06.2022 Office Talk

Seize the opportunity of delivering fresh groceries

Go survey Market Research Consultant / provide

Recently, supermarket, mass merchandiser, pharmacy and other exclusive retail channel brands have successively joined the delivery platform, expanding the delivery items from cooked food and catering to daily necessities and fresh groceries; Fresh e-commerce has also been upgraded due to the demand for home epidemic prevention, adding supporting services such as zero contact distribution and whole point disinfection delivery boxes, which has supported another wave of growth momentum for the delivery market. In this issue, go survey will analyze the 3 major trends and 3 major business opportunities of fresh food delivery in the future.

Recently, supermarket, mass merchandiser, pharmacy and other exclusive retail channel brands have successively joined the delivery platform, expanding the delivery items from cooked food and catering to daily necessities and fresh groceries; Fresh e-commerce has also been upgraded due to the demand for home epidemic prevention, adding supporting services such as zero contact distribution and whole point disinfection delivery boxes, which has supported another wave of growth momentum for the delivery market. In this issue, go survey will analyze the 3 major trends and 3 major business opportunities of fresh food delivery in the future.Trend 1 physical mass merchandising and supermarket blessing drive the rapid growth of fresh food delivery market

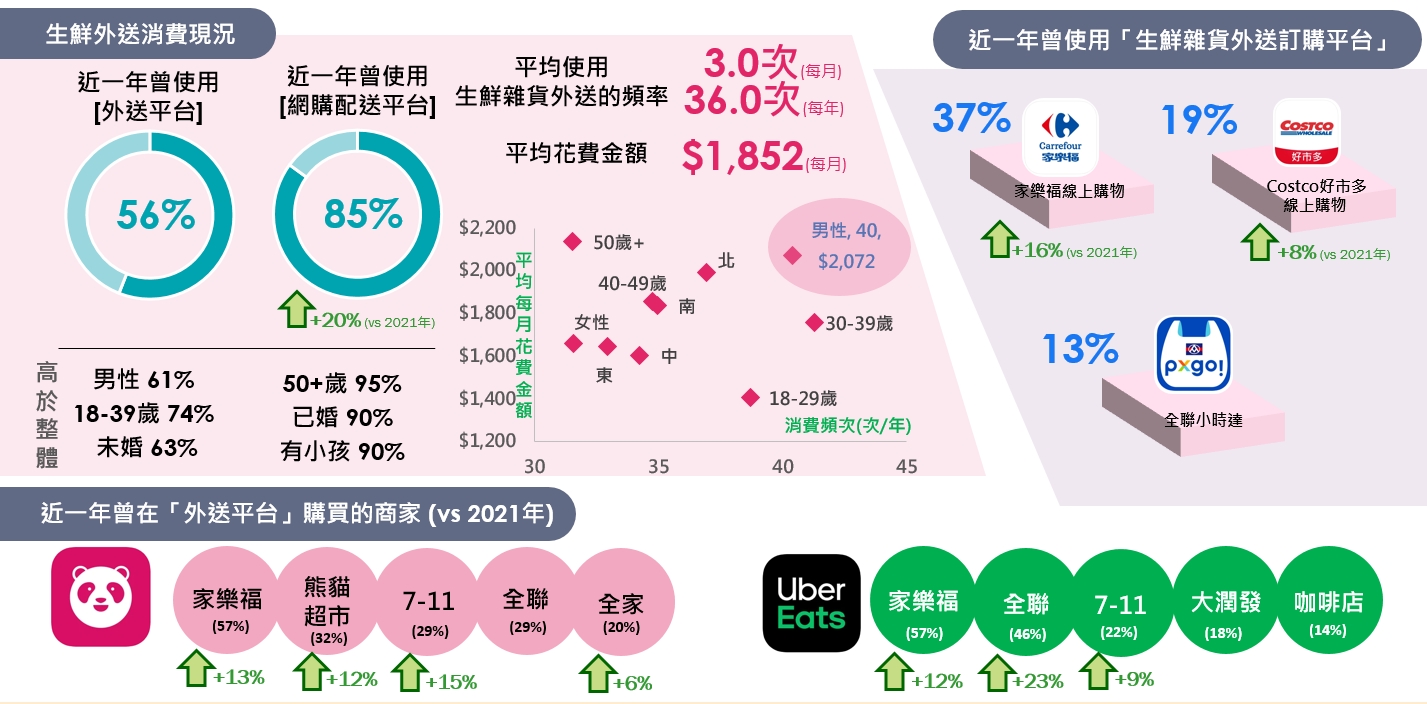

According to the go survey, in the past year, 85% of the people have used the "online shopping platform" to purchase fresh groceries. Driven by the epidemic, it has increased by 20% compared with last year. Among them, the use of "Carrefour" and "Costco online shopping" has increased the most (by 16% and 8% respectively compared with 2021). Less than a year after the launch of "all in one hour", there is also a 13% utilization rate. The supermarket's mass merchandising leader continues to drive the growth momentum of the fresh delivery market.

Trend 2 connects mass merchandisers, supermarkets and supermarkets to promote the performance growth of "delivery platform" fresh groceries

Trend 2 connects mass merchandisers, supermarkets and supermarkets to promote the performance growth of "delivery platform" fresh groceriesIn addition to the official online shopping website and app, retailers also use the "delivery platform" to connect their own goods with the last mile of consumers. The survey found that in the past year, 56% of the people had used the "delivery platform" to purchase fresh groceries, among which Carrefour, quanlian, 7-11 and the whole family were the most popular. Even foodpanda's self operated panda supermarket was the second best-selling store, and the purchase rate was higher than last year. As supermarkets, mass merchandisers, supermarkets and other retail channel brands have successively joined the delivery platform, the performance of fresh groceries has been driven to grow.

Trend 3 「 delivery platform 」 attracts young male consumers and starts new consumption momentum

The fresh "delivery platform" attracts male, 18-39 years old, unmarried young customers, which is different from the mature, married and family customers of the "online shopping platform"; In addition, the consumption frequency and amount of men are higher than that of the whole (+4 times / year, +ntd220), with strong demand, injecting new momentum into the fresh delivery market.

With the increasing number of "stay at home" and "work at home" groups, fresh food delivery has become a public habit, and the adhesion of mature customers continues to deepen. What should retailers do in the future? Go survey explores 3 business opportunities for you.

"Business opportunity 1" focuses on hot selling commodities in the channel to drive long-term consumption

Go survey found that the types of fresh groceries that people often buy in different channels are quite different, among which the beverage items of foodpanda and Uber eats are the most popular; Carrefour, Momo and Costco mainly focus on household commodities, but Costco's imported fruits and vegetables are also very popular; Momo is a strong beauty and skin care product; Shopee's snacks, cookies and candies are the most popular; Instant cooking and cake desserts are the best for the whole family; The domestic fruits and vegetables and fresh meat products sold well in quanlian. To sum up, the delivery platform focuses on beverage demand; Mass selling e-commerce meets daily needs; Supermarkets and supermarkets meet the needs of instant food and daily consumption; Each channel can use hot selling commodities as a sharp weapon to develop long-term consumption demand.

"Business opportunity 2" uses "speed" to seize the heart share of 30 generations and central customers

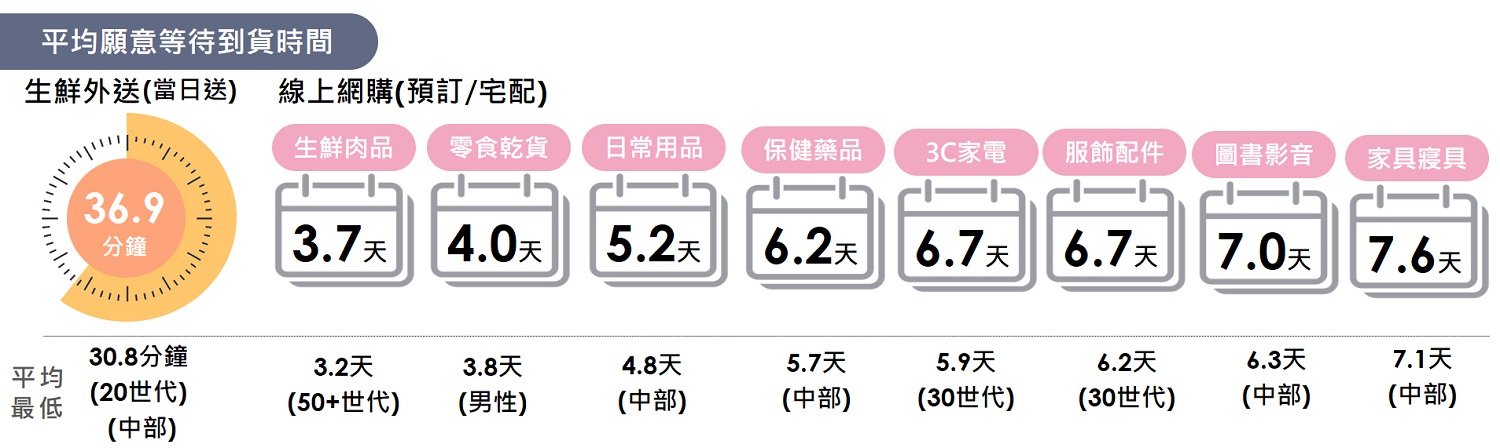

"Business opportunity 2" uses "speed" to seize the heart share of 30 generations and central customersQuick arrival has become one of the means for delivery home distribution companies to rush orders. However, how fast does the goods need to be delivered so that consumers can pay? The survey shows that consumers who deliver fresh food on that day are willing to wait for 37 minutes on average; Fresh meat and snack dry goods online shopping are expected to be delivered within 4 days; Other online purchase orders for supplies, cosmetics, home appliances and clothing are expected to arrive within one week; Among them, the 30-39 year-old and the middle customer group are willing to wait for a short time, which shows that if future operators develop "fast arrival" upgrade services, they must use "speed" to capture the hearts of the 30 generation and the middle customer group.

Business opportunity 3 strengthens price preference and commodity difference, and improves platform adhesion

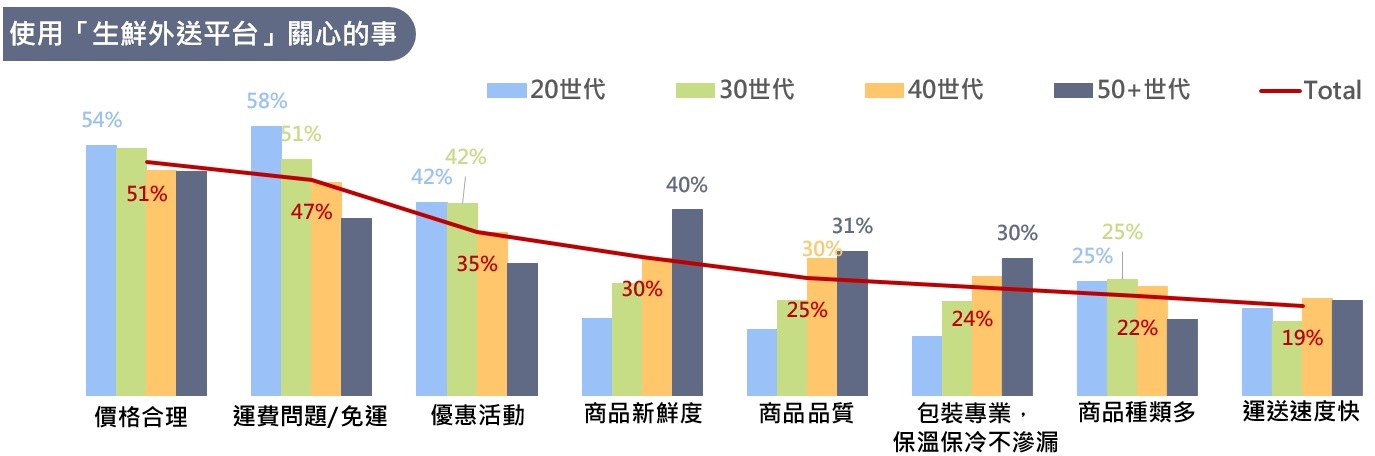

Business opportunity 3 strengthens price preference and commodity difference, and improves platform adhesionWhen using the fresh food delivery platform, the most concerned factors of the public are price, free shipping, preference, commodity type, freshness, quality and packaging. If analyzed from the perspective of each generation, the younger generation (generation 20 / 30) pay more attention to price, free shipping, preferential activities and commodity types; The mature generation (40 / 50 + generation) paid more attention to the freshness, quality and packaging professionalism of commodities; Platform operators need to carry out differentiated and customized operation for different customer groups, provide the procurement elements that can most move each customer group, and cultivate consumption adhesion.

The epidemic has accelerated the development of stay at home economy. Retailers have actively entered the e-commerce and delivery market. The delivery service of fresh groceries has become a must for supermarkets, supermarkets and mass merchandisers. The fresh food delivery market itself has changed rapidly. From its new competitor, coupang, an e-commerce giant known as "Amazon of Korea", to its entry into the fresh food delivery market in Taiwan in 2021, to foodpanda and Uber eats' entry into the traditional market, its impact on the fresh food delivery market in the future is worth continuing observation.

* survey description: the "food and beverage delivery consumption survey" is an online survey conducted by the go survey market research consultant on the go survey platform from December 28, 2021 to January 24, 2022. A total of 4784 samples were collected. The respondents were happy go cardholder aged 18 to 70.

* go survey official website: https://www.gosurvey.com.tw/web/index/index.jsp

#