09.2022 Office Talk

The physical and chemical complexity of ready to eat food becomes "scissors" -- an analysis of scissors economy

Go surf Market Research Consultant / provided

Changes in work and lifestyle and the impact of the epidemic have reshaped consumers' ways and needs for "eating", and instant cooking has become the main representative of convenient eating. According to the statistics of the Ministry of economic affairs, in 2020, the output value of meals and dishes (such as frozen dumplings and other prepared foods) reached ntd30.4 billion, a record high over the years. In the first half of 2021, it also exceeded ntd15.5 billion. Fast, convenient and delicious food can be served as soon as it is cut and microwaved, forming a consumption trend that can not be ignored.

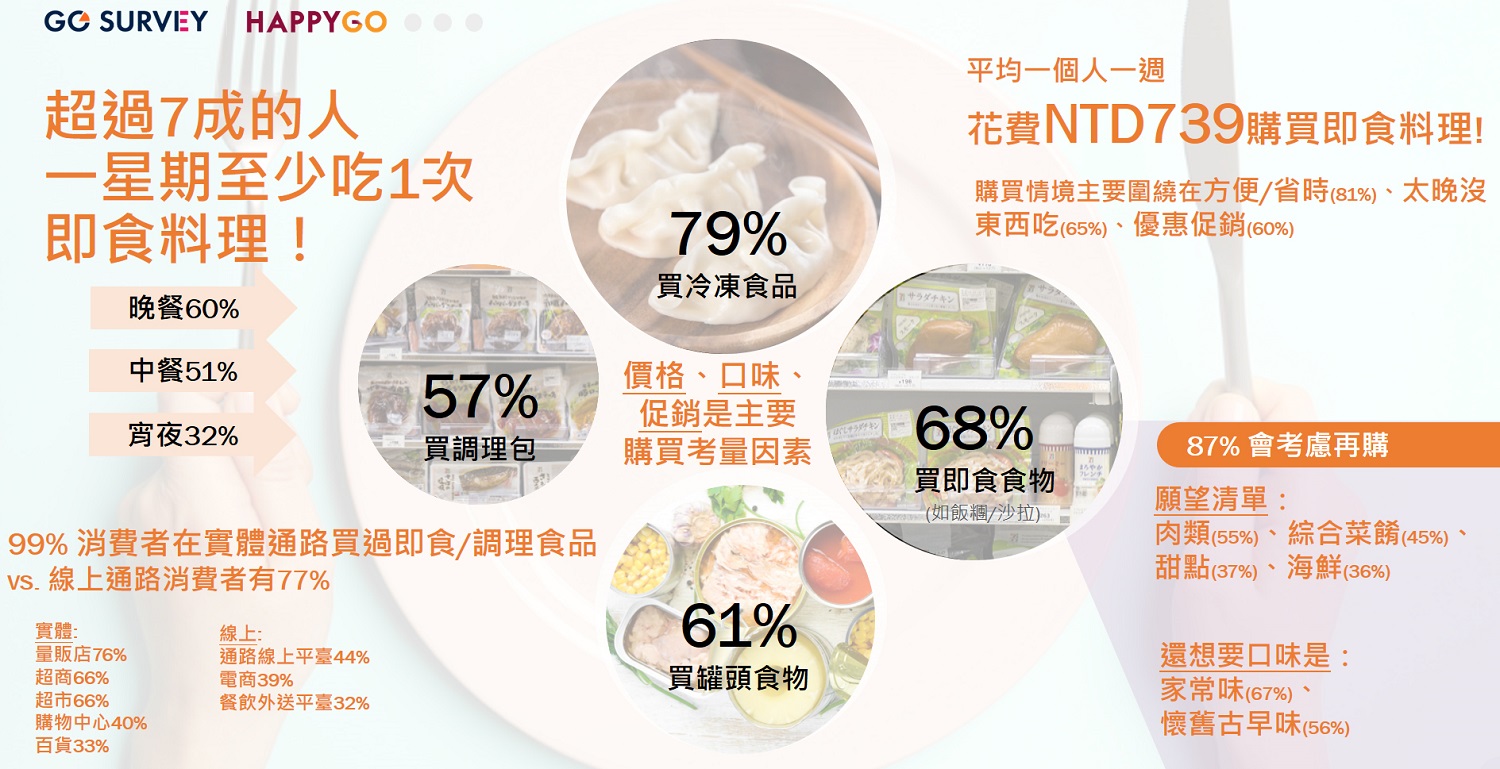

Changes in work and lifestyle and the impact of the epidemic have reshaped consumers' ways and needs for "eating", and instant cooking has become the main representative of convenient eating. According to the statistics of the Ministry of economic affairs, in 2020, the output value of meals and dishes (such as frozen dumplings and other prepared foods) reached ntd30.4 billion, a record high over the years. In the first half of 2021, it also exceeded ntd15.5 billion. Fast, convenient and delicious food can be served as soon as it is cut and microwaved, forming a consumption trend that can not be ignored. According to the go serve survey, up to 98% of the people have purchased instant food, of which frozen food, ready to eat food and canned food are the most popular. More than 70% of consumers eat ready to eat food at least once a week, and the average person spends ntd739 per week. In terms of procurement channels, 99% of the people have purchased instant food through physical channels such as mass merchandising, supermarkets, shopping centers and department stores, and 77% of the people will purchase it through online platforms, e-commerce, catering delivery platforms and other online channels.

According to the go serve survey, up to 98% of the people have purchased instant food, of which frozen food, ready to eat food and canned food are the most popular. More than 70% of consumers eat ready to eat food at least once a week, and the average person spends ntd739 per week. In terms of procurement channels, 99% of the people have purchased instant food through physical channels such as mass merchandising, supermarkets, shopping centers and department stores, and 77% of the people will purchase it through online platforms, e-commerce, catering delivery platforms and other online channels.As for the situation of buying instant cooking, it is mainly because of convenience / time saving, too late to eat, preferential promotions, etc. Sixty percent of the respondents chose instant cuisine as their dinner, followed by Chinese food (51%) and late night snack (32%). When shopping, price, taste and promotion are the main considerations of consumers. Nearly 90% of consumers are willing to buy back meat, comprehensive dishes, desserts and seafood; Customers with a high willingness to repurchase also hope that in the future, there will be more homely and nostalgic products on the market to choose from. The above reflects the degree to which instant cooking is integrated into consumer life.

Master the characteristics of instant cooking customers and expand diners

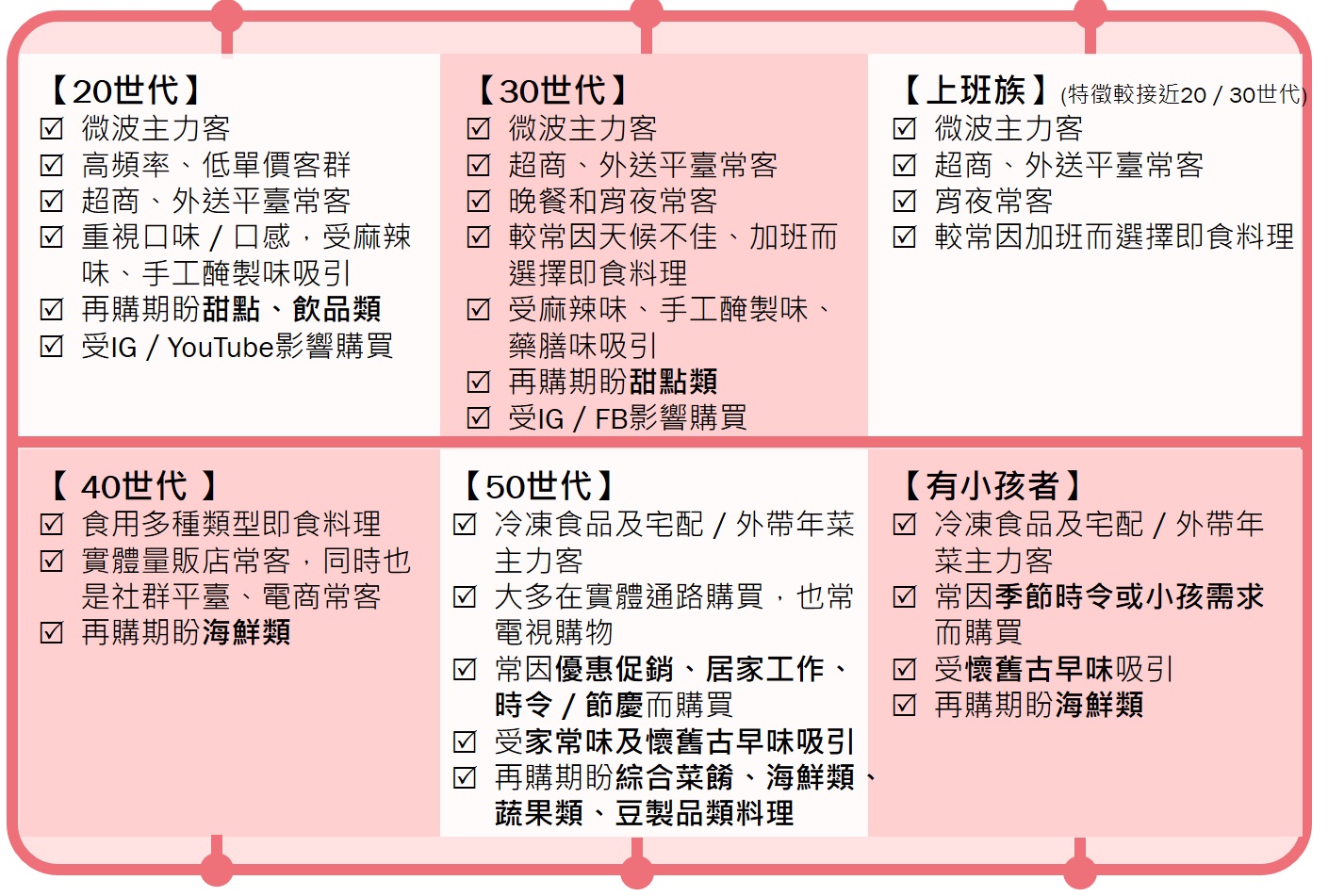

Observing the characteristics of various ethnic groups, the 40th generation with high consumption power has the widest acceptance of "various types" of ready to eat cuisine; The 50th generation / groups with children are the main customers of frozen food and home delivery / take out new year's dishes. Most of the generation 40, 50 + and those with children buy in mass merchandising stores. In particular, the proportion of generation 50 + buying in mass merchandising stores, shopping centers / department stores, markets, restaurants, brand stores and other physical channels is significantly higher than the whole, which also shows that their consumption channels are more diversified.

For online consumption, the 40th generation preferred to use social platforms and e-commerce platforms for online shopping, which was higher than the overall 3%; As for the 50 + generation, they often use TV shopping. In addition, incentives such as preferential promotions, working from home, seasonal / festival activities will attract 50 + generations to buy, and breakfast and Chinese food account for the highest proportion.

In terms of ordering considerations, the 50 + generation not only values sales promotion, but also demands high quality and good price. They also value the convenience of picking up goods, freshness of goods, less additives, and trustworthy brands / enterprises. They also have the most wish list items for the future, preferring comprehensive dishes, seafood, vegetables and fruits, and bean products; In terms of taste, we look forward to simple and nostalgic home flavor and ancient morning flavor; Seafood also attracts nearly 40% of the 40s and those with children. On the whole, mature customers are the main consumption force of multiple channels and types of instant cooking. In the future, they can mainly use high-quality goods, supplemented by preferential promotions, to drive consumption momentum.

On the other hand, young people and office workers of the 20th and 30th generations are the main customers of microwave, especially used to shopping at supermarkets; As for online consumption, they also use food delivery platforms more often than other groups (> 5% or more vs. the whole). Among them, generation 30 often choose delivery platforms due to poor weather and overtime work, and generation 30 and busy office workers enjoy a higher proportion of snacks and dinners; The 20th generation ate ready to eat food during informal dining hours (such as afternoon tea and night snack), which was higher than that of other ethnic groups. From the point of view of placing orders, it can be seen that generation 20 is more concerned about the taste / taste of the product itself, whether it can be directly microwaved, and the amount of food. In terms of the list of future purchases, the 20th generation is more interested in desserts and drinks; Interestingly, desserts can also soothe the hearts of the 30th generation (+ 3% vs. the whole). On the whole, the tastes that the 20th and 30th generations want in the future are similar, and they are also attracted by the spicy flavor and the hand cured flavor. However, the 30th generation also hopes to have ready to eat cuisine with medicinal flavor. In terms of purchase decisions, generation 20 is more influenced by Ig and Youtube, while generation 30 prefers Ig and FB (> 3% + vs. the whole).

To sum up, go serve summarizes the following three "scissors business opportunities":

Business opportunity 1: young customers and office workers are the main customers of microwave food. Supermarkets and delivery are the main channels. Dinner and night snack are the main battlefields. Social media can be used to promote purchase intention.

The 50 + mature generation of business opportunity 2 mainly focuses on physical channels, prefers early and Chinese food periods, and requires good quality and good price. It is suggested to stimulate consumption with preferential promotions.

"Business opportunity 3" seafood / nostalgic early taste ready to eat cuisine is more popular with customers of mature age (generation 40 / 50) and with children. It is suggested to develop related products to attract customers.

* survey description: "instant condiment survey" is an online survey conducted by go serve market research consultant on go serve platform from December 28, 2021 to January 24, 2022. A total of 4784 samples were collected. The respondents are happy go cardholders aged 18 to 70.

* official website of go surf Market Research Consultant: https://www.gosurvey.com.tw/web/index/index.jsp

#