02.2019 Life Guide

How much do you know about the withholding of salary

Far Eastern New Century Corporation / Chen Yizhen

When you get your salary every month, you always feel happy and excited. What a wonderful thing it is to make money by your own efforts! But look closely, the salary figures seem to be different from expectations, in addition to labor insurance premiums, health insurance premiums, but also deducted "income tax"? Many people must be thinking: Why deduct tax? Can't you do without it? This issue of Legal Column answers your question about the withholding of salary income.

The withholding of income tax from salary is not the employer intentionally Undercalculating salary to employees, but the employer takes the responsibility of withholding agent, first withholding tax from employees'salary according to the prescribed withholding rate, and withholding agent (your company) pays tax to the Treasury within the prescribed period. The main purpose is to enable the government to obtain tax as soon as possible, to facilitate the treasury funds dispatch, to master tax information, and to reduce the pressure of taxpayers (i.e. workers) to bear annual tax at one time. The following will briefly introduce the relevant methods and current provisions of withholding income tax.

I. Procedures for withholding salary income

1. All salary recipients shall submit tax exemption declaration forms to withholding agents of their service organs, organizations or undertakings, stating such matters as the names of spouses and dependent relatives who are allowed to deduct tax exemptions, the date of birth and the unified number of their national identity cards in accordance with Article 17 of the Income Tax Law.

2. In the course of the year, if one of the following happens, the payee shall inform the withholding agent of the circumstances after the change within 10 days from the date of occurrence. After receiving the tax exemption declaration form filed by the payee, the withholding agent shall record it separately. If there is a notice of the change, the withholding agent shall register the change.

A. Marriage, divorce or death of spouse.

B. Increase or decrease in the number of dependent relatives.

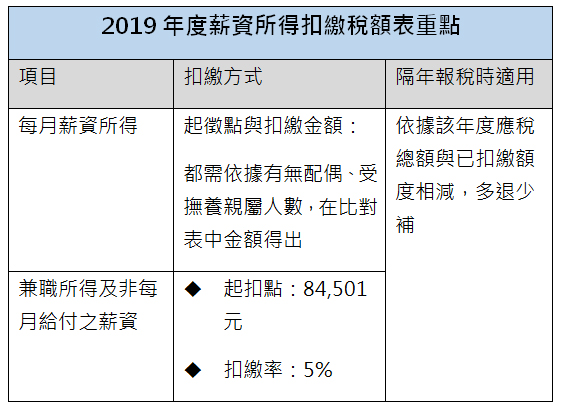

3. When a company pays salaries, it shall deduct tax according to the number of spouses and dependents of each salary recipient, and apply the provisions of the payroll income withholding tax scale. The company shall deduct tax according to the payroll income withholding tax amount, including the number of spouses, dependents and the monthly salary amount.

4. Fixed salary: Those who have filled in the "Application Form for Dependence of Relatives of Recipients of Salary Income" may be withheld in accordance with the tax deduction form of salary income announced by the Ministry of Finance; those who have not filled in the application form for Dependence of Relatives shall withhold 5% of their total salary.

5. Part-time income and non-monthly salary: 5% of total salary is deducted.

1. Monthly salary (taxable) income

A. The starting deduction point of monthly salary income is 84,501 yuan, among which different deductible tax amounts are generated according to the number of spouses and dependents. However, if the monthly salary does not exceed the starting point, no deduction is required.

B. If the amount of tax withheld from income tax does not exceed 2000 yuan per month, it shall be exempted from withholding.

2. Part-time earnings and non-monthly salaries (year-end and employee remuneration, etc.)

If it exceeds the threshold of 84,501 yuan, it should also be withheld first. The withholding tax rate is fixed at 5% of the total salary. The year-end bonus, which is common in all walks of life, belongs to non-monthly salaries and needs to be taken into account. Similarly, if the year-end does not exceed the starting point, the withholding shall not be included.

3. Lottery prizes or prizes:

The prizes or prizes awarded in lottery activities shall be deducted 10% of the total amount according to the deduction rate of all kinds of income, but those who pay less than 20,000 yuan for each winning prize or prize shall be exempted from deduction; those who pay less than 1,000 yuan for the same winner throughout the year shall be exempted from filling out the deduction-free voucher.

The amount of income tax withheld in advance will be offset by the amount of tax payable in the next year. The mechanism of more refunds and less compensation will be adopted. If the amount of tax withheld in advance exceeds the amount of tax payable, the tax will be refunded to the taxpayer. On the contrary, insufficient tax will be paid.

The vast majority of wages will appear on withholding vouchers as the basis for tax payment. Only a few of them are tax-exempt. The following sections are listed only:

1. Travel, daily expenses and overtime expenses:Travel expenses, daily expenses and overtime expenses paid for the performance of the employer's duties shall not be included in the salary income if they do not exceed the prescribed standard. Among them, overtime is exempt from tax within 46 hours, and the number of overtime hours is taxable; overtime on legal holidays is exempt from tax, and is exempted from accounting for 46 hours.

2. Self-employment pension:According to the Labor Pension Regulations, voluntary contributions to pensions or annuity insurance premiums are not included in the annual salary income tax, but the deductions or special deductions are not allowed to be declared.

3. Food expenses:The meal fee is 2,400 yuan per month, which is salary but tax-free. Therefore, the company can help employees reduce taxes, and it can also be regarded as the company's act of taking care of employees.(Source: State Tax Bureau, Ministry of Finance)