04.2024 Life Guide

General type? Circular type? How is the most cost-effective way to borrow?

Far Eastern International Bank / Zhang Jia'en

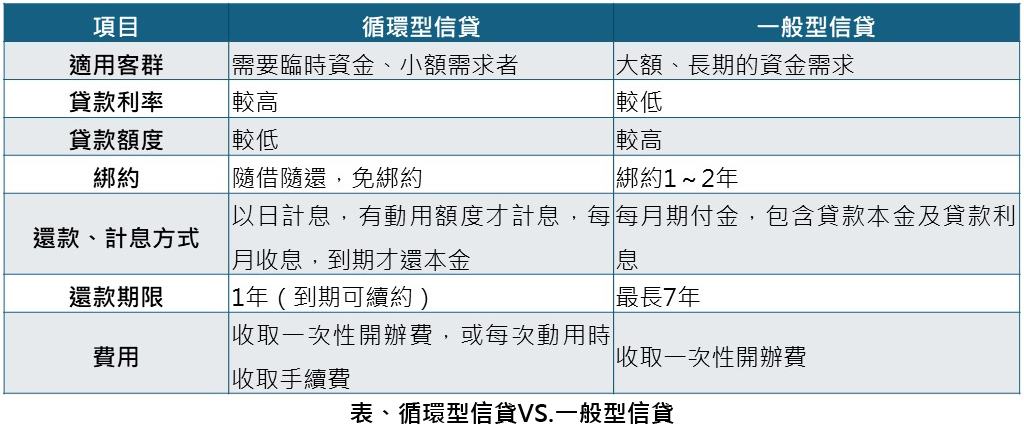

What is the difference between the two types of credit loans, in addition to the "general credit" mainly offered by various banks, there is another type of "revolving credit"? What kind of loan is suitable for oneself to apply for? Let the Finance Column unveil it for you in this issue.

What is the difference between the two types of credit loans, in addition to the "general credit" mainly offered by various banks, there is another type of "revolving credit"? What kind of loan is suitable for oneself to apply for? Let the Finance Column unveil it for you in this issue.1、 What is a general type of credit?

General type credit is a comprehensive evaluation of the credit status and repayment ability of the applicant by the bank, providing a sum of funds. The applicant can then repay the principal and interest in installments based on their chosen repayment period (up to seven years), without the need for collateral or a guarantor. This is the flagship product of various banks, which is more suitable for ethnic groups with long loan periods and the need for installment repayment. Because the monthly burden is based on the monthly amortization of principal and interest during the loan period, also known as installment credit.

2、 What is revolving credit?

Circular credit is a personal credit that withdraws the required funds from a fixed amount approved by the bank, and is subject to unlimited use and repayment at any time. Interest is only calculated when there is use. When the loan amount is valid, there are two monthly payment methods: one is to only pay interest; The second is to pay interest and a portion of the principal (such as the current principal balance multiplied by 0.4%), with a retention period of one year for the credit limit, which can be renewed upon maturity (the bank will reassess the customer's credit status and repayment ability to decide whether to renew the contract); After maturity, the principal can be repaid in one lump sum, without the need for binding contracts, free collateral, or guarantors. It is suitable for ethnic groups that need short-term or one-year capital turnover and can be used as temporary working capital, also known as "wealth management credit".

1. Advantages

The use of funds is fast and convenient, and there is no restriction on the binding period. Within the limit, funds can be borrowed and returned at any time. Online transfer (online banking or mobile banking transfer), telephone voice transfer, or collection at the counter branch are all available. Interest is calculated based on the number of days used. If borrowing or repaying on the same day, interest is waived.

2. Disadvantages

A. Higher interest rates: "General credit" usually has a binding period of 1-2 years and cannot repay debts in advance; Revolving credit has no restrictions and is highly mobile. For banks, the risk is relatively high, so the interest rate is slightly higher than that of general credit.

B. Strict review: Due to the fact that there is no need to repay the principal during the loan period and no guarantor or collateral is required, the bank's review is stricter.

C. Low credit limit and high fees: For banks, there is a greater risk of non monthly repayment of principal, so the loan limit is usually lower and the fees are higher than general credit.

3. Interest calculation method

A revolving loan is a loan in which the borrower uses the amount within the "quota" as needed, and based on this amount, "interest is calculated on a daily basis" and "interest is paid on a monthly basis" to repay the principal upon maturity. The calculation formula is "daily interest=total cumulative amount used x annual interest rate ÷ 365".

For example, Mr. Wang applied for a revolving credit with a bank approved limit of NTD 1 million and an annual interest rate of 5%. On January 1st, Mr. Wang used NTD 300000 and repaid on January 11th. If he actually used it for 10 days, the interest to be paid would be NTD 300000 x 5% x 10 days ÷ 365 days=NTD411. Therefore, the total interest is NTD411.

4. Charging method

It can be roughly divided into two types: one is to charge the establishment fee in the first year, and the other is to charge the account management fee from the second year onwards; Another option is to waive the establishment fee, but a handling fee will be charged for each use.

3、 How to choose credit?

The biggest difference between "revolving credit" and "general credit" is that the former starts calculating interest only when funds are used. For example, for a revolving credit with a loan amount of NTD 300000 from a bank, only NTD 100000 is actually used, and the bank will calculate the interest of NTD 100000 based on the actual number of days of use. When it expires, the principal NTD 100000 will be used again to repay it; For general credit, interest and principal repayment should be calculated based on the loan term of NTD 300000.

Generally speaking, the interest rate of revolving credit is higher than that of general credit, but the borrower may not pay more interest because the amount of interest depends on the actual amount used, borrowing time, and repayment ability.

4、 Conclusion

The advantage of "revolving credit" is the flexible use of funds, which can be borrowed and repaid at any time, without being limited by the binding period. It is suitable for short-term financing investors, small self operated businesses, general office workers, or small capitalists who have temporary capital turnover needs, making it convenient to repay the principal at any time; On the contrary, if the public needs to borrow for more than a year and is unable to repay the principal in the short term, it is recommended to apply for "general credit" with lower interest rates and longer terms, which can be repaid in installments.

When choosing a loan method, please make financial planning based on your repayment ability and borrowing time, and not only choose the one with the lowest interest rate; Before applying for "revolving credit", it is even more important to plan the use of funds reasonably and avoid irrational expenditures. If funds are used at will, it is customary to only bear interest every month, and the principal cannot be repaid when due, which may lead to financial deterioration and poor credit.

#