2018年12月號 领航者的话

Disruptions in Retail

Far Eastern New Century / Morris Yang

As the competitive environment, consumer behaviors, and expectations are all experiencing rapid change, how should the retail industry adapt to embrace this new marketplace and regain retail power? Below is the economic outlook for 2019 and includes two case studies of retail distruption for reference.

1.Foreword

The retail industry has grown steadily in 2018; in particular between January and September, Taiwan’s retail performed remarkably with overall growth of 3.88%. Major momentum came from several drivers. One comes from convenience stores thanks to close connection with consumers’ daily lives and diversified operating models, resulting in total revenues increase of 6.7% year-on-year. Another factor is online and TV shopping which increased 5.94% from last year. In addition, food and beverage purchases also grew 4.95% especially the beverage industry where coffee and hand-shaken drinks are vital engines. In contrast, the department store’s and hypermarket’s growth registered only 2.87% and 3.77% respectively.

Since early 2018, joint moderate recovery of the developed economies including U.S., Euro Zone, U. K., and Japan gradually diverted. Among which, U.S. outshone others, India was relatively better, while other major economies face sluggish growth.

In interest rates outlook, after an experimental rate lift starting December 2015, normalized rate hikes began. Bank of England tentatively raised interest rates twice, in November 2017 and August 2018. Given unstable recovery there is still room for the expected regular interest rate hike. With sluggish recovery, benchmark interest rates of Europe and Japan remained at an all time low; European Central Bank expressed to end QE (Quantitative Easing) while Japanese Central Bank insisted on QE. In Taiwan, interest policy of its Central Bank remained steady.

Moreover, after the financial crisis, most of the global capital shifted to the emerging economies. However, since early this year global capital has returned to the developed economies including the U.S. leading to drastic financial turmoil in the foreign-capital dependent nations of the emerging market, that has caused partial financial crises. Exchange rates of currencies in Argentina, Turkey, Brazil, South Africa, Russia, and India were all devaluated by at least 10%. The most extreme drops included the Argentine Peso to U.S. dollar of more than 50%, and Turkish Lira to U.S. dollar by over 40%.

Furthermore, the future global oil outlook is unpredictable, thanks to Brent crude oil prices rising to nearly US$80 since July 2017, US President Trump’s granting Iran sanction waivers, and the US major oil productions in shortage of pipelines. The escalating US-China Trade War may also endanger world economic growth, and will impact the need for crude oil and heavy commodities, as well as affecting global commodity prices. IHS Markit projected that annual inflation will rise from 2.7% in 2017 to 3.0%, and continue to increase to 3.1% in 2019.

In summary, the 2019 world economy will be affected by the following four factors: uncertainty of U. S. trade policy, financial risk in the emerging market, economic and financial risk in China, and geopolitical risk. According to the IHS forecast, 2018 global growth stands at around 3.3%, the highest since 2012. As for 2019, IHS Global Insight indicates relatively pessimistic view about the economic forecast of the U. S., Euro zone, China, Japan, Korea, Taiwan, etc.

3.Transformation and Disruptions in the Retail Industry

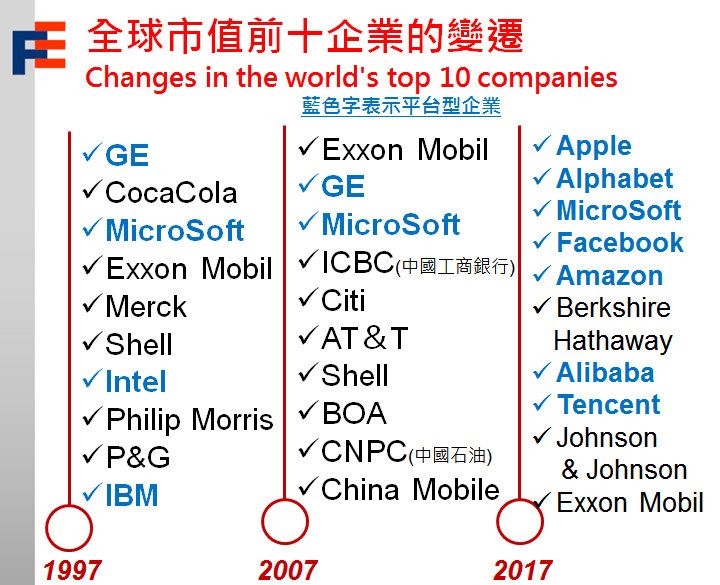

From 1997 to 2017, there has been a visible decrease in monopoly and resources enterprises and an increase of platform enterprises ranking among the top ten companies with the highest market capitalization in the world. Leading companies from IoT, and its related hardware and software enterprises can become infrastructure providers to jointly build eco-system of the Internet of Things. Below we will explore the changes in two major global retailers through their establishment of platforms and applying platforms to achieve transformation.

With competition from e-commerce and changes in shopping behaviors, revenues of U.S. department stores continued to drop during recent years, contributing to a decreasing GDP since 2012. Despite strong recovery of the U.S. economy in 2018, contribution to GDP from the department stores sector was still down by 3.9%, illustrating that U.S. brick and mortar stores are facing a decline of their life cycle.

Revenues of Macy’s in 2017 compared to the previous year was dropping, but its profits and margin ratio were still higher than its competitors, and surged 148% year-on-year to reach US$156 million. This is due to an increase in real estate income from sales of partial-branch, lower operating cost with the closure of stores, the revenues from 2017’s 4th quarter holiday season sales, decreasing inventories, and higher than expected revenues.

Macy’s was established in 1868 in New York City enjoying a market share as high as 11.5% in the U.S., only next to Target and Walmart. Until the first quarter of 2018, Macy’s owned 852 stores. With such a rich history and large scale, Macy’s faced these drastic changes in this new environment, still strives to look for transformation opportunities.

With the rise of e-commerce leading to lower competitiveness of physical stores, Macy’s first decided to close some of their stores and sell relevant warehouses and real estates. In 2017, income from the sale of these real estates reached US$544 million, up 160% from that of 2016. The income was then distributed into new channels, including expanding Backstage (outlet) and Bluemercury (cosmetics) stores.

By closing these stores, Macy’s then had the capacity to invest in new channels and establish an information platform. With the addition of upgraded RFID technology, Macy’s can now utilize a national interconnected inventory instead of a decentralized managing system, which allows them to more effectively predict supply demand and instant notification of low inventory. Suppliers can then act swiftly to replenish inventory.

The application of big data and algorithms in a brand new order management system creates an easy-to-use platform for consumers to check the inventories of various branch stores and suppliers online. After placing their orders, they can choose to deliver to a certain store, or ask suppliers to mail the merchandise directly to their home if the branch store is out of inventory and save time.

In addition, Macy’s created an APP to connect with the front desk allowing consumers to pay for their order, check membership information, access special discounts, and browse online inventories. They can also scan the QR Code at stores to inquire about price and inventory, and schedule mail home services for the merchandise bought in the store through the APP. The e-wallet within the APP can also collect consumers’ shopping data both on- and offline to help the company better understand their consumers’ shopping behaviors.

Next, the physical stores expanded to complete multiple services including becoming delivery spots, acting as distribution centers, and become a convenient return and exchange center for online orders. Thus, Macy’s is not pressured to build new distribution centers and online delivery can be shipped quickly and efficiently to consumers. In addition, Macy’s offers 15% to 20% discounts on selected items to online users that pick up their orders in-store, encouraging online shoppers to go into stores and make purchases, increase sales, and lower shipping and handling costs. According to their figures, online shoppers’ contributions to Macy’s profits are 8 times that of storefront shoppers.

Lastly, Macy classifies the level of loyalty members based on the spending and the holding of Macy’s credit card in order to provide customer benefits to boost loyalty.

In addition to construct O2O shopping platform, Macy’s has also executed the 3E strategies (Edited, Elevated, and Exclusive). Macy’s has selected exclusive merchandise to offer differentiation in order to boost customer loyalty. The exclusive and Macy branded merchandise accounts for 29% of total merchandise. It is expected to reach 40% by 2020. With the increase of its own-label merchandise, this has increased the risk of inventory. Macy has utilized its Outlet Store ~ Backstage channel to provide merchandise of the previous season to reduce inventory pressure.

The net profit of Amazon has reached US$2.534 billion as of 2Q of 2018, which enjoys significant growth of 1186% year-on-year with profits over US$1 billion for three consecutive years. The market capitalization has surpassed US$1 trillion with stock price raised more than 400 times since its listing 21 years ago. During the same period, the rise in NASDAQ is less than 4 times whilst growth in S&P is also less than 2 times.

The stock history of Amazon is progressing closely with its development. Before 2010, the company had significant capital expenditures in constructing logistics infrastructure and the stock has gradually taken off. Between 2010 and 2015, Amazon invested in AWS extensively and migrated toward a technology-oriented company. Its stock has also risen speedily. After 2015, AWS has brought explosive growth for the company and on its bottom line, pushing the stock to its peak along with market capitalization.

During these 23 years, there are two critical capital expenditures for Amazon. The first phase is before 2009, where it invested heavily in logistics infrastructure to be its core competitiveness. At the end of 2017, the global warehouse of Amazon reached 19.40 million square meters and established over 123 warehouse centers across 185 countries with shipping network to cover all 185 countries. The second phase started from 2010, when they invested significantly in the cloud computing area. Until the 1st half of 2018, AWS had a global market share of 34% in this field and it has since become a major revenue driver for Amazon.

With its up-front investment, Amazon logistics and AWS have become the new revenue drivers. The complete eco-system comprises of e-commerce, logistics, cloud computing, and the new retailing. From these, there are many areas that we could learn from: (1) Construction of a complete logistics system that pushes the development of e-commerce, then opens up logistic services. (2) Provide complete merchandise categories for customers for both its own-label and platform developments. (3) Transformation from an e-commerce business to be a technology company contributes explosive growth in its profits. The revenue of AWS accounts for 11% of revenue but contributes to 60% of operation profits. It has also boosted the new business areas of AI, IoT, and new retailing. (4) There are over 100 million Amazon prime members with tremendous business upside of servicing them. (5) Technology has advanced developments in the new retailing. The offline service will require the new capability imposed by technology to boost efficiency. The online commerce will need the traffic of offline channel to support its service experience.

Based on the transformational cases of both retail giants, retailers will need five major infrastructures to push the new retailing:

*Traffic: construct the O2O channel in order to direct both traffic on/off line.

*Properties: the omni-channel strategy can enhance flexibility of store locations.

*Payment: Retail is an important scenario for utilizing mobile payment. The popularity of mobile payment will be a critical enabler for the new retailing.

*Logistics: Logistics serves as the core of the retailing. With the advancement of logistics technologies, it can reduce cost and advance significantly.

*Development of platform: Construct a technological platform that could be nimble in various retailing advancement.

4.Conclusion

As retailers, no matter how fast the evolution of technology and product cycle changes, ultimately we must understand the customers’ changing habits, strengthen customer experience, learn customers’ expectations of retailers, and adjust relevant indicators in a timely manner by seeking support of outside technology and embrace digital new world. Of course, physical stores should not be underestimated, as they still have value. How to empower physical stores with new value will be an important task for the retail industry.

In conclusion, I would like to share with you the wisdom of John F. Kennedy: “Change is the Law of Life. And those who look only to the Past or Present are certain to miss the Future.” Hope we may seize the initiative in this dynamic era!

(Keynote speech made by Chairman Douglas Hsu at the Far Eastern Department Stores’ Vendors’ Party)#