09.2024 Life Guide

Practice slow, rich and happy life with small habits

Far Eastern International Bank / Xie Mingrong

The major issues in a person's life are all related to money. If one can learn to control money instead of being controlled by it, perhaps they can take a step towards a happy life. In this issue of 'Finance Column', we introduce how to achieve financial freedom and enjoy life with peace of mind through small investments.

The major issues in a person's life are all related to money. If one can learn to control money instead of being controlled by it, perhaps they can take a step towards a happy life. In this issue of 'Finance Column', we introduce how to achieve financial freedom and enjoy life with peace of mind through small investments.The behavior pattern of investing first and then consuming

When fishermen catch fish, they release small fish in order to ensure the survival of the fishing population and ensure a continuous supply of future catches. This is the ancient wisdom passed down by our ancestors. The same principle applies to financial management: maintain discipline and continuously save money, make good use of it to become the mother of investment money, and gradually accumulate great wealth. If the salary is used up as soon as it is received, or even excessively consumed, in addition to working hard for money for life, the personal financial situation will also be quite fragile and cannot afford any accidents.

To accumulate sufficient wealth to meet the needs of different stages of life, in addition to inheritance gifts and income from work, it is more important to invest in order to accelerate wealth accumulation. However, investment is not the residual use after being satisfied with food and drink, but a priority area that is forcibly retained. It is recommended to separate consumption and investment into two accounts, strictly control various expenditures, and regularly review the results of investment.

Small money mother discipline investment creates a smile curve

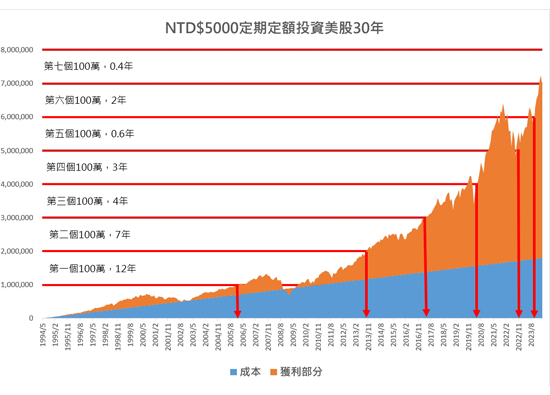

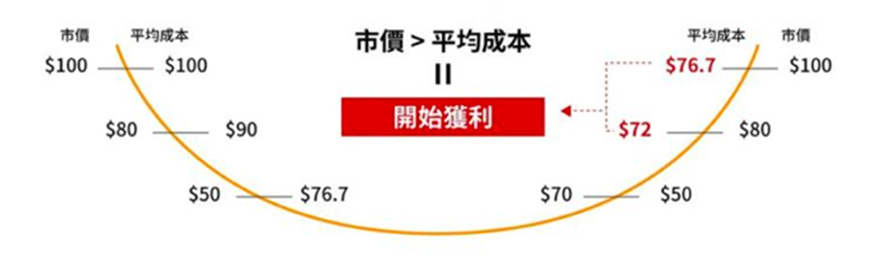

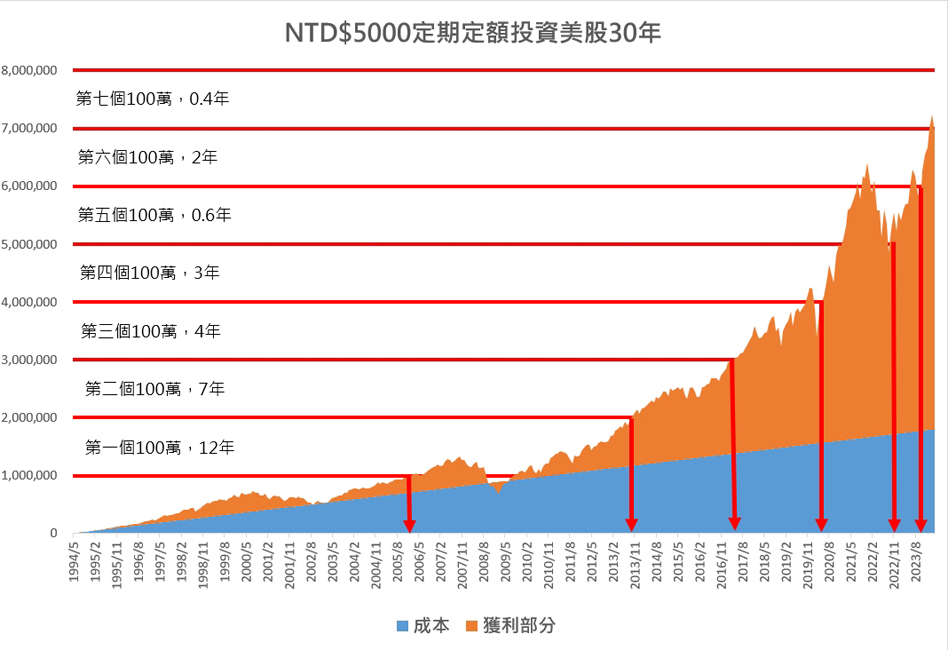

For investors with limited funds and investment experience, "regular quota" is the simplest starting point. Regardless of market fluctuations, as long as a small amount is invested on time, the cost can be evenly spread. If the investment target is long-term upward, the profit probability will be very high. In a volatile market, the curve that creates excess returns is called the "smile curve". Therefore, when the market price drops, it is still necessary to adhere to regular fixed investment. Not only will the average cost become cheaper, but as the investment cost decreases, the same amount can buy more units. When the market price rises above the average cost, profits will begin to emerge.

The biggest reason why the vast majority of investors lose money is "chasing high and killing low", because the market atmosphere is hot and optimistic, so they buy at relatively high prices; Once the market outlook turns pessimistic, panic rushes out and sells at the lowest point, creating a negative atmosphere of "losing money on investments" in the long run, ignoring the fact that the market environment has been growing upwards. And regular fixed quotas are used to treat this symptom, overcoming the misconception of blindly following the crowd with discipline. Regardless of market fluctuations, we insist on investing with a fixed amount. If we can be more proactive in picking up bargains during downturns, we have a chance to laugh until the end.

Source: Bloomberg Far Eastern International Bank The data period is from May 30, 1994 to April 30, 2024. Assuming an investment of NTD5000 at the end of each month, with continuous deductions each month, the cumulative amount equals the invested principal plus investment profit and loss. The investment profit and loss is calculated based on the index price as of April 30, 2024 multiplied by the cumulative number of units. The US stock index is calculated using the S&P 500 index. The above calculations are for reference only and do not guarantee the actual performance of the fund, nor do they guarantee the future performance of the fund. Investors will have different investment performance due to different entry times, and past performance does not guarantee future performance. The above is only the result of simulating the investment portfolio based on historical data and does not represent the actual return rate and future performance guarantee of this investment portfolio. The results may vary depending on the simulation operation conducted at different times.

Source: Bloomberg Far Eastern International Bank The data period is from May 30, 1994 to April 30, 2024. Assuming an investment of NTD5000 at the end of each month, with continuous deductions each month, the cumulative amount equals the invested principal plus investment profit and loss. The investment profit and loss is calculated based on the index price as of April 30, 2024 multiplied by the cumulative number of units. The US stock index is calculated using the S&P 500 index. The above calculations are for reference only and do not guarantee the actual performance of the fund, nor do they guarantee the future performance of the fund. Investors will have different investment performance due to different entry times, and past performance does not guarantee future performance. The above is only the result of simulating the investment portfolio based on historical data and does not represent the actual return rate and future performance guarantee of this investment portfolio. The results may vary depending on the simulation operation conducted at different times.Accumulate happiness calmly and become rich

Investment is not the exclusive domain of the wealthy, but an essential skill for everyone to practice their financial freedom. For investors who do not have large amounts of funds or time to research various wealth management products, regular fixed investment mutual funds are the most effective tool. Compared to individual stocks or bonds, mutual funds invest in different asset classes, which can diversify risks and achieve long-term stable returns; In addition, mutual funds are monitored by a professional team that focuses on observing market changes, with dedicated personnel analyzing the overall environment, industry conditions, corporate profits, and even the international situation. There is a high chance of creating excess returns and reducing risks, in other words, hiring a group of experts to protect your assets.

In addition, mutual funds have matured and investors with different preferences can find suitable products based on their individual needs, such as high-tech funds with high explosive power, high dividend/bond funds with high interest rates, investment grade bond funds with low volatility and stable net worth, etc. Of course, several funds with different characteristics can also be selected to create exclusive gold investment portfolios.

Far Eastern International Bank's wealth management experts suggest that in order to increase the success rate of investments, the following three principles should be followed: 1. Long term investment, balancing costs and compounding benefits; 2、 Choose markets with a larger and more mature investment scope, such as the US market and the global market, and avoid shallow plate markets that are prone to volatile fluctuations; 3、 Choose asset management companies with good credit and performance, as investment research values the combat effectiveness of the team. Companies that have been tempered over time and have long-term high quality are usually able to maintain stable performance. The next step is to prepare the monthly investment amount based on personal investment goals and investment period. Among them, special attention should be paid to products with higher annualized returns, which usually have greater volatility and require longer investment time to mitigate market volatility risks.

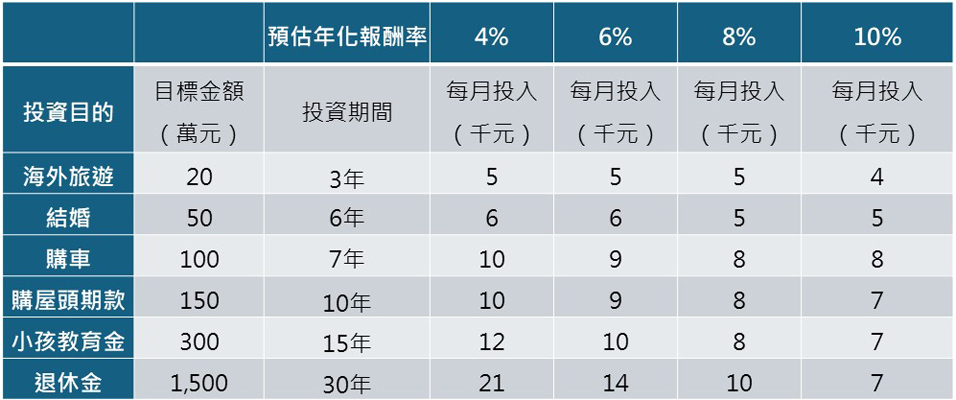

As presented in the 'Dream Checklist', as long as you develop the habit of investing regularly and with a fixed amount of money, you have the opportunity to accumulate wealth. Money is not a dream, so start the journey of a prosperous life now!

Table: Dream Calculation Table (Unit: NTD)

Data source: Far Eastern International Bank, based on different expected annualized rates of return, backtesting a fixed monthly investment and rolling over a certain period of time to accumulate the total amount.

*The above calculations are the results of simulating investment portfolios based on historical data, and do not guarantee the actual performance of the fund or its future performance. Investors will have different investment performance due to different entry times, and past performance does not guarantee future performance.

There are always risks involved in investing, and there are both profits and losses in fund investments. Before subscribing, it is necessary to carefully read the prospectus (Investor Notice)