01.2025 Life Guide

Outlook for Global Financial Markets in 2025

Far Eastern International Bank / Xu Shihang

The global economy has experienced continuous recovery in 2023 and 2024, and may slow down slightly in 2025, but it is not yet in recession. Due to the consecutive interest rate cuts by the Federal Reserve System and major central banks worldwide (excluding Japan), it is expected to bring more stimulus to the market. At the same time, the US labor and consumer markets are gradually improving, and the economy is expected to achieve a soft landing. In addition, the central banks of mature countries are beginning to implement loose policies, which is also conducive to the flow of funds to emerging markets and boosting their economic performance. This issue of 'Finance Column' analyzes the global financial market outlook for 2025, helping investors to strategically layout their stock market strategies.

The global economy has experienced continuous recovery in 2023 and 2024, and may slow down slightly in 2025, but it is not yet in recession. Due to the consecutive interest rate cuts by the Federal Reserve System and major central banks worldwide (excluding Japan), it is expected to bring more stimulus to the market. At the same time, the US labor and consumer markets are gradually improving, and the economy is expected to achieve a soft landing. In addition, the central banks of mature countries are beginning to implement loose policies, which is also conducive to the flow of funds to emerging markets and boosting their economic performance. This issue of 'Finance Column' analyzes the global financial market outlook for 2025, helping investors to strategically layout their stock market strategies.Due to the lack of significant signals of economic recession in the data, the continued interest rate cuts by the Federal Reserve System in the United States have been questioned by the market. In addition, multiple economic policies in the future will heavily support the real economy, making it difficult to reduce long-term inflation to the Federal Reserve System's ideal target of 2%. To avoid an economic hard landing, it is estimated that the Federal Reserve System will initiate a gradual interest rate cut, and short-term market fluctuations will not change the direction of future monetary policy.

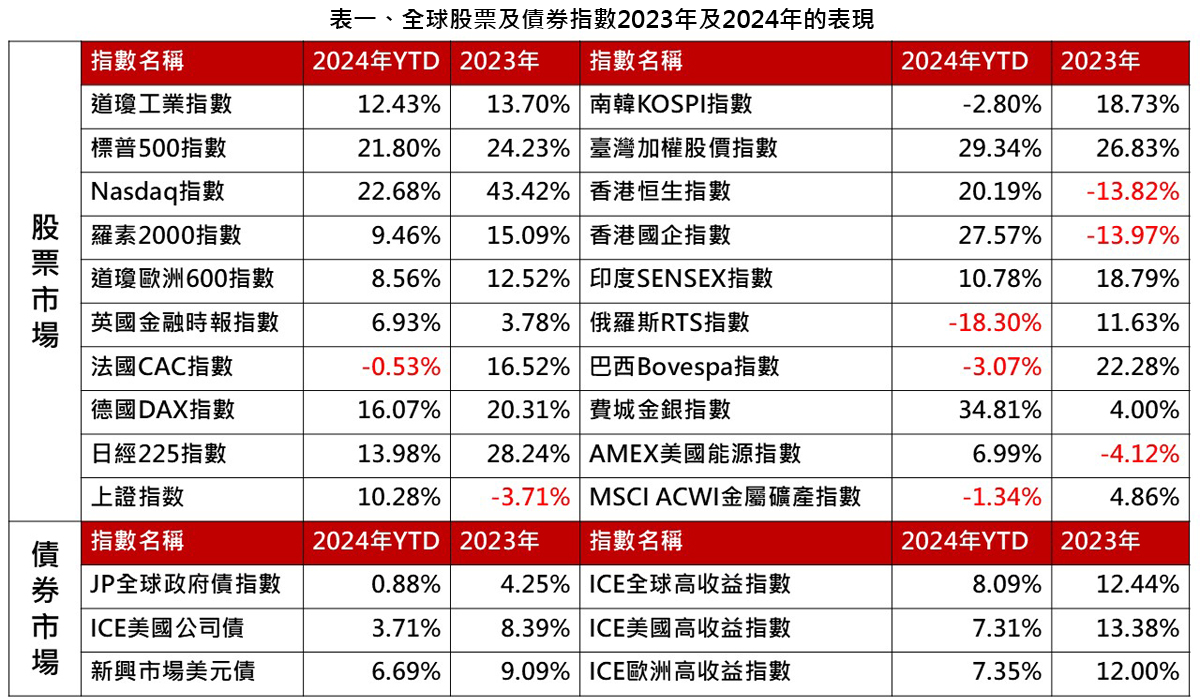

The global stock market has been greatly affected by the US market and has been rising for two consecutive years. It is expected that the US stock market return (increase) may converge by 2025, but the US economy is still growing steadily, and corporate profit expectations remain optimistic. AI themes are still an important growth driver in the US market and are expected to drive investments in the internet and technology industries. Due to the fact that the US stock market still leads mature countries, emerging markets that have joined the US AI technology supply chain will also benefit.

Data source: Bloomberg, 2024/10/24

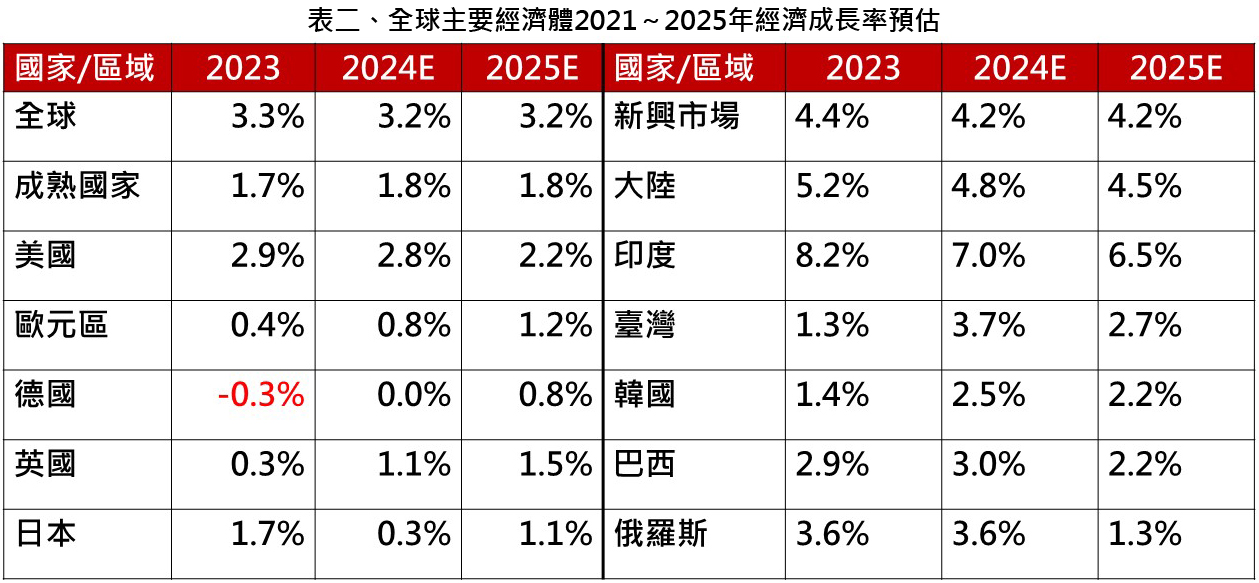

Data source: Bloomberg, 2024/10/24The global economic growth will slow down in 2025, and the differences in strength among different markets will become more apparent

Although the global economy is expected to maintain a soft landing, the momentum of growth is weakening, while trade protectionism, high interest rates, and geopolitical conflicts continue to suppress global economic freedom. If trade tariffs and geopolitical risks continue to rise in the future, the impact on some countries and regions may exceed expectations.

1. Economic growth slows down, service industry outperforms manufacturing industry

In 2024, there are signs of a slowdown in global economic growth, mainly due to poor performance in the manufacturing sector, with the "Manufacturing PMI" of major global economies performing poorly. Affected by unclear demand and international political uncertainty, the manufacturing industry in mature countries such as the United States and Europe continues to slow down; The mainland, which is known for its manufacturing industry, has experienced a slowdown in manufacturing investment due to the lack of confidence caused by the real estate market and unclear external demand. The manufacturing PMI has fallen below the boom bust line of 50. The above situation may continue until 2025, and the manufacturing industry can only seek stability first and then seek new growth opportunities.

In fact, the main driving force behind the growth of the US economy is the service industry, with three-quarters of the country's workforce engaged in the service industry, especially the finance, shipping, insurance, and information services industries, which account for a large proportion of GDP. In addition, information companies such as Microsoft, Apple, Google, Amazon, and Facebook play a crucial role globally, and these "soft powers" support the main driving force of US economic growth. It is expected that the service industry will continue to outperform the manufacturing industry in 2025.

2. Different countries have different industrial characteristics, and there will be significant differences in their economies

US: The job market continues to improve, with an unemployment rate of around 4.1%. In addition, inflation is gradually easing, providing more room for the Federal Reserve System. Due to the absolute technological advantage of the United States and the active investment in related industries driven by AI themes, it is estimated that although the economy may slow down slightly, it will still maintain growth.

Mainland China: With strong support from the government and central bank, the worst economic situation has temporarily eased, but the trade bans imposed by the US and Europe on mainland China will continue to expand. Faced with international difficulties, the economy can only "maintain stability" first, and the opportunity for significant improvement is not high.

Japan: The uncertainty of domestic politics has increased. Although deepening reforms is beneficial for economic development, the process is full of obstacles that cannot be achieved overnight. In addition, Japan's traditional industries and automotive industry are facing global challenges, and it is estimated that there will still be multiple tests in 2025.

Data source: IMF, 2024/10 Explanation: E represents that the data in this field is an estimated value

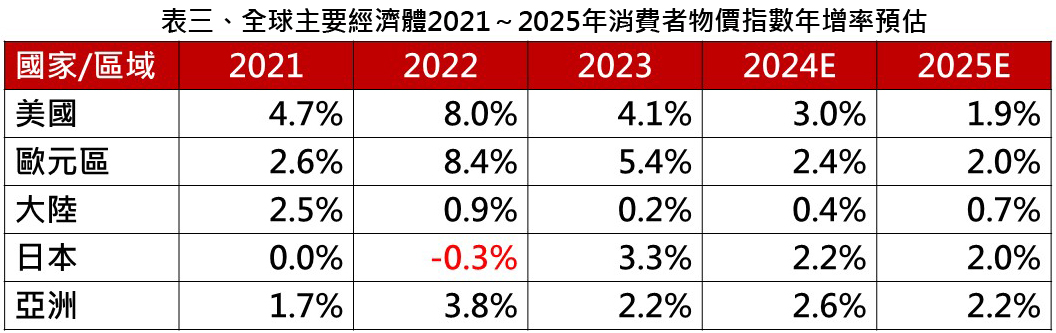

Data source: IMF, 2024/10 Explanation: E represents that the data in this field is an estimated value3. The issue of inflation still requires caution

In the past period, inflation data from major countries around the world have shown a downward trend, and CPI and PCE in the United States have gradually improved; Although the problem of inflation seems to have been resolved, it is positively correlated with the economy and consumption. If the economy is significantly better than expected by 2025 and consumption is too strong, concerns about secondary inflation will seriously hit the economy. Therefore, adjusting monetary policy is particularly important. Cutting interest rates too quickly or releasing too much liquidity may lead to a resurgence of inflation; Slow interest rate cuts and excessive tightening can lead to an economic recession. Overall, inflation in 2025 is expected, but caution should be exercised.

Data source: IMF, 2024/10 Explanation: E represents that the data in this field is an estimated value

4. Geopolitical risks have not yet come to an end

The 2024 Ukraine Russia War, Middle East conflict, tensions on the Korean Peninsula, and military exercises in the Taiwan Strait demonstrate the biggest geopolitical challenges since World War II. Although under the restraint of multiple forces, there will not be a full-scale war in various regions, the dove of peace has already flown far away and cannot escape geopolitical risks by 2025. Financial markets usually react calmly to known or controllable bearish conditions, and are most afraid of uncontrollable uncertainties. Geopolitical emergencies can become unpredictable bombs, so when investing in 2025, one should consider hedging or risk diversification.

Investment Plan for 2025

1. Stock investment, please pay attention to growth themes

In 2024, the United States will become the leader, driving the global stock market to a higher level. In addition to the performance of the U.S. stock market itself, it will also promote the market of relevant overseas supply chains in the United States. For example, Taiwan OEM semiconductors and AI servers, and India's acquisition of a large number of orders from Chinese Mainland are all driving forces for economic transformation and growth. In 2025, large technology companies and their supply chains in the United States may continue to grow, and AI orders will accelerate corporate profitability. Therefore, they will still be the focus of investment portfolio allocation. As for other non growth industries, maintaining a reasonable proportion is sufficient.

2. Bond investment remains attractive

The Federal Reserve System of the United States initiated interest rate cuts in September 2024. Although there were occasional doubts in the market and many research institutions were not optimistic about long-term inflation, the yield of US bonds fluctuated. However, the direction of the Federal Reserve System gradually reducing interest rates to long-term neutral rates is not easy to change. Therefore, bond investment is still profitable in the medium to long term, in addition to providing stable returns.

3. Asset allocation strategy: flexible adjustment with both attack and defense

The planning of asset allocation in 2025 must be more flexible, as trade barriers are increasing and non economic factors such as geopolitics may cause international hot money to move faster, leading to a widening gap in the strength of stock markets in different countries. In the investment portfolio, the ratio of stock based funds to balanced funds can exceed 50%, but the proportion of the former should be reduced compared to 2024, and funds should be transferred to balanced funds that can be attacked and defended. In addition, the United States has the advantage of mastering new technologies, and large technology blue chip stocks still have growth potential. AI themes will also continue to expand their application areas. It is recommended that stock funds prioritize focusing on large US blue chip stocks; Bonds can first establish basic positions and adjust their proportions appropriately according to market trends, mainly consisting of US composite bonds and investment grade corporate bonds.

*Investment funds have both profits and losses. Please read the prospectus or investor notice carefully before investing.

#