08.2020 Office Talk

Analysis of sharing locomotive using behavior

Tianxia innovation college /

.jpg) The popularity of online communities and mobile devices has contributed to the rapid rise of the sharing economy. Among them, the discussion on sharing locomotives, which has been developing for more than three years, is the most heated. Different platforms for sharing locomotives have their own supporters, forming a situation in which the three powers stand. This article will expose the riding motivation, impression and preference of different brands of sharing locomotive users, so that go survey can take you to grasp the new trend in the sharing era.

The popularity of online communities and mobile devices has contributed to the rapid rise of the sharing economy. Among them, the discussion on sharing locomotives, which has been developing for more than three years, is the most heated. Different platforms for sharing locomotives have their own supporters, forming a situation in which the three powers stand. This article will expose the riding motivation, impression and preference of different brands of sharing locomotive users, so that go survey can take you to grasp the new trend in the sharing era.Usufruct replaces ownership and sharing economy sweeps across Taiwan

On the whole, 47% of the people thought that they knew or understood the concept of sharing economy. Among them, nearly half of the young generation understood the concept of sharing economy, especially the 30 generation (as high as 58%); and more than 40% of the mature generation thought that they knew the concept of sharing economy.

When we asked the respondents to briefly describe their concept of sharing economy, 43% of them mentioned "resource sharing / CO use", 24% of them said "services for leasing and using through platform mediation", and 20% thought that sharing economy was the concept of "cost saving / sharing expenses / saving money".

When we asked the respondents to briefly describe their concept of sharing economy, 43% of them mentioned "resource sharing / CO use", 24% of them said "services for leasing and using through platform mediation", and 20% thought that sharing economy was the concept of "cost saving / sharing expenses / saving money".From the perspective of generations, in addition to "resource sharing", all generations also generally believe that the sharing economy is a service that needs to be mediated and used through the platform. It can be seen that the use mode of platform has been deeply rooted in the hearts of the people. A good platform interface is more related to the success or failure of shared services. In addition, 19% of the 20th generation believe that the sharing economy also has the concept of "more important than use, not ownership / user payment / payment only when used". Thus, it can be seen that the new sharing lifestyle in which the right to use replaces ownership has become a trend.

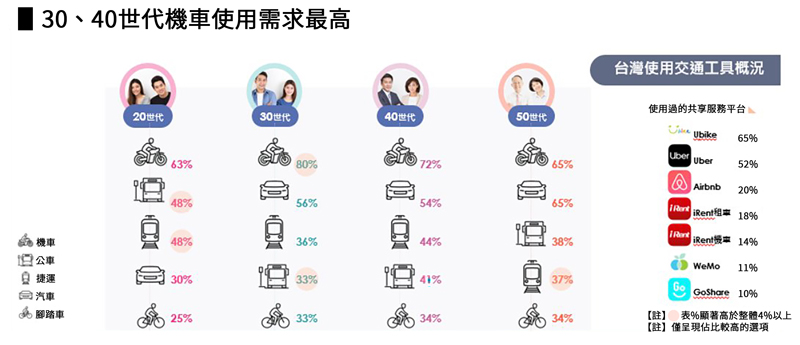

Locomotives are popular in Taiwan. More than 60% of the people have fixed needs

Taiwan's locomotives are among the best in the world in terms of quantity and density. From the general situation of the use of vehicles, it can be found that more than 60% of the people have the demand for regular use of locomotives, of which 30 / 40 generations are the most (more than 70%). With the rising awareness of environmental protection and energy conservation and the continuous encouragement of the government, the development of electric locomotive has become the trend of the times. The sharing locomotive industry mainly based on electric locomotive is ready to go. Under the high-density demand for locomotives, it has great development potential in the future.

After an in-depth investigation of the shared services used by Taiwanese, the sharing service platforms of transportation tools are generally favored by the public. After ubike (65%) and Uber (52%), the usage rate of Irent (18%), wemo (11%) and goshare (10%) has gradually increased, which can be said to be the future star of Taiwan's sharing economy.

After an in-depth investigation of the shared services used by Taiwanese, the sharing service platforms of transportation tools are generally favored by the public. After ubike (65%) and Uber (52%), the usage rate of Irent (18%), wemo (11%) and goshare (10%) has gradually increased, which can be said to be the future star of Taiwan's sharing economy.Shared locomotive service has high popularity and growth potential

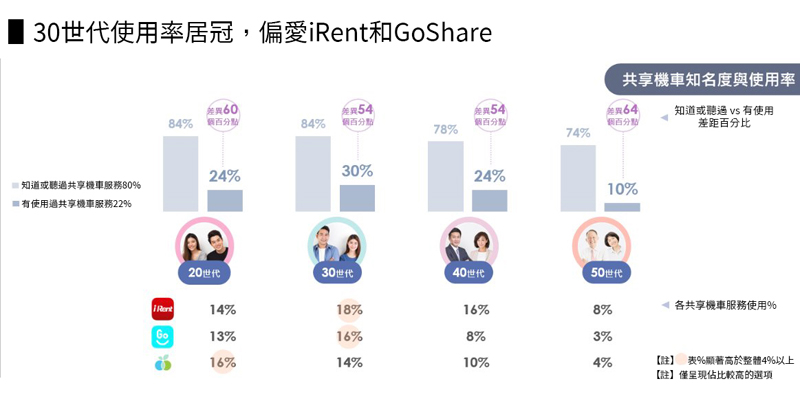

On the whole, 80% of the people knew or heard of the shared locomotive service, and another 22% had used the service. It can be seen that the shared locomotive service has been well-known in Taiwan, but there is still a lot of room for development in terms of utilization rate.

This may be limited by platform access. At present, the operation scope of shared locomotive platform is mostly in greater Taipei area and a few big cities in central and southern China, which has not yet been popularized in all counties and cities. Therefore, the expansion of operation scope will be the key factor to improve the utilization rate.

In terms of generations, 30% of the 30 generations have used their homes, and they prefer Irent, which is the most widely operated in Taiwan, and goshare, which has a lot of topics; while the 20th generation prefers wemo, which has the most vehicle layout and is provided to users under 24 years of age, the "youth program information fee".

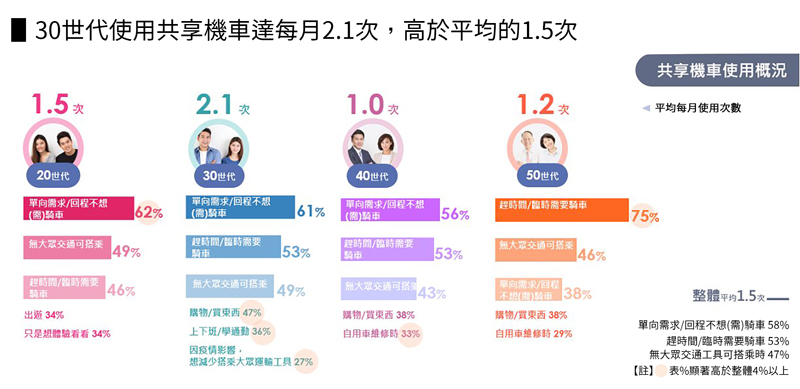

The frequency of young generation is high, and 30 generation is the main customer group

The frequency of young generation is high, and 30 generation is the main customer groupHow often do people use shared locomotives? In what context? According to the go survey, people use 1.5 shared locomotives per month on average, with 30 generations using 2.1 times a month; other generations have at least once a month.

Among them, 58% of the respondents used it when "one-way demand / no cycling for return trip"; 53% of the respondents used it for "rush time / temporary cycling"; and 47% used it "when there is no public transport available". These results show that "single use" and "temporary emergency and no other alternative" are the situations where most people are most likely to use shared locomotives.

Among them, 58% of the respondents used it when "one-way demand / no cycling for return trip"; 53% of the respondents used it for "rush time / temporary cycling"; and 47% used it "when there is no public transport available". These results show that "single use" and "temporary emergency and no other alternative" are the situations where most people are most likely to use shared locomotives.From the perspective of generations, the use of "shopping / shopping" (47%) and "commuting / commuting" (36%) in the 30 generation group was significantly higher than that in the other generation. It can be seen that the younger generation will use shared locomotives as a means of daily commuting, shopping and traveling. Interestingly, the generation 30 is also more likely to "want to reduce the use of public transport due to the impact of the epidemic" (27%) However, the use of shared locomotives enables shared locomotives to make a silent contribution to the new coronavirus epidemic. The use of shared locomotives in the "self use vehicle maintenance" (33%) and the "rush / temporary cycling" (75%) scenarios of the 50th generation are also more prominent than other generations, indicating that the mature generation tends to use shared locomotives as a "solution to temporary needs".

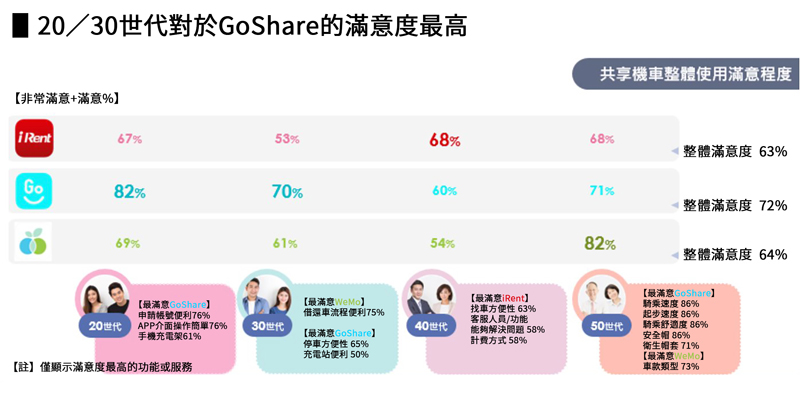

Young people love goshare most, generation 40 and generation 50 are most satisfied with Irent and wemo

How satisfied are the users of shared locomotives with each brand? For the three major shared locomotive brands, goshare (72%) ranked first, followed by wemo (64%) and Irent (63%). Among them, 20 / 30 generations are most satisfied with goshare; 40 generations are most satisfied with Irent; and 50 generations are most satisfied with wemo.

The younger generation is more concerned about "the fluency and convenience of digital operation", such as convenient account application, simple operation of APP interface, mobile phone charging rack, and convenient car borrowing and returning process For example, riding speed, starting speed, riding comfort, whether the helmet is easy to use, the type of car, and the convenience of finding a car Etc.

The younger generation is more concerned about "the fluency and convenience of digital operation", such as convenient account application, simple operation of APP interface, mobile phone charging rack, and convenient car borrowing and returning process For example, riding speed, starting speed, riding comfort, whether the helmet is easy to use, the type of car, and the convenience of finding a car Etc.Assessment of the future: more than 50% of all generations will use shared locomotives

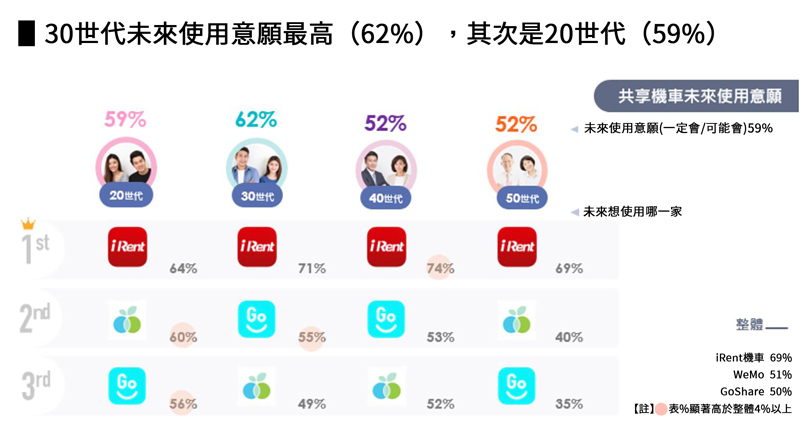

59% of the people said that they would or might use it in the future. Among them, the 30 generations had the highest willingness (62%), followed by the 20 generations (59%); and the mature generation also had more than 50% willingness to use.

Irent, the brand with the most extensive expansion, is the brand that all generations want to try, among which the 40 generation has the highest willingness to use it (74%); goshare is widely welcomed by the younger generation and is generally willing to try; as for wemo, it is a relatively willing choice for the 20th generation.

Driven by high willingness to use, the market competition of shared locomotives is becoming increasingly fierce. Wemo, Irent and goshare have recently announced new strategic layout. Wemo takes advantage of commuting opportunities; Irent introduces the industry's only "4-wheel ride and 2-round" solution; and goshare chooses to attack the tourist area to challenge the fixed-point loan and return service. The main layout axes of the companies are different, but they are actively grabbing the market pie, which also makes the outside world look forward to the future trend of Taiwan's shared locomotive market.

Driven by high willingness to use, the market competition of shared locomotives is becoming increasingly fierce. Wemo, Irent and goshare have recently announced new strategic layout. Wemo takes advantage of commuting opportunities; Irent introduces the industry's only "4-wheel ride and 2-round" solution; and goshare chooses to attack the tourist area to challenge the fixed-point loan and return service. The main layout axes of the companies are different, but they are actively grabbing the market pie, which also makes the outside world look forward to the future trend of Taiwan's shared locomotive market.Share the advantages of Locomotive Development: convenient, time-saving, and can meet the "instant" demand

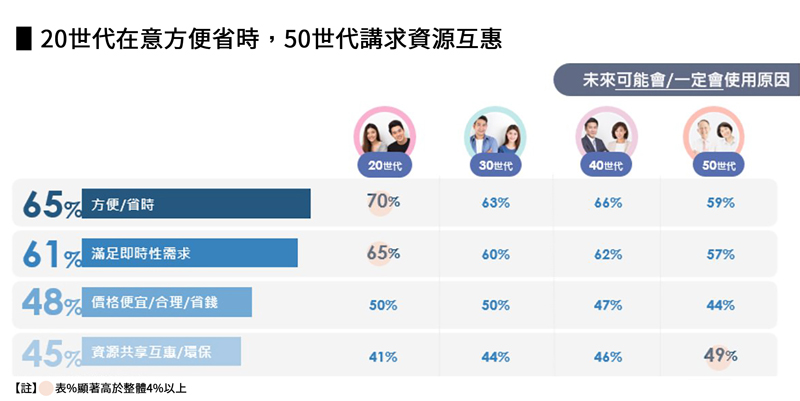

For the users of shared locomotives, "convenience / time saving" (65%) is the biggest driving force for the use of shared locomotives, and "meeting the immediate needs" (61%) is the future development focus. In terms of generations, the 20th generation is more concerned with "convenience" and "instant", while the 50s are more concerned with "resource reciprocity" and more environmental awareness.

Strengthening personal hygiene and personal security will help to enhance the confidence of users

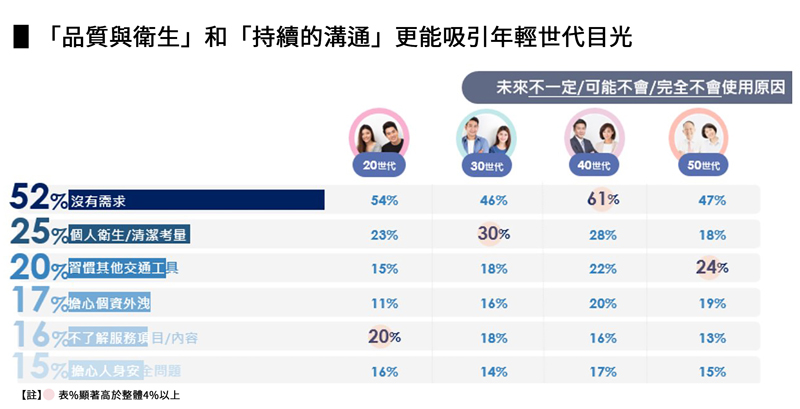

Strengthening personal hygiene and personal security will help to enhance the confidence of usersAs for those who do not use shared locomotives, most of them are "without demand" (52%). Therefore, creating more usage situations or demands will be a major challenge for the operators. In addition, 25% of the respondents were due to "personal hygiene / cleanliness considerations" and 17% were "worried about the leakage of personal resources". It is suggested that businesses should pay more attention to "personal hygiene" and "personal safety" in the future, so as to enhance consumers' confidence.

For the young generation, "maintaining vehicle quality and hygiene" and "continuous brand information service content communication" can attract their attention more; for the mature generation, because of the high proportion of vehicles and relatively stable lifestyle, the demand is mainly temporary. It is suggested that the operators can provide different service and consumption scenarios for different generations, so as to change the usage habits of consumers and accelerate the popularization of shared locomotives.

Based on the above survey results, we can find that after ubike and Uber, the brand of shared locomotives has gradually sprouted, and the utilization rate has gradually increased, which is expected to become a star of tomorrow in the sharing industry. Driven by the high willingness to use the market, with the advantages of "saving time and convenience", "maximizing the value of resources" and "meeting the immediate needs", we are ready to welcome the advent of the era of shared locomotives. Finally, we will make a brief summary of the "young" and "mature" generations.

Sharing motorcycles have been integrated into the daily life of the younger generation (20 / 30 generations). Most of them use them for commuting, shopping and traveling, and are brave to try different brands. However, in terms of choice, the younger generation is more concerned about the fluency and convenience of digital operation. In the future, operators can optimize the fluency and quality of digital operation, and continuously communicate brand information, so as to strengthen the use of young customers.

In the use of shared locomotives, the mature generation (40 / 50 generation) focuses on temporary needs, such as temporary cycling or maintenance of their own cars. Therefore, they care about riding comfort and convenience. In addition, the brand concept of resource sharing and mutual benefit and environmental awareness can also trigger the mature generation's willingness to use. Enterprises can promote environmental awareness, meet temporary needs, change the use of habits In order to meet the mobile needs of the mature generation, we should create usage scenarios and make breakthroughs in the operation of "sharing convenience".

As the scenery on Taiwan's roads is gradually changed by shared locomotives, we can see that more and more people do not care about "owning" but only need to "use". This growing market potential will bring changes to many industries. I believe that the next new business opportunity of sharing will emerge soon. I hope you are ready.

Survey description: "shared locomotive use behavior survey" is a survey conducted by go survey market research consultant on go survey platform from April 8 to April 21, 2020. A total of 1000 samples were collected, and the interviewees were 18-59 years old.