06.2020 Life Guide

Analysis of credit loan makes you understand all the key points of application.

Far Eastern International Bank / LV Yixin

1、 Common puzzles of applying for credit

1. Super low interest rate is attractive?

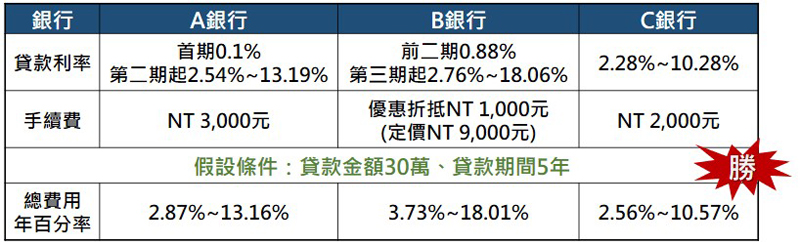

There are a variety of credit programs of various banks, some of which boast that the first interest rate is only 0.1%, some of which boast that the first two interest rates are only 0.88%. Most people think that as long as the interest rate is the lowest, it is worthwhile, but in fact it is not! In the face of ultra-low and ultra-low ladder interest rate advertisements, we should not only look at the initial interest rate, but also pay attention to the later interest rate after the preferential period. Sometimes, the average price of the latter interest rate is higher than that of the first interest rate, so we should not be careless.

2. Service charge is also a hidden cost

In addition to the interest rate, the handling fee is also a big expense. Some credit advertisements have ultra-low preferential interest rates, but they charge a handling fee higher than the average market price (the handling fee is not more than 10000 yuan according to the financial supervision commission), which results in a lot of higher actual amount paid; or the advertising gimmick is that the handling fee is discounted to NT 1000 yuan within a time limit, in fact, NT 8 will still be charged after the discount, The high service charge of RMB 000 is much higher than that of other banks which only charge NT 5000. Therefore, it should be calculated by the annual percentage of the total charge (note) to evaluate which loan interest rate is really cost-effective.

If it is estimated that there will be funds available to repay the loan in a short period of time, please pay attention to the contractual terms of "restricted repayment period" (at present, the regulated restricted repayment period of each bank is 1-3 years). Once the contract is established, if you want to prepay the loan, you must pay an additional liquidated damages for prepayment (about 2-3% of the principal repayment, according to each bank's contract) It is suggested that if it is sure to pay off the loan in full in a short period of time (3-6 months), the scheme of "unlimited repayment period" will be a better choice, even if the interest rate is high, but not to the loss of additional interest or liquidated damages.

2、 Fast loan application without asking

1. Select regular banks

In order to get the funds in place quickly, it is better to choose banks that often deal with fund financing, salary transfer transaction banks or credit card issuing banks, because these banks will know more about the assets or credit status of customers than other banks, and the review speed is relatively fast. Some banks even pre-examine the exclusive line of existing customers, as long as the customers agree to apply, they can establish I.e. loan allocation.

2. Online quick bidding

At present, most of the bank's digital finance is well developed. If you know how to make good use of online channels, you will find that the original application for credit is easy and simple, and can be completed anytime and anywhere through mobile phones or tablets. Generally, when the bank completes the loan verification, it will immediately notify the applicant of the approval results by SMS or e-mail. As long as the applicant completes the signing process online, the money will be automatically transferred into the designated account. The whole process does not need to run the bank at all, which can save a lot of time and solve the burning eyebrow. Take far Eastern International Bank as an example. Online application for credit loan only needs five steps. After approval, it can be allocated as soon as one hour.

3、 Tips for smart bidding

The age limit for applying for credit loan is 20-65 years old. As long as they have stable income and normal credit, they can apply. However, most people only know to provide the most basic ID card photocopy and current monthly income information (nearly three months' salary slip or nearly one year's withholding voucher) when they apply. They don't know that the assets can actually increase their scores.

When applying for the bid, it actively provides information about its assets, including real estate, fund, stock and insurance policy In addition to the rapid approval of loans by banks, some banks will deduct the loan balance, financing or pledge amount from the asset information provided by customers, and then convert the residual value into personal monthly income, which will help applicants to obtain higher loan amount (according to the financial supervision commission It is required that the total balance of personal loans to all financial institutions should not exceed 22 times of the monthly income), which may also result in better interest rate conditions.

4、 Good credit makes you more valuable

In fact, banks value "repayment" when applying for credit! In the process of applying for credit, if the bank finds that the loan or credit card payment of the applicant in other financial institutions has been delayed and the repayment has not been made on time, even if the applicant has a good job and high income, he may be refused the loan, or the loan cannot reach the desired amount, let alone be noted as bad credit by the joint levy center due to the long delay in payment, which will definitely result in For each bank's declined account. Therefore, cultivating good credit is the only way to apply for credit easily.

Moreover, almost all existing customers who have made loans and have a good payment record will be provided with more favorable loan terms than those on the market. The so-called "it's not difficult to borrow and repay". Only when the credit loan is repaid on time and good credit value is accumulated, can the bank become a competitive high-quality customer.

* Note: the annual percentage of total expenses (abbreviated to APR) is the actual annual interest rate of the loan, which means the annual percentage calculated after summing up the interest, handling fee or account management fee and other costs payable during the loan period.