11.2024 Life Guide

The most convenient online application for tax refund for energy-saving appliances

Far Eastern New Century Corporation / Chen Siyu

To encourage the use of energy-saving household appliances, reduce carbon emissions, and achieve the goal of green consumption, by June 14, 2025, those who purchase new refrigerators, new air coolers (heaters), or new dehumidifiers with energy efficiency level 1 or 2 approved by the Ministry of Economic Affairs, and are not for sale or have no returns or exchanges, can apply for a refund of goods tax online within the deadline. This issue of 'Legal Column' compiles the 'Q&A on Refund and Reduction of Goods Tax', allowing you to master the essentials of easily applying for tax refunds without leaving your home, without queuing, and within 24 hours.

To encourage the use of energy-saving household appliances, reduce carbon emissions, and achieve the goal of green consumption, by June 14, 2025, those who purchase new refrigerators, new air coolers (heaters), or new dehumidifiers with energy efficiency level 1 or 2 approved by the Ministry of Economic Affairs, and are not for sale or have no returns or exchanges, can apply for a refund of goods tax online within the deadline. This issue of 'Legal Column' compiles the 'Q&A on Refund and Reduction of Goods Tax', allowing you to master the essentials of easily applying for tax refunds without leaving your home, without queuing, and within 24 hours.Q1. How to apply for online tax refund?

(1) Application path:

(1) Application path:Ministry of Finance Tax Portal ">" Tax Information ">" Refund and Reduction of Goods Tax Special Zone for Purchasing Energy saving Electrical Appliances ">" Consumer Online Application ".

(2) Application method:

➀ Certificate identity authentication: Consumers who are individuals can use natural person certificates or health insurance cards; For profit public institutions can use business certificates; Organizations and groups use organization and group credentials to publish information on the "Ministry of Finance Tax Portal".

Simplified identity authentication (limited to direct dialing tax refund): Upload an image file of the cover of the financial institution account passbook (including the financial institution code, name, account number, and account name), and the account name must be the same as the buyer's, for the National Taxation Bureau and financial institutions to compare information and verify identity.

Q2. How to know the energy efficiency classification of electrical products?

The energy efficiency related information of refrigerators, air coolers or dehumidifiers will be displayed next to their display machines, in product manuals or product catalogs. You can also check the "Energy Efficiency Grading and Labeling Management System" of the Energy Bureau of the Ministry of Economic Affairs.

Q3. What is the deadline for applying for a refund of the reduced amount of goods tax?

From the day after the transaction date recorded on the unified invoice or receipt, an application shall be submitted within 6 months, and no refund shall be applied for after the deadline.

Q4. How do I know how much tax can be refunded for a new refrigerator, new air cooler (heater), or new dehumidifier?

Step 1: Confirm whether the new refrigerator, air cooler or dehumidifier belongs to the first or second level of energy efficiency products approved by the Ministry of Economic Affairs.

Step 2: Confirm the effective internal volume of the new refrigerator, the rated cooling capacity of the air cooler (heater), and the rated dehumidification capacity of the dehumidifier.

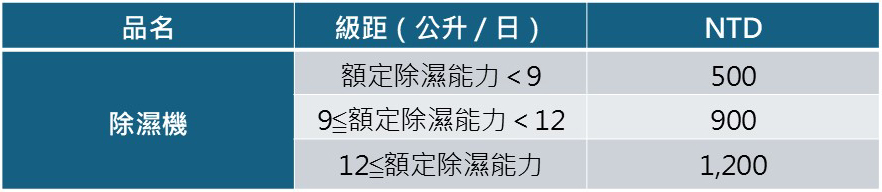

Step 3: Search for the "Table of Reduced Goods Tax Rates for Refrigerators, Air Conditioning Machines, Dehumidifiers".

※ Table of Goods Tax Reduction for Refrigerator, Air Conditioner, Dehumidifier:

Note: Separate cooling (heating) units, only the "outdoor unit" has energy efficiency classification and can apply for tax refund

Note: Separate cooling (heating) units, only the "outdoor unit" has energy efficiency classification and can apply for tax refundWhen applying for a refund of reduced goods tax, it is recommended that everyone make use of the 24-hour online application service of the Ministry of Finance's tax portal. The process is simple and not limited by time and location, which can save the round-trip time and document copying cost of applying for a counter. You can also check the progress of case review at any time, saving time and convenience. In addition, it is important to grasp the time limit when applying to avoid affecting tax refund rights. If you have any related questions, you can go to the "Ministry of Finance Tax Portal">"Tax Information">"Refund and Reduction of Goods Tax for Purchasing Energy saving Electrical Appliances Special Zone" for inquiries, or call the free service hotline 0800-000321 for inquiries. (Source: Tax Portal of the Ministry of Finance, press release from the North District State Taxation Bureau)

*Image source: freepik

#