02.2021 Life Guide

Happy retirement, make preparation in advance Let's go!

Far Eastern International Bank / Yang Lijin

The issue of annuity reform has led to worries about the bankruptcy of labor insurance. It has become a consensus for many people to "save your own pension". Especially in the era of low interest rates, you should build your own retirement coffer through stable financial products and simple investment methods. In this issue, we will explain the preparation skills and precautions for your pension, and invite you to launch the "happy retirement" program!

The issue of annuity reform has led to worries about the bankruptcy of labor insurance. It has become a consensus for many people to "save your own pension". Especially in the era of low interest rates, you should build your own retirement coffer through stable financial products and simple investment methods. In this issue, we will explain the preparation skills and precautions for your pension, and invite you to launch the "happy retirement" program!According to the "108 year simple life table" released by the Ministry of the interior on August 5, 2020, the average life expectancy of Chinese is 80.9 years, which is higher than the global average. According to the household income and expenditure survey of the general accounting office of the Executive Yuan, the average monthly consumption expenditure of Chinese is about NT $22000. In other words, if a couple has an average remaining life of 25 years after retirement, they need to prepare a pension of about 15 million yuan. To achieve this goal, how much reserve should they have each month?

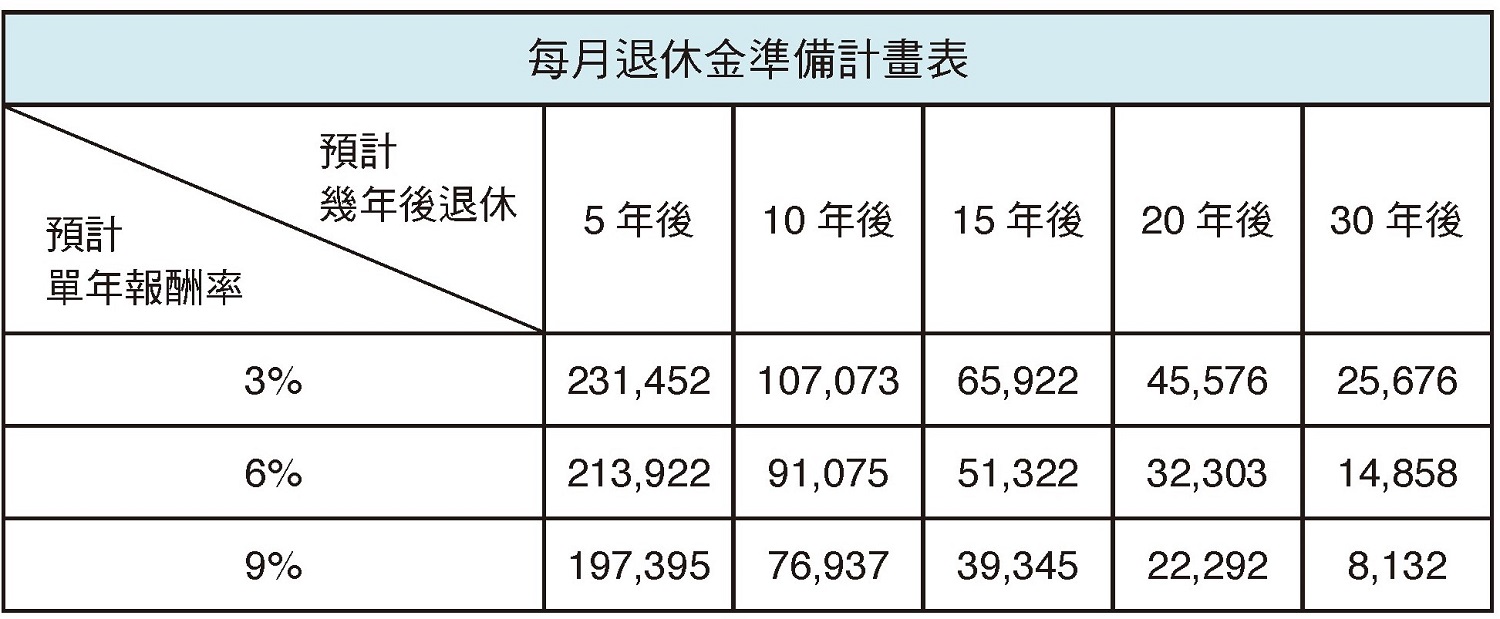

The "monthly pension preparation plan" below is calculated separately according to the retirement time and the annualized average rate of return. The pressure of capital preparation also shows the importance of long-term investment. However, the overall rate of return on investment can not be ignored. How to choose the appropriate financial products and trading methods is the key to success.

Select mutual funds with low volatility and high accumulation

Select mutual funds with low volatility and high accumulationIn recent years, there have been many discussions on the topic of "pension withdrawal". Among them, the "fixed investment method" is the most popular. It demands to invest a lower amount of money in a regular time and frequency, and it can be adjusted at any time according to the personal capital situation. It is widely welcomed by the new people in the society or the young people with old and small families. In fact, the "fixed investment method" has the advantage of average investment cost, but it is also easy to cause the investment myth of the general public. Most people expect to get a high rate of return on investment, they will choose a single country stock or industrial fund, but this type of fund has a relatively high risk of price fluctuations. If there is a significant price drop, investors often redeem the fund due to lack of confidence or short-term funds can not be continued, which leads to asset shrinkage.

By observing the financial market events in the past 20 or 30 years, we can see that mutual funds with wide investment areas (such as the world, Europe, the United States, Asia, etc.), diversified underlying Holdings (such as both stocks and bonds), or fixed income can achieve the double conditions of relatively stable net worth performance and steady and upward long-term performance. In addition, we should pay special attention to whether the assets managed by the fund team have a certain scale, so as to avoid the risk of liquidation due to the continuous reduction of scale.

Cost cutting

After choosing the right mutual fund, we have taken the first step towards "happy retirement", and then we have to carefully calculate the investment cost. In general, investing in a mutual fund incurs the following fees:

Fund sales agencies (platforms): subscription fees, trust fees, conversion fees Etc. is a one-time fee paid when applying for a transaction.

Fund company: fund manager (Management) fee, fund custody fee (or single administrative management fee) Most of them are included in the net value of the fund, with annualized rates ranging from 0.5% to 5%.

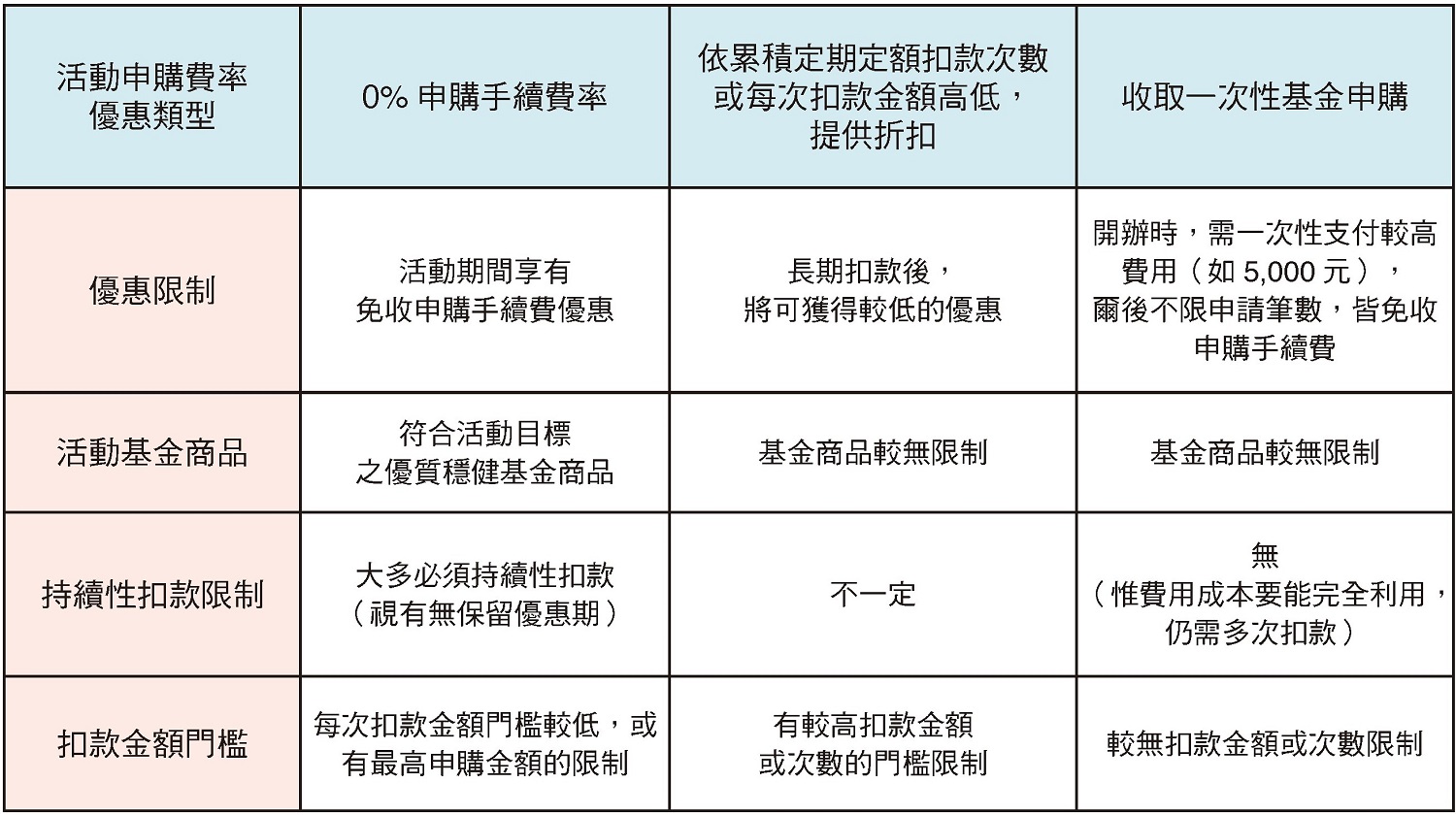

The second fee is the fee charged by the fund company for issuing and maintaining the operation of the fund, while the first fee is the fee that investors must pay when applying for mutual fund related transactions with the sales agencies. However, most sales agencies offer preferential activities for retirement preparation targets or fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed fixed The number of times or the amount of each deduction is high or low, and only one-time fund subscription account opening fee is charged. Among them, the "0% subscription fee rate" is the most attractive. However, customers are usually required to hold it for a long time and make continuous deductions. Investors should take relevant transaction restrictions into consideration to avoid the preferential treatment of earning the fee. However, due to some unexpected factors, they pay higher fees when they need emergency redemption funds.

Keep personal flexible operation space

No matter in order to prepare for pension or other personal funds, we must persevere in order to obtain the results of steady growth of assets. It is suggested that we should have a deep understanding of the rules of each fund sales agency for regular fixed amount activities, such as adjusting the frequency of deduction or strategically converting different fund targets To ensure long-term investment, it is necessary to reserve funds, transaction frequency and flexible operation space for individuals to use each month.

At present, many financial institutions have provided online account opening service, and the operation steps are also very simple. As long as you use your mobile phone, you can complete it without waiting time. "Retirement" is a compulsory credit for every generation. Only by starting the pension preparation plan as soon as possible can we feel the wonderful compound interest effect. Time doesn't wait. Come and join the ranks of "happy retreat"!