07.2019 Life Guide

It is not a dream to achieve financial goals by making use of the investment policy

Far Eastern International Bank / Liu Meiling

In an era of low profits, conservative and single asset allocation (e.g. fixed deposit) may be affected by interest rate cuts and inflation, resulting in property shrinkage. It is suggested that the public may make good use of investment-based life insurance policies and monthly balances to achieve" Many a little makes a mickle " and become the basis of personal wealth.

Investment-based insurance policy is one of the most popular insurance policies in Taiwan in the past 10 years. Its advantages include:

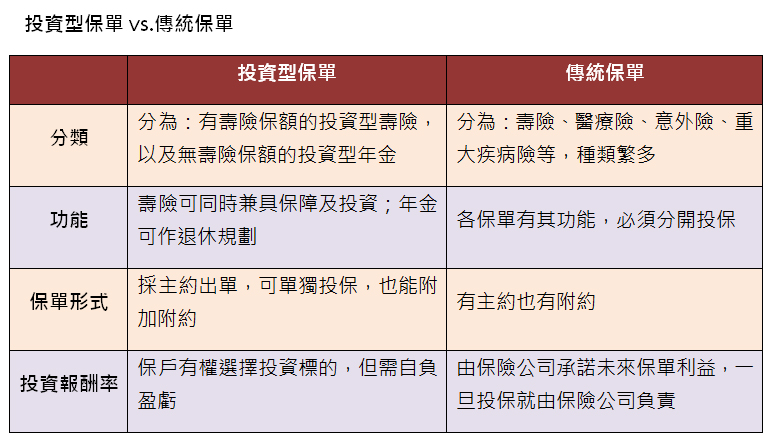

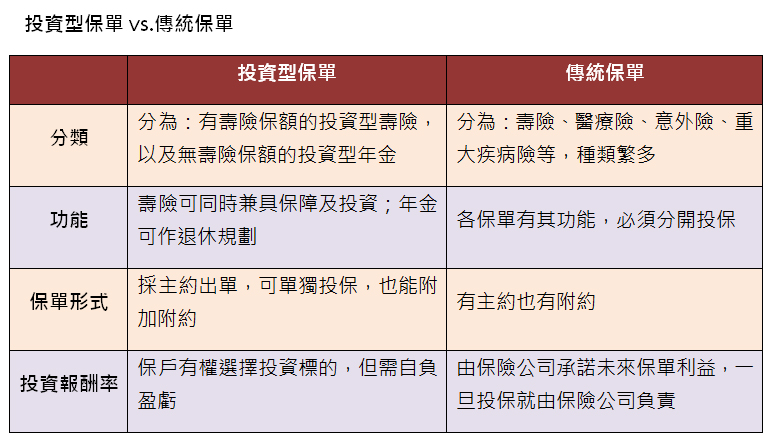

1. Enjoy both security and investment

Unlike traditional insurance policies, if the policy holder chooses investment-based life insurance with security function, he can not only enjoy the insurance amount, but also invest in fund or ETF at the same time to achieve the goal of accumulating wealth under the condition of paying premium. In other words, it has the dual functions of "protection" and "investment". In addition, on the investment platform of investment policy, hundreds of funds can be linked to facilitate the self-allocation of policy holders, which is more flexible and full of selectivity than those an amount of money can only be invested in a single fund.

2. The amount and period of payment can be selected according to the personal demands.

2. The amount and period of payment can be selected according to the personal demands.

Generally, traditional insurance policies must pay premiums on time, otherwise they may face the consequences of lapse of policy; however, there are many payment cycles of investment life insurance policies, which can be divided into monthly payment, quarterly payment, semi-annual payment, annual payment, or one-time payment, so as to facilitate the people to choose the mode of payment. If there is additional income or quick bonus, they can also pay additional premium to enjoy more opportunities for investment income.

3. Invest early and accumulate the first barrel of gold

Investment-based insurance has the characteristics of "flexible adjustment premium" and "application for adjustment premium", and can obtain personal security at a more reasonable premium cost. As long as the premium is paid regularly, it can not only disperse risks, but also extend the protection in a long-term and continuous accumulation.

conclusion

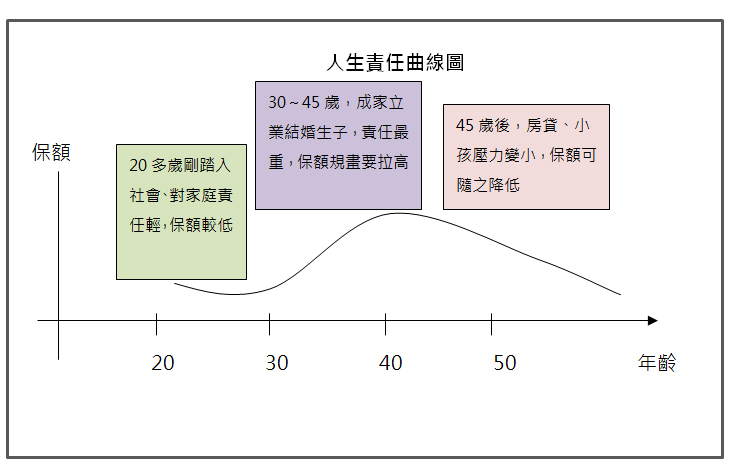

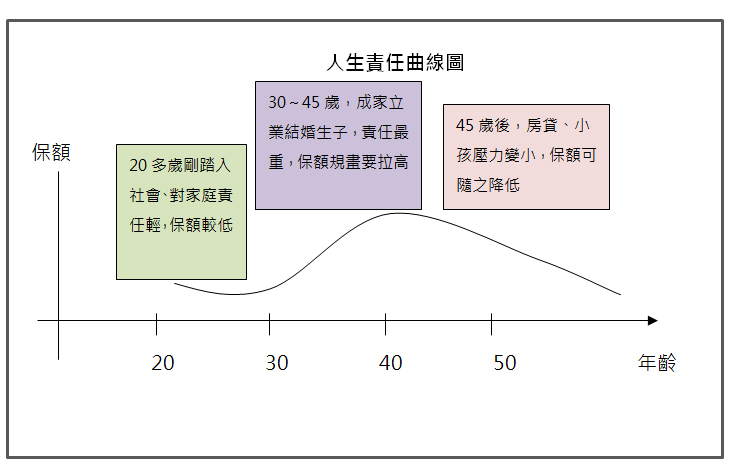

The structure of investment policy is transparent, and it can set up regular, single payment or long-term investment to accumulate assets. On the investment platform, the insurance company provides hundreds of funds which are priced at New Taiwan dollar and US dollar for investors to choose and allocate, so that each policy holder can achieve financial goals at different stages of his life!

Investment-based insurance policy is one of the most popular insurance policies in Taiwan in the past 10 years. Its advantages include:

1. Enjoy both security and investment

Unlike traditional insurance policies, if the policy holder chooses investment-based life insurance with security function, he can not only enjoy the insurance amount, but also invest in fund or ETF at the same time to achieve the goal of accumulating wealth under the condition of paying premium. In other words, it has the dual functions of "protection" and "investment". In addition, on the investment platform of investment policy, hundreds of funds can be linked to facilitate the self-allocation of policy holders, which is more flexible and full of selectivity than those an amount of money can only be invested in a single fund.

Generally, traditional insurance policies must pay premiums on time, otherwise they may face the consequences of lapse of policy; however, there are many payment cycles of investment life insurance policies, which can be divided into monthly payment, quarterly payment, semi-annual payment, annual payment, or one-time payment, so as to facilitate the people to choose the mode of payment. If there is additional income or quick bonus, they can also pay additional premium to enjoy more opportunities for investment income.

3. Invest early and accumulate the first barrel of gold

Investment-based insurance has the characteristics of "flexible adjustment premium" and "application for adjustment premium", and can obtain personal security at a more reasonable premium cost. As long as the premium is paid regularly, it can not only disperse risks, but also extend the protection in a long-term and continuous accumulation.

conclusion

The structure of investment policy is transparent, and it can set up regular, single payment or long-term investment to accumulate assets. On the investment platform, the insurance company provides hundreds of funds which are priced at New Taiwan dollar and US dollar for investors to choose and allocate, so that each policy holder can achieve financial goals at different stages of his life!