07.2022 Life Guide

Regular and fixed deposit of good shares and small assets can also become large

Oriental Securities Corporation / Chen Bailin

How to invest best in epidemic disturbance

At the beginning of 2020, covid-19 spread rapidly around the world, causing a series of chain reactions. At that time, the dramatic plot of three circuit breakers (Note 1) occurred in the U.S. stock market in two weeks, which was unheard of by Buffett, the "God of stocks"; Taiwan's stock market can't escape the fate of washing up and down. It once broke the 10000 point barrier, but it reached a record high of 18000 points at the beginning of 2022. Should I sell my stocks now? Or continue to overweight? No one can say for sure. The only thing you can be sure of is that if you miss the bull market in the previous two years, if you are still empty handed, be careful that the cash on your hand is getting thinner and thinner. Why not invest in stocks on a regular basis to accumulate wealth for yourself?

Disciplined investment and flexible use of smile curve

There are many kinds of investment strategies. For "single purchase", if there is a boom correction period immediately after the boom peak enters the market, and there is no standby fund for operation (Note 2), you have to wait until the boom cycle, ranging from 3 years to 5 years, or even longer, before you have the opportunity to return to the price at which you bought, and then make a profit. Therefore, for novices, the risk of single purchase is high.

As for "fixed-term quota", it is a long-term investment strategy. By buying stocks of different prices and quantities in batches for a long time, the average cost can be reduced and the average return can be earned. In addition, due to the purchase of fixed time and amount, there is no need to keep a close eye on the trend of the stock market for a long time during operation, and the disciplined investment mode can also avoid making wrong decisions on impulse.

From the "regular quota smile curve", we can find that even if we buy at the high point of the stock price, as long as we continue to buy, when the stock price reaches the low point, we can buy more units; When the stock price rises, the number of units accumulated at the low point can quickly return the investment to a positive return. So once you start regular and fixed investment, it's best not to interrupt at will, otherwise it may affect the subsequent profits.

Careful selection of targets to accelerate profits

Careful selection of targets to accelerate profits"How to choose the right investment target" is the biggest problem when investing. In fact, funds, stocks or ETFs have their own advantages and disadvantages. The most important thing is whether the company's commodities or physical fitness are stable? Is the prospect promising? For example, many investors in Taiwan are keen on financial stocks, because the stock price fluctuation and entry threshold are low, and the interest distribution is stable. If you can choose the target stocks with a yield (Note 3) greater than 3% for regular investment, the long-term cumulative compounding effect (Note 4) will be better than the average 0.15 ~ 0.2% of the living deposit rate of the traditional accounts of general banks.

If you are worried that the investment of a single target is not robust enough, in addition to the optional portfolio, ETF is also an option, because its "basket stock" characteristics, compared with a single stock, the investment risk is more dispersed; Compared with the fund, the management fee is lower, so it has become a hot investment project in recent years. The familiar 0050 and 0056 are the first and second places in the number of households agreed on in the fixed quota for many months. As for those who are interested in foreign stock markets but do not want to take too much risk, they can also consider the overseas ETFs launched by some investment companies.

Insist on continuous deduction and dynamic adjustment to earn enough

The value of fixed-term quotas is that when the stock market falls, you can buy more units. Therefore, you should adhere to long-term investment, and do not give up halfway because of temporary fluctuations, so as to highlight the value of fixed-term compound interest and average cost. However, it should be noted that the longer the investment time is, the higher the total amount of assets accumulated will be, and the effect of regular quota lowering the average cost will also be passivated. Investors should still regularly check the status of assets and make profits in due course, or adjust their investment strategies to invest more funds in the event of price decline in a "regular and irregular" way, "buy more at low prices and buy less at high prices" to increase the speed of wealth accumulation, When the boom picks up in the future, the reward will be more considerable.

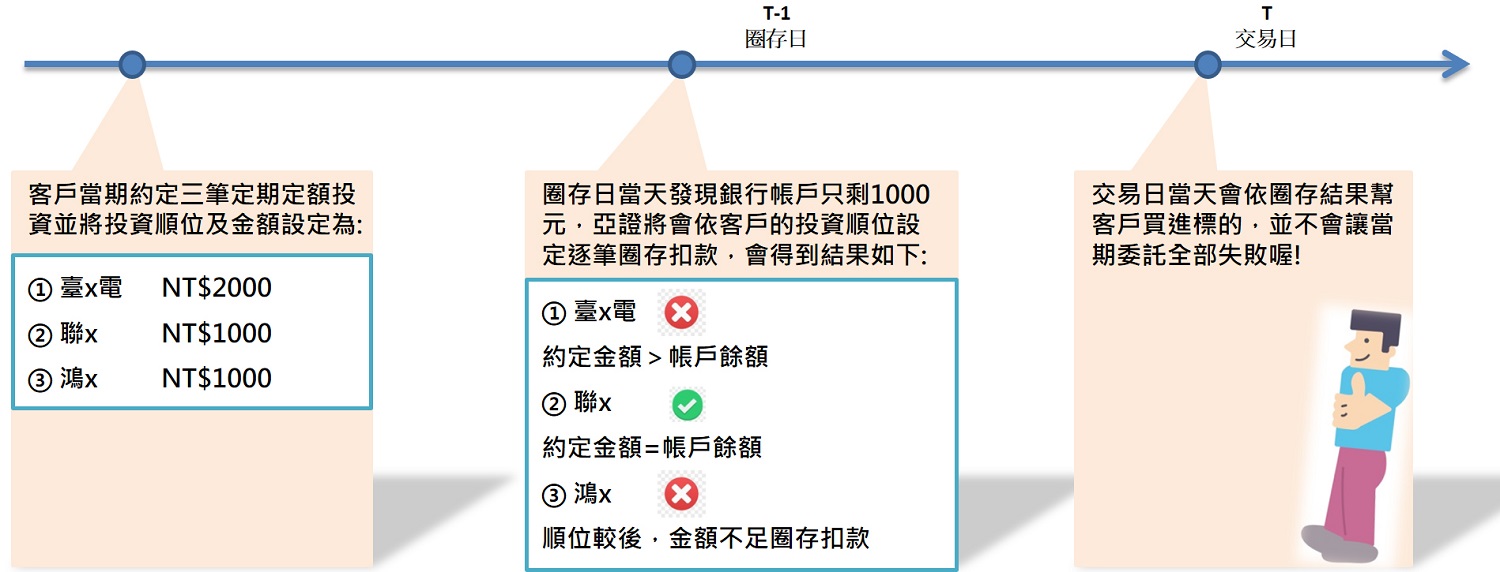

Whether it's office workers and petty bourgeoisie who are too busy to care about the stock market, or people who want to help themselves with retirement planning and children's education fund, regular and fixed stock deposits can meet your financial planning needs, and the minimum ntd1000 per month can participate. Investors only need to ensure that the balance in their accounts is sufficient to deduct money and maintain the discipline of monthly investment. In order to make investment friends more flexible in operation and more convenient in the use of funds, Oriental Securities Corporation has opened the "regular quota change" function, allowing customers to adjust the amount or order of deduction according to their needs, so as to avoid being unable to buy any target due to insufficient funds in the current account.

The business process of applying for fixed-term fixed deposit is quite simple. As long as you sign relevant contracts with the securities company and agree on the purchase date, amount and target, the system will automatically implement it, forcing fixed savings and regular investment, so that you can save the time cost of looking for buying points and disperse investment risks. Interested friends are welcome to refer to the official website of "Oriental Securities Corporation" and the "Oriental Petrochemical (Taiwan) e-profit" app, or contact the customer service hotline 0800-088-567.

Note 1: "circuit breaker" refers to the setting up of a node to allow the stock market to suspend trading for a period of time in order to prevent investors' panic from causing greater stock market fluctuations after a large-scale share price crash.

Note 2: "amortized" refers to investors who buy stocks and lose money due to the decline in share prices, so they buy stocks at a low price to reduce the cost of ownership.

Note 3: "dividend yield" = Cash Dividend / share price, which refers to the interest rate of return that can be obtained by buying individual shares.

Note 4: "compound interest" refers to the reinvestment of the interest generated by the principal into the next interest calculation, resulting in the benefit of rolling interest.

#