06.2019 Life Guide

Does Interest rate policy of life insurance industry provoke resentment due to global stock market turmoil in 2018

Far Eastern International Securities / Wang Zhaohan

Global stock markets went up and down in 2018, with the Taiwan weighted index falling by - 8.6% and the US Standard & Poor's Index falling by - 6.2%, and the US Federal Reserve System raising interest rates by 4 yards in 2018, resulting in a rare double drop in global equity and debt. Recently, Taiwan's life insurance industry has announced its dividend distribution status in 2018. Most life insurance companies rarely suffer losses under the shock of the global stock and bond market, and declared that they did not pay dividends. In fact, the fluctuation of life insurance industry profits and losses in 2018 is not due to poor investment performance of life insurance companies, but to the applicability of IFRS9 in 2018.

Among the old IAS39, the impact of market shocks is relatively small.

Under the old International Accounting Standards 39 (IAS39), enterprises can classify financial assets on their own. The measurement of financial assets can be divided into trading purposes, reserve for sale, holding to maturity, and no active market. For life insurance companies, after collecting premiums from customers, most of the funds will be allocated to stocks and bonds. These investment portions will generally be placed in the two subjects of "reserve for sale" and "hold to maturity". When placed in the subject of "reserve for sale", stocks and bonds must be evaluated according to market price changes, but in IAS39, only the item of "unrealized evaluation profit and loss of reserve for sale of financial assets" under "other comprehensive gains and losses" will be presented. Simply put, even if the market shocks sharply, as long as the position is not sold, the loss on the account will not affect the earnings per share (EPS) most concerned by ordinary investors. In addition, life insurance companies will hold a large number of bonds to obtain fixed income, and will not actively trade during the period. Therefore, they will be placed in the subject of "holding to maturity". If there is no actual reduction in bonds, the market price changes will not affect the company's profits and losses.

Under the new IFRS 9, the fluctuation of earnings in life insurance industry increases

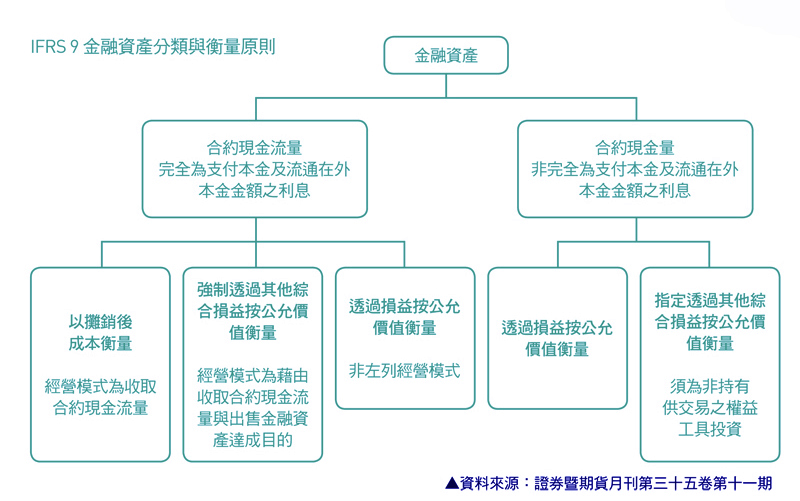

After the introduction of IFRS9, enterprises must consider two tests when classifying financial assets: contract cash flow test and business model test. Financial assets will be measured by fair value (FVTPL), fair value through other comprehensive gains and losses (FVTOCI), and post-amortization cost. In other words, after the application of the new system, many parts will be reclassified to Fair Value Measurement (FVTPL). As a result, changes in the market prices of stocks and bonds during the holding period will directly affect earnings per share. Therefore, when Q4 global stock and bond market produces a large backlog in 2018, many life insurance companies or financial controllers are rare. There was a loss. Although the remaining portion of the "reserve sale" is the same as before, market price changes will not affect earnings per share through other comprehensive gains and losses measured at fair value (FVTOCI), bonds previously placed in the "hold to maturity" subject should be recognized in IFRS9, taking into account the risk of future default. Loss.

Before the life insurance company allocates interest, it is necessary to list the relevant reserve.

Because the profits of life insurance industry depend on the interest margin between investment income and insurance policy cost, the insurance bureau is worried that if the life insurance company distributes a large amount of cash to shareholders, the loss of interest margin will be borne by the whole people once a major loss occurs. Therefore, to regulate the annual profits of life insurance industry, it is necessary to deposit 20% of the statutory surplus reserve first, and then to make an exception in accordance with relevant regulations. Exchange reserve and special surplus reserve shall be allocated in full, and then other unrealized losses shall be examined before the dividend allocation is calculated and the capital adequacy ratio (RBC) is less than 250%. Only after the approval of the Financial Supervisory Commission can the dividend be allocated.

Many investors are also concerned about whether life insurance companies can resume their interest rate policy when the global market stabilizes in the first quarter of this year. The following will be analyzed from three points:

1. The new accounting system IFRS17 is ready to go on the road. The life insurance industry needs to increase the reserve.

International Financial Reporting Standards Bulletin No. 17 (IFRS 17) is expected to start in 2021. Compared with the international market, Taiwan will delay its start for three years. The biggest impact on the insurance industry is the provision of reserves. As mentioned above, IFRS9 mainly aims at the reclassification of financial assets, and changes in the market value of financial assets will directly affect the profits and losses of enterprises; however, IFRS17 emphasizes that the debt side of the financial industry must be expressed at a fair price.

In the early years when Taiwan's interest rates were high, life insurance companies sold many high-interest policies and health insurance with no claim cap. If we re-evaluate them at the current interest rates in Taiwan, we must recognise the loss of spreads in the financial statements. Re-evaluating old policies in financial statements also means that life insurance companies must deposit more reserves for future obligations. Therefore, starting this year, the government encourages life insurance companies to replace cash dividends with common shares or stock dividends as much as possible, so as to enrich capital and strengthen net worth.

2. After the financial tsunami, the United States implemented the policy of low dividend on financial stocks.

After the 2008 financial tsunami, the United States, as the origin of the financial crisis, made an in-depth review of the causes of the financial crisis and proposed three major reform plans, namely, financial institutions, financial markets and consumer protection, which were eventually integrated into the Dodd-Frank Wall Street Reform and Consumer Protection Act, authorizing the Federal Reserve System Fed to require. Financial institutions of a certain scale declare financial information and propose capital utilization plans. It is hoped that through a number of overall Prudential measures, the safety net of financial supervision in the United States will be effectively strengthened and consumer protection strengthened.

3. The U.S. financial industry has to pass extreme stress tests before it can issue cash dividends and implement Treasury stocks.

The Federal Reserve System Fed ensures that large institutions have sufficient capital every six months to respond to the impact of the economic environment and conduct regular stress tests in general economic extremes. It includes:

(1) An overview of capital adequacy ratio: Its assessment methods and results must conform to the provisions of Basel III.

(2) Future capital utilization plan: including dividend payment plan, treasury stock purchase plan and cash increase plan... And so on.

(3) The governance policy of future capital allocation and capital increase plans.

(4) Self-administered stress testing: In a specific economic situation, the analysis of the sources and use of corporate capital in the next nine quarters (stress testing) is expected to improve the lack of stress testing only for historical data in the past.

It can be seen that after the financial tsunami, when the United States requires the financial industry to make profits, it needs to increase its capacity of capital cushion, rather than actively pay dividends, so as to avoid the reversal of the economic situation at that time, and it also needs the help of the government. However, after the market turmoil in 2018, the announcement of interest rate policy in life insurance industry has also given many investors a new understanding of the impact of the application of the new accounting standards on life insurance companies and the situation they are facing, and taken this opportunity to reassess the appropriateness of their investment.