11.2023 Life Guide

More than 4% increase in basic salary in 2024

Far Eastern New Century Corporation / Dingguang Yuan

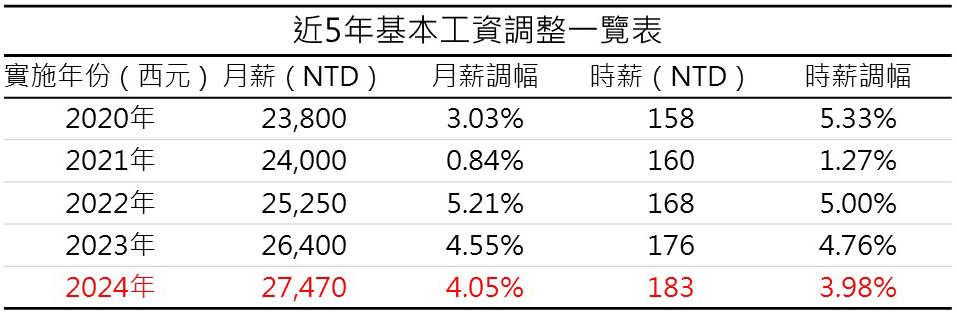

On September 8th, the Ministry of Labor held a basic wage review committee to review the situation of rising prices and economic growth. In order to maintain the purchasing power of labor's basic living, it was decided to increase the monthly basic wage from NTD26400 to NTD27470 in 2024, with an increase of NTD1070 or 4.05%; The hourly salary has been increased from NTD176 to NTD183, with an increase of NTD7, an increase of about 4%. It is estimated that 2.39 million workers will benefit. The entire case has been approved by the Executive Yuan and will be implemented from January 1, 2024.

On September 8th, the Ministry of Labor held a basic wage review committee to review the situation of rising prices and economic growth. In order to maintain the purchasing power of labor's basic living, it was decided to increase the monthly basic wage from NTD26400 to NTD27470 in 2024, with an increase of NTD1070 or 4.05%; The hourly salary has been increased from NTD176 to NTD183, with an increase of NTD7, an increase of about 4%. It is estimated that 2.39 million workers will benefit. The entire case has been approved by the Executive Yuan and will be implemented from January 1, 2024.In the Basic Wage Review Committee, both labor and capital members agree to protect the rights and interests of marginal workers. The labor committee believes that the price increase of important livelihood materials should be reflected in the adjustment of basic wages; The management representative expressed that the future prosperity is not as optimistic as expected, and the increase in basic wages should be within a reasonable range; Scholars' representatives believe that basic wages aim to maintain the substantial purchasing power required for workers' basic livelihood, and the increase in important livelihood materials has a considerable impact on grassroots workers. After a thorough exchange of opinions in two stages, taking into account the annual growth rate of the consumer price index, the annual growth rate of 17 important civilian and biological resources, the economic growth rate, and the overall economic situation, a consensus was reached - a 4.05% increase in basic wages, which is higher than the 4% increase in salaries for the entire Taiwan military, public education, and education.

What is basic salary? What is the basis for the increase?

Monthly basic salary "refers to the minimum salary that an employer must pay for a worker who provides services on a monthly basis within 40 hours of legal normal working hours; The "hourly basic wage" refers to the minimum wage that employers must provide for workers who are paid per hour.

In order to ensure the basic living purchasing power of workers, the Ministry of Labor holds a basic wage review meeting in the third quarter of each year. Based on the annual economic growth rate (GDP), consumer price index (CPI), and national income data released by the Accounting and Accounting Office, the meeting discusses whether to increase the basic wage in alternate years.

Does the basic salary include a full attendance bonus? Is it legal to deduct full attendance bonus due to taking leave, resulting in salary being lower than the basic salary?

The remuneration received by workers for their services, or the remuneration regularly fixed by employers to workers, can be considered as wages, such as fixed base salary, food allowance, job bonus, full attendance bonus, etc., all of which meet the definition of wages and can be included in the basic wage calculation items. If, after deducting the full attendance bonus, the actual salary of the worker is lower than the basic salary, the employer is considered illegal; However, if the employer only deducts the hours of sick leave or personal leave that the worker did not attend in the current month, without deducting the full attendance bonus, and because the worker did not provide labor during normal working hours, the employer deducts the hours, resulting in the actual salary being lower than the basic salary, it is not illegal.

The remuneration received by workers for their services, or the remuneration regularly fixed by employers to workers, can be considered as wages, such as fixed base salary, food allowance, job bonus, full attendance bonus, etc., all of which meet the definition of wages and can be included in the basic wage calculation items. If, after deducting the full attendance bonus, the actual salary of the worker is lower than the basic salary, the employer is considered illegal; However, if the employer only deducts the hours of sick leave or personal leave that the worker did not attend in the current month, without deducting the full attendance bonus, and because the worker did not provide labor during normal working hours, the employer deducts the hours, resulting in the actual salary being lower than the basic salary, it is not illegal.Is it legal for the salary to be lower than the basic salary after deducting labor and health insurance?

The cost of labor and health insurance is borne by employers, laborers, and the government, and varies in proportion according to the target audience. Among them, the labor and health insurance expenses that are "borne by the worker themselves" are mostly withheld with the assistance of the employer. Therefore, if the monthly salary received by the worker is lower than the basic salary after deducting the "self payment amount" of the employer's withholding of labor insurance, personal insurance, and health insurance premiums, the employer is not illegal.

How much additional labor and health insurance fees do you need to pay after the basic salary increase?

The average accident insurance rate for labor insurance in 2024 is 12%. Based on the basic monthly salary of NTD27470, the labor insurance premiums for employed workers will be increased from NTD3168 to NTD3296. At present, the monthly premium burden ratio for labor insurance is "Employer 7: Labor 2: Government 1", so the employer's monthly burden amount is NTD2307, an increase of NTD89 compared to last year; The monthly burden of labor is NTD659, an increase of NTD25 compared to last year.

Based on the current health insurance premium rate of 5.17% and a basic monthly salary of NTD27470, the health insurance premium for employed workers will be increased from NTD1365 to NTD1420. Due to the health insurance premium burden ratio of "Employer 6: Labor 3: Government 1", the monthly burden of employers is NTD852, an increase of NTD33 compared to last year; The monthly burden of labor is NTD426, an increase of NTD16 compared to last year. (Reference materials: Ministry of Labor official website, National Regulations Database, 518 Workplace Bear News)

Image source: freepik

#