01.2025 Life Guide

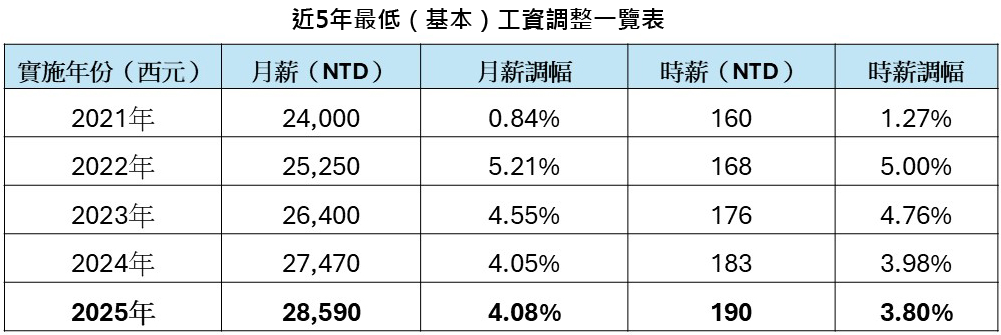

What impact does the consecutive 9 increases in minimum wage have on salaries?

Far Eastern New Century Corporation / Chen Ting

With the implementation of the Minimum Wage Law in 2024, the term 'basic wage' will enter history. Compared to the "basic wage" determined by the "Basic Wage Review Measures" which only has a command level, the "minimum wage" is evaluated and determined by the Minimum Wage Review Committee in accordance with Article 6 of the "Minimum Wage Law". Its rank has legal effect, and it clarifies the reference indicators, establishes a research group, improves the decision-making and approval process, and related penalties, making the regulations more rigorous and complete. In this issue of the 'Legal Column' reorganization, common questions about 'minimum wage' will be asked to help everyone quickly grasp their own rights and interests.

With the implementation of the Minimum Wage Law in 2024, the term 'basic wage' will enter history. Compared to the "basic wage" determined by the "Basic Wage Review Measures" which only has a command level, the "minimum wage" is evaluated and determined by the Minimum Wage Review Committee in accordance with Article 6 of the "Minimum Wage Law". Its rank has legal effect, and it clarifies the reference indicators, establishes a research group, improves the decision-making and approval process, and related penalties, making the regulations more rigorous and complete. In this issue of the 'Legal Column' reorganization, common questions about 'minimum wage' will be asked to help everyone quickly grasp their own rights and interests.The Ministry of Labor held its first Minimum Wage Review Committee in September 2024 and approved a continuous increase in the minimum guaranteed wage for nine years, with a monthly adjustment from NTD 27470 to NTD 28590, a 4.08% increase; The hourly wage will be adjusted from NTD 183 to NTD 190 by 3.80%, effective from January 1, 2025, and is expected to benefit 1.89 million workers.

The following are common FAQs after the implementation of the minimum wage:

Can the wage agreed upon by both labor and management be lower than the 'minimum wage'? If violated, will the employer face penalties?

The wage agreed upon by both labor and management shall not be lower than the minimum wage, otherwise the employer shall be deemed to have violated the law. According to Article 17 of the Minimum Wage Law, the employer shall face a fine ranging from NTD 20000 to NTD 1 million, and the maximum fine may be increased to NTD 1.5 million depending on the severity of the violation, the number of people involved, and the size of the enterprise. The competent authority will also publicly disclose the name of the institution, the name of the person in charge, the date of punishment, and the amount of the fine, and order it to improve within a specified period of time. Those who fail to improve within the specified period will be punished on a per occurrence basis.

2. Did the employer violate the law if the base salary received by Lao Wang is lower than the "minimum wage"?

Not necessarily, it should depend on the regular salary. Basic salary generally refers to the basic salary of workers, while regular salary is the monthly remuneration paid to employees. In addition to basic salary, it also includes fixed allowances and bonuses, such as meal allowances, transportation expenses, monthly work (production, performance, performance) bonuses, and attendance bonuses. Therefore, there is no relevant regulation that simply "basic salary" is lower than the minimum wage. However, if other aforementioned incomes are added and still do not meet the "minimum wage" standard, it is illegal.

3. Xiaoming's monthly salary is NTD 28590, with 8 days off per month, but the average hourly wage is lower than the statutory hourly wage. Can he request the employer to adjust his salary?

If Xiaoming's monthly salary is converted into an average hourly wage of NTD 162 (NTD 28590 ÷ 22 working days ÷ 8 hours), it is indeed lower than the statutory hourly wage of NTD 190. However, according to Article 4 and Article 5 of the Minimum Wage Law, the minimum wage should be determined based on the labor contract signed by both the employer and the employee, and the salary calculation method should be agreed upon in advance to adopt the "monthly salary system" or "hourly salary system", and cannot be adjusted arbitrarily.

In January 2025, Xiaohua signed a labor contract with a breakfast shop owner, with a minimum wage of NTD 28590 per month. However, in February, Xiaohua was one hour late and his salary was deducted NTD 500 by the owner, as well as labor and health insurance fees. His actual salary would be lower than the statutory monthly salary. Has the employer violated the law?

(1) Regarding the illegality of late pay deduction

According to Article 11 of the Implementation Rules of the Labor Standards Law, the minimum wage is the remuneration received by workers during "normal working hours", and does not include wages for extended working hours, as well as wages for rest days, holidays, and holiday work. In addition, according to the explanation letter No. 34335 issued by the Ministry of Labor (82), if an employee is late and fails to provide labor services, they will not be paid wages. Instead, wages must be paid according to their actual working hours in proportion. Therefore, if Xiaohua is one hour late, the minimum wage should not be lower than NTD 28471 (NTD 28590-28590/240 hours). If NTD 500 is deducted, it will be lower than NTD 28471, which does not comply with the principle of "proportional calculation".

(2) Regarding the legality of labor and health insurance

According to Article 16 (1) of the Labor Insurance Regulations and Article 30 (1) of the National Health Insurance Law, employers who purchase labor insurance and national health insurance for their workers must bear part of the costs themselves. The actual cost borne varies depending on the insured person's identity and whether their family members are covered by health insurance, and the insured unit "withholds" it. Therefore, it is not illegal for the deducted actual salary to be lower than the minimum wage.

※ Data source: Ministry of labor 、 Regulatory database, labor law query system, labor insurance bureau

#