01.2024 Life Guide

Global Financial Market Outlook for 2024

Far Eastern International Bank / Gao Yixun

Under the influence of the Federal Reserve System and strong interest rate hikes from major central banks, stocks and bonds experienced a double decline in 2022. Although the pace of interest rate hikes slowed down in 2023, the cycle of interest rate hikes has not ended. In addition, US bond yields have also continuously reached new highs. If the US 10-year bond yield remains above 4.0% by the end of 2023, it is more likely to set a record for the first consecutive two-year bond decline in history. At the same time, AI themes are causing a whirlwind in the stock market... How will the economic trend evolve in 2024? This issue of "Finance Column" takes you through various aspects of interpretation.

Under the influence of the Federal Reserve System and strong interest rate hikes from major central banks, stocks and bonds experienced a double decline in 2022. Although the pace of interest rate hikes slowed down in 2023, the cycle of interest rate hikes has not ended. In addition, US bond yields have also continuously reached new highs. If the US 10-year bond yield remains above 4.0% by the end of 2023, it is more likely to set a record for the first consecutive two-year bond decline in history. At the same time, AI themes are causing a whirlwind in the stock market... How will the economic trend evolve in 2024? This issue of "Finance Column" takes you through various aspects of interpretation.Economic growth has slowed down, corporate profits have declined, and US bond yields have hit new highs. Originally, the stock market could not escape the risk of a downturn. However, in 2023, led by Nvidia and other AI concept stocks in the United States, a wave of investment in technology stocks swept through, reversing the decline in 2022. This has also left the Federal Reserve System puzzled. Why is the economic momentum still strong after interest rate hikes, but the downward momentum of inflation is gradually slowing down.

However, a rise in the stock market can increase household wealth, and coupled with the booming US job market, the US economy has not experienced a severe recession as expected, but has gradually entered a soft landing state. In other words, monetary tightening policies have not caused significant economic damage.

However, many securities firms and research institutions still expect that the US and even the global economy will fall into a recession in 2024. Fortunately, the magnitude of the recession is estimated to be small and the duration is also short, roughly leaning towards a soft landing. However, the impact of inflation and geopolitics will not stop.

However, many securities firms and research institutions still expect that the US and even the global economy will fall into a recession in 2024. Fortunately, the magnitude of the recession is estimated to be small and the duration is also short, roughly leaning towards a soft landing. However, the impact of inflation and geopolitics will not stop.Slowing economic growth

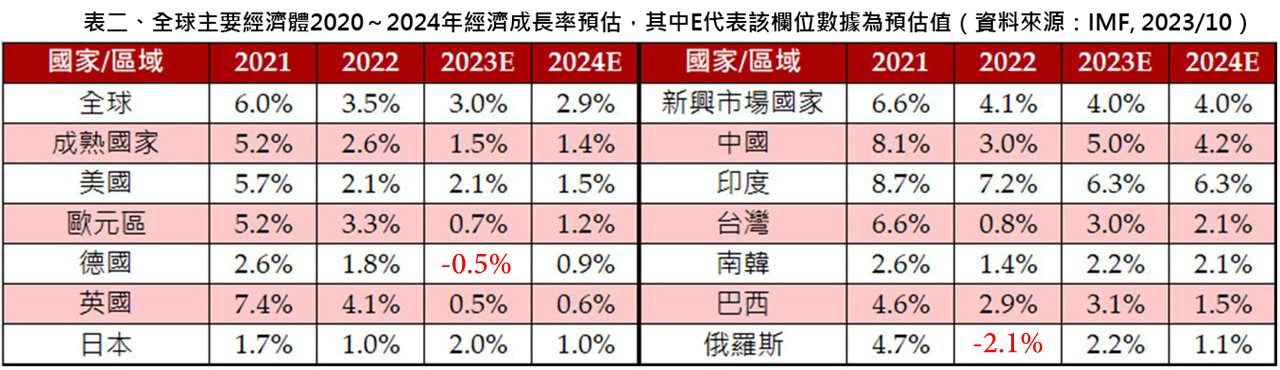

According to the "PMI of manufacturing in major global economic systems", the prosperity of mature regions will continue to slow down in 2023 after reaching the peak in 2022, of which the Eurozone is the most serious. In addition to the fact that people's livelihood consumption is not as strong as that of the United States, its main trading partner, the Chinese Mainland, will be affected by the real estate and consumption contraction in 2023, resulting in the reduction of trade volume between the two regions. Looking at 2024, it is difficult to see large-scale monetary and fiscal policy support that can drive the economy from a trough to prosperity in a short period of time, as seen in 2020. Therefore, economic growth is expected to slow down.

Although the economy may not recover quickly, the likelihood of a severe recession is also low, mainly due to the following reasons:

The employment market in the United States remains strong: in the second half of 2023, the unemployment rate in the United States remained at 3.5% to 3.8%. Although many companies laid off employees, the proportion of workers aged 55 and above returning to the workplace began to rise, keeping the unemployment rate at a low level. As long as the job market is stable, the US economy is not prone to recession, and global trade and economy can also be supported.

Chinese Mainland's economy is expected to stabilize, or even recover: Chinese Mainland's government will relax the control on the real estate market since the second half of 2023, and cooperate with increasing the issuance scale of government bonds and reducing the reserve ratio and interest rate, which has slowed down the strength of Q4's economic decline, helping to improve consumer confidence and regain the strong consumption power.

The Japanese economy will experience stable growth: Although Japan's economic growth momentum may not be as strong as that of China and the United States, the situation has turned to stable growth due to the depreciation of the yen and continuous wage hikes by businesses.

Emerging markets also have leaders: India and Russia have performed well, especially Russia, which has not been greatly affected by Western sanctions on its economic situation.

Inflation monsters cannot be eliminated, and interest rates are expected to remain high

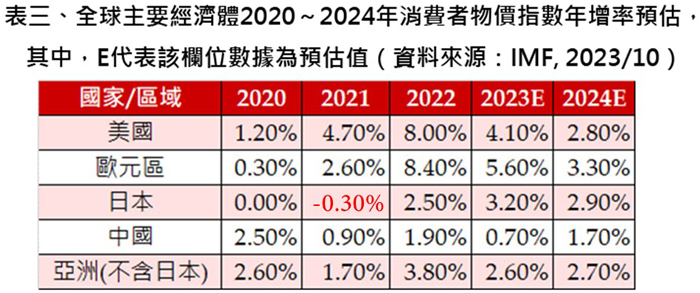

Inflation monsters cannot be eliminated, and interest rates are expected to remain highUnder the tightening monetary policies of various countries, the global inflationary pressure has significantly cooled in 2023, but due to the structural damage caused by inflation since 2020, it cannot be completely eliminated. Compared to 2022, the annual growth rate of consumer price indices in major economies has significantly decreased in 2023, and it is expected to maintain this trend in 2024, but still above the central bank's target of 2%. In order for the economy to recover, it is necessary to continue taking the good medicine of tightening monetary policy and not reduce the dosage until inflation returns to the target range. Therefore, it is expected that global central banks will continue to tighten monetary policies and will not easily relax their control over inflation.

Continued geopolitical risks

In addition to the conflict between Ukraine and Russia, in 2023, the Palestinian radical organization Hamas launched 5000 missiles against southern Israel, igniting the flames of war in the Middle East. Although Western countries attempted to narrow down the scope of the conflict, neighboring Islamic radical organizations opposing Israel continued to provoke, causing even more tension in the situation. The Taiwan Strait, South China Sea, and other East Asian waters are also potential geopolitical risk areas. Once a war or conflict occurs, it may have a significant impact on the global economy.

Investment Plan for 2024

1. Stock investment theme: Corporate profit recovery and election year

In 2023, thanks to the good performance of AI concept stocks, the impact of corporate profit recession on the stock market will be reduced. In addition, the Federal Reserve System will slow down the pace of interest rate increase and the U.S. economy will show resilience. Stock investors can be described as a Dafengshou (Salad of assorted fresh vegetables). More importantly, the profitability of US companies turned positive in the third quarter of 2023, which will contribute to the subsequent performance of the stock market. Among them, the technology related stocks that investors love the most are expected to rank in the top tier among the 11 major industries due to the approaching end of inventory digestion and the increasing demand for AI.

On the other hand, 2024 is an election year, and 18 regions in emerging markets will hold elections. The ruling party usually introduces policy checks that are beneficial to the economy and people's livelihoods in order to continue its political power, in order to increase investor expectations and stimulate stock market performance. According to statistics, in the fourth year of the US presidential term, the average increase per share was 7.3%, especially in the first term, with an average increase of 12.2%. Currently, it is President Biden's first term, so the opportunity for the US stock market to rise in 2024 is relatively high.

2. Bond investment theme: high yield rates and central bank interest rate cuts

In 2023, Taiwan did not deposit stocks recklessly, but instead deposited bonds recklessly. In addition to traditional bond funds, including overseas corporate bonds, bond ETFs, etc., funds are also invested. In addition, investment grade bonds with a relatively low default rate in the past 10 years (bond credit rating of BBB - or above) have a maturity yield of about 2.5% to 3.5%. After a significant interest rate hike in the Federal Reserve System, the yield has risen to 4.5% to 5.5%, reaching the level of non investment grade bonds in the past. For bond investors, it is undoubtedly an excellent investment target.

The Federal Reserve System's interest rate cut is a common expectation among bond investors, and there is finally a chance to achieve it in 2024. Due to the negative correlation between interest rate levels and bond prices, lowering interest rates will cause bond prices to rise, allowing investors to earn capital gains in addition to bond yields. However, inflation has not yet been steadily controlled, and it is expected that the Federal Reserve System will adopt a gradual interest rate cut. Although it will affect the extent to which bond investors can earn capital gains, this dividend is still highly anticipated.

3. Asset allocation strategy: flexible adjustment of regular quotas as a backup, with both offensive and defensive capabilities

The return rate of stocks is much higher than that of bonds, so most investors tend to invest their funds in the former. However, high returns also come with high risks, and the economy is not as strong as imagined. In addition, bond yields are still high. Therefore, good asset allocation is the best strategy to welcome the financial market in 2024.

Looking back at the beginning of 2023, the stock market atmosphere was sluggish, and investors had just experienced a double decline in stock and bond prices in 2022. Coupled with the expected cycle of interest rate cuts, most of their funds were invested in bonds; Unexpectedly, ChatGPT caused an AI boom, and the performance of the US and Japanese stocks was also impressive. Many people only entered the stock market later, and their investment performance was inevitably affected. Therefore, asset allocation in 2024 should be more proactive than in 2023, with a ratio of over 50% between stocks and balanced targets; Although the bond ratio is relatively low, its defensive characteristics have been restored, and even if there is a short-term rebound, the impact on the investment portfolio is relatively limited. The most important thing is to properly allocate assets for investment portfolios, and regular quotas are a good tool for defense, especially when financial asset prices are at a low level or fluctuate greatly. It is advisable to take advantage of this opportunity to cultivate profit potential.

#