06.2022 Life Guide

The era of interest rate rise is coming. Do I need to pay more for my loan?

Far Eastern International Bank / wangwenqi

Affected by the epidemic and the international situation, the market is facing a global inflation crisis. Even if the yield curve hovers on the edge of upside down, the US Federal Reserve System (FED) resolutely announced an interest rate increase on March 16, 2022 in order to avoid the inflation rate higher than the bank deposit rate, and the Central Bank of Taiwan announced to follow up the next day. Does it mean that the era of interest rate hike has come after 10 years of interest rate hike? How should loan families respond?

The "interest rate hike" has not only affected the investment market, but also severely impacted the housing loan and credit groups. I believe many people want to know whether the monthly payment will soar as a result?

1、 Interest calculation method of bank loan: fixed interest rate vs. floating interest rate

The interest rate rise does not necessarily mean an increase in monthly payments. As the interest calculation methods of bank loans are divided into "fixed interest rate" and "floating interest rate", as the name suggests, the interest rate of "fixed interest rate" is fixed; The "floating interest rate" is composed of the "fixed Reserve interest rate index" and the "overweight interest rate". The former is generated by calculating the average value by referring to the fixed Reserve interest rates of several major financial institutions in Taiwan over a certain period of time. Although the definition of the "fixed reserve interest rate index" of each bank is slightly different, it will change due to the interest rate hike policy of the central bank.

2、 Changes in interest rate of bank loan products after interest rate rise

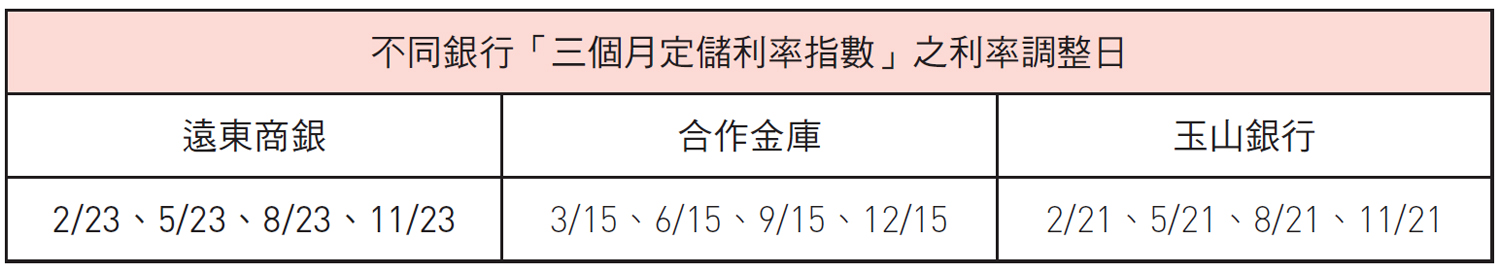

The interest rate hike will increase the fixed deposit rate index of the bank, but it will not necessarily affect the interest immediately. Because bank loans are adjusted at a fixed frequency (monthly or quarterly), even if the interest rate is increased, it will not increase the interest rate of existing loans until the next "interest rate adjustment date" (also known as "interest rate calculation base date"). However, for new loans, some banks may use low interest rates to gain market share, which is beneficial to fund demanders. However, people who have loans or are preparing loans should pay attention. Experts expect that the US Federal Reserve System will raise interest rates many times this year, and the Central Bank of Taiwan still has the opportunity to follow up. In this way, the floating interest rate will rise again. It is suggested to estimate the monthly payment after the interest rate rise and whether the cash flow in hand can be borne.

3、 How much will the interest increase after the interest rate rise?

On March 17, Taiwan's central bank announced an interest rate increase of one yard, equivalent to 0.25%. According to the formula for calculating the floating interest rate by banks, it is almost necessary to increase the interest rate by 0.25 ~ 0.29% on the next interest rate adjustment day. The public can calculate the new monthly payment through the trial calculation tools provided by banks. For example, for a five-year credit, the interest rate will increase by one yard (0.25%) for each ntd1million loan, and the monthly payment will increase by about ntd108 ~ 133.

4、 The monthly payment rises. What should I do?

Although the interest rate hike may not seem like much, people with high loan amount or monthly actuarial expenses may still face the dilemma of being shy.

If your current loan interest rate is high and you still have idle funds, you can contact the loan specialist or telephone customer service to repay part of the loan first, because reducing the total amount owed can also reduce the monthly payment; As for those who do not have funds, they can also consider lending to other banks. If you have good credit and normal payment, other banks may be able to provide better interest rates. However, regardless of the choice, you should pay attention to whether it is still within the binding period to avoid overpaying liquidated damages.

5、 Will you be fined for prepayment? What is a binding clause?

In order to avoid the impact of customers' repayment too quickly or lending to other banks on the financial income of banks, most banks have provisions for early repayment of liquidated damages (also known as binding). Although there are other plans not binding, they must bear higher interest rates. The binding time varies according to the loan type and the bank's policy, usually between 1 and 5 years. Each bank also has very big differences in trigger conditions, binding period, calculation method, or rate. As of January 25, 2022, trigger conditions have (but are not limited to) the following three types:

1. within the binding period, the repayment of 50% of the total loan limit will be triggered (e.g. Far Eastern International Bank).

2. during the binding period, it will be triggered when the full principal is paid off and the payment certificate is applied (for example, cooperative Treasury).

3. during the binding period, the amount of prepayment of any ratio will be triggered (for example, Cathay Pacific).

In addition to the triggering conditions, the liquidated damages are also composed of many elements. Therefore, before applying for a loan, please be sure to understand the details or select a familiar bank, so that you will not suffer losses in vain due to misunderstanding or ignorance of the terms of default.

● summary of standards for banks to charge liquidated damages for early repayment of consumer loans: https://reurl.cc/ZA4dAW

#