07.2022 Life Guide

Economic outlook for the second half of 2022

Far Eastern International Bank / Chen Guancheng

In the first half of 2022, the global economy mainly focused on covid-19 variant virus, Ukraine Russia war and global inflation, which not only attacked the global supply chain, but also prompted many governments to raise interest rates and implement monetary tightening policies. Will inflation fall smoothly in the second half of the year? What is the global economic outlook? What international trends should investors pay attention to? This article will explain one by one for you.

In the first half of 2022, the global economy mainly focused on covid-19 variant virus, Ukraine Russia war and global inflation, which not only attacked the global supply chain, but also prompted many governments to raise interest rates and implement monetary tightening policies. Will inflation fall smoothly in the second half of the year? What is the global economic outlook? What international trends should investors pay attention to? This article will explain one by one for you.Review of the first half of 2022: the cycle of raising interest rates has started, and inflation has become the primary topic

In the first half of 2022, the financial market experienced twists and turns. Not only did the interruption of the global supply chain not be improved, but the subsequent Omicron and the Ukrainian Russian war at the end of February led to the rapid rise in food, energy and metal prices. Coupled with the sharp rise in wages, inflation became more uncontrollable and became an important topic for governments.

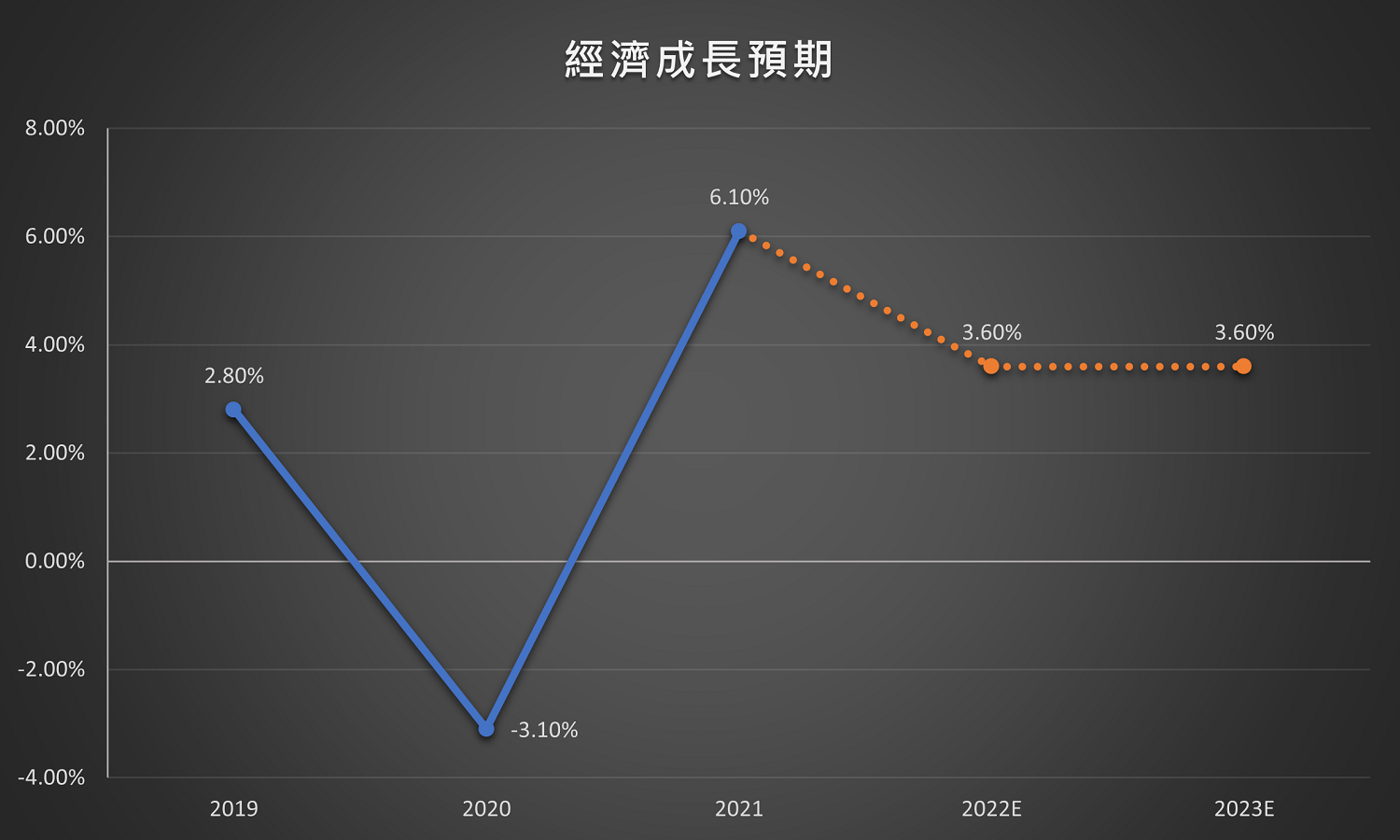

Economic and employment activities continued to strengthen, the unemployment rate fell steadily, and inflation remained high, reflecting the imbalance between supply and demand. In order to slow inflation, the Federal Reserve System (FED) of the United States held a "monetary policy meeting" (hereinafter referred to as the "FOMC meeting") in March, announcing an interest rate rise of 1 yard (about 0.25%), opening the prelude to monetary tightening. The FOMC meeting was held again in May, raising interest rates by 2 yards at one go and starting to shrink the balance sheet. Due to the unprecedented situation of raising interest rates and shrinking the table at the same time, the market is worried that the overly strong policy may cause the economy to fall into recession, so the global economic growth expectation is lowered, and the financial market also has a substantial correction.

The focus of market concern in the second half of 2022: the epidemic in China, the war between Ukraine and Russia, and tightening policies

The focus of market concern in the second half of 2022: the epidemic in China, the war between Ukraine and Russia, and tightening policies1、 The global epidemic prevention measures are gradually loosened, but the supply chain problems caused by China's zero clearance policy still need to be solved

Covid-19 epidemic has lasted for more than two years since its massive outbreak in China in December 2019. Unlike 17 years ago, the SARS epidemic was almost extinguished in just one year. Covid-19 virus is constantly mutating, and the attitude of developed countries in the face of the epidemic gradually tends to coexist with the virus. At present, many countries have drafted open border policies, and countries dominated by tourism and leisure industry have successively lifted quarantine measures and reopened tourism, To stimulate economic growth and accelerate the recovery of the service industry. Nevertheless, China still insists on adopting the "clearance and blockade" measures, which not only shrinks internal supply and demand, but also has a joint impact on the global economy, especially the impact of the closure of Shanghai on the supply chain.

Why does Shanghai's "clearance and blockade" policy affect global economic growth? From the historical experience, the Black Friday, Easter and Christmas holidays in western countries, as well as the double 11 Shopping Festival in recent years, are all in the fourth quarter with strong global consumption momentum. A large number of seasonal goods, from production, packaging to transportation, must be prepared in advance. However, at present, the resumption of factory work is far away, the port is short of work and cannot deliver goods, plus the shortage of parts and components and the global supply chain is tight, Both dragged down economic growth expectations in the second half of the year.

In addition, international well-known brands such as apple and Tesla mentioned in the first quarter financial report that China's city closure measures have led to the interruption of production activities. Whether it is the new mobile phones to be announced in the fourth quarter or the orders for electric vehicles, they may face the dilemma of out of stock or even unable to ship, which will affect the profits of enterprises. Therefore, how long it will take for China to achieve the goal of dynamic zeroing will be one of the focuses of global enterprises in the second half of the year.

2、 The interference of the Ukrainian Russian war has driven up the cost of enterprises and reduced the profit expectation

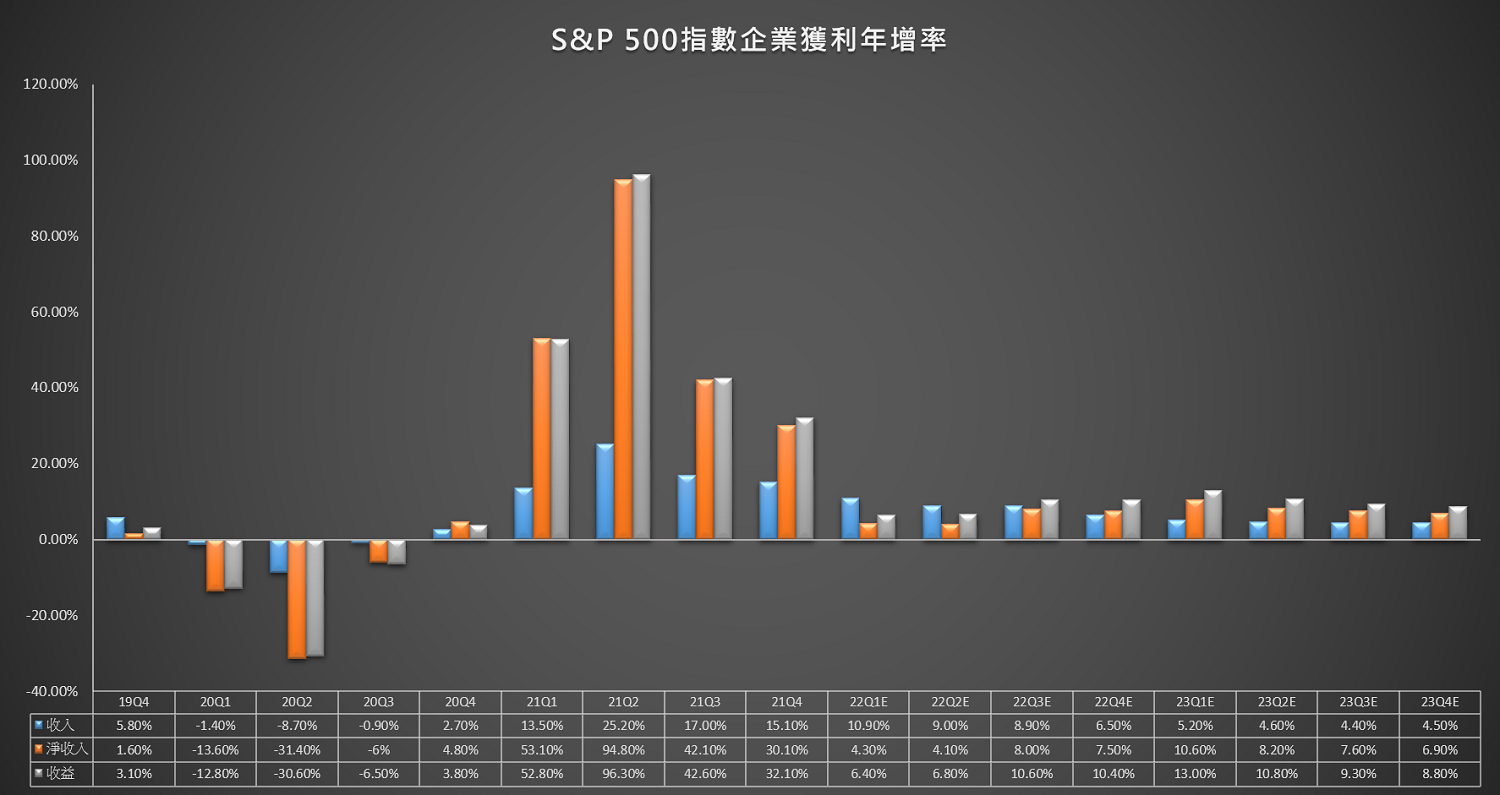

After the outbreak of the Ukrainian Russian war in February, the impact on the prices of energy and raw materials was the most obvious. When the price of crude oil continued to remain above USD100 per barrel, the high energy cost had a serious impact on the consumer price index (CPI) and producer price index (PPI), resulting in the continuous rise of inflation in the first half of the year. The problem of lack of work and materials was reflected in the production cost, which enterprises could not afford, Only the cost can be passed on to consumers, which indirectly reduces the disposable income of consumers. According to refinitiv statistics, in addition to rising production costs, inflation further weakens corporate profits and slows the overall economic growth. Therefore, it is expected that the growth rate of corporate profits will decline significantly in 2022.

3、 Inflation is rising rapidly, how to adjust the pace of tightening policy?

Affected by the rapid rise of inflation in the first half of 2022, the market has stronger expectations for future interest rate hikes, making the U.S. 10-year bond yield (refers to the income earned by investment) soar to 3% from 1.63% at the beginning of this year, which has put pressure on the valuation of stocks. Under the two pressures of interest rate hike and war, the stock markets of various countries have been revised all the way back from the end of December 2021. Among the 11 stocks in the S & P 500 index, only energy stocks have been spared, The overvalued technology stocks even corrected by nearly 30%. In addition, the boost in demand and supply chain problems have also prompted the market to expect the annual growth rate of U.S. CPI to reach 5.1% in 2022, which is far from the inflation target expected by the U.S. Federal Reserve System to fall at an average of 2%. Therefore, tightening measures must be accelerated to suppress excessive inflation.

Most of the market expect that the interest rate will rise by 10 ~ 11 yards in 2022. Compared with the previous interest rate rise cycle, which took about 3 years to complete, the strength of this interest rate rise cycle may be stronger. However, although it is urgent to solve the problem of soaring inflation, the pace of tightening still needs to be adjusted at any time. In particular, the Ukrainian Russian war and China's anti epidemic policy have slowed down the pace of U.S. economic growth. If the rate of interest rate rise and reduction is too fast, it may lead to a real recession. Therefore, Powell, chairman of the U.S. Federal Reserve System, also said that the possibility of raising interest rates by more than 3 yards in the future is low. In fact, from the CPI data released in May, the 1-yard interest rate hike in March has begun to curb the increase of CPI, and even began to decline. In May, the 2-yard interest rate hike and the reduction of the balance sheet are expected to make inflation peak and fall. If inflation slows down in the second half of 2022, China's epidemic, soaring prices and supply chain problems are eased, and the U.S. Federal Reserve System will further adjust tightening policies, which will help boost enterprises Consumer and investor confidence.

Conclusion: in the difficult investment environment, we should first seek stability and then good

According to historical data, the cycle of the general business cycle takes about 8 to 10 years to complete. However, since the outbreak of the epidemic in March 2020, the rapid interest rate cut and the unprecedented unlimited quantitative easing policy have made the economy quickly go through the stage of recession and recovery, and enter the expansion period of the business cycle. In such a rapidly changing investment environment, "seeking stability before seeking good" will be a more appropriate investment strategy.

1、 Core assets:

On the whole, the period of economic expansion is conducive to the performance of risky assets, but there are still many uncertain factors in the current market, such as epidemic, war and interest rate rise cycle. Therefore, in the allocation of core assets, it is recommended to take stable income as the premise, whether it is a multi asset that takes into account income and anti volatility, or a high dividend asset with long-term stable stock price and higher than the market average interest, it is a good choice.

2、 Satellite assets:

Even though the Federal Reserve System of the United States has started the cycle of raising interest rates, due to the impact of the Ukrainian Russian war, the prices of energy and raw materials fell slowly, coupled with the impact of China's anti epidemic "zeroing blockade" policy on the supply chain, the pace of inflation decline will slow down in the short term. It is recommended to allocate appropriately to value stocks in relatively stable developed countries.

3、 Bond market:

Despite the strong interest rate rise of the Federal Reserve System, thanks to the loose policies of various countries and the environment of low interest rates in the previous two years, the market funds are very large. Most issuers of non investment grade bonds take this opportunity to borrow new for old, improve corporate credit rating, and the default rate will continue to remain low in a short time. Therefore, in addition to investment grade bonds, non investment grade bond funds can still become a part of asset allocation.

4、 Foreign exchange market:

Under the accelerated tightening policy of the Federal Reserve System in the United States, market risk aversion has increased, and investors have reduced their holdings of emerging market currencies. In addition, as the economic growth momentum of the euro zone is not as strong as that of the United States, and the Bank of Japan continues to maintain loose policies, both the euro and the yen, which account for a high proportion of the dollar index, are facing greater selling pressure, indirectly supporting the dollar to maintain a strong posture. It is suggested that the Taiwan dollar position held can be timely converted to the US dollar position to facilitate future investment allocation.

#