08.2023 Office Talk

Optimistic retail prospects remain challenging after the epidemic

Group Comprehensive Efficiency and Retail Planning Headquarters / Investment and Operation Analysis Group

The COVID-19 epidemic has affected the world for more than three years, and will finally come to an end in 2023. However, new challenges remain for physical retail. In addition to the chain effect brought about by the epidemic, the global geopolitical and interest rate hikes have also triggered an uneasy financial and economic environment, which has also impacted the performance of physical retail. This article will analyze the hidden concerns faced by physical retail in the post pandemic era from the perspectives of demand and supply, and provide corresponding solutions.

The COVID-19 epidemic has affected the world for more than three years, and will finally come to an end in 2023. However, new challenges remain for physical retail. In addition to the chain effect brought about by the epidemic, the global geopolitical and interest rate hikes have also triggered an uneasy financial and economic environment, which has also impacted the performance of physical retail. This article will analyze the hidden concerns faced by physical retail in the post pandemic era from the perspectives of demand and supply, and provide corresponding solutions.The COVID-19 once hit the retail industry hard, and the three-level alert made the revenue of department stores and restaurants decline precipitously. With the slowdown of the epidemic, the physical channel has regained its popularity and welcomed the spring swallow again. However, challenges such as high inflation and lack of workers are still testing the quick response ability of retailers.

Hidden worries about the demand for physical retail in the post pandemic era

1. Consumption tends to be conservative: Taiwan's economic growth rate forecast for 2023 has been continuously revised down since the fourth quarter of 2022. In April, the IMF significantly reduced Taiwan's economic growth rate for 2023 from 2.8% predicted in October 2022 to 2.1%. In fact, since November last year, the signal of Taiwan's prosperity has been in a downturn of less than 12 points for six consecutive months. It is expected that the public's consumption power will tend to be conservative, and with the increase of interest rates and inflation effects, the mentality will be more tight on the purse strings. Although the government is actively issuing NTD 6000 cash with a special budget in the hope of boosting private consumption, according to the East Line listing survey, most people use it to replace their original daily expenses, which has limited effect on stimulating additional consumption.

1. Consumption tends to be conservative: Taiwan's economic growth rate forecast for 2023 has been continuously revised down since the fourth quarter of 2022. In April, the IMF significantly reduced Taiwan's economic growth rate for 2023 from 2.8% predicted in October 2022 to 2.1%. In fact, since November last year, the signal of Taiwan's prosperity has been in a downturn of less than 12 points for six consecutive months. It is expected that the public's consumption power will tend to be conservative, and with the increase of interest rates and inflation effects, the mentality will be more tight on the purse strings. Although the government is actively issuing NTD 6000 cash with a special budget in the hope of boosting private consumption, according to the East Line listing survey, most people use it to replace their original daily expenses, which has limited effect on stimulating additional consumption.2. Opening up tourism: Border opening is a double-edged sword for the domestic consumer market, although international tourists visiting Taiwan can promote the performance of department store retail channels, especially for stores located in popular tourist areas; But if people go shopping abroad and consume in duty-free stores, they will inevitably exclude the consumption of Taiwanese department stores, especially in the boutique, women's, and cosmetics industries, which will have a greater impact. Taking 2019 (before the epidemic) as an example, the average number of overseas tourists per month exceeded 1.4 million. In the first quarter of this year, it has recovered to 50%. However, with the fourth wave of the epidemic starting in late May, overseas tourism has returned to normal, providing some buffer time for the negative impact of specific department store businesses.

3. Irreversible use of digital channels: After years of epidemic, the public has become accustomed to using digital channels. According to the March 2023 Consumer Dynamics Quick Report released by Dongfang Online, the majority of people's purchases of daily necessities, entertainment activities, food and beverage consumption will continue in the future, and even increase their reliance on physical retail, which has significantly reduced their dependence on physical retail. According to a survey conducted by the Statistics Department of the Ministry of Economic Affairs, from 2019 to 2022, the compound annual growth rate (CAGR) of the revenue of the e-commerce and mail order industries reached 14%. Within three years, the amount of online shopping increased by over NTD 100 billion. In addition to the benefits of the epidemic on major e-commerce platforms, physical retail has also opened various digital sales channels to grab the e-commerce pie, and some physical retail may have made some achievements, But most of them have limited performance compensation effects.

Post epidemic New normal Physical Retail Supply Challenges

1. "Goods" - High homogeneity of goods: In recent years, large-scale retail channels have gradually expanded and merged, and the boundaries of channels such as department stores, mass sellers, supermarkets, supermarkets, and even e-commerce have become increasingly blurred. In addition to its peers, department stores also face competition from mass selling peripheral counters and catering; In addition to mass selling, the competitors of mass selling also share many potential markets with supermarkets deep into the community. With the lifting of the epidemic and the easing of the commodity supply chain crisis, international brands are actively setting up counters or independent street stores in large shopping malls. Large shopping malls continue to expand in order to maintain their growth momentum. Department stores and shopping centers are faced with a high degree of homogenization of goods. Similar brands, such as catering chains, Fast fashion clothing, home furnishing stores, entertainment and bookstores, have become the Political base of large malls, and brand uniqueness of individual malls has gradually disappeared.

2. "Field" - Construction engineering and operating costs remain high: Since the outbreak of the epidemic, the shortage of labor and materials has led to a high cost of construction engineering. According to the Construction Engineering Index released by the Accounting and Accounting Office of the Executive Yuan, as of May this year, the total index has grown by 24% during the epidemic period, with a rise of nearly 30% in materials and nearly 20% in labor. Despite the recent easing of the epidemic, costs remain rigid and difficult to improve in the short term. In the future, regardless of self built, modified, or leased buildings, property costs in retail malls will rise. In addition, the Russo-Ukrainian War caused a sharp rise in international fuel prices. Most countries increased electricity prices to reduce the losses of power companies. Taiwan also increased electricity prices from April 1 this year, especially in large factories, department stores and other high-voltage and ultra-high voltage industries, with the highest increase of 17%, and there is still pressure for further growth in the future. Due to the high proportion of electricity bills in mall service costs, retailers have resorted to methods such as replacing old equipment, replacing energy-saving lighting fixtures, and investing in energy management systems to save energy and carbon, in order to save operating costs.

3. "People" - The problem of job vacancies continues to worsen: 104 Job Bank announced in March 2023 that the number of job vacancies in various industries in Taiwan reached 1.03 million, setting a record high. On average, every job seeker has nearly 8 job opportunities, with accommodation and catering being the most vacant industries. The number of job vacancies in electronic information and wholesale and retail is also high. To sum up the reasons, in addition to the reduction of young ethnic groups due to Sub-replacement fertility, the low salary structure of the service industry and the rise of the Gig economy are the main reasons. The 9-to-5 work is no longer attractive to young people, and the flexible working hours of delivery staff, web celebrity, SOHO and self entrepreneurship are more popular with young people. To address this issue, the county and city governments and private enterprises have started introducing secondary employment for the middle-aged and elderly, hoping to fill the labor gap. For example, McDonald's in Taiwan has taken friendly measures to call on the middle-aged and elderly to return to the workplace.

Innovation in shopping malls and digital transformation simultaneously focus on sustainability issues

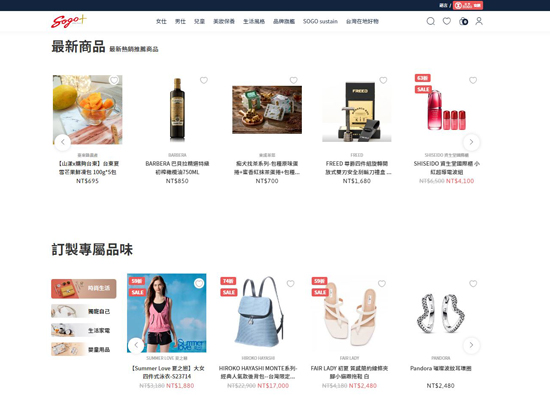

Conservative consumption and open tourism involve many overall decent factors. Although Taiwan has been affected by international factors this year and its economic prospects are not optimistic, private consumption remains the main driving force for economic growth. How to attract the attention of the public and stay in local consumption, in addition to actively developing characteristic brands and creating differentiation in shopping malls, virtual and real integration has become the key competitiveness of the retail industry in the post pandemic era. It is necessary to make good use of the online shopping behavior that the public has become accustomed to, and drive digital transformation through omnichannel OMO strategies and data decisions, through channels such as physical stores, official websites, e-commerce platforms, online communities, and apps, Enable consumers to access and purchase Far Eastern Group retail products and services.

In the era of diversified open source, it is also necessary to actively reduce costs, adopt the most appropriate development strategy to reduce property expenses, use the most efficient property management methods to reduce service costs, and pay attention to the issue of sustainable net zero, moving towards sustainability and corporate social responsibility, in order to gain consumer trust and maintain corporate image. Deloitte Zhongye Zhongxin Management Consultant pointed out in its global retail trend outlook that the retail industry should include "sustainable retail" in its planning, with the three major aspects of "profit, people, and land" as the main axis, layout sustainable investment, and use sustainable certification as the core strategy of products and brands, re-establish connections with consumers, and consolidate consumers' adhesion to the brand.

#