01.2020 Life Guide

Set up correct investment concept and plan the future as soon as possible

Far Eastern International Bank / Wang Liting

According to the definition of the United Nations World Health Organization (WTO), Taiwan has officially entered the "aged society" from the "aged society", and it is estimated that it will enter the "super aged society" in 2026. Facing the irreversible trend of aging, what should investors prepare for? This issue of "finance column" particularly analyzes the new thinking of investment in the age of old age.

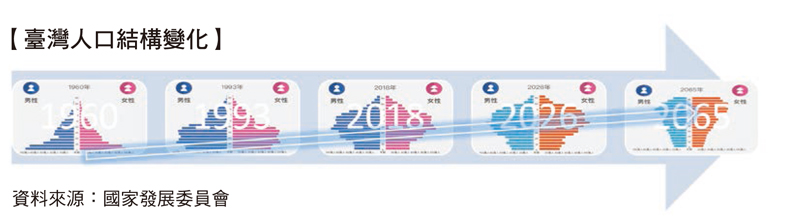

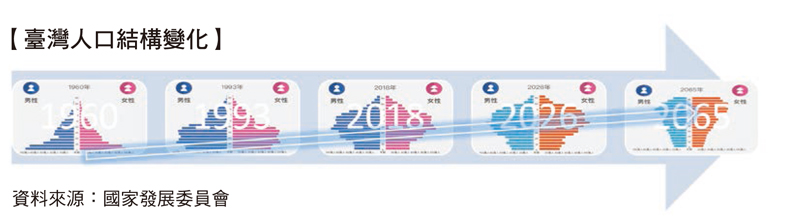

The middle structure of Taiwan's population pyramid, from "aging society" and "aging society" to "super aging society", has evolved from the bottom wide and top pyramid type "to the" golden bell type "with the elderly as the main population. It is estimated that in 2065, Taiwan's working population is only half of that in 2018, and the ratio of supporting the elderly will rise to 82.9% from 20.07% in 2018, in other words, every 1.2 young and middle-aged people The need to support an old man will certainly increase the social burden.

Does fixed income continue to be favored in the old age?

Does fixed income continue to be favored in the old age?

The pursuit of regular cash flow, steady wealth accumulation and inheritance, and low-risk investment, has become a new prominent investment in the age of old age.

According to the statistics of the investment trust and Investment Consulting Association, as of September 2019, Taiwan's domestic and foreign funds combined, the scale of bond funds exceeded NT $2.45 trillion, ranking the top three, showing that the charm of fixed income is irresistible. However, when people rush to pursue bonds (investment grade bonds or non investment grade high-yield bonds based on personal risk tolerance) and push up the price of bonds, can they continue to undertake at this time? Or should it be adjusted? I believe many investors know that the biggest risk of "up long" is to rise too much, and the biggest advantage of "down deep" is to fall too deep. Therefore, only the right asset allocation can meet the financial needs. In order to pursue the maximum investment return, many investors are exposed to great risks and ultimately affect the quality of life. For example, if they can choose the right financial management process, they should first set the "need" life style, then set the reward goal, establish the most suitable asset allocation, and regularly control the risk, so as to achieve the ideal life style.

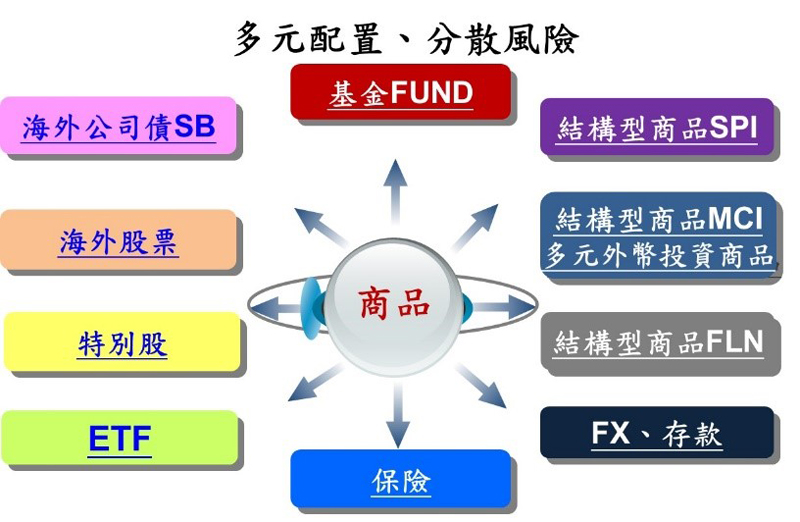

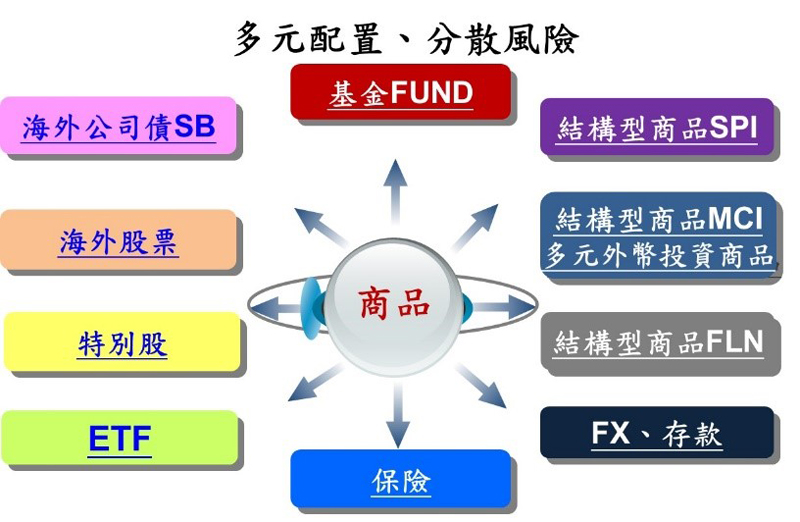

In the face of the irreversible aging future, the demand for fixed income is bound to increase unabated, but the so-called fixed income does not necessarily mean the purchase of bonds or bond funds. With the change of financial environment, the adjustment of investment strategy has been driven. In recent years, diversified and balanced asset allocation has been continuously launched. More conservative investors can meet the goal of low volatility and stable income through dynamic allocation of composite bonds, while stable investors can use balanced allocation of multiple assets, stocks and bonds to seek fixed income under tolerable risks. Therefore, the new investment strategy should focus on multiple income balance, not limited to high-yield bonds or high dividend stocks.

Carry out the financial management plan regularly and cumulatively

Experts have studied the views of 100 investors on the future retirement plan, 68 of them think that the savings are too low, and 24 plan to increase the savings, but only 3 actually increase the savings, which shows the lack of understanding and implementation. In addition, most people ignore the power of small money rolling out of the snowball. Far Eastern International Bank suggests that investors should make financial planning as soon as possible in the face of the elderly in the future, especially novice investors are very suitable to enjoy the results of compound interest through regular fixed amount of small investment.

Source: National Development Commission

Source: National Development Commission

The most important thing in investment is to try not to lose money, and how to maintain the stability of assets is the most important thing in the construction of portfolio. When the investment loss is 20%, it needs to rise 25% to return. If the loss is 50%, it needs to double, that is, 100% to unwind. Once someone asked Jim Rogers, the investment master, what his core investment strategy was. He only gave investors four words that were obvious and easy to understand: buy low, sell high. In addition, building a good asset allocation is the key to financial success. Ray Dalio, the founder of Bridgewater, the world's largest hedge fund, once said, "no one can predict. The real danger is not to spread the risk. No matter what happens to the market, you should always hold a basket of unrelated assets, adjust the corresponding leverage under different historical conditions, so as to truly avoid the risk. Therefore, only by making good use of diversified commodity allocation, constructing a good asset allocation, and combining with the regular fixed investment strategy with compound interest effect, can we practice the financial management vision, and truly feel at ease, happy and assured.

The middle structure of Taiwan's population pyramid, from "aging society" and "aging society" to "super aging society", has evolved from the bottom wide and top pyramid type "to the" golden bell type "with the elderly as the main population. It is estimated that in 2065, Taiwan's working population is only half of that in 2018, and the ratio of supporting the elderly will rise to 82.9% from 20.07% in 2018, in other words, every 1.2 young and middle-aged people The need to support an old man will certainly increase the social burden.

The pursuit of regular cash flow, steady wealth accumulation and inheritance, and low-risk investment, has become a new prominent investment in the age of old age.

According to the statistics of the investment trust and Investment Consulting Association, as of September 2019, Taiwan's domestic and foreign funds combined, the scale of bond funds exceeded NT $2.45 trillion, ranking the top three, showing that the charm of fixed income is irresistible. However, when people rush to pursue bonds (investment grade bonds or non investment grade high-yield bonds based on personal risk tolerance) and push up the price of bonds, can they continue to undertake at this time? Or should it be adjusted? I believe many investors know that the biggest risk of "up long" is to rise too much, and the biggest advantage of "down deep" is to fall too deep. Therefore, only the right asset allocation can meet the financial needs. In order to pursue the maximum investment return, many investors are exposed to great risks and ultimately affect the quality of life. For example, if they can choose the right financial management process, they should first set the "need" life style, then set the reward goal, establish the most suitable asset allocation, and regularly control the risk, so as to achieve the ideal life style.

In the face of the irreversible aging future, the demand for fixed income is bound to increase unabated, but the so-called fixed income does not necessarily mean the purchase of bonds or bond funds. With the change of financial environment, the adjustment of investment strategy has been driven. In recent years, diversified and balanced asset allocation has been continuously launched. More conservative investors can meet the goal of low volatility and stable income through dynamic allocation of composite bonds, while stable investors can use balanced allocation of multiple assets, stocks and bonds to seek fixed income under tolerable risks. Therefore, the new investment strategy should focus on multiple income balance, not limited to high-yield bonds or high dividend stocks.

Carry out the financial management plan regularly and cumulatively

Experts have studied the views of 100 investors on the future retirement plan, 68 of them think that the savings are too low, and 24 plan to increase the savings, but only 3 actually increase the savings, which shows the lack of understanding and implementation. In addition, most people ignore the power of small money rolling out of the snowball. Far Eastern International Bank suggests that investors should make financial planning as soon as possible in the face of the elderly in the future, especially novice investors are very suitable to enjoy the results of compound interest through regular fixed amount of small investment.

The most important thing in investment is to try not to lose money, and how to maintain the stability of assets is the most important thing in the construction of portfolio. When the investment loss is 20%, it needs to rise 25% to return. If the loss is 50%, it needs to double, that is, 100% to unwind. Once someone asked Jim Rogers, the investment master, what his core investment strategy was. He only gave investors four words that were obvious and easy to understand: buy low, sell high. In addition, building a good asset allocation is the key to financial success. Ray Dalio, the founder of Bridgewater, the world's largest hedge fund, once said, "no one can predict. The real danger is not to spread the risk. No matter what happens to the market, you should always hold a basket of unrelated assets, adjust the corresponding leverage under different historical conditions, so as to truly avoid the risk. Therefore, only by making good use of diversified commodity allocation, constructing a good asset allocation, and combining with the regular fixed investment strategy with compound interest effect, can we practice the financial management vision, and truly feel at ease, happy and assured.