capital gains). If it is a 'non investment grade bond' (with a credit rating below BBB -), the yield to maturity is currently 7.8% (taking the ICE US non investment grade corporate bond index as an example), and the yields of both types of bonds are higher than the average level of the past 10 years.

In addition to evaluating returns, investment should also consider the fundamentals of the investment target. Even after the COVID-19, the fundamentals of issuers of investment grade bonds and non investment grade bonds did not deteriorate, and even continued to improve. Before the third quarter of 2023, the profitability of enterprises was not good, but since the fourth quarter, the profit momentum has gradually rebounded. Coupled with the continuous improvement of operating costs and debt management, even energy companies that were originally criticized by the market have shown significant improvement in their physical condition. Therefore, in the case of low default risk, the current CP value of investing in bonds is higher than in the past few years.

3、 Asset allocation strategy

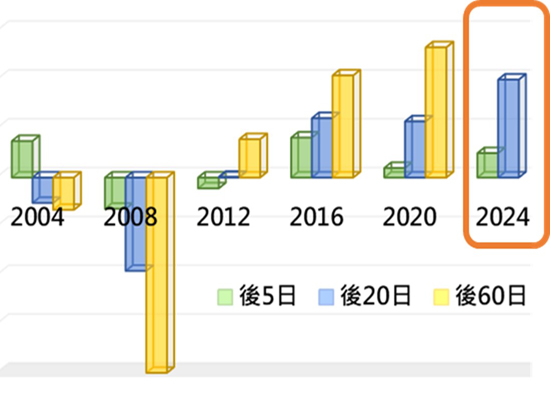

Affected by changes in the external environment, asset allocation this year is not as easy as last year. Although the financial market fluctuated in the first half of the year compared to last year, both the overall economic and corporate conditions performed better than last year. In the second half of the year, it is advisable to adopt a prudent asset allocation strategy, such as a stock to bond ratio of 6:4 or 5:5. In addition, continuous and fixed investment is definitely an indispensable strategy. On the one hand, you don't have to worry about buying high and selling low. On the other hand, the medium to long term return rate is quite high. Most importantly, fixed investment is suitable for everyone. As long as you are willing to start, wealth will gradually approach you.

Disclaimer and Disclaimer: This article is compiled and analyzed based on the information obtained, and does not guarantee the completeness and accuracy of any information. Some of the content contains "forward-looking statements" such as "may, will, anticipate, should, anticipate, expect, forecast, estimate, plan, sustain" or similar words, although these expectations and assumptions are reasonable, they should not be considered necessarily credible; Due to the existence of various risks or uncertainties, actual performance may deviate significantly from what is shown or implied in the "forward-looking statements", therefore this article should not be considered as an offer or inducement to buy or sell securities or other financial products.

*Image source: Freepik

#