02.2020 Life Guide

2020 economic outlook: the challenge of structural reform with a slight end to trade war

Far Eastern International Bank / Jiang Zhihao

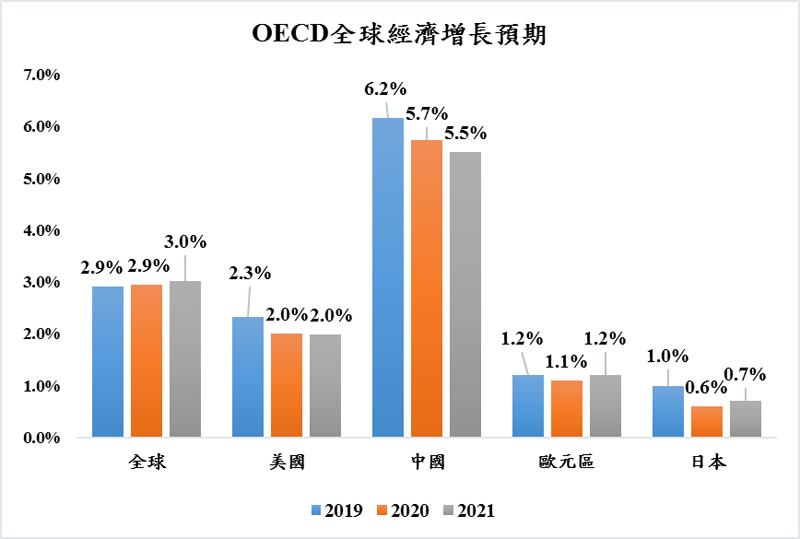

The organization for economic cooperation and development (OECD) cut the growth rate of global GDP to 2.9% in 2019 and 2020, and it is predicted that the growth rate will only grow slightly to about 3% in 2021, lower than the previous forecast of 3.5%, which is the lowest level since the global financial crisis, and the premise is that risks such as trade war and China's unexpected sharp slowdown can be kept under control. In the short term, the economic outlook of each economy varies according to the relative importance of trade to the region, and China, the eurozone and Japan are relatively affected. OECD believes that in the future, the global economic outlook will face greater concerns, mainly from the challenges of climate change, the digitalization of economies, and the collapse of the global multilateral order. There is not much practical action. We should reconsider fiscal policies and actively respond to these challenges, so that we can reverse the trend and improve economic growth and living standards.

In terms of the economic outlook of major countries, the OECD revised the growth rate of the U.S. economy in 2019 to 2.3%, lower than the 2.4% predicted in September, mainly due to the decrease of the effect of tax cuts in the U.S. and the weakening of the economy of major U.S. trade partners; by 2020 and 2021, the growth rate of the U.S. economy will slow down to 2%. For the euro area, it is estimated that the economic growth rate will be 1.2% in 2019, 1.1% in 2020 and 1.2% in 2021; for Japan, it is estimated that the economic growth rate will be 1.0% in 2019, 0.6% in 2020 due to the impact of consumption tax increase, and 0.7% in 2021.

The OECD slightly revised up the growth rate of China's economy to 6.2% in 2019, but believed that China's economic growth will continue to decline, mainly because China's trade tensions cannot be completely relieved, and the growth momentum will continue to weaken when the economic structure is slowly transforming into domestic demand economy; the economic growth rate is estimated to be 5.7% in 2020 and 5.5% in 2021. Due to the imbalances in many emerging market economies, only a modest recovery is expected in other emerging market economies. In general, the growth rate of emerging market economy is lower than it should be. China's economy is undergoing structural changes, from exports and manufacturing to consumption and services; in addition, the Chinese government also hopes to shift imported technology to domestic production and use the transfer of energy to solve the pollution problem. Among them, the growth of service industry causes the change of China's import demand, and China's traditional contribution to the growth of Global trade is bound to slow down. Although India's economy will maintain rapid growth, its model is different from that of China, and it is still not enough to replace China as a global engine of traditional manufacturing industry.

OECD analysis shows that the decisive and timely easing of monetary policy by central banks (especially major central banks in Europe, the United States and Japan) offsets some negative effects of trade tensions on the economy, helps prevent rapid deterioration of the economic outlook, and paves the way for structural reform and public investment, such as infrastructure spending to support digital economy and climate change It is hoped that the long-term growth rate will be increased in the future. However, so far, in addition to the limited support provided by a few countries in fiscal policy, the effect of real investment has not been great. Not only asset prices have continued to rise, but also the crisis of bubbles has emerged. However, the biggest worry is that the deterioration of the economic outlook has not weakened, which shows that the current economic structural changes are more obvious than the impact of the past several economic cycles.

As for the stock market, the US and China have the opportunity to sign the first phase agreement to promote the return of funds to the stock market and bring a short-term high point of the global stock market. However, only after the second phase agreement or other favorable support is completed, can we reach a new high. In the short term, the conflict between the US and China is still difficult to resolve, so the second phase agreement that touches on structural issues such as technology and patents is reached It's quite difficult. It is estimated that the global stock market in 2020 will be in a fluctuating and rising pattern, and the high point may fall between the second quarter and the third quarter, that is, before the U.S. election; according to the prediction of major securities companies in Europe and the United States, the average high point of SP500 in this year is 3270 points, and the median is 3300 points; based on the 3220 points at the end of 2019, the U.S. stock market still has 1.5% - 2.5% room for growth this year. In terms of investment targets, US technology stocks and emerging Asia are still the most noteworthy industries and regions.

In terms of bond market, although the three central banks are loose at the same time, if the Federal Reserve System and the European Central Bank do not cut interest rates further or expect to cut interest rates in the first half of the year, the central banks of emerging countries will also temporarily stop cutting interest rates. It is estimated that there is not much room for the global bond market to rise in price, so bond interest will become the main contribution of bond yields. It is estimated that high-yield bonds and emerging market bonds with high interest in the first half of 2020 will have more performance space, but high-yield bonds should pay attention to whether the risk of default is rising. In the second half of 2020, with the increase of global climate variables and the increase of the rate reduction probability of federal reserve system, investment grade bonds and government bonds will have the opportunity to return to the main investment axis. As a whole, combining investment grade bonds and high-grade bonds The compound bond of multiple bond types of income bond and emerging market bond is a better bond investment choice this year.

In terms of foreign exchange market, the US dollar should maintain a range reorganize trend in 2020, while non US currencies will have a chance to rebound, while European currencies are expected to stabilize after the elimination of political risks, while emerging market currencies that benefit from the easing of trade tensions will have more room to rebound; however, non US currencies should pay attention to the second half of 2020, if the economy cools down again, the US dollar may be in danger demand again Go on.

In terms of raw materials, although OPEC production cuts can support oil prices, global demand and the increase in shale oil output in the United States also bring pressure on oil prices. It is estimated that in 2020, the price of crude oil in Western Dezhou was reorganize in the range of US $50~60. Because of the US presidential election in 2020, we need to guard against the possibility that President trump will suppress oil prices again. In terms of gold price, the yield of U.S. Treasury bonds is stable, and the boom is still moderate. It is estimated that the gold price will be reorganized in 2020. However, if there is any change in the boom in the second half of the year, the interest rate reduction probability of the federal reserve system will increase, and the gold price will still have the opportunity to stand at the level of $1550 or even $1600 again.