01.2021 Life Guide

Economic outlook for 2021: new normal of economic recovery in post epidemic Era

Far Eastern International Bank / Huang Baiwei

At the beginning of 2020, after 18 months of the US China trade war, investors were still intoxicated with the joy of the global stock market hitting a new high, but a black swan quietly entered. The sudden COVID-19 epidemic not only dried up the liquidity of the US currency and fixed income market, but also caused the US stock market to blow four times in 10 days, shaking the global financial market. In 2021, what factors will affect the strength of global economic recovery?

At the beginning of 2020, after 18 months of the US China trade war, investors were still intoxicated with the joy of the global stock market hitting a new high, but a black swan quietly entered. The sudden COVID-19 epidemic not only dried up the liquidity of the US currency and fixed income market, but also caused the US stock market to blow four times in 10 days, shaking the global financial market. In 2021, what factors will affect the strength of global economic recovery?US presidential election and epidemic development

After months of fierce fighting, the US presidential election is expected to be won by Democratic candidate Biden, and the Senate and house of representatives are expected to be held by the Republican Party and the Democratic Party respectively. The separation and confrontation between the two parties seem to hinder the implementation of the policy, but it also reduces the risk of policy changes. Naturally, this is what investors like to see.

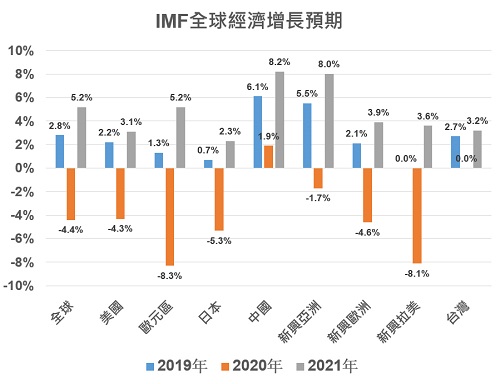

After the US election ended, the focus of the market turned to the COVID-19 epidemic itself. After the onset of winter, the second and third waves of COVID-19 epidemic occurred in the United States and Europe. As a result, European countries renewed social bans to varying degrees, and the International Monetary Fund (IMF) slightly lowered its global economic growth forecast in 2021. It can be seen that the development of covid-19 is still the most important and critical factor affecting the economy.

Outlook for 2021: "believe" will be better

The IMF raised the global GDP growth rate to - 4.4% in 2020, mainly because the economic recovery in the second and third quarters of 2020 was stronger than expected, and the large-scale fiscal and monetary policies of various governments were gradually effective. Among the mature countries, the United States is the best (- 4.3%) and Europe is the worst (- 8.3%); In emerging markets, emerging Asia is the strongest (- 1.7%) and emerging Latin America is weaker (- 8.1%). On the whole, under the impact of the epidemic, mature and emerging markets have also been greatly impacted. However, from the perspective of absolute growth and adjustment trends, the stronger economies are still the United States and emerging Asia. The most special is that China, which was hit by the epidemic earlier than other countries, saw a strong economic recovery after the lifting of the epidemic prevention blockade in the first quarter, becoming the only country among the world's major economies that maintained positive growth (1.9%).

Although the global economic performance in 2020 is not ideal, the IMF estimates that the global GDP is expected to rebound to 5.2% in 2021. Although the process of economic recovery is long, tortuous and highly uncertain, the global economic base period in 2020 is low. In addition, the governments of various countries continue to launch policies to stimulate the economy and the COVID-19 vaccine is expected to be launched in 2021. It is almost certain that there will be high economic growth in 2021.

In terms of policy, countries still in the midst of the epidemic must continue to provide enterprises and individuals with easy monetary policies and liquidity measures to ensure that relief funds continue to flow to small and medium-sized enterprises, thereby supporting employment and financial stability. If the support is cancelled prematurely, the economic recovery may come to an abrupt halt.

The main axis traversing 2021: when will the vaccine be released?

This is the topic that everyone is most concerned about. After all, the longer the effective vaccine is available, the weaker the economic recovery will be. Although several vaccine companies have reached the clinical phase III targets, and even some countries have authorized the use of it urgently, looking at the global population of 7 billion, it is estimated that the time point of large-scale popularization will still fall after the second half of 2021. This also represents that in the past, governments of various countries provided funds to relieve enterprises and people, The future will turn to promoting the self operation of the global economic engine, and the vaccine is a key turning point. The earlier the vaccine is applied, the more favorable it will be for the restart of economic activities and help promote the process of economic recovery in various countries.

Post epidemic "new normal": the advent of the digital age

The COVID-19 epidemic has had a major impact on global economic activities. In order to avoid cluster infection, measures such as locking up countries and closing cities have been launched one after another. However, the crisis is also a turning point. The change of mode has changed the way people produce and consume, and also accelerated the process of digitization. Enterprises began to seek to turn the working environment to digital, so as to minimize the negative impact on the income side; For individuals, new lifestyles such as online shopping and long-distance work emerge as the times require. As the epidemic has eased and countries have gradually lifted their closures, people have found that their economy, work and life have completely changed. After getting used to the speed and convenience of digitalization, it is no longer possible to return to the old "normal.".

Therefore, mastering the "new normal" is an important key. Only by analyzing and understanding the impact of the new normal on the enterprise itself and its industry as soon as possible, and further grasping the opportunities and deploying in advance, can we stand out:

1. Focus on customer expectations through Digitalization: in the process of digitalization, customer satisfaction is the key. Only by considering the whole consumption process from the perspective of customers can enterprises find ways to meet customer expectations.

2. Improve business operation with Digitalization: optimize decision-making and business operation with big data and artificial intelligence, improve operation speed and enhance prediction success rate.

3. From e-commerce to non-contact Economy: through automated digital investment, improve the ability of virtual and real integration, change the previous mode of counter handling, and create new value for the industry.

4. Speed up the organization's adaptability: Digitalization also means faster response speed. Only by quickly deciding the strategy at the moment when things happen can we retain our own value in an increasingly rapid generation.

Global investment market under the new normal

The following is an analysis of the global financial market trends in 2021:

1. Stock market

Due to the easing policies adopted by various countries, unprecedented huge funds flow in the market. The overall low interest rate environment is relatively favorable for the stock market, and the stock indexes of various countries also show a long trend. However, compared with the technology, medical and other epidemic affected stocks that led the rise in 2020, in 2021, in addition to the pan technology industry that still benefited under the new normal, the previously undervalued value assets will also get the opportunity to make up for the rise under the rotation of such stocks; In addition, with the implementation of vaccines and the gradual recovery of economic activities, domestic consumption and small and medium-sized stocks are expected to become one of the focuses of economic recovery.

2. Bond market

With the US election coming to an end, the vaccine has also shown its light, the uncertainty has been greatly reduced, the bond market will gradually return to its proper level, and the credit bond market will also tend to be stable. Under the flattening of the yield curve, attractive yields are increasingly scarce. It is estimated that high-yield bonds with high interest spreads and emerging market bonds will gradually be favored by the market, especially emerging Asia with better epidemic control and low default rate.

3. Foreign exchange market

The policy of near zero interest rate in mature markets means that the value of emerging markets is relatively rising. In addition, after US President Biden takes office, international conflicts are expected to be eased. It is expected that under the condition of unchanged monetary easing policy, non US currencies will return to the rising trend.

The darkness will pass, and the dawn will come

The world is looking forward to the specific drugs and vaccines for COVID-19. The daily life and economic activities stagnated during the epidemic are also gradually recovering. Although the epidemic has brought many pain and harm, looking forward to the future, under the new overall economic conditions, it is expected to bring a new look to the market. No matter what the economic prospects are, investors must make preparations in advance to go higher and farther.

#