07.2020 Office Talk

Contactless mobile payment prevails

Tianxia innovation college /

With the impact of the epidemic, many people are worried that banknotes or coins may become the media of the epidemic, so people tends to use mobile payment to pay bills. As a result, the "contactless" “scan economy” become popular. And it can be used in more and more places. In addition to buying things in department stores or chain restaurants, people can just scan mobile phones in the gas filling stations, the four supermarkets and night markets!

Compared with the past, what is the change of people's acceptability for different types of mobile payment? What is the commonly used mobile payment? GO SURVEY analyzed the trend of mobile payment and the usage characteristics of different generations.

Mobile payment ranked third in Taiwan

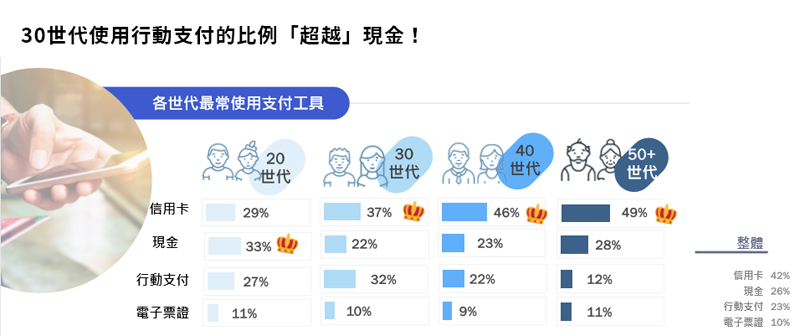

In terms of the overall mode of payment, credit card (42%) and cash (26%) are the most commonly used modes of payment. Mobile payment (23%) ranked third, and paying by electronic ticket also accounts for 10%.

According to the survey, the 20th generation uses cash most commonly, credit card is still the most commonly used payment tool in other generations, especially in the 40s and 50s (46% and 49% respectively), and the utilization rate of mobile payment is relatively low. One of the challenges for the popularization of mobile payment in the future is to change the habit of using credit card for mature generation. In particular, the proportion of using mobile payment among 30th generation has exceeded that of cash, indicating that the 30th generation has quietly moved towards the era of cashless payment.

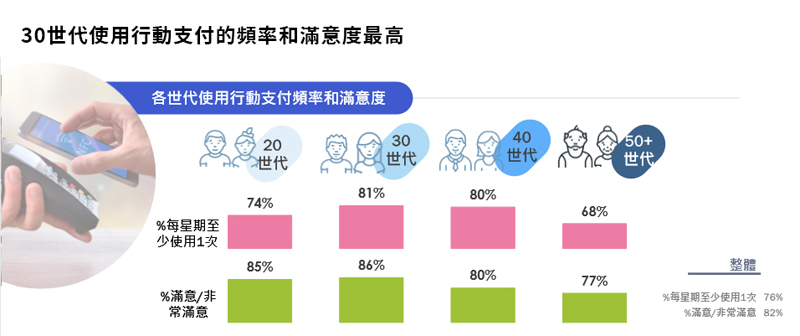

In terms of experience, 76% of the people use the mobile payment at least once a week, and 82% are satisfied with the current use of the mobile payment. Among them, the frequency and satisfaction of the 30th generation are the highest while the two elements of 50th generation are the lowest. Although the satisfaction of the 20th generation is as high as 85%, it is limited by the option of payment binding or low applicability, so the utilization rate is low. The frequency and overall satisfaction of the 40th generation every week are also as high as 80%. It is promising to cultivate the habits of the group to use more mobile payment than cash.

The significance of mobile payment: virtual credit card, a replacement for cash, simple and easy to operate

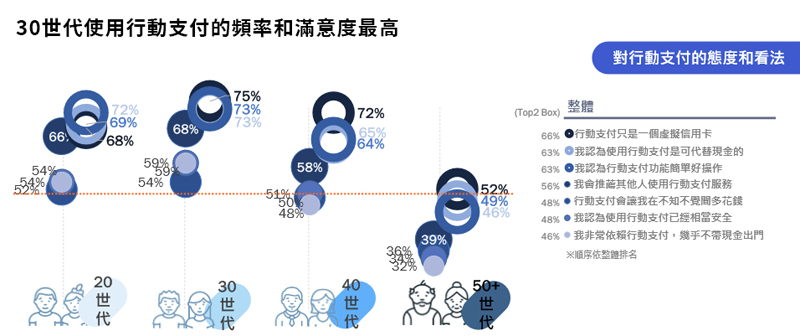

What is the attitude of the public towards mobile payment? It is generally accepted that mobile payment is a virtual credit card, which can replace cash, and is easy to operate. The proportion of those who are willing to recommend other people to use mobile payment accounts for more than 50% of the total. The recognition degree of using mobile payment to replace cash is also more than 60%. The goal of moving towards a cashless society in the future is not far away.

Among the descriptions of the attitude towards mobile payment, the most common one is that "mobile payment is just a virtual credit card", especially for the 30th and 40th generation. In addition, the 20th and 30th generations are more dependent on mobile payment, and the proportion of people who are willing to recommend to others is also higher; on the contrary, the proportion of dependence and willingness to recommend mobile payment of generation over 50 is low.

Main fields of using mobile payment: convenience stores, mass merchandisers, supermarkets and department stores

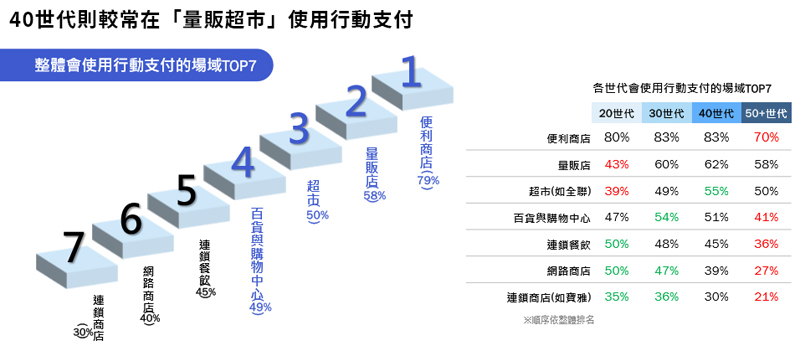

What kinds of consumption channels or fields do you usually use mobile payment? According to GO SURVEY, convenience stores (79%), mass merchandisers (58%), supermarkets (50%) and department stores (49%) are the main fields where consumers use mobile payment.

In terms of generations, consumers of 20th and 30th generations are more likely to use it in the "chain restaurants / stores and online stores". In addition, the proportion of consumers of 30th generation to use it in "department stores" is also higher, while that in 40th generation is more often used in "mass merchandisers". It shows that the consumption patterns of different generations in the physical channel are also reflected in the use of mobile payment, so mobile payment companies can consider consumers' daily consumption channels when they plan to expand new fields for using mobile payment in the future.

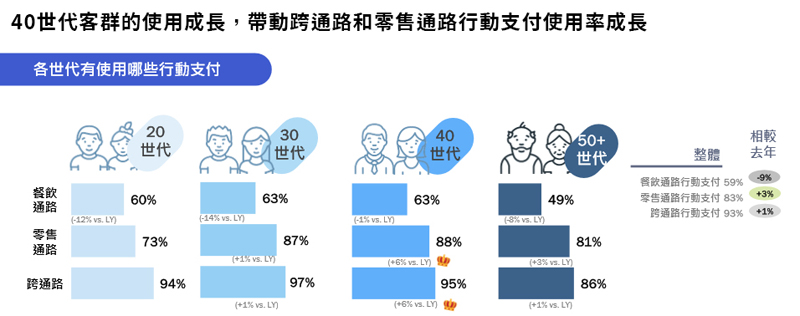

Usage rate of "mobile payment in the retail channel" increased by 3%

Next, let's look at which types of mobile payments are most commonly used and how they have changed in use. According to GO SURVEY, among the three types of mobile payment, "cross channel mobile payment" has the highest penetration rate of 93%, while the mobile payment launched by "retail channel" and "catering channel" has a utilization rate of 83% and 59% respectively. In terms of generation, the utilization rate of 30th and 40th generation is still higher than that of generation 50 or above.

Compared with last year, the utilization rate of "cross channel mobile payment" was flat (+ 1%), the utilization rate of "retail channel mobile payment" increased (+ 3%), while the utilization rate of "catering channel mobile payment" decreased (- 9%). Among them, the main source of growth in the utilization rate of "cross channel mobile payment" and "retail channel action payment" is the 40th generation. Obviously, in the application of digital mobile payment, most of the 40th generation customers use it in the retail channels (such as mass merchandisers), which can drive the growth of the utilization rate of "cross channel" and "retail channel mobile payment".

In contrast, the use of "catering channel mobile payment", including McDonald's and Mos Burger, has shown a trend of decrease in different generations. It is speculated that the reason is that various catering brands have gradually started diversified payment (such as prepaid card, credit card, adoption of cross channel mobile payment, payment by digital self-service ordering machine, and electronic ticket, etc There are more ways of payment, but the degree of consumers’ adhesiveness to the mobile payment of the brands has declined.

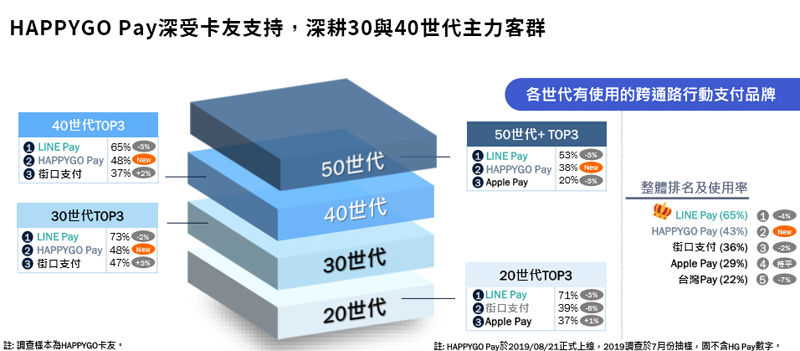

In "cross channel mobile payment", the utilization rate of LINE Pay dropped by 4%, still ranking first

Among the "cross channel mobile payment", LINE Pay has the highest utilization rate of 65%. However, it has declined (- 4%) compared with last year. It is speculated that the reason is that in order to respond to the needs of consumers that LINE Pay app needs to be more intuitive and convenient, so it has separated LINE Pay app and re launched it. And HAPPYGO Pay has been greatly supported by HAPPYGO cardholders Since its launch with the utilization rate of 43%, among which the usage rate of 30th and 40th generation is the highest, with nearly 50% respectively; compared with last year, the overall utilization rate of JKOS has declined slightly (- 2%), but the utilization rate of generation 30 and generation 40 is still growing; while Apple Pay was flat (29%); the rate of Taiwan Pay showed a downward trend (- 7%).

Before the outbreak of the novel coronavirus, l LINE Pay and JKOS began cross-border e-payment functions (such as Japan) in order to seize the business opportunities of foreign tourism consumption, which is a big step forward for the expansion of future mobile payment to overseas. After the outbreak, cross channel payment will be an important payment method for Taiwanese overseas in the future, and gradually develop into cross-border mobile payment.

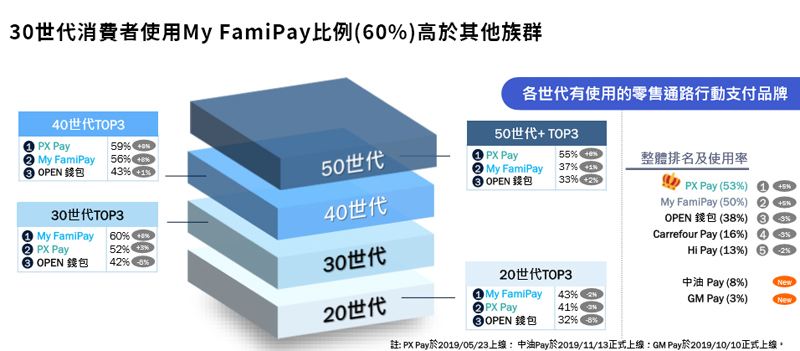

The utilization rates of PX Pay and My FamiPay of "retail channel mobile payment" were top 2, with growth of 5% respectively

Among the "retail channel mobile payment", PX Pay (53%), My FamiPay (50%) and Open wallet (38%) were the most commonly used payment tools in "retail channel mobile payment". The utilization rates of PX Pay and My FamiPay increased by 5% compared with last year. CNPC pay and GM pay, which were launched at the end of 2019, also account for the rate of 8% and 3% in the short term.

PX Pay has successfully driven 40th and 50th generations to actively learn technology tools (+ 8% & + 6%). The utilization rate of PX Pay in the 20th and 30th generations is also ranked second. All these are attributed to the patient "promotion team". Through active offline promotion, helping customers overcome the problems in downloading and solve their problems are the elements of PX Pay's rapid growth, which also set a good example for traditional retailers in digital transformation.

Convenience stores are the fastest growing field of mobile payment, and FamilyMart is also striving for new retail and technology retail business opportunities. In 2017, it took the lead to launch its own payment tool My FamiPay; in 2018, it further integrated with the official app to facilitate the functions of completing payment, points collection and invoice storage at one time; in 2019, My FamiPay also opened online payment function, making the FamilyMart the first convenience store in Taiwan to open online payment function of its own payment tool. With online and offline payment, consumers feel more convenient. These convenient features are also accepted by the main consumers of 30th and 40th generation (+ 8%). Among them, the proportion of 30 generation consumers using My FamiPay (60%) is higher than that of other groups.

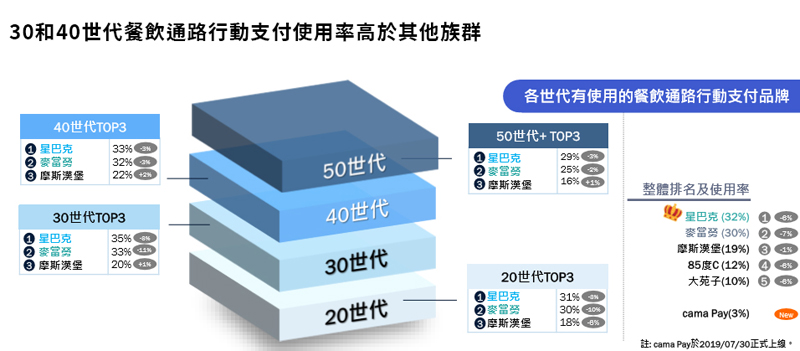

Starbucks and McDonald's, which have the highest utilization rate of "catering channel mobile payment", both decline by more than 6%

Starbucks (32%), McDonald's (30%) and Mos Burg (19%) are the most commonly used "catering channel mobile payment" by cardholders. Cama Pay, launched at the end of July 2019, also accounts for the rate of 3%. Among them, the utilization rate of 30 and 40 generations was higher than that of other groups, and the utilization rate of 50 generations was the lowest.

Taking Starbucks as an example, in 2014, Starbucks Taiwan took the lead in introducing the "Starbucks Card APP mobile payment" service, which started the mobile payment trend of Taiwan's chain catering industry. In 2019, LINE Pay let consumers’ choices more diversified and more convenient.

In 2017, McDonald's launched the "McDonald's card" which can store value, consume and accumulate points. It started the first step of diversified payment. Then, it fully opened the "smallest payment of credit card" service and the connection with the three major international mobile payment tools (Apple pay / Google pay / Samsung pay). Recently, payment by four e-tickets (Easy Card, iPass, icash and Happy Cash) have been opened, which can be said to be the most active operator to accept the diversified payment in the fast food industry.

Compared with last year, the usage rate of catering channel payment brands mostly declined due to the opening of diversified payment, with Starbucks and McDonald's falling by 6% and 7% respectively. Among them, the decline proportion of 20th and 30th generations is higher, which indicates that the loyalty of young generation to payment tools is weak. On the whole, each catering brand has its own strategy in the payment layout, but it is an irreversible trend to support diversified payment.

"Discount or reward" is still the biggest driving force for using mobile payment, and its importance has greatly increased

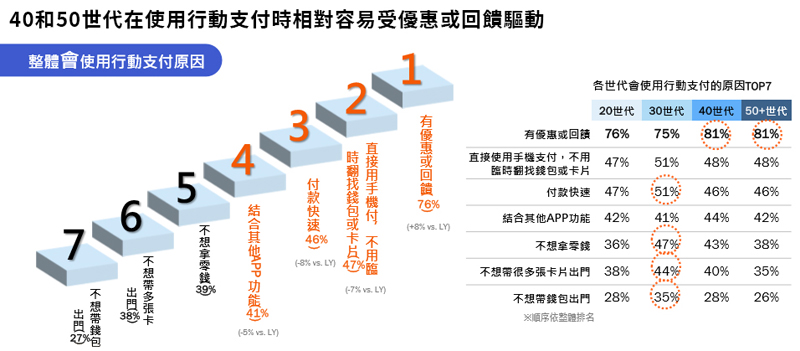

For mobile payment users, "discount or reward" is the biggest driving force to use mobile payment, and its importance has increased significantly (+ 8%) compared with last year. The key reasons for using mobile payment are "fast payment", "no need to search for wallet or card temporarily", or "combining with other functions of the APP".

In terms of generations, the 40s and 50s are driven by discounts or rewards, while the 30s are more motivated by factors such as quick payment, unwillingness to take changes, going out with cards or wallets.

"Payment habits" or "inforamtion security issues" affect the willingness to use, but the degree of hindrance is greatly reduced

As for those who do not use mobile payment, most of them are reluctant to change their habits because of “getting used to other payment methods" or "being worried about the information security of mobile payment". However, compared with last year, the degree of hindering the willingness to use is significantly reduced.