04.2023 Life Guide

Prospects for Stock Market Investment in 2023

Oriental Petrochemical (Taiwan) Investment Advisor / Xie Yifan, Lin Xiaohan

.jpg) In 2022, the global economy will continue to fluctuate under the influence of climate change, epidemic, European energy crisis, inflation, Russia-Ukraine conflict and other situations after the stock and debt fall together. Will the global economy recover or decline as we enter 2023? Where will Taiwan's economic development go? This issue of 'Finance Column' shares market observations with you.

In 2022, the global economy will continue to fluctuate under the influence of climate change, epidemic, European energy crisis, inflation, Russia-Ukraine conflict and other situations after the stock and debt fall together. Will the global economy recover or decline as we enter 2023? Where will Taiwan's economic development go? This issue of 'Finance Column' shares market observations with you.The stock market in 2022 can be described as a turbulent year. At the beginning of the year, the Taiwan Stock Weighted Index hit a historic high, but in October, it experienced the largest cumulative decline point in nearly 20 years, with a correction rate of 32.17%. The stock market was filled with sorrows, and most investors were unable to escape.

Whether the stock market will experience a new low in 2023 depends on the economic trend. With the epidemic becoming increasingly flu like, inflation and interest rate rise expected to peak, and the economy of Chinese Mainland is expected to recover, as well as strong employment in the United States, the market began to expect a soft landing of the United States economy. In the second half of the year, the stock market bottomed up and the market became stronger and stronger.

Is the Federal Reserve System nearing the end of interest rate hikes?

After the February meeting of the Federal Reserve System (Fed) in the United States, Chairman Jerome Powell stated that it was too early to declare victory over inflation and reiterated that interest rates would continue to rise until inflation dropped to 2%. In other words, the key to whether to cut interest rates in the second half of the year is still the performance of economic data. If inflation declines rapidly and salary and employment growth slows down, then cutting interest rates is still one of the options for the Federal Reserve System. From the current situation, the probability of a repeat interest rate hike of two yards in the future has significantly decreased, and the pressure of financial tightening is gradually easing. For the market, the adjustment of valuation is expected to come to an end and refocus on fundamentals.

Will the global economy have a soft landing?

In its recent report, the International Monetary Fund (IMF) raised its economic growth forecast for this year. The main reasons include: the U.S. economy is tougher than expected, demand recovery in Chinese Mainland after deregulation, and Europe is expected to maintain growth despite the impact of energy costs. This is the first revision since the beginning of 2022, indicating that the real economy may not be as pessimistic as the market imagined. Given that all four major economies around the world have performed better than expected, there may be an opportunity for a recovery in the second half of the year.

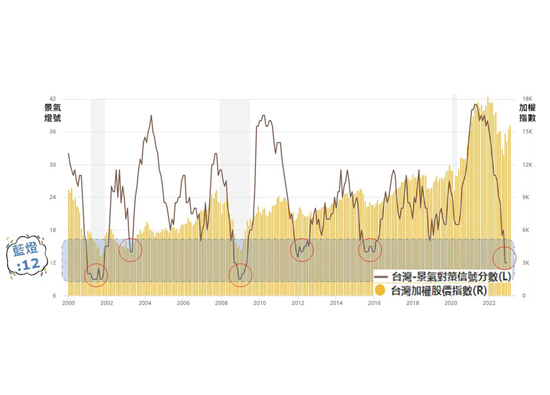

Find a relative low point from the prosperity light signal

The prosperity light number is a comprehensive score given by the National Development Commission for nine indicators, including currency total count M1B, stock price index, industrial production index, employment in non agricultural sectors, customs export value, import value of machinery and electrical equipment, manufacturing sales volume index, wholesale, retail and catering industry turnover, and manufacturing business climate testing points, to determine the overall prosperity status of each month.

Red light 38-45 points

Prosperity and heat meridians

Yellow and red lights 32 to 37 points

Pay attention to steering

Green light 23 to 31 points

Stable prosperity

Yellow and blue lights 17 to 22 points

Pay attention to steering

Blue light: 9-16 points

Depression

Usually, the prosperity indicator is positively correlated with the weighted index. When the prosperity rises and the fundamentals continue to rise, the stock market often also prospers. Although the blue light has been on for two consecutive months, it has actually been on six consecutive occasions since 2000. At that time, the stock market either fell or fluctuated at a low level. However, if viewed over time, the blue light is often a turning point in the band and a buying point for long-term investment.

Observing the blue light of Taiwan's prosperity in the past, it can take as little as 3 months to quickly turn green, and sometimes more than 10 months to restore stability, with an average of about 9 months. Therefore, in the short term, Taiwan's economic situation is still facing a headwind, and it is necessary to wait for the global economic downturn to turn upward in order to have the opportunity to break out of the trough.

Source: Finance M Square

Stand by and wait for the opportunity

The biggest hidden concern for Taiwan's economy lies in exports. In 2022, the Federal Reserve System adopted a radical interest rate hike, with a cumulative effect of 17 yards of interest rate hikes fermenting. Although inflation has declined, it is still at a high level. In the first half of the year, consumer electronics inventory continued to adjust, and the economy is still weak. It is expected that the global stock market will also be in a state of turbulence and reorganization, and only in the second half of the year will there be a chance to see the light and gradually enter a better situation.

#