11.2019 Life Guide

Mobile phones have become mobile banks? Have a clear understanding the types of banks in the new era

Far Eastern International Bank / Zhang Xiaojuan

With the development of science and technology, various banks have developed Internet banks, and a whirlwind of digital banks has sprung up. Recently, the financial supervision commission has passed three pure online banking licenses. But what's the difference between "pure online banking", "mobile banking", "Digital Banking" and "social banking"? This issue of "Finance Column" is clear for you!

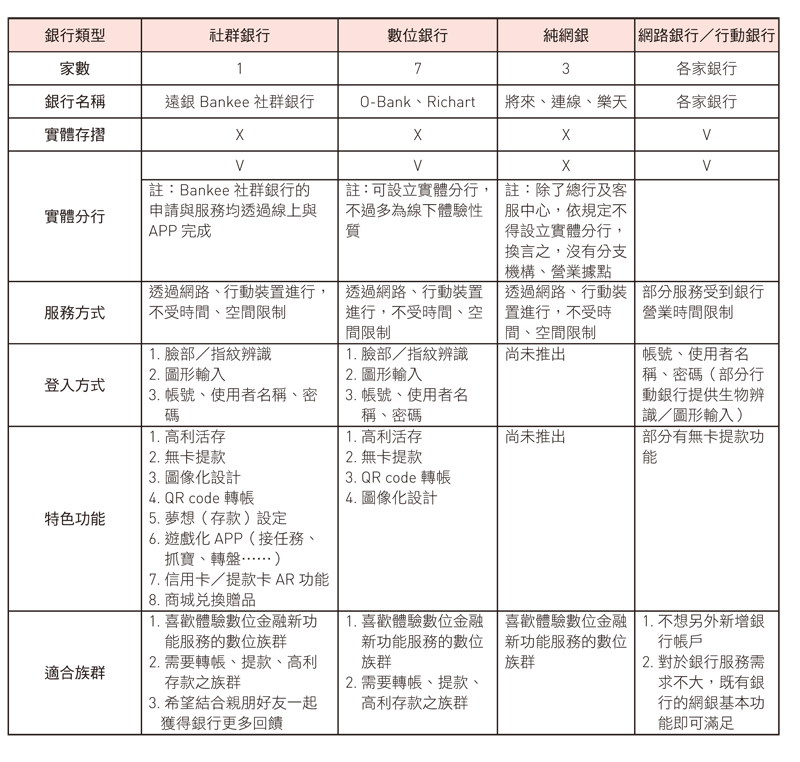

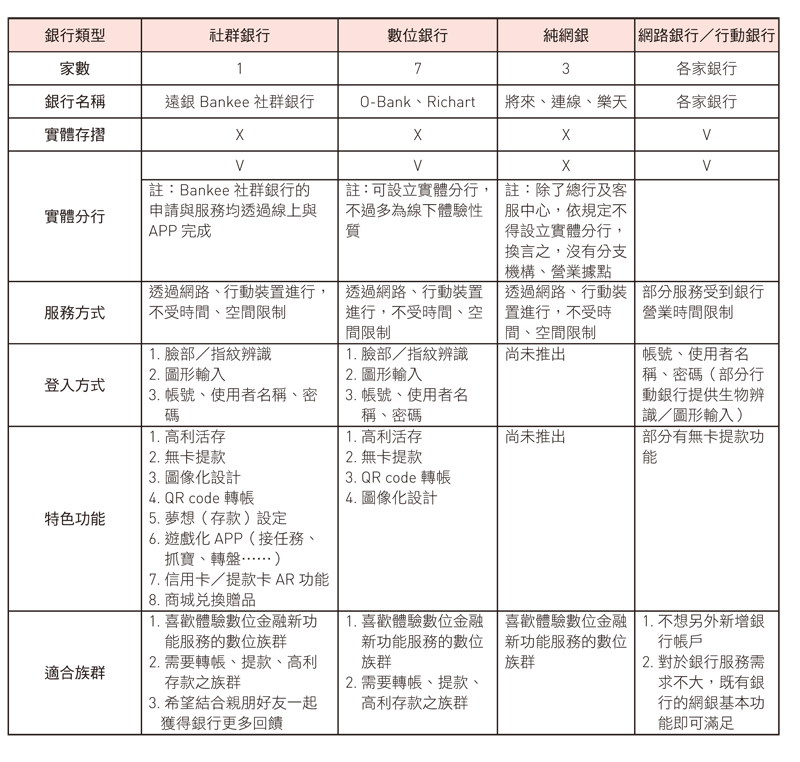

At present, there are 7 digital banks, 3 pure online banks and 1 Community Bank of Far Eastern International Bank, the first in Taiwan. What's the difference? Here is a table for you to understand in seconds.

As a whole, social bank, digital bank and action bank mostly integrate the services of account transfer, fixed deposit, card free withdrawal, investment and financing, credit card, loan and payment tax. They can easily use various functions in mobile phone, master balance, credit card details, asset and liability status anytime and anywhere, and experience the fastest, convenient and safe action Financial Service Business. If you can make good use of "my favorite" function, you can also customize common functions, which is convenient and considerate. Taking Far Eastern International Bank as an example, through data analysis, the app will preset 5 most commonly used functions for customers. Of course, it can also edit according to personal usage habits to create a list of exclusive commonly used functions.

As a whole, social bank, digital bank and action bank mostly integrate the services of account transfer, fixed deposit, card free withdrawal, investment and financing, credit card, loan and payment tax. They can easily use various functions in mobile phone, master balance, credit card details, asset and liability status anytime and anywhere, and experience the fastest, convenient and safe action Financial Service Business. If you can make good use of "my favorite" function, you can also customize common functions, which is convenient and considerate. Taking Far Eastern International Bank as an example, through data analysis, the app will preset 5 most commonly used functions for customers. Of course, it can also edit according to personal usage habits to create a list of exclusive commonly used functions.

To "pure online banking", "mobile banking", "Digital Banking" and "social banking", which is the most suitable for you? The following will recommend appropriate bank types for different groups of needs.

* demand for Financial Services is "lightweight": if you only need to query the balance, transfer and online payment are not often used In fact, financial traders do not need to apply for a new account in order to pursue new services. They only need to apply for the account password of the online bank from the original correspondent bank and download the mobile bank app.

* demand for Financial Services is "medium level": in order to compete for the market, social banks and digital banks provide many preferential policies for transfer, withdrawal and high interest deposit, so they can choose suitable banks to apply. However, they should pay attention to the term and limit of the preferential policies. For example, the limit of high interest deposit is 100000 yuan, with interest of 66 yuan per month, less than one convenient money. There is no upper limit for 0.6% of Bankee social bank's current deposit. If the deposit is 1 million yuan, the monthly interest will be 333 yuan more, which is quite considerable over the years.

* Financial Service demand "heavyweight": users in the front-end of the times, or people who want to try new user interface, can consider applying for the most powerful social bank, digital bank or pure online bank, and make actual use and comparison. For example, social bank's main business is to recommend the participation of relatives and friends, double the feedback, and the fixed live deposit interest is as high as 2.6%, which is 2.6 times of the fixed deposit for one year. It is suitable for people who like to share information or gather the whole family to get high feedback.

* Financial Service demand "heavyweight": users in the front-end of the times, or people who want to try new user interface, can consider applying for the most powerful social bank, digital bank or pure online bank, and make actual use and comparison. For example, social bank's main business is to recommend the participation of relatives and friends, double the feedback, and the fixed live deposit interest is as high as 2.6%, which is 2.6 times of the fixed deposit for one year. It is suitable for people who like to share information or gather the whole family to get high feedback.

In the era of action, we should be quick and efficient in everything. Even Financial Services are no exception. As long as we know how to make good use of all kinds of intimate functions, our mobile phone can become a 24-hour personal bank secretary, and help you manage your money easily!

At present, there are 7 digital banks, 3 pure online banks and 1 Community Bank of Far Eastern International Bank, the first in Taiwan. What's the difference? Here is a table for you to understand in seconds.

To "pure online banking", "mobile banking", "Digital Banking" and "social banking", which is the most suitable for you? The following will recommend appropriate bank types for different groups of needs.

* demand for Financial Services is "lightweight": if you only need to query the balance, transfer and online payment are not often used In fact, financial traders do not need to apply for a new account in order to pursue new services. They only need to apply for the account password of the online bank from the original correspondent bank and download the mobile bank app.

* demand for Financial Services is "medium level": in order to compete for the market, social banks and digital banks provide many preferential policies for transfer, withdrawal and high interest deposit, so they can choose suitable banks to apply. However, they should pay attention to the term and limit of the preferential policies. For example, the limit of high interest deposit is 100000 yuan, with interest of 66 yuan per month, less than one convenient money. There is no upper limit for 0.6% of Bankee social bank's current deposit. If the deposit is 1 million yuan, the monthly interest will be 333 yuan more, which is quite considerable over the years.

In the era of action, we should be quick and efficient in everything. Even Financial Services are no exception. As long as we know how to make good use of all kinds of intimate functions, our mobile phone can become a 24-hour personal bank secretary, and help you manage your money easily!