02.2024 Life Guide

Long time no travel! Save money for exchange. Look here

Far Eastern International Bank / Chen Mengfeng

Since the lifting of the epidemic lockdown, the number of tourists has increased significantly. Are you also planning an overseas trip? Regardless of which country you are going to, the most important thing is to prepare a tourism fund. In this issue of "Finance Column", we will share with you some tips on saving money and exchanging foreign exchange to help you prepare for your trip.

Since the lifting of the epidemic lockdown, the number of tourists has increased significantly. Are you also planning an overseas trip? Regardless of which country you are going to, the most important thing is to prepare a tourism fund. In this issue of "Finance Column", we will share with you some tips on saving money and exchanging foreign exchange to help you prepare for your trip.Save tourism funds

If you plan to travel overseas in the near future, it is recommended to first arrange all the attractions, transportation, accommodation, and other itineraries, estimate the approximate cost of the entire trip, and then adopt a "vision based financial management" approach, set goals based on the total cost budget, and calculate the amount to be deposited each month from the present until the day before the trip, based on the departure date. If the couple travels or the whole family shares the cost of the trip, it is recommended to apply for a travel account together; If you are unable to open an account at the branch on weekdays, Far Eastern International Bank's personal finance business group provides online digital deposit account opening applications, which is quite convenient. In the future, you can also upgrade to a physical account at the branch and enjoy more comprehensive services. After opening a dedicated travel fund account, it is convenient for the whole family to store their travel expenses here, distinguishing them from common accounts and avoiding disruptions to target planning due to excessive spending.

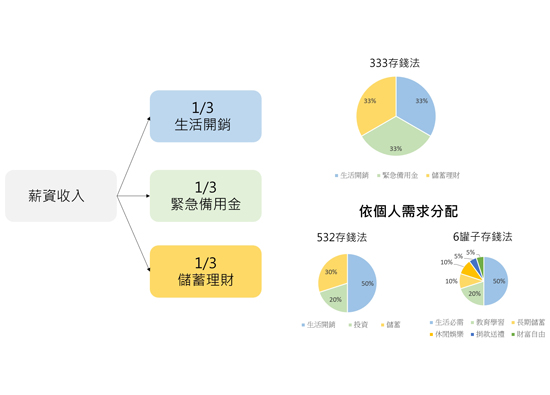

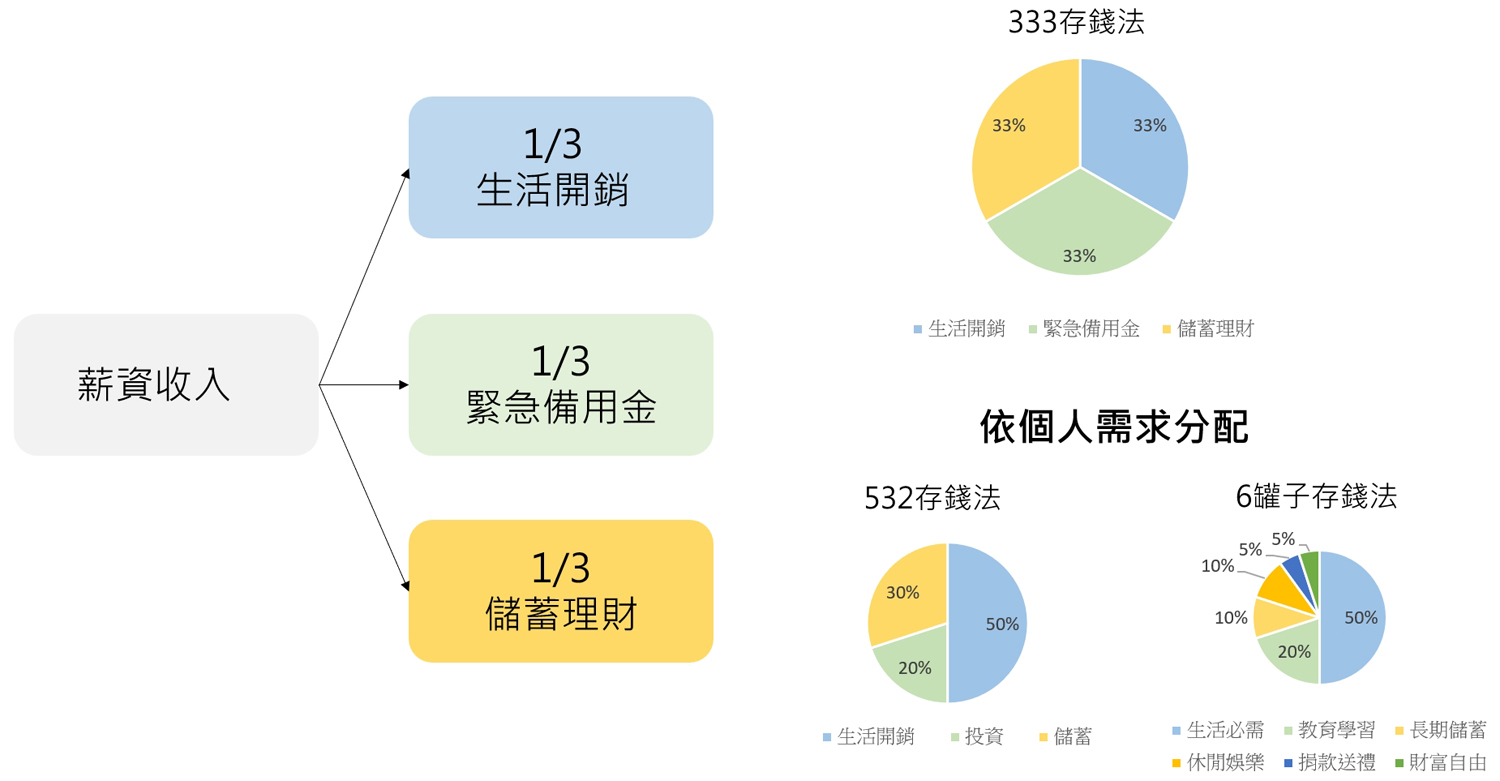

One of the best ways to accumulate tourism funds with ease is to deposit the monthly salary into a dedicated account without affecting daily expenses. Suggest using the 333 savings method, which divides salary equally into three parts: living expenses, emergency reserves, and savings and financial management; Some people may merge their living expenses with emergency reserves into one share, while the other two may be investments and savings; Some people will adopt the "532 savings method", which distributes salaries in a ratio of 5:3:2; Some people, due to different goals in savings and financial management, adopt the "6-jar savings method" and save money according to the ratio of 6 categories; Some people want to save money to buy a car or a house, or their children's education fund... In short, they can divide their salary into more equal parts according to their personal goals. Most importantly, once they receive their salary, they can immediately allocate and use it in a way that not only helps manage their monthly expenses, but also allows them to gradually save up their travel fund.

.jpg) You may choose a suitable method based on the inflow and outflow of funds. If the travel time is long and there is ample time to prepare funds, and the savings in the dedicated account will not be used before the trip, you can also use "fixed deposit" to accelerate the goal of saving money; If a fixed portion of the salary is allocated every month as a travel fund, you can choose "zero deposit lump sum payment" to gradually accumulate the amount; If there is a long-term unused fund, or if there happens to be a bonus in the bag, you can also choose to "deposit and pay as a whole" and wait until you receive all the principal and interest before departure; If you have accumulated a certain amount of savings or have retired and hope to have stable cash flow every month, you can choose the "saving capital and interest" method to accumulate tourism funds through monthly interest distribution.

You may choose a suitable method based on the inflow and outflow of funds. If the travel time is long and there is ample time to prepare funds, and the savings in the dedicated account will not be used before the trip, you can also use "fixed deposit" to accelerate the goal of saving money; If a fixed portion of the salary is allocated every month as a travel fund, you can choose "zero deposit lump sum payment" to gradually accumulate the amount; If there is a long-term unused fund, or if there happens to be a bonus in the bag, you can also choose to "deposit and pay as a whole" and wait until you receive all the principal and interest before departure; If you have accumulated a certain amount of savings or have retired and hope to have stable cash flow every month, you can choose the "saving capital and interest" method to accumulate tourism funds through monthly interest distribution. How to exchange foreign currency before departure

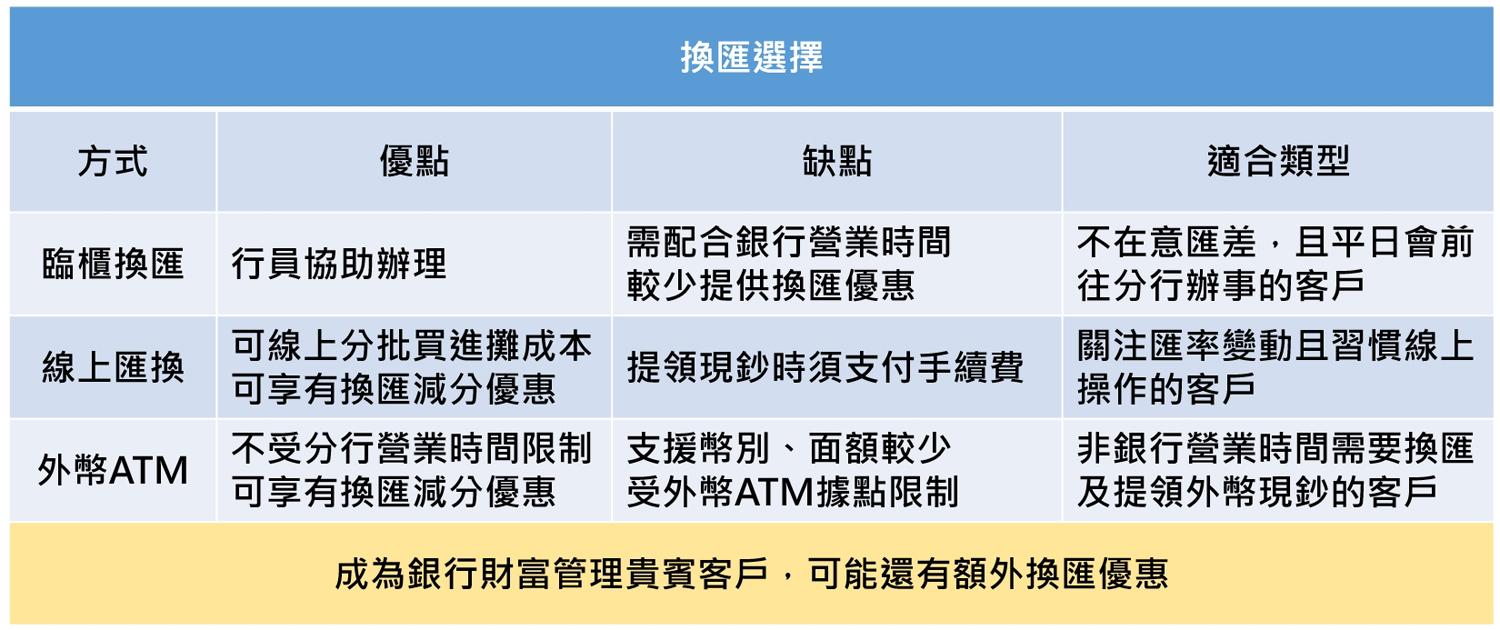

How to exchange foreign currency before departureAfter preparing the tourism fund, the next step is to use a cost-effective and convenient method to exchange Taiwan dollars into foreign currency. The following are three methods:

1. Exchange at the counter - suitable for customers who are not concerned about exchange differences and usually go to the bank to handle transactions

The most traditional method of exchange is to exchange currency at the branch counter, as long as you bring your passbook, seal, and ID card to the bank for processing. However, the disadvantage is that you must cooperate with the bank's business hours, and there are fewer discounts available for exchange at the counter, which may not be convenient for office workers who find it difficult to find time on weekdays.

2. Online exchange - suitable for customers who are concerned about exchange rate fluctuations and accustomed to online operations, but must pay attention to the handling fees for withdrawals

With the popularization of online banking and mobile banking, customers who already have foreign currency accounts can buy foreign currency in batches online to spread the purchase cost. In the past, it was necessary to regularly monitor exchange rate fluctuations in order to exchange to a satisfactory price. Now, with the exchange rate to price function launched by banks, you can receive notifications when the exchange rate reaches a satisfactory price and buy cost-effective foreign currency in a timely manner. In addition, banks also periodically offer exchange rate discounts, which are a good choice to reduce exchange costs.

Although purchasing foreign currency online can reduce the cost of exchange, you still need to go to the bank or foreign currency ATM to withdraw cash and pay an additional handling fee (calculation method=amount of foreign currency withdrawn X [exchange rate of cash sold by the bank - spot exchange rate sold by the bank]). Taking Japanese yen as an example, if the cash exchange rate sold on the same day is 0.2239 and the spot exchange rate sold by the bank is 0.2219, the difference is 0.002. If the public withdraws JPY 50000, they need to pay NTD 100 handling fee. If they withdraw JPY 200000, the handling fee is NTD 400. For some banks, the handling fee for foreign currency ATMs is NTD 100 per withdrawal as long as the amount is within the upper limit. It is recommended to decide whether to withdraw through foreign currency ATMs based on the required amount, or pay attention to whether regular banks offer handling fee discounts.

3. Foreign currency ATM exchange - suitable for customers who need to exchange during non bank business hours, please pay attention to the currency that can be withdrawn

In addition to buying foreign currencies in batches online, foreign currency ATMs can also directly exchange and withdraw them, enjoying a discount on the exchange rate of selling in cash. If you exchange and withdraw them in a Taiwan dollar account, there will be no handling fee. It is recommended to check the location of foreign currency ATMs on the official website of each bank first. Just pay attention to the upper limit of a single withdrawal and whether the currency and denomination supported by ATM can meet the demand.

Becoming a VIP customer of bank wealth management can enjoy additional exchange rate discounts

Each bank will provide exclusive wealth management services and diverse preferential benefits for VIP clients in wealth management. In other words, the closer the relationship, the more upgraded the VIP privileges enjoyed, and the more opportunities they have to obtain preferential exchange rate prices. Far Eastern International Bank offers a rich VIP honor program, welcoming group colleagues to become VIP guests and enjoy dedicated service and high-quality treatment.

Of course, if you haven't decided on a tourist destination yet, it's okay to deposit a travel fund in advance; If you are traveling in US dollars, it is also a good choice to exchange currency first and then earn interest steadily through US dollar fixed deposits!

#