01.2024 Life Guide

Income tax rate adjustment benefiting the entire population's purse

Far Eastern New Century Corporation / Cai Jialing

In response to the rise in the Consumer Price Index (CPI) and to alleviate the burden on the public and increase personal disposable income, the Executive Yuan passed the "Income Tax System Optimization and Benefiting Measures" on November 23, 2023. What impact does this policy have on the public? This issue of the Legal Column will explain it to you in a simple and easy to understand way.

In response to the rise in the Consumer Price Index (CPI) and to alleviate the burden on the public and increase personal disposable income, the Executive Yuan passed the "Income Tax System Optimization and Benefiting Measures" on November 23, 2023. What impact does this policy have on the public? This issue of the Legal Column will explain it to you in a simple and easy to understand way.The following is a list of the main adjustments to the income tax rate, the related impact items, and a comparison table for your clear understanding:

1、 Increase the basic living expenses per person for the year 2023

The basic living expenses for each person in 2023 are NTD20200, an increase of NTD6000 compared to 2022 (NTD196000). This can be applied when the public applies for the 2023 comprehensive tax in May 2024.

2、 Increase the tax exemption, deduction amount, and tax level range for 2024

The adjustment limits for each category are as follows, which will be applicable to the public when declaring the 2024 comprehensive income tax in May 2025.

3、 Increase in the starting value of tax payment in 2024

3、 Increase in the starting value of tax payment in 2024After adjustment, the starting tax payment value for 2024 will be increased. Taking "single fresh people" as an example, those who earn NTD below 423000 in 2023 will be exempt from tax, and in 2024, it will be increased to NTD 446000 (an increase of NTD23000); Taking "a family of four (including two children under the age of five)" as an example, income below NTD 127000 in 2023 is exempt from tax. In 2024, it will be increased to NTD 1326000 (an increase of NTD 56000).

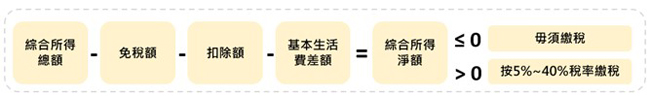

4、 Trial calculation formula for payable comprehensive income tax

Similarly, assuming that the income for both 2023 and 2024 is NTD 1 million, using the formula in the table on the right, the comprehensive tax payable for each year is NTD 30000 and NTD 28000, respectively.

Similarly, assuming that the income for both 2023 and 2024 is NTD 1 million, using the formula in the table on the right, the comprehensive tax payable for each year is NTD 30000 and NTD 28000, respectively. Note: Basic living expenses difference: According to the provisions of the Taxpayer Rights Protection Law, the basic living expenses announced by the Ministry of Finance for each person multiplied by the total basic living expenses calculated by the number of taxpayers, spouses, and declared dependent relatives. If the difference exceeds the total tax-free amount and deduction amount (*) of the declared household, it may be deducted from the total comprehensive income declared for the current year. (* Deductions do not include special deductions for property transaction losses and salary gains.)

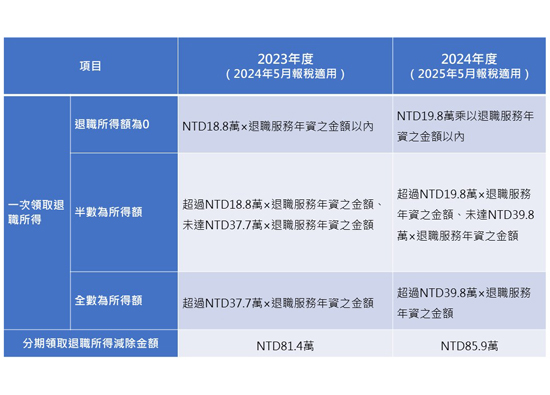

Note: Basic living expenses difference: According to the provisions of the Taxpayer Rights Protection Law, the basic living expenses announced by the Ministry of Finance for each person multiplied by the total basic living expenses calculated by the number of taxpayers, spouses, and declared dependent relatives. If the difference exceeds the total tax-free amount and deduction amount (*) of the declared household, it may be deducted from the total comprehensive income declared for the current year. (* Deductions do not include special deductions for property transaction losses and salary gains.)5、 Adjustment of Resignation Income

In addition, the tax system for income from this resignation has also been adjusted. The total amount of one-time collection in 2024 is NTD198000 yuan × Below the amount of service experience, the income is zero; More than NTD198000 × Years of experience, less than NTD 398000 × The amount of "seniority" is calculated at half of the income; Over NTD 398000 × The total amount of "seniority" is the income amount; For installment recipients, the income will be calculated by subtracting NTD 859000 from the total amount received throughout the year (as detailed in the table below).

For example, Miss Wu has been working in the company for 20 years. If she retires in 2024 and receives a severance pay of NTD 7 million, then NTD 3.96 million will be tax-free (NTD 198000) × 20 years); Half of the included income is NTD1520000 (700-396) ÷ 2=152). Therefore, Miss Wu will receive NTD 7 million in 2024, of which NTD 1.52 million needs to be classified as taxable income when declaring in 2025.

Source: Ministry of Finance, United News Network

#