07.2023 Life Guide

Global Financial Market Outlook for the Second Half of 2023

Far Eastern International Bank / Gao Yixun

After more than a year, the Federal Reserve System of the United States finally ended its interest rate hike cycle this year, but is still concerned about inflation risks. Therefore, if no major events occur, it will continue to maintain high interest rates and reduce its balance sheet size through quantitative tightening, recovering funds from the financial system, until inflation reaches or approaches its target. How will the global economy change next? How should the public invest? This issue of 'Finance Column' provides you with answers one by one.

After more than a year, the Federal Reserve System of the United States finally ended its interest rate hike cycle this year, but is still concerned about inflation risks. Therefore, if no major events occur, it will continue to maintain high interest rates and reduce its balance sheet size through quantitative tightening, recovering funds from the financial system, until inflation reaches or approaches its target. How will the global economy change next? How should the public invest? This issue of 'Finance Column' provides you with answers one by one.Opportunities for a soft landing in the global economy increase

At the monetary policy meeting held in March this year, both the Federal Reserve System of the United States and the Bank of England said that the country's economy would fall into recession. However, the International Monetary Fund (IMF) pointed out in its "World Economic Outlook" in April that the global economy seems to be preparing for a gradual recovery, but it is still quite fragile; It is evident that the views of various sectors on the future prosperity are not consistent. In fact, the global economy will indeed slow down or even experience a slight recession, and the chances of a "soft landing" (while the government suppresses inflation, it also leads to moderate economic growth) are increasing. Here are four observations:

1. The Zero-COVID in Chinese Mainland ends

In December 2022, Chinese Mainland will adjust its epidemic prevention policy and reopen to the outside world. Not only will the number of tourists and the amount of consumption rise significantly during the New Year and the Lunar New Year holiday, but the consumption power will continue even to March. As various commercial activities slowly return to the normal track, the land and air traffic volume will gradually return to the level before the epidemic. As the world's second largest economy, even if the economic growth rate of Chinese Mainland cannot regain its former glory for the time being, the demand and trade volume created by contributing 5% of economic growth can still add fuel to the operation of the global economic engine.

2. The employment market and consumption power remain strong

The economic policy of Chinese Mainland in 2023 will primarily pursue stable growth, followed by stable employment. Governments at all levels attach great importance to employment. On the other hand, even though there are frequent news of layoffs among large companies in Europe and America, the job market still tends to be stable. Taking the United States as an example, the unemployment rate in the first half of the year was about 3.4-3.7%, which is a relatively low point in the past 30 years; The unemployment rate in European countries is also at a similar level. In addition, in recent years, labor wage increases in Germany and Japan have exceeded 3%, coupled with high household savings (the proportion of excess savings to GDP in major economies outside the United States is at its highest point since the pandemic). As long as public confidence rebounds, potential consumption power will be released.

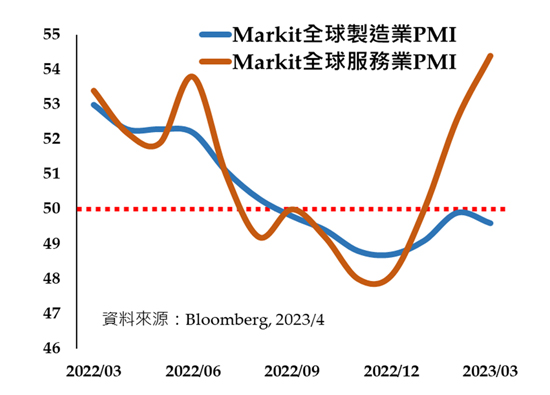

The leading indicator "Purchasing Manager Index" (hereinafter referred to as PMI) can also reveal clues. According to data released by Markit, although the global manufacturing PMI is below the boom and bust point of 50, the service industry PMI has returned to above 50 in January 2023, and the upward trend is accelerating, indicating a significant rebound in the service industry, with a recovery strength higher than that of the manufacturing industry.

3. Global central banks gradually end the cycle of interest rate hikes

The central banks of countries such as Canada and Australia have gradually ended the cycle of interest rate hikes, and even if they continue to raise interest rates, the magnitude and speed are much slower than in 2022. As the degree of monetary policy tightening no longer intensifies, inflationary pressures are slowly cooling down, and the global economy can also hope to take a breather.

4. The U.S. banking crisis will not cause Systematic risk

After the collapse of the Silicon Valley Bank in the United States, many small and medium-sized banks reported bankruptcy risks in succession, causing concern from all walks of life about the recurrence of the financial crisis in the United States. However, the likelihood is not high. Firstly, the physical condition of large financial institutions has improved and has passed multiple stress tests through the Federal Reserve System. Secondly, the debt level of American households and enterprises is far lower than that in 2008, and the chance of Bank failure caused by serious debt reversal is low. Finally, after the events of Lehman Brothers and Silicon Valley Bank, the Federal Deposit Insurance Corporation, Federal Reserve System and the Ministry of Finance were able to deal with the banking crisis immediately to avoid chain effects.

Investment Perspectives for the Second Half of 2023

1. Asset allocation is the king's way

This year's financial media news often featured the headline 'debt is better than stock', which is partly due to market concerns that an economic recession will cause financial market volatility; On the other hand, whether the yield to maturity of government bonds or corporate bonds is higher than in the past few years, the investment attractiveness naturally increases. However, investing cannot be done in one size fits all. Taking the US stock market as an example, investment returns have been much higher than bonds since the beginning of this year.

Last year, both stocks and bonds fell, and many people may believe that asset allocation is useless. In fact, this year, the performance and volatility of stock and bond allocation have returned to their usual state. Therefore, under the conditions of the end of the interest rate hike cycle and high opportunities for an economic soft landing, both stock and bond assets are expected to perform well, and only through asset allocation can they advance and retreat.

2. Overcoming uncertainty through regular quotas

Faced with major market fluctuations, most people are hesitant to invest, especially with the help of the media, and are even more concerned about economic recession. Since we can't predict the future, it's better to spend time to earn rewards than to spend all our time chasing the perfect entry point, because the economic performance is cyclical and will not decline or expand forever. As of April 2023, the National Bureau of Economic Research (NBER) in the United States has not yet indicated a domestic economic recession. Even in the event of a recession, the economy will return to its expansion phase in the next 1-2 years. "Regular quotas" are one of the investment strategies that respond to the current environment.

#