03.2019 Life Guide

Federal Reserve System Monetary Policy Tools, Operations and Recent Development Overview

Far Eastern International Securities / Chen Mingzhao

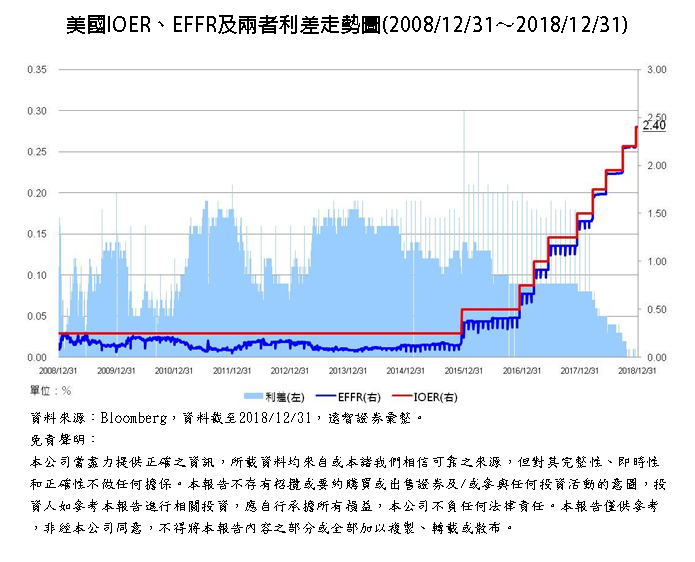

The Federal Reserve System raised interest rates for the first time since the financial tsunami started in December 2015. By December 2018, it had raised interest rates by 9 yards (2.25%). The target interest rate range of the Federal Fund had risen from 0.00%-0.25% to 2.25%. In October 2017, it began to reduce its balance sheet and gradually recover the liquidity released by the previous three quantitative easing policies. As of January 2, 2019, the balance sheet had shrunk by nearly $400 billion to $4.058 trillion. There are many indicators to measure liquidity. In this issue, "Finance Column" will focus on the product of the financial tsunami, namely, the Interest Rate on Excess Reserves (IOER), and the implications and interest spreads of the Effective FED Funds Rate (EFFR).

"Excess deposit reserve" refers to the part of deposit institutions (mostly banks) that is deposited in the central bank and exceeds the statutory deposit reserve, mainly used to pay for liquidation, transfer or use as reserve funds for assets. The benchmark interest rate calculated by the central bank for the excess deposit reserve interest paid by deposit institutions is IOER, which is the product of the bankruptcy of Lehman Brothers in 2008.

Lehman Brothers went bankrupt on September 15, 2008. The market was in panic, the economic outlook was bleak, liquidity was tight and asset prices were falling. As the Central Bank of the central bank, the Federal Reserve System of the United States, should come forward to inject liquidity into the market to solve the problem of reluctance of financial institutions to lend. At that time, Congress passed the Emergency Economic Stability Act, which allowed the Federal Reserve System to pay interest on deposit reserves and excess deposit reserves. IOER was born. This is undoubtedly a way for banks to deposit their unwilling loans into the Federal Reserve System as deposit reserve or as excess deposit reserve to earn almost risk-free interest, which is actually not helpful to market liquidity. Later, the funds released by the three quantitative easing policies of Federal Reserve System flowed to the real economy and stimulated banks to lend to the outside world for a limited amount. Instead, the funds released by the Federal Reserve System were transferred to the Federal Reserve System account, resulting in the continuous expansion of the excess deposit reserve of the Federal Reserve System, which was less than $2 billion before Lehman Brothers went bankrupt. All the way up, it was close to $2.7 trillion in August 2014.

The effective interest rate of federal funds is the real interest rate of interbank lending funds from American deposit institutions, which can represent the ultra-short-term interest rate level of the market, and can also be regarded as the cost of funds of banks. EFFR mostly falls within the target range of the Federal Fund Rate, and IOER will be the upper limit of the target range of the Federal Fund Rate for most of the time. For example, assume that the current target interest rate range for federal funds is between 1.00% and 1.25%, where EFFR will fall (market-determined, 2.40% by the end of December 2018) and IOER will be 1.25% (Federal Reserve System-determined, 2.40% by the end of December 2018). For the bank side, an arbitrage opportunity arises: when EFFR is less than IOER, banks and interbank lending funds are then deposited into the Federal Reserve System to earn the spread (almost zero risk) between IOER and EFFR.

In the past, IOER would be higher than EFFR by an average of about 10 basis points (1 basis point is 0.01%), but since last year, the spread between them has gradually converged. In June 2018, the Federal Reserve System decided to raise interest rates by 1 code (0.25%). It raised the target interest rate range of the Federal Fund from 1.50% to 1.75%, to 1.75% to 2.00%, and the IOER unexpectedly increased by only 0.20% to 1.95%. In the past, it was the upper limit of the interest rate range from 1 code to 2.00%. In September of the same year, the Federal Reserve System raised the target interest rate range of the Federal Fund and IOER by one code, the former by 2.00%-2.25% and the latter by 2.20%. In December of the same year, the Federal Reserve System raised the target interest rate range of the Federal Fund by another code, from 2.00% to 2.25%, to 2.50%. IOER increased only by 0.20% to 2.40% for the second time after June, resulting in the spread between IOER and EF. Convergence is nearly zero. This phenomenon conveys that the Federal Reserve System is aware of the problem of market liquidity under the successive interest rate hikes and the continuous reduction of balance sheet. It hopes that by reducing the increase of IOER, the spreads will converge and the arbitrage space will be reduced, and then the funds deposited in the Federal Reserve System when the excess deposit reserve is released to the market to relieve liquidity. As pressing danger.

However, the Federal Reserve System's plan may backfire from the US Treasury's ongoing financing and debt issuance. Since the Federal Reserve System started this interest-rate-raising cycle in December 2015, it has also promoted the level of bond yields, especially the 2-year bond yields, which rose from 0.909% on December 1, 2015 to 2.490% on December 31, 2018. In response to fiscal expenditure and tax cuts, the U.S. Treasury Department issued a large amount of debt financing in 2018, with new public debt amounting to $1.357 trillion, and wrote down the largest increase since 2010, making the original Federal Reserve System plan that deposit institutions and interbank lending funds could flow to the market as planned, with the spread between IOER and EFFR approaching zero. Rates higher than IOER and the U.S. Treasury continued to issue debt, but these funds were sucked away, the ultimate liquidity of the market has not been effectively boosted.

Next, if Federal Reserve System raises interest rates by two yards this year according to its schedule in December last year, it will be accompanied by rising market interest rates, rising short-term bond yields, rising corporate borrowing costs and refinancing costs, and the Ministry of Finance will continue to issue bonds to absorb bank-side funds, and then feed them back to the level of interest rates for further improvement. At a certain critical point, due to the lack of market liquidity, enterprises will not be able to borrow money or financing costs are too high, resulting in an increase in the probability of default. The worst case scenario is that the Federal Reserve System continues to raise interest rates and shrink its scale, resulting in risks due to insufficient liquidity, leading to a sharp slowdown or even recession of the economy.

However, as of late January, with a series of unexpected economic data and no significant improvement in inflation, Jerome Powell, chairman of Federal Reserve System, has made a statement: "When we look at how the economic situation is going, we will be patient and ready to adjust our policies quickly and flexibly, and when we need to keep the economy on the growth track." Use all our tools to support the economy. At the same time, it emphasizes that there is no presupposed policy path. Based on the substantial softening of the Federal Reserve System's interest rate hike position, the Federal Fund Rate Futures Level shows that the market expects the probability of the Federal Reserve System not raising interest rates this year to be close to 70%. On the other hand, IOER has also narrowed its interest rate gap with EFFR to 0 in mid-December last year, which means that the original bank has brought arbitrage funds. We need to find another outlet.

To sum up, even if the US Treasury Department continues to issue debt financing this year, liquidity risk will improve in part with the softening of the Federal Reserve System interest rate hike position, the limited rise in short-term bond yields, and the convergence of the spread between IOER and EFFR to zero. The U.S. economy may still find it hard to escape a slowdown, but the likelihood of a recession is extremely low.