09.2024 Life Guide

What about natural disaster losses? Three steps to get tax reduction done

Far Eastern New Century Corporation / Wu Ruoqi

Recently, unpredictable earthquakes and typhoons have hit one after another, causing fear and anxiety among the public, and even leading to property losses such as houses, land, and motorcycles. How can we reduce damage and alleviate financial pressure? In this issue of 'Legal Column', we will share with you the three steps to reduce taxes and give you a helping hand!

Recently, unpredictable earthquakes and typhoons have hit one after another, causing fear and anxiety among the public, and even leading to property losses such as houses, land, and motorcycles. How can we reduce damage and alleviate financial pressure? In this issue of 'Legal Column', we will share with you the three steps to reduce taxes and give you a helping hand! Step 1: Take a photo to save evidence

Step 1: Take a photo to save evidencePlease take photos of the scene as soon as possible and preserve the visual evidence.

Step 2: Attach the documents

List the list of losses and relevant supporting documents, such as photos of the disaster damage, original proof of ownership of the damaged property, repair estimate, etc.

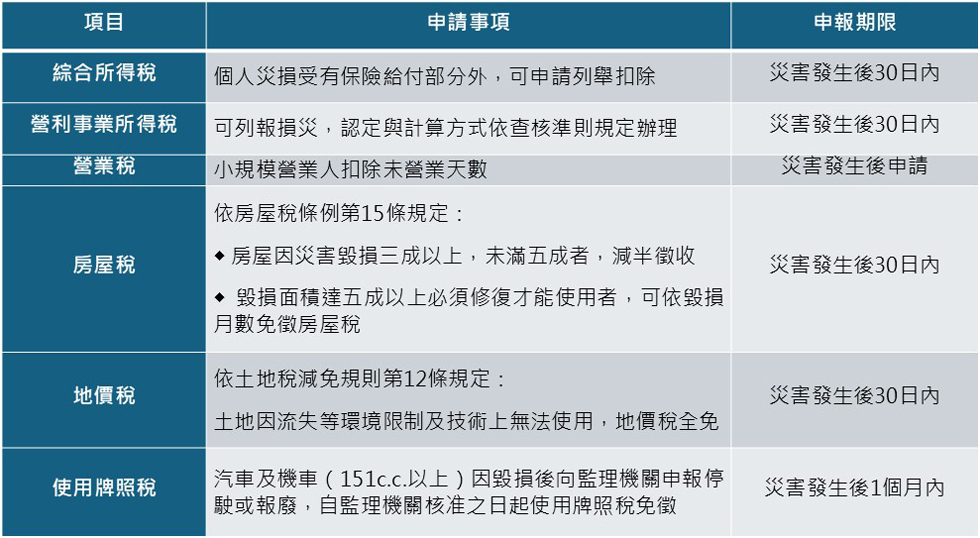

Step 3: Apply for Reduction or Exemption

Within 30 days after the disaster occurs, report to the local tax collection authority for relevant matters. In addition to processing applications at the counter or by written mail, applications can also be made through the tax portal network of the Ministry of Finance ("Online Services">"Online Application">"Online Tax Application").

2. After approval, the reduced portion can be deducted from the comprehensive income tax declaration of the current year and cannot be deferred to the following year for deduction. If the tax cannot be fully paid within the statutory period, the taxpayer may apply to the tax collection authority for an extension (up to 12 months) or installment payment (up to 36 periods) within the prescribed payment period.

The common tax items and exemption regulations are shown in the following table:

In response to the impact of natural disasters on people's property, the Ministry of Finance stated that tax collection agencies will adhere to the principles of leniency and urgency, actively assist and guide affected taxpayers in applying for various tax exemptions and reductions. If an individual or family's for-profit business incurs property and business losses, please be sure to grasp your own rights and apply for exemption within the time limit! (Source: Ministry of Finance)

#