12.2019 Life Guide

Prospect of economic investment in Europe and America in 2020

Far Eastern International Securities / Zhan Dingcheng

At the end of the year, when it's time to look forward to the next year, don't forget that investment and financing also need to work out new plans. This issue of "finance column" puts forward economic analysis and investment outlook for the United States and Europe, and provides investors with reference for financial allocation in the new year.

In 2020, European and American investment focuses on the capital environment of preventive interest rate reduction and low interest rate easing in the United States, favorable allocation of index stock funds (ETFs) and high-yield bonds; Europe expands negative interest rates and implements a new round of quantitative easing, and asset allocation focuses on High Dividend Stocks and similar income securities. The following is the outlook of European and American economic investment in 2020:

I. outlook for economic investment in the United States

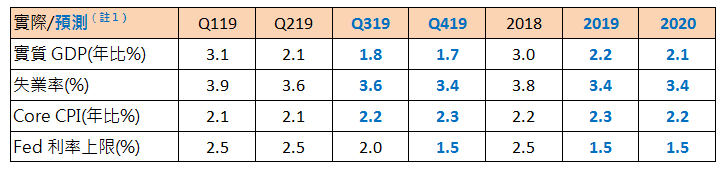

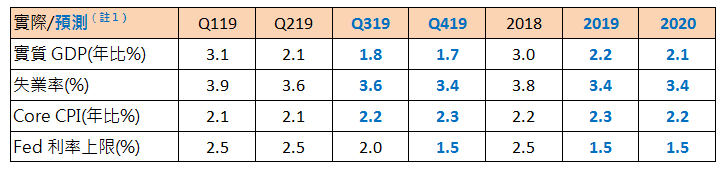

According to the existing overall economic data and federal fund futures data, the market forecasts that the federal reserve system will cut interest rates again at the end of this year, with the interest rate range of 1.50% - 1.25% at the end of this year and the benchmark interest rate of 1.25% at the low level next year. Here are some key observations:

According to the existing overall economic data and federal fund futures data, the market forecasts that the federal reserve system will cut interest rates again at the end of this year, with the interest rate range of 1.50% - 1.25% at the end of this year and the benchmark interest rate of 1.25% at the low level next year. Here are some key observations:

1. Sustained economic growth: the 11th year of economic growth in the United States is the longest period of economic expansion since 1854. So far, there has been no late stage phenomenon of economic expansion, such as wage inflation caused by high inflation, high interest rates and labor shortage. Domestic economy is the largest contributor to GDP growth, with personal consumption contributing 1.8%, government expenditure contributing 0.4%, and overseas fixed investment contributing 1.8% The contribution of export sector is - 0.4%.

2. Inventory adjustment and enterprise profit: due to the excessive inventory accumulation in the second half of 2018, the production and employment plan of manufacturing industry in the first half of 2019 will be affected. Although the current inventory sales ratio is still lower than the peak in 2016, the recent slowdown in economic growth will drag down inventory deregulation, and the inventory will continue to adjust in the second half of 2018. Corporate profits drive private sector employment and investment. It is expected that the economic growth trend will remain unchanged next year, and the private sector will continue to increase employment and business investment next year.

3. Potential growth risks: the growth rate of personal income in the United States slows down, temporary employment increases and employment population growth slows down in the second half of the year, which becomes the main risk of economic growth in 2020. In addition, the trade conflict between the United States and China reduces the willingness of manufacturers to hire. Although the growth rate of personal income in the second half of the year is still larger than inflation, it can maintain personal consumption expenditure and promote economic growth, but The growth strength is obviously weakened.

4. Benchmark interest rate forecast: Based on the global economic slowdown and trade headwinds, the federal reserve system will take preventive measures to cut interest rates by one yard in July and September this year. Bloomberg economic research team expects that the federal reserve system will cut interest rates again before the end of this year, and the benchmark interest rate is expected to reach 1.50% - 1.25% at the end of this year, if the yield of 10-year bonds falls below the September low of 1.45% before the end of this year In the first half of next year, the federal reserve system may implement another preventive interest rate cut.

5. Investment Outlook: in view of the fact that the dividend yield of S & P 500 major enterprises is still higher than the US dollar 10-year bond rate (Note 2), the market expects active investors to focus on ETF for asset allocation and participate in the long-term growth dividend and capital gains of enterprises; and the continuous action of Federal Reserve System for preventive interest rate reduction and loose funds is beneficial for bond issuers to borrow new to repay old and reduce the probability of bond default In addition to ETFs, stable investors are also allocated with high-yield bonds; conservative investors are allocated with investment grade bonds as well as US government bonds.

II. Outlook for economic investment in the euro area

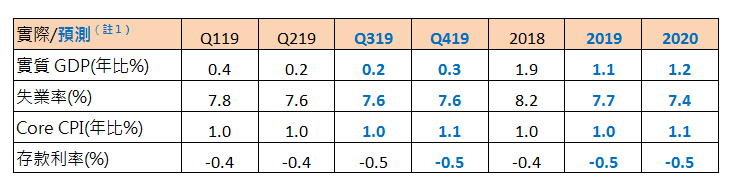

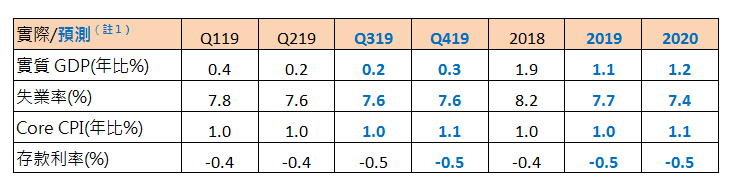

Based on the existing overall economic data and euro exchange rate information, the market estimates that the European Central Bank (ECB) will maintain the deposit rate at - 0.5% at the end of this year, and continue to support the euro area economy by adopting quantitative easing policy and hierarchical interest rate system. Here are some key observations:

Based on the existing overall economic data and euro exchange rate information, the market estimates that the European Central Bank (ECB) will maintain the deposit rate at - 0.5% at the end of this year, and continue to support the euro area economy by adopting quantitative easing policy and hierarchical interest rate system. Here are some key observations:

1. Zero economic growth: the economic growth of the euro area is affected by the German economic recession and Italy's zero growth. The GDP growth rate is halved to 0.2%. If the economic recession continues to expand or spread to the surrounding countries, the whole euro area will face zero economic growth. At present, the marginal countries in the region, such as Spain, Ireland and Greece, perform better.

2. Three major risks of economic growth: the UN agreed brexit of the UK, the hard landing of China's economy and the tariff conflict between Europe and the United States are three major challenges for the economic growth of the euro area next year. The latter two factors have seriously affected German exports since the second quarter of this year. German industrial production has declined by double-digit percentage. Manufacturing industry has reduced employment and capital expenditure. The German government may be forced to launch fiscal stimulus policies To avoid a recession next year.

3. Inflation and interest rate forecast: according to the published data, this year's core inflation rate (core CPI) in the euro area is 1.0%, which has long deviated from the ECB target of 2%. The chief economist of the ECB also said that the euro area needs a long-term and highly loose monetary policy, so the market expects that the ECB will not be able to raise the deposit rate before 2022, and the highly loose monetary policy of the ECB will be changed to "bond purchase" The former reduces the long-term financing interest rate and reduces the financing cost of the state and high-quality enterprises, while the latter, through the ECB, reduces the fees for banks to deposit reserves, alleviates the profit loss caused by the negative interest rate policy.

4. Investment Outlook: in view of the fact that the dividend yield of Dow Jones EU 50 Index enterprises is far higher than that of German 10-year Euro bonds (Note 3), the market expects active investors to focus on ETF in asset allocation and participate in long-term cash dividends and capital gains of enterprises; stable investors prefer to allocate stocks, ETFs or hybrid securities with regular return and safe dividend distribution, while ECB has a long-term and highly loose monetary policy. The policy and bond purchase plan are favorable for enterprises to borrow new and repay old with zero or very low interest rate. The probability of bond default is low. Conservative investors focus on Euro Corporate Bonds with positive interest rate to eliminate the impact of negative interest rate monetary policy on investment principal.

Three. Conclusion

As an important category of investors' asset allocation, European and American ETFs, although the global economy slows down next year, are in the monetary policy environment of low or negative interest rates, which does not necessarily mean that investors' equity investment will exit or reduce the proportion of investment. In 2020, driven by domestic consumption, the market expects that the return rate of American ETFs or high-yield bonds will be better than the performance of bond interest rate Under the negative interest rate of ECB and long-term highly loose monetary policy, the return rate of stocks, ETFs or hybrid securities with regular yield and safe dividend payout is expected to be better than the performance of bond interest rate.

[notes]

* Note 1: the above overall economic data is from Bloomberg information. The data of Q2 in 2018-2019 are historical data, the data of q3-2020 in the United States is the economic forecast of the Federal Reserve System in the United States, and the data of q3-2020 in the euro area is the economic forecast of Bloomberg information to integrate all research institutions.

Note 2: Bloomberg information in September 2019 shows that the dividend yield of S & P 500 companies in the United States is higher than that of 10-year Treasury bonds.

Note 3: Bloomberg information in September 2019 shows that the dividend yield of Dow Jones EU 50 enterprises is far higher than that of German 10-year bonds.

[disclaimer]

We shall use our best efforts to provide correct information, all of which are from or sources we believe to be reliable, but we do not guarantee the integrity, timeliness and correctness of the information. There is no intention to solicit or offer to buy or sell securities and / or participate in any investment activities in this report. If the investor makes relevant investment with reference to this report, he shall bear all profits and losses on his own, and the company shall not bear any legal liability. This report is for reference only, and shall not be copied, reproduced or distributed in whole or in part without the consent of the company.

In 2020, European and American investment focuses on the capital environment of preventive interest rate reduction and low interest rate easing in the United States, favorable allocation of index stock funds (ETFs) and high-yield bonds; Europe expands negative interest rates and implements a new round of quantitative easing, and asset allocation focuses on High Dividend Stocks and similar income securities. The following is the outlook of European and American economic investment in 2020:

I. outlook for economic investment in the United States

1. Sustained economic growth: the 11th year of economic growth in the United States is the longest period of economic expansion since 1854. So far, there has been no late stage phenomenon of economic expansion, such as wage inflation caused by high inflation, high interest rates and labor shortage. Domestic economy is the largest contributor to GDP growth, with personal consumption contributing 1.8%, government expenditure contributing 0.4%, and overseas fixed investment contributing 1.8% The contribution of export sector is - 0.4%.

2. Inventory adjustment and enterprise profit: due to the excessive inventory accumulation in the second half of 2018, the production and employment plan of manufacturing industry in the first half of 2019 will be affected. Although the current inventory sales ratio is still lower than the peak in 2016, the recent slowdown in economic growth will drag down inventory deregulation, and the inventory will continue to adjust in the second half of 2018. Corporate profits drive private sector employment and investment. It is expected that the economic growth trend will remain unchanged next year, and the private sector will continue to increase employment and business investment next year.

3. Potential growth risks: the growth rate of personal income in the United States slows down, temporary employment increases and employment population growth slows down in the second half of the year, which becomes the main risk of economic growth in 2020. In addition, the trade conflict between the United States and China reduces the willingness of manufacturers to hire. Although the growth rate of personal income in the second half of the year is still larger than inflation, it can maintain personal consumption expenditure and promote economic growth, but The growth strength is obviously weakened.

4. Benchmark interest rate forecast: Based on the global economic slowdown and trade headwinds, the federal reserve system will take preventive measures to cut interest rates by one yard in July and September this year. Bloomberg economic research team expects that the federal reserve system will cut interest rates again before the end of this year, and the benchmark interest rate is expected to reach 1.50% - 1.25% at the end of this year, if the yield of 10-year bonds falls below the September low of 1.45% before the end of this year In the first half of next year, the federal reserve system may implement another preventive interest rate cut.

5. Investment Outlook: in view of the fact that the dividend yield of S & P 500 major enterprises is still higher than the US dollar 10-year bond rate (Note 2), the market expects active investors to focus on ETF for asset allocation and participate in the long-term growth dividend and capital gains of enterprises; and the continuous action of Federal Reserve System for preventive interest rate reduction and loose funds is beneficial for bond issuers to borrow new to repay old and reduce the probability of bond default In addition to ETFs, stable investors are also allocated with high-yield bonds; conservative investors are allocated with investment grade bonds as well as US government bonds.

II. Outlook for economic investment in the euro area

1. Zero economic growth: the economic growth of the euro area is affected by the German economic recession and Italy's zero growth. The GDP growth rate is halved to 0.2%. If the economic recession continues to expand or spread to the surrounding countries, the whole euro area will face zero economic growth. At present, the marginal countries in the region, such as Spain, Ireland and Greece, perform better.

2. Three major risks of economic growth: the UN agreed brexit of the UK, the hard landing of China's economy and the tariff conflict between Europe and the United States are three major challenges for the economic growth of the euro area next year. The latter two factors have seriously affected German exports since the second quarter of this year. German industrial production has declined by double-digit percentage. Manufacturing industry has reduced employment and capital expenditure. The German government may be forced to launch fiscal stimulus policies To avoid a recession next year.

3. Inflation and interest rate forecast: according to the published data, this year's core inflation rate (core CPI) in the euro area is 1.0%, which has long deviated from the ECB target of 2%. The chief economist of the ECB also said that the euro area needs a long-term and highly loose monetary policy, so the market expects that the ECB will not be able to raise the deposit rate before 2022, and the highly loose monetary policy of the ECB will be changed to "bond purchase" The former reduces the long-term financing interest rate and reduces the financing cost of the state and high-quality enterprises, while the latter, through the ECB, reduces the fees for banks to deposit reserves, alleviates the profit loss caused by the negative interest rate policy.

4. Investment Outlook: in view of the fact that the dividend yield of Dow Jones EU 50 Index enterprises is far higher than that of German 10-year Euro bonds (Note 3), the market expects active investors to focus on ETF in asset allocation and participate in long-term cash dividends and capital gains of enterprises; stable investors prefer to allocate stocks, ETFs or hybrid securities with regular return and safe dividend distribution, while ECB has a long-term and highly loose monetary policy. The policy and bond purchase plan are favorable for enterprises to borrow new and repay old with zero or very low interest rate. The probability of bond default is low. Conservative investors focus on Euro Corporate Bonds with positive interest rate to eliminate the impact of negative interest rate monetary policy on investment principal.

Three. Conclusion

As an important category of investors' asset allocation, European and American ETFs, although the global economy slows down next year, are in the monetary policy environment of low or negative interest rates, which does not necessarily mean that investors' equity investment will exit or reduce the proportion of investment. In 2020, driven by domestic consumption, the market expects that the return rate of American ETFs or high-yield bonds will be better than the performance of bond interest rate Under the negative interest rate of ECB and long-term highly loose monetary policy, the return rate of stocks, ETFs or hybrid securities with regular yield and safe dividend payout is expected to be better than the performance of bond interest rate.

[notes]

* Note 1: the above overall economic data is from Bloomberg information. The data of Q2 in 2018-2019 are historical data, the data of q3-2020 in the United States is the economic forecast of the Federal Reserve System in the United States, and the data of q3-2020 in the euro area is the economic forecast of Bloomberg information to integrate all research institutions.

Note 2: Bloomberg information in September 2019 shows that the dividend yield of S & P 500 companies in the United States is higher than that of 10-year Treasury bonds.

Note 3: Bloomberg information in September 2019 shows that the dividend yield of Dow Jones EU 50 enterprises is far higher than that of German 10-year bonds.

[disclaimer]

We shall use our best efforts to provide correct information, all of which are from or sources we believe to be reliable, but we do not guarantee the integrity, timeliness and correctness of the information. There is no intention to solicit or offer to buy or sell securities and / or participate in any investment activities in this report. If the investor makes relevant investment with reference to this report, he shall bear all profits and losses on his own, and the company shall not bear any legal liability. This report is for reference only, and shall not be copied, reproduced or distributed in whole or in part without the consent of the company.