08.2024 Office Talk

The changes in generational consumption power under the dual rise of stocks and houses

Group Integrated Efficiency and Retail Planning Headquarters / Investment and Operation Analysis Team

Stock and housing prices rise, and people are crazily investing

Stock and housing prices rise, and people are crazily investingThe weighted index of the Taiwan stock market soared from 14000 points in December 2022 to 23000 points in June 2024, with a staggering 65% increase in just one and a half years. This was driven by the rotation of stocks related to AI, heavy power, green energy, and construction, ETFs have become the darling and lifeblood of the market. With the launch of 00940, the establishment scale reached NTD175.1 billion, and the number of shareholders was nearly one million. Among them, there were many stock market novices or market aunties who released their savings and insurance savings, investing their funds in purchases. Some investors also entered the market through credit or housing loans to increase their investment. Investing in the stock market has become a popular movement. As of May this year, the number of investors in the Taiwan stock market has reached 12.83 million, and in the once-in-a-century bullish trend, it has continuously set new records for the Taiwan stock market. In 2023, the average earnings of stock investors reached NTD1.12 million, which is a historical high. In the first half of this year, it continued to rise, and the wealth of stock market investors has significantly.

On the other hand, the real estate market is also a once-in-a-lifetime bull market. According to the analysis of new construction cases on 591 Housing Network, in 2020, there were a total of 684 new construction cases in Liudu and Hsinchu during the 520 period, with an average transaction price of about NTD 350 million per ping. In 2024, during the 520 period, there were 741 new construction cases with an average transaction price of about NTD 520 million per ping, an increase of nearly 50%. The market generally believes that the "New Youth Anxin Home Purchase Preferential Loan Improvement Plan" launched in August 2023 is a match that ignites the gasoline barrel of the housing market. The government has extended the loan term from 30 years to 40 years to subsidize young people's shopping and subsidized home buyers' interest rates, successfully incentivizing housing market buying. In addition, Taiwan's overall environment is supported by factors such as low interest rates, a sharp rise in the stock market, and inflation. Speculation on topics such as technology industry factories, urban renewal, and rail transit has led to record high housing prices across Taiwan, and the upward trend has not stopped. Among them, investors or multi homeowners have made a lot of money.

The consumption power of the people is closely related to factors such as disposable income and savings rate. In recent years, Taiwan has had the opportunity to redistribute wealth income under the dual rising trend of the stock and housing markets, which has had a profound impact on consumers from the two major groups of 60+and 30-40 year old.

60+strong generation assets increase, consumption capacity takes off

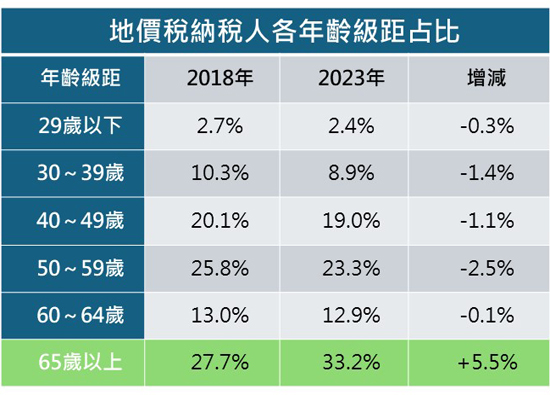

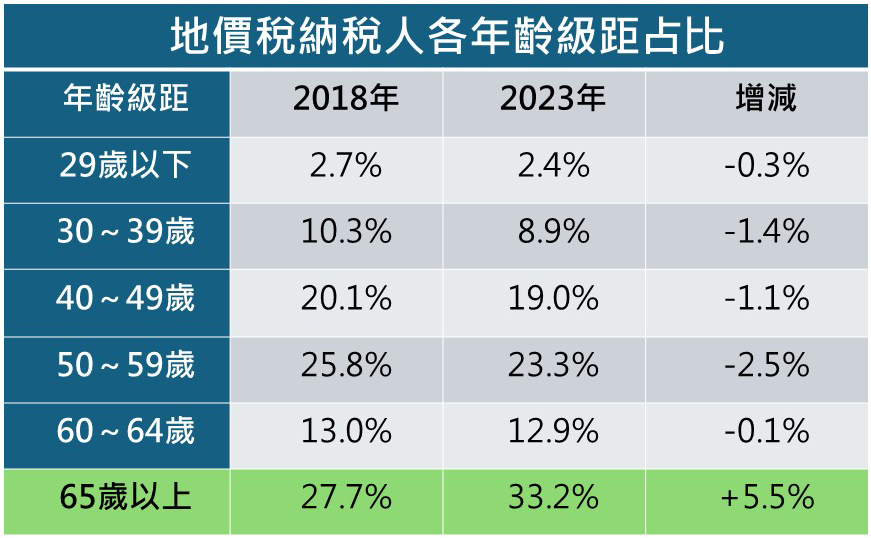

According to the statistics of Taiwan Stock Exchange Corporation in May 2023, the age of investors who opened accounts was 61 years old and above, accounting for the highest proportion of 29.7%. The Statistics Department of the Ministry of Finance also conducted a survey on the age of households subject to land price tax in 2023. The proportion of households aged 60 and above reached 46.1%, an increase of 5.4% compared to 5 years ago (40.7%). This indicates that the generation that will benefit the most from this wave of stock housing prices will be those aged 60 and above.

Perhaps the public still holds onto the stereotype that mature people over the age of 60 live frugally and are reluctant to spend money. However, according to data analysis from the United Credit Card Processing Center in 2023, the average single consumption amount for catering and entertainment for customers over the age of 60 is twice that of the 30th generation, and the cost of decoration is 1.5 times that of those aged 30-40. Compared to young people, they are more willing to spend money. According to a survey conducted online by Dongfang, the focus of life for silver haired individuals aged 65 and above is on entertainment, and they are more willing to spend time exercising and managing their appearance. Their pursuit is no longer a peaceful old age, but a happy life.

The media has started to label this group of 60+customers with deep pockets and willingness to consume with various titles, such as the 60+strong generation, which refers to the age group of 60 years old but still in their forties, also known as the orange generation, energetic silver haired generation, etc. In the current trend of both stock and housing prices rising, their wealth is rapidly accumulating and their consumption potential is further enhanced. They will be the new darlings of the future consumer market. With the accelerated aging of Taiwan's population, they may even become the main force. Therefore, the consumer industry should re-examine the profile of this generation of consumers, understand their current and future needs, in order to create business opportunities.

The burden on young adults aged 30-40 is increasing, and they may be excluded from consumption

The generation led by young adults is the most enthusiastic about entering the real estate market as they enter the stage of starting their own families and businesses. According to statistics from the Ministry of Finance, in May 2024, the number of households granted loans in a single month was 8273, with a loan amount of NTD63.6 billion, both reaching a new high since the launch of the "New Youth Anxin Home Purchase Preferential Loan Improvement Program" in August last year. In addition to the old "Youth Anxin Home Purchase Preferential Loan Improvement Program", the total number of Qing'an mortgage applications has exceeded 400000, of which 70% are under the age of 40; In addition, data from the Joint Application Center also shows that the number of people applying for housing loans in Q1 2024 is about 55000, with about 68% being under the age of 45. The younger generation entering the Taiwan housing market to buy houses at a historical high point will no longer be able to engage in stocks or other investments. Under the crowding out effect of funds, opportunities to profit from the investment market will also decrease.

In recent years, although the income of Taiwanese people has increased, the annual rate is about 1-2%, making it difficult to cope with inflation. According to a survey conducted by Shangzhou and Lewu.com, in most counties and cities, the median annual income group will see their mortgage to income ratio skyrocket to 50% after the grace period, which is equivalent to bearing the burden of skyrocketing housing prices. If they still need to support their children or elders, the economic pressure on the young and middle-aged generation can be imagined. Their consumption behavior and willingness will become more conservative, and they will instead pursue high CP value daily consumption.

Insight into changes, breaking through boundaries, thinking and creating new situations

In order to adapt to new changes and build sustainable competitiveness, the Group's Integrated Efficiency and Retail Planning Headquarters gathers internal and external information and data, sets up a global retail consumption observation radar, and long-term focuses on domestic and international retail trends, development dynamics, market marketing, consumer opinions and other data. Together with retail related enterprises, we grasp the forefront of trends and formulate future business policies, core values and positioning, with the aim of forward-looking deployment and innovative business opportunities.

#