05.2022 Life Guide

ESG sustainable investment contributes to the earth

Far Eastern International Bank / Liang Zhipeng

"ESG" can be called the hottest topic today. We can see the trace of ESG no matter the enterprise purpose, newspapers and magazines or media advertisements. Why can ESG become a new index to evaluate enterprise value? How to choose enterprises with ESG concept? This issue of "finance column" will answer for you one by one.

"ESG" can be called the hottest topic today. We can see the trace of ESG no matter the enterprise purpose, newspapers and magazines or media advertisements. Why can ESG become a new index to evaluate enterprise value? How to choose enterprises with ESG concept? This issue of "finance column" will answer for you one by one.ESG decrypts why the concept of environmental protection is popular all over the world

Since the industrial revolution in the 18th century, greenhouse gas emissions and deforestation have caused serious damage to the climate and ecology, but also affected human life. Therefore, governments of various countries have launched a series of carbon reduction policies, hoping to slow down the rate of global warming. For example, the United States has promised to reduce greenhouse gas emissions by 50% by 2030; China has set a carbon peak in 2030 and a carbon neutralization plan in 2060; The EU has formulated that renewable energy will account for more than 40% of the overall energy consumption by 2030; Countries reached a consensus in cop26 (the 26th United Nations Climate Change Conference) to control the global temperature rise within 1.5 ° C and gradually reduce the use of coal. However, energy conservation and carbon reduction and environmental protection must not rely solely on the strength of the government. The investment of individuals, organizations and society are indispensable elements. Therefore, there is a "ESG" trend of paying attention to environmental protection, social responsibility and corporate governance.

ESG has become a new index for evaluating enterprises

In recent years, ESG has also become a hot topic in the investment field to evaluate the degree of corporate social responsibility. In the past, profit data was regarded as the main indicator of the operating status of enterprises. However, with the frequent negative events such as wastewater pollution, food safety storm, Business Scams and false financial reports, the concepts of "corporate ethics" and "social responsibility" have been paid more and more attention. When many fund managers choose to invest, in addition to excluding industries such as high environmental pollution, tobacco, arms and games, We also try our best to choose enterprises committed to environmental protection and social welfare. According to the research, while pursuing long-term profits, these enterprises also achieve the goal of sustainable growth by improving their business model. Therefore, they are relatively less vulnerable to shocks in the face of changes in the economic environment, which helps to reduce the volatility of their portfolios.

Make good use of compound interest effect to overcome inflationary pressure

Inflation pressure is increasing year by year. If the hard-earned savings are only placed in bank accounts, they will eventually not catch up with the speed of inflation. It has become a top priority to properly plan financial management to obtain a better rate of return. However, there are countless financial products on the market. For financial newcomers who do not have professional knowledge and investment experience, investing in funds in a regular and fixed way is a relatively simple choice. The fund is managed by a professional fund manager team. Combined with the fluctuation of the financial market and the future industrial trend, combined with precise model calculation, the fund selects the most appropriate portfolio of stocks, bonds and other investments. In addition to dispersing risks, it is also expected to obtain a return rate that exceeds the market. For investors, there is no need to keep an eye on the market every day. As long as an appropriate amount is invested at a fixed frequency, they can accumulate assets through the compound interest effect. In addition, regular quotas can also cultivate savings habits and bring yourself closer to your dreams.

ESG makes investment more valuable

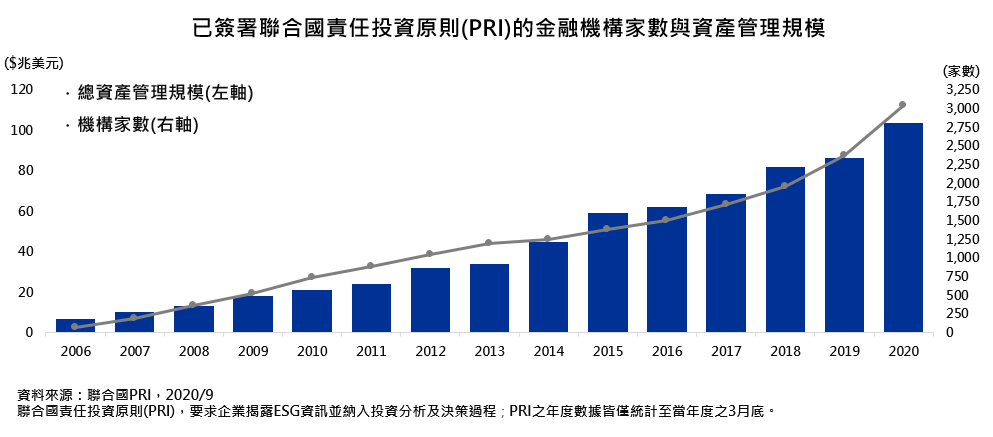

However, there are thousands of funds on the market. In addition to different brands, they are also divided into stock type, bond type and balanced type. It is inevitable that investors will be dazzled and do not know where to choose. In fact, the principle is very simple. If you aim at steady growth or the market fluctuates greatly, you can choose bond funds or balanced funds with relatively small volatility. Investors with high risk tolerance or optimistic about the market prospect can choose stock funds. However, no matter how to choose, mastering the market trend is the key to profit; By 2020, more than 3000 financial institutions have signed the United Nations principles for Responsible Investment (PRI), with asset management scale of up to US $100 trillion. In 2020, the scale of ESG funds in Taiwan will not only reach US $29 4.4 billion, with an annual growth rate of 336%, ranking first in Asia. It can be seen that ESG financial investment is not only popular all over the world, but also favored by investors in Taiwan. Although the relationship between "ESG" and "profit" cannot be equated, it is undeniable that most enterprises willing to invest in environmental protection and social welfare are in a better operating condition, because they have the ability to give back to the society only when their profits are stable; In contrast, companies with poor profits need to take into account their own business conditions and may not have extra efforts to engage in ESG. Therefore, enterprises with ESG concept have more investment value.

The assessment of ESG against green drift can also be based on evidence

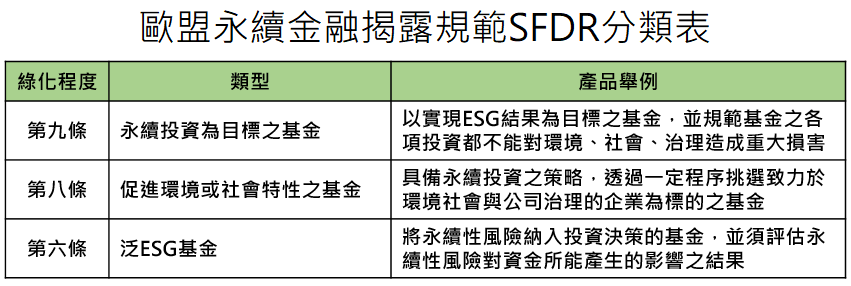

The assessment of ESG against green drift can also be based on evidenceWith the ESG trend spreading all over the world, many funds try to enhance their value through greening. In order to enable investors to clearly identify the authenticity, the EU launched the "sustainable financial disclosure regulation (SFDR)" in March 2021 to strengthen the protection of financial commodity investors and improve the disclosure provided by financial market participants to investors, which not only integrates the sustainability risks of enterprises, but also presents the factors unfavorable to sustainability in the investment process, and ranks from low to high according to the degree of greening, Articles 6, 8 and 9 (as shown below) help investors make correct decisions through highly transparent information.

In addition, Morningstar, a fund rating agency, has also launched a sustainable investment rating to measure the performance of the fund's asset composition in three aspects: environmental protection, social responsibility and corporate governance. It is compared with similar types of funds. According to the performance, it is divided into five levels, with a minimum of one earth and a maximum of five earth.

"Far Eastern International Bank 30, esg30" investment funds can also love the earth

Far Eastern International Bank has always attached importance to social responsibility and committed to social welfare. This year marks the 30th anniversary of its establishment. "Far Eastern International Bank 30 and ESG 30" have become the core business philosophy of this year. It is expected to implement the spirit of "Inclusive Finance and sustainable finance" through a series of financial services and public welfare activities combined with ESG concept, so that people can enjoy high-quality financial services at the same time, We can also join hands in environmental protection and social welfare.

In order to improve the investment quality and environmental protection value, it is suggested that when selecting funds, investors can refer to SFDR and Morningstar sustainable investment rating and choose funds with high greening degree, so as to realize the sustainable growth of wealth on the one hand, and contribute to the environment and society on the other hand to create a win-win situation.

* Note 1: refers to the risk level that the insurance industry is willing to accept when pursuing its value.

#